Philippines E-Invoicing Market Size, Share, Trends and Forecast by Channel, Deployment Type, Application, and Region, 2025-2033

Philippines E-Invoicing Market Overview:

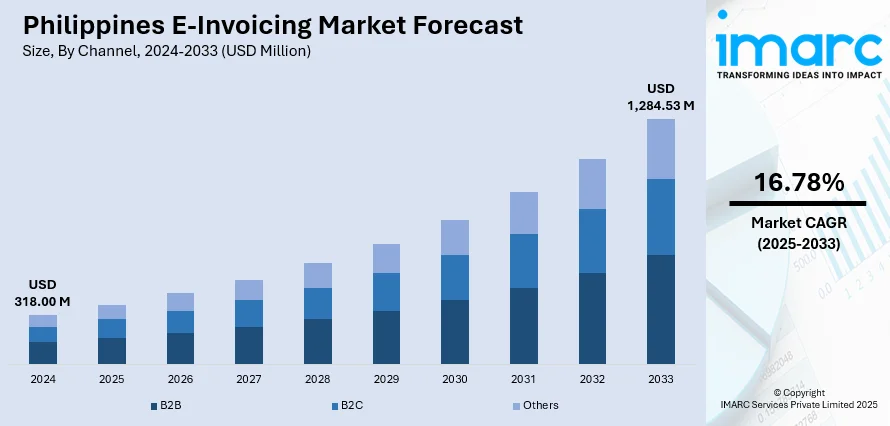

The Philippines e-invoicing market size reached USD 318.00 Million in 2024. Looking forward, the market is projected to reach USD 1,284.53 Million by 2033, exhibiting a growth rate (CAGR) of 16.78% during 2025-2033. Mandatory implementation by the Bureau of Internal Revenue (BIR), increased tax transparency goals, digital transformation in finance, cost savings for enterprises, improved compliance, growing internet penetration, and support for anti-tax evasion initiatives are some of the factors contributing to Philippines e-invoicing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 318.00 Million |

| Market Forecast in 2033 | USD 1,284.53 Million |

| Market Growth Rate 2025-2033 | 16.78% |

Trends of Philippines E-Invoicing Market:

Digital Tax Enforcement Gaining Ground

The Philippines is pushing forward with mandatory electronic invoicing for top taxpayers and export-oriented or digital-heavy businesses. Under the oversight of the Bureau of Internal Revenue, companies are now required to transmit real-time transaction data using certified platforms like computerized accounting systems and point-of-sale software. This move isn’t just a technical upgrade, it signals a firm shift in how tax reporting will be monitored and enforced. Early adoption is being strongly encouraged to avoid penalties and disruptions. The pressure to comply is particularly high among large enterprises and online sellers, as authorities tighten controls and refine digital audit trails. It’s becoming increasingly clear that paper invoicing is being phased out in favor of automated, transparent reporting. These factors are intensifying the Philippines e-invoicing market growth. For example, in January 2025, the Philippines advanced its Electronic Invoicing System (EIS), led by the Bureau of Internal Revenue (BIR), initially targeting the country’s top 100 taxpayers. The system requires exporters, e-commerce firms, and large taxpayers to electronically report sales data through CAS, POS, or invoicing software, as mandated by the 1997 Tax Code. Businesses were urged to upgrade systems early to meet compliance deadlines and avoid penalties under the evolving digital tax framework.

To get more information of this market, Request Sample

Electronic Invoicing Becoming Regulatory Priority

The Bureau of Internal Revenue is now requiring large businesses, e-commerce operators, and LTS-registered entities to adopt structured e-invoicing and real-time sales reporting. Exporters and other sectors are expected to be included once systems are ready. To support compliance, tax incentives are available to offset setup costs, but penalties will apply for delays or failure to meet requirements. This push is accelerating the shift toward digital tax systems and fueling demand for reliable invoicing and reporting software. Businesses are under pressure to modernize operations and ensure compatibility with government systems. As enforcement tightens, electronic invoicing is becoming a standard part of doing business in the Philippines. For instance, in March 2025, the Philippines' BIR enforced new regulations under the e-Invoicing Act, mandating structured electronic invoicing and real-time sales reporting for large taxpayers, e-commerce firms, and LTS-registered entities by March 2026. Future compliance would extend to exporters and other sectors once systems are ready. Tax incentives are offered for setup costs, while penalties apply for non-compliance. This move is expected to drive significant growth in the country’s e-invoicing and tax tech market.

Shift Toward Cloud-Based Solution

The movement towards cloud-based e-invoicing solutions is picking up a lot of momentum in the Philippines as companies seek more efficient, secure, and scalable invoicing. Cloud technology provides instant access to invoices, fast-processing, and enables smooth collaboration across departments and stakeholders regardless of their location. It eliminates the need for complex on-premise infrastructure, reducing operational costs and increasing efficiency. Businesses find advantages in the form of automatic updates, safe storage, and integration with accounting or ERP systems, which facilitate smooth financial processes. This shift is especially useful for companies that have multiple offices or distant operations. As digital transformation speeds up, the preference for cloud-based solutions is anticipated to notably increase Philippines e-invoicing market demand in the coming years.

Growth Drivers of Philippines E-Invoicing Market:

Rising Digital Transformation in Businesses

Digital transformation is altering how businesses in the Philippines handle financial processes, with automation emerging as a significant driver of efficiency. E-invoicing solutions permit organizations to replace manual, paper-based systems with quick, precise, and fully digital workflows. By minimizing human errors and providing real-time tracking, businesses can improve compliance, bolster customer relationships, and enhance operational performance. This transition is especially crucial for companies operating in various locations, where centralized and automated invoicing fosters better coordination. As more sectors adopt digital tools, the uptake of e-invoicing is projected to rise, providing scalability, accuracy, and agility in managing financial operations amid a progressively competitive business environment.

Cost Savings and Efficiency

E-invoicing provides a clear path for businesses in the Philippines to lower operational costs and boost payment cycles. By eradicating expenses tied to paper, printing, and physical storage, companies can significantly reduce overheads while supporting sustainable business practices. Automated systems streamline the creation, approval, and delivery of invoices, leading to swifter payment processing and enhanced cash flow. According to "Philippines e-invoicing market analysis," this efficiency benefits not just large corporations but also empowers SMEs to stay competitive by optimizing resources. The capacity to manage high transaction volumes without incurring additional labor costs positions e-invoicing as a wise investment for sustainable operational and financial growth.

Integration with Business Systems

The smooth integration of e-invoicing platforms with ERP, CRM, and accounting systems is revolutionizing financial management in the Philippines. This connectivity enables businesses to automate data transfer, minimize manual input, and maintain consistent records across departments. Integrated systems allow for quicker approvals, real-time monitoring, and precise reporting, all of which aid in better decision-making and adherence to regulatory standards. For organizations processing substantial transaction volumes, integration ensures that invoicing operations remain aligned with inventory, sales, and customer relationship management. This enhances efficiency and reduces the likelihood of discrepancies, establishing e-invoicing as a crucial tool for modern businesses striving for operational excellence.

Philippines E-Invoicing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on channel, deployment type, and application.

Channel Insights:

- B2B

- B2C

- Others

The report has provided a detailed breakup and analysis of the market based on the channel. This includes B2B, B2C, and others.

Deployment Type Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based and on-premises.

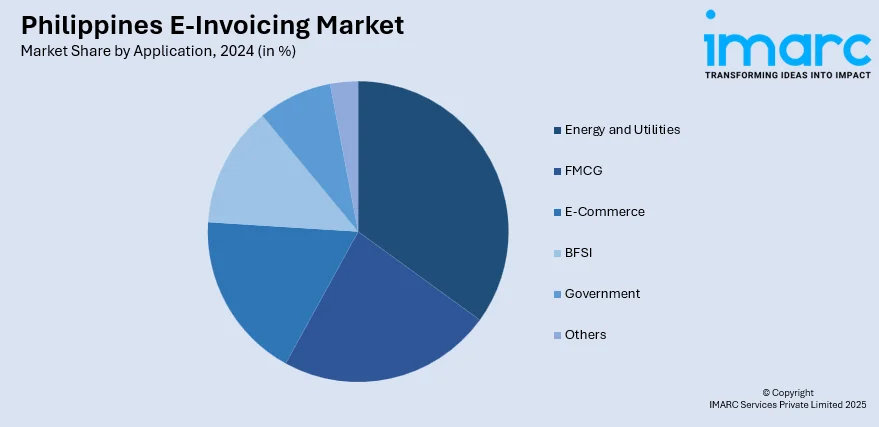

Application Insights:

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes energy and utilities, FMCG, e-commerce, BFSI, government, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines E-Invoicing Market News:

- In June 2025, the Philippines’ Bureau of Internal Revenue (BIR) enacted Revenue Regulation No. 011-2025, mandating electronic invoicing and real-time sales reporting under the amended NIRC and Republic Act No. 12066. This directive applies to e-commerce, export, and digital businesses. Beyond invoicing, the regulation signals major change for payroll and compliance systems, which must now integrate tightly with tax platforms to ensure synchronized, real-time financial and employee data reporting.

Philippines E-Invoicing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines e-invoicing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines e-invoicing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines e-invoicing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-invoicing market in Philippines was valued at USD 318.00 Million in 2024.

The Philippines e-invoicing market is projected to exhibit a compound annual growth rate (CAGR) of 16.78% during 2025-2033.

The Philippines e-invoicing market is expected to reach a value of USD 1,284.53 Million by 2033.

The market trends include a shift toward cloud-based platforms, mobile-enabled invoicing, and real-time invoice tracking. Businesses adopting AI-driven automation for faster processing, while cross-border e-invoicing and enhanced data security measures are also gaining traction to support compliance and global trade efficiency.

There has been a rising adoption of e-invoicing in Philippines due to the regulatory compliance needs, growing demand for automation, and integration capabilities with ERP and accounting systems. Cost savings, faster payment cycles, and scalability for SMEs further fuel growth. Increasing digital transformation across industries also strengthens the role of e-invoicing as a core business efficiency tool.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)