Philippines Edible Cutlery Market Size, Share, Trends and Forecast by Product, Raw Material, Flavor, Application, Distribution Channel, and Region, 2026-2034

Philippines Edible Cutlery Market Summary:

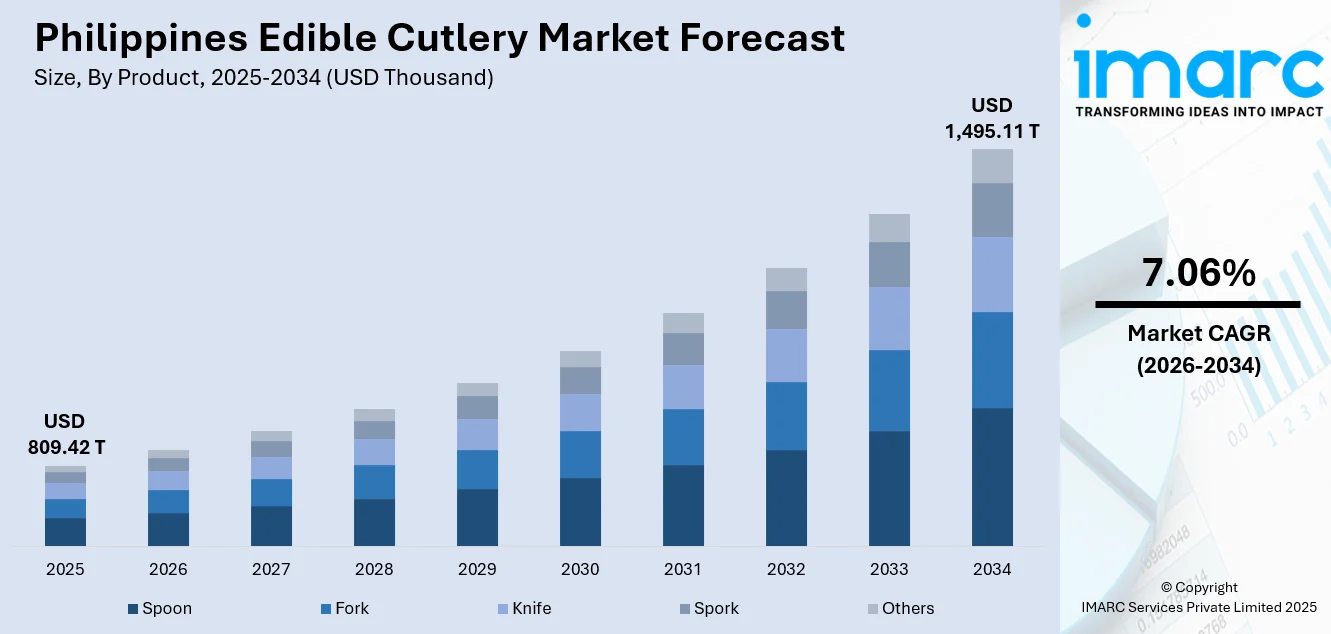

The Philippines edible cutlery market size was valued at USD 809.42 Thousand in 2025 and is projected to reach USD 1,495.11 Thousand by 2034, growing at a compound annual growth rate of 7.06% from 2026-2034.

The market is driven by increasing environmental consciousness among the consumers seeking sustainable alternatives to single-use plastic utensils. Growing government initiatives promoting eco-friendly products, rising adoption in the food service industry, and expanding awareness about plastic pollution in marine ecosystems are bolstering demand. The shift toward biodegradable and zero-waste dining solutions, coupled with innovative product development and favorable regulatory frameworks supporting sustainable packaging, continues to strengthen the Philippines edible cutlery market share.

Key Takeaways and Insights:

- By Product: Spoon dominates the market with a share of 38% in 2025, driven by widespread applicability across diverse cuisines, ease of consumption for soups, desserts, and rice-based dishes prevalent in regions dining culture.

- By Raw Material: Corn leads the market with a share of 43% in 2025, owing to abundant local availability, cost-effectiveness in production processes, neutral taste profile complementing various food items, and excellent moldability for manufacturing durable edible utensils.

- By Flavor: Plain represents the largest segment with a market share of 65% in 2025, driven by compatibility with all food types and lack of interference with food taste and greater acceptance by food establishments.

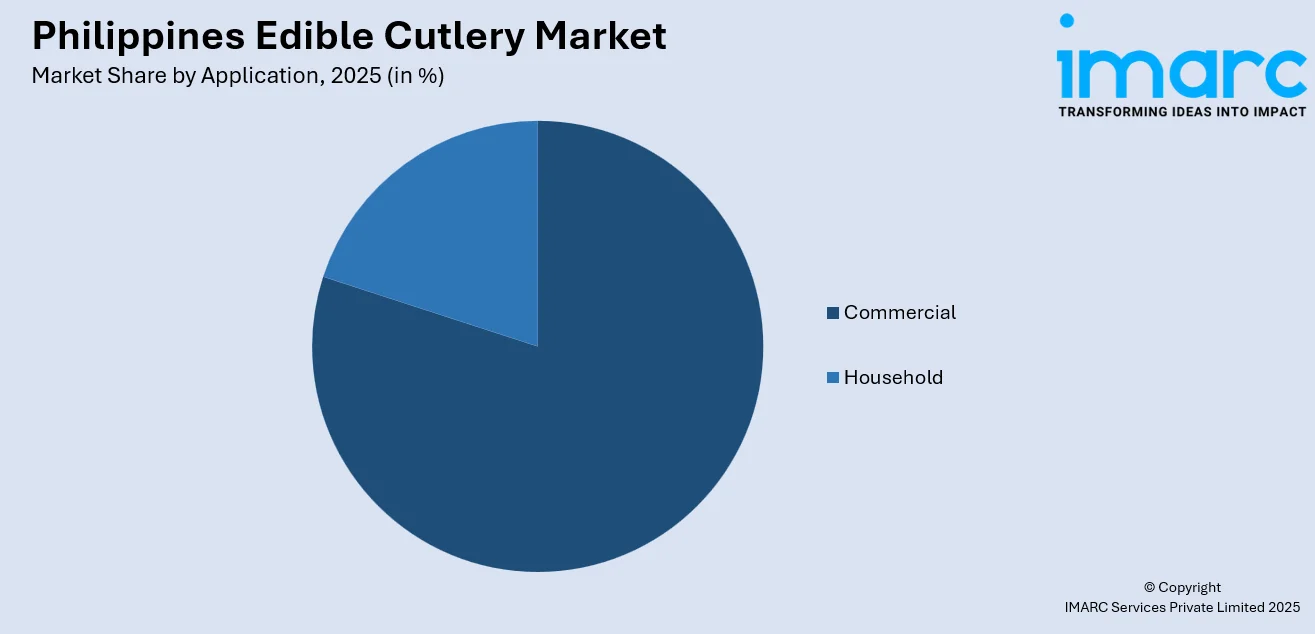

- By Application: Commercial dominates the market with a share of 80% in 2025, owing to increasing adoption among restaurants, cafeterias, catering services, and food delivery platforms seeking sustainable alternatives aligned with corporate sustainability commitments.

- By Distribution Channel: Online stores represents the market with a share of 55% in 2025, driven by rapid e-commerce expansion, doorstep delivery convenience, wider product variety availability, competitive pricing strategies, and increasing digital literacy among the consumers.

- By Region: Luzon leads the market with a share of 57% in 2025, owing to urban population concentration in Metro Manila, higher disposable incomes, greater environmental awareness, and numerous commercial food establishments.

- Key Players: The Philippines edible cutlery market exhibits a moderately fragmented competitive structure, with domestic manufacturers competing alongside international sustainable product suppliers across various price tiers and distribution networks throughout the archipelago.

To get more information on this market Request Sample

The Philippines edible cutlery market is experiencing robust growth propelled by escalating environmental concerns and stringent government regulations targeting single-use plastic reduction across the archipelago. Rising consumer preference for sustainable and eco-friendly alternatives in food consumption, particularly among environmentally conscious millennials and urban populations, is driving market expansion. The food service industry's increasing commitment to sustainability practices, combined with growing awareness about oceanic plastic pollution affecting Philippine waters, continues to stimulate demand. Additionally, the expanding café culture, rising number of quick-service restaurants, and flourishing food delivery ecosystem are creating substantial opportunities for edible cutlery adoption, as establishments seek differentiation through environmentally responsible practices. Furthermore, supportive government initiatives promoting biodegradable alternatives, increasing corporate social responsibility commitments among food service chains, and growing tourism sector adoption of sustainable dining solutions are strengthening market fundamentals and accelerating the transition toward eco-friendly cutlery options nationwide.

Philippines Edible Cutlery Market Trends:

Rising Integration with Food Delivery Platforms

The proliferation of food delivery applications across Philippine urban centers is creating significant opportunities for edible cutlery adoption. Delivery platforms are increasingly partnering with eco-conscious restaurants to offer sustainable packaging options, including edible utensils. As per sources, in April 2024, foodpanda Philippines expanded its Bisikleta Iwas Droga initiative, increasing bicycle, walker, and e-bike deliveries via DHLPI to reduce emissions and promote sustainable food delivery practice. Moreover, this trend reflects changing consumer expectations for environmentally responsible food delivery experiences.

Expansion of Flavor Innovation and Customization

Manufacturers are increasingly focusing on developing diverse flavor profiles to enhance consumer appeal and create unique dining experiences. Beyond traditional plain variants, producers are introducing locally inspired flavors that complement the regions cuisines, including savory and mildly sweet options. According to reports, Edgetec students from the Technological Institute of the Philippines created ube, vanilla, and chocolate flavored edible cutlery, winning third place at the Swiss Innovation Prize, highlighting flavor innovation potential. Furthermore, this innovation trend extends to customization services for commercial clients seeking branded or specially flavored edible cutlery for events and promotional purposes. The movement toward experiential dining is encouraging establishments to incorporate flavored edible utensils as complementary elements to their menu offerings.

Growing Adoption in Institutional Food Service Segments

Educational institutions, corporate cafeterias, and healthcare facilities across the Philippines are increasingly transitioning toward edible cutlery solutions as part of broader sustainability initiatives. This institutional adoption is driven by corporate social responsibility commitments and regulatory compliance requirements targeting plastic waste reduction. As per sources, the DepEd City Schools Division of Dasmariñas banned single-use plastic cutlery and utensils in schools, prompting cafeterias to adopt reusable and eco-friendly alternatives, including biodegradable and edible options. Moreover, universities and corporate offices are implementing comprehensive sustainability programs that include mandatory use of biodegradable or edible alternatives.

Market Outlook 2026-2034:

The Philippines edible cutlery market is poised for substantial revenue growth during the forecast period, driven by accelerating sustainability initiatives and expanding consumer awareness regarding environmental preservation. Favorable government policies supporting plastic alternatives, combined with increasing investments in manufacturing capabilities and distribution infrastructure, are expected to bolster market expansion. The growing penetration of edible cutlery across commercial food service establishments, rising tourism sector recovery, and expanding e-commerce channels will contribute to sustained revenue generation. The market generated a revenue of USD 809.42 Thousand in 2025 and is projected to reach a revenue of USD 1,495.11 Thousand by 2034, growing at a compound annual growth rate of 7.06% from 2026-2034.

Philippines Edible Cutlery Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Spoon |

38% |

|

Raw Material |

Corn |

43% |

|

Flavor |

Plain |

65% |

|

Application |

Commercial |

80% |

|

Distribution Channel |

Online Stores |

55% |

|

Region |

Luzon |

57% |

Product Insights:

- Spoon

- Fork

- Knife

- Spork

- Others

Spoon dominates with a market share of 38% of the total Philippines edible cutlery market in 2025.

Spoon commands the largest market share within the Philippines edible cutlery landscape, reflecting deep-rooted dining customs prevalent across the archipelago. Filipino cuisine predominantly features rice-based dishes, soups, stews, and desserts that necessitate spoon usage for optimal consumption. The structural requirements for edible spoons align favorably with available manufacturing technologies, enabling production of durable products capable of maintaining integrity throughout meal duration. Additionally, the versatility of spoons across various culinary applications strengthens their dominant market positioning.

The widespread applicability of edible spoons across diverse food service contexts, from quick-service restaurants to catering operations, reinforces dominance. Commercial establishments prioritize spoon procurement given universal utility across menu categories, driving bulk purchasing patterns. In addition, Quezon City implemented an executive order effective from April 2025, banning several types of single‑use plastics including disposable cutlery within city government premises and encouraging reuse and sustainable alternatives, reflecting growing policy support for eco‑friendly utensils. Consumer familiarity with spoon-based dining further accelerates adoption rates, as edible variants seamlessly integrate into existing eating habits without requiring behavioral adaptation. Growing sustainability awareness among the consumers and increasing regulatory pressure on plastic alternatives continue bolstering demand for edible spoon products.

Raw Material Insights:

- Corn

- Wheat Bran

- Rice Bran

- Others

Corn leads with a share of 43% of the total Philippines edible cutlery market in 2025.

Corn commands the largest market share within the Philippines edible cutlery raw material landscape, benefiting from abundant agricultural availability within Philippine farming regions. The cost-effectiveness of corn as a primary ingredient enables manufacturers to maintain competitive pricing structures while delivering quality products. Corn's neutral flavor profile ensures minimal taste interference with diverse food preparations, enhancing consumer acceptance across various culinary applications. Local sourcing capabilities reduce supply chain complexities and transportation costs significantly.

The processing characteristics of corn facilitate efficient manufacturing operations, allowing producers to achieve consistent product quality and structural durability. Local sourcing capabilities reduce supply chain complexities and transportation costs, strengthening the economic viability of corn-based production. Consumer familiarity with corn as a food ingredient alleviates concerns regarding safety and digestibility, accelerating market adoption rates. Additionally, corn-based products offer excellent moldability properties that enable diverse product designs catering to varied consumer preferences.

Flavor Insights:

- Plain

- Sweet

- Spicy

Plain exhibits a clear dominance with a 65% share of the total Philippines edible cutlery market in 2025.

Plain commands the largest market share within the Philippines edible cutlery flavor landscape, driven by universal compatibility with all food categories and absence of taste interference with meal flavors. Commercial establishments predominantly prefer plain variants to ensure consistent customer experiences regardless of menu item selections. Health-conscious consumers favor plain options due to minimal additive content and straightforward ingredient profiles. This broad acceptability across diverse consumer demographics strengthens plain flavor dominance.

Plain in edible cutlery offers maximum versatility across diverse dining contexts, from formal catering events to casual quick-service establishments. The simplicity of plain variants facilitates streamlined inventory management for commercial clients, eliminating complexity of matching specific flavors with dishes. Manufacturing efficiencies associated with plain production enable cost advantages that translate into competitive retail pricing. Furthermore, plain variants appeal to consumers with dietary restrictions or sensitivities seeking uncomplicated ingredient compositions.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Household

- Commercial

Commercial leads with a market share of 80% of the total Philippines edible cutlery market in 2025.

Commercial commands the largest market share within the Philippines edible cutlery application landscape, reflecting substantial demand from restaurants, cafeterias, catering services, and food delivery operations. As per sources, the Philippines launched the National Plastic Action Partnership (NPAP), uniting government, businesses, and civil society to reduce plastic pollution and encourage adoption of sustainable alternatives, reinforcing commercial interest in edible cutlery solutions. Moreover, commercial establishments face increasing pressure from consumers and regulatory bodies to adopt sustainable alternatives, driving procurement decisions toward edible cutlery solutions.

The sustainability in corporate mandates and brand differentiation strategies motivate food service businesses to integrate edible cutlery into their operational frameworks comprehensively. The visibility of sustainable practices within commercial dining contexts generates positive consumer perceptions and potential competitive advantages. Catering operations particularly value edible cutlery for events emphasizing environmental responsibility, creating consistent demand patterns. Additionally, quick-service restaurants and food delivery platforms increasingly incorporate edible utensils to enhance their eco-friendly brand positioning among environmentally conscious consumers.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Online stores exhibit a clear dominance with a 55% share of the total Philippines edible cutlery market in 2025.

Online stores command the largest market share within the Philippines edible cutlery distribution landscape, propelled by exponential growth of e-commerce penetration across Philippine consumer demographics. Digital platforms offer extensive product variety, competitive pricing, and convenient delivery options that appeal to both individual consumers and commercial buyers. The accessibility of online purchasing eliminates geographical barriers, enabling market reach across dispersed island communities throughout the archipelago. Growing digital literacy further accelerates online channel adoption.

Online stores facilitate detailed product information dissemination, enabling informed purchasing decisions based on specifications, reviews, and comparative analysis effectively. Subscription-based purchasing models emerging through online channels provide predictable revenue streams for manufacturers while ensuring consistent supply for commercial clients. The integration of edible cutlery into broader sustainable product marketplaces enhances visibility and cross-selling opportunities. Furthermore, promotional campaigns and digital marketing strategies employed by online retailers significantly boost consumer awareness and product accessibility.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon dominates with a market share of 57% of the total Philippines edible cutlery market in 2025.

Luzon commands the largest market share within the Philippines edible cutlery regional landscape, driven by concentration of economic activity, population density, and commercial food service establishments within Metro Manila and surrounding provinces. Higher disposable income levels among Luzon residents correlate with greater willingness to pay premiums for sustainable alternatives. Urban environmental awareness campaigns and visible plastic pollution concerns motivate adoption among metropolitan consumers seeking eco-friendly dining solutions.

The concentration of corporate headquarters, educational institutions, and government agencies within Luzon creates substantial institutional demand for sustainable cutlery solutions consistently. Superior logistics infrastructure facilitates efficient distribution networks, enabling rapid market penetration and reliable supply chain operations throughout the region. The tourism industry concentration in Luzon further amplifies demand from hospitality establishments seeking eco-friendly credentials. Additionally, progressive local government regulations restricting single-use plastics accelerate edible cutlery adoption across commercial establishments.

Market Dynamics:

Growth Drivers:

Why is the Philippines Edible Cutlery Market Growing?

Strengthening Government Regulations on Single-Use Plastics

The Philippine government's progressive stance on plastic reduction is creating a favorable regulatory environment for edible cutlery market expansion. As per sources, in August 2025, the National Police Commission (Napolcom) banned single‑use plastics, including disposable utensils, across all its offices, reinforcing the push for sustainable alternatives in food service and institutional settings. Moreover, local government units across numerous municipalities have enacted ordinances restricting or banning single-use plastic utensils, compelling food service establishments to seek compliant alternatives. National-level policy discussions continue advancing toward comprehensive plastic reduction frameworks that will further accelerate adoption.

Expanding Environmental Consciousness Among Filipino Consumers

Filipino consumers are demonstrating increasing awareness regarding plastic pollution impacts on marine ecosystems and overall environmental health. Social media campaigns, educational initiatives, and visible pollution affecting coastal communities have elevated sustainability considerations in purchasing decisions. According to reports, in April 2024, a Greenpeace‑commissioned survey found that 94 % of Filipinos support capping plastic production, reflecting strong public concern for environmental protection and willingness to embrace sustainable alternatives. Moreover, younger demographic segments particularly exhibit strong preferences for environmentally responsible products, influencing household consumption patterns and commercial establishment choices.

Rapid Expansion of Food Service Industry and Urbanization

The Philippines food service sector continues expanding, driven by rising disposable incomes, urbanization trends, and evolving consumer lifestyles favoring convenience dining. Quick-service restaurants, cafés, and catering businesses are proliferating across urban centers, creating substantial demand for sustainable cutlery alternatives. As per sources, the USDA projects the Philippine food services industry to grow 12 % as restaurants, cafés, kiosks, and bars expand outlets, reflecting increased dining-out demand and rising consumer mobility. Further, the growing middle-class population seeks dining experiences aligned with environmental values, prompting establishments to adopt eco-friendly practices. Commercial kitchens increasingly prioritize biodegradable solutions to enhance brand reputation and meet consumer expectations.

Market Restraints:

What Challenges the Philippines Edible Cutlery Market is Facing?

Higher Production Costs Compared to Conventional Plastic Alternatives

Edible cutlery manufacturing involves specialized ingredients, processing requirements, and quality control measures that result in elevated production costs relative to conventional plastic utensils. These cost differentials translate into higher retail pricing that may deter price-sensitive consumer segments and commercial establishments operating on thin margins. The challenge of achieving price parity with plastic alternatives constrains market penetration rates, particularly in lower-income demographic segments.

Limited Shelf Life and Storage Requirements

Edible cutlery products face inherent shelf-life limitations due to their food-grade composition, requiring careful storage conditions to maintain quality and safety standards. Humidity sensitivity, potential for staleness, and vulnerability to pest contamination necessitate specialized handling throughout distribution chains. These storage complexities increase operational costs for distributors and retailers while potentially limiting product availability in certain geographic areas.

Consumer Awareness and Behavioral Adaptation Challenges

Despite growing environmental consciousness, significant consumer segments remain unfamiliar with edible cutlery products, their proper usage, and associated benefits. The novel concept of consuming utensils requires behavioral adaptation that some consumers may resist or find uncomfortable. Marketing and education investments necessary to overcome awareness gaps represent additional cost burdens for market participants seeking to expand consumer adoption.

Competitive Landscape:

The Philippines edible cutlery market features a developing competitive structure characterized by a mix of domestic manufacturers and international sustainable product suppliers. Market participants compete across multiple dimensions including product quality, pricing strategies, flavor variety, and distribution network coverage. Domestic players leverage local agricultural sourcing advantages and market knowledge, while international entrants bring technological expertise and established sustainable product portfolios. The market remains relatively unconsolidated, presenting opportunities for strategic positioning and market share capture. Competitive dynamics increasingly emphasize innovation in product durability, taste profiles, and packaging solutions.

Philippines Edible Cutlery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Spoon, Fork, Knife, Spork, Others |

| Raw Materials Covered | Corn, Wheat Bran, Rice Bran, Others |

| Flavors Covered | Plain, Sweet, Spicy |

| Applications Covered | Household, Commercial |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines edible cutlery market size was valued at USD 809.42 Thousand in 2025.

The Philippines edible cutlery market is expected to grow at a compound annual growth rate of 7.06% from 2026-2034 to reach USD 1,495.11 Thousand by 2034.

Spoon held the largest market share, driven by widespread applicability across the regions cuisines featuring rice-based dishes, soups, stews, and desserts, along with superior structural integrity, excellent durability during extended use, and seamless integration into existing traditional consumer dining habits nationwide.

Key factors driving the Philippines edible cutlery market include include strengthening government regulations restricting single-use plastics, expanding environmental consciousness among consumers, growth of the food service and delivery ecosystem, and rising corporate sustainability commitments.

Major challenges include higher production costs compared to conventional plastic alternatives, limited shelf life and specialized storage requirements, consumer awareness gaps regarding product benefits, price sensitivity among certain market segments, and distribution infrastructure limitations across dispersed island geographies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)