Philippines Education Apps Market Size, Share, Trends and Forecast by Product Type, Operating System, End User, and Region, 2025-2033

Philippines Education Apps Market Overview:

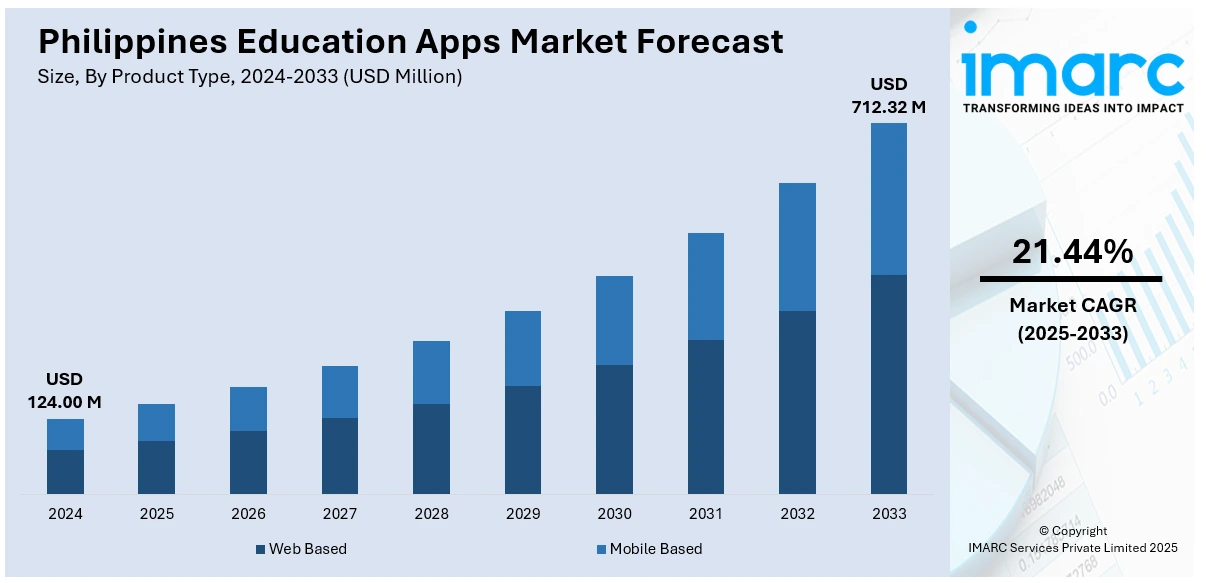

The Philippines education apps market size reached USD 124.00 Million in 2024. The market is projected to reach USD 712.32 Million by 2033, exhibiting a growth rate (CAGR) of 21.44% during 2025-2033. The market is driven by the unprecedented surge in mobile-first learning adoption with Filipino internet traffic from mobile devices increasing, the rapid integration of AI and emerging technologies, and comprehensive government digital education initiatives including the establishment of the first AI education research center in Southeast Asia. Additionally, strategic partnerships between international EdTech companies and local institutions are expanding the Philippines education apps market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 124.00 Million |

| Market Forecast in 2033 | USD 712.32 Million |

| Market Growth Rate 2025-2033 | 21.44% |

Philippines Education Apps Market Trends:

Mobile-First Learning Platform Dominance

The Philippine education apps sector is experiencing unprecedented growth driven by the country's massive shift toward mobile-first digital consumption, with mobile web traffic surging from 41.04% to 87.64% within a single year, representing the most dramatic mobile adoption rate globally. This transformation reflects Filipinos' increasing reliance on smartphones and tablets as primary learning devices, and the availability of affordable mobile data plans nationwide. Educational institutions and app developers are rapidly adapting their platforms to prioritize mobile-responsive designs, offline content capabilities, and data-efficient streaming options to accommodate the diverse connectivity infrastructure across urban and rural regions. The mobile-first approach has democratized access to quality educational content, enabling students from remote provinces to access the same learning resources as their urban counterparts. This trend is particularly significant for K-12 and higher education segments, where mobile learning applications provide flexibility for students who balance education with work or family responsibilities, ultimately contributing to improved retention rates and educational outcomes across the archipelago.

To get more information on this market, Request Sample

Artificial Intelligence and Emerging Technologies Integration

The integration of artificial intelligence and emerging technologies represents a defining characteristic of the Philippine education apps landscape, with Filipino students demonstrating the highest global adoption rates at 83% for AI-powered learning tools, significantly exceeding international benchmarks and showcasing the market's exceptional receptivity to technological innovation. Educational platforms are increasingly incorporating machine learning algorithms for personalized learning paths, natural language processing for automated tutoring systems, and predictive analytics to identify students at risk of dropping out, thereby enhancing both learning outcomes and institutional efficiency. The Philippines education apps market growth is further accelerated by the rising popularity of Web3 and blockchain education platforms, which combines gamification with professional skill development in emerging technologies. Filipino educators have embraced AI with 62% utilizing generative AI for content creation and lesson planning, while students leverage these tools for research, writing assistance, and foreign language learning, creating a comprehensive ecosystem of AI-enhanced educational experiences. This technological integration is supported by government policy frameworks and institutional guidelines that promote responsible AI use while maintaining academic integrity standards.

Government-Led Digital Education Transformation and Policy Support

The Philippine government's comprehensive digital education transformation initiative represents a strategic commitment to modernizing the educational sector through systematic technology integration, policy development, and infrastructure investment. The Department of Education's Digital Rise Program encompasses three major components: ICT-enhanced curriculum development introducing programming skills from Grade 7, ICT-assisted teaching providing educators with modern equipment and software, and ICT-assisted learning through the DepEd Learning Management System reaching over 130,000 students and 1,500 teachers nationwide. The establishment of the Education Center for AI Research (E-CAIR) in February 2025 positions the Philippines as the first Southeast Asian nation to create a dedicated AI education research hub, demonstrating the government's proactive approach to emerging technology adoption and regional leadership ambitions. These initiatives are supported by ambitious scaling targets, including the goal to extend digital education access to several Filipino learners. The government's policy-driven approach creates a stable regulatory environment that encourages private sector investment while ensuring equitable access to digital education resources across socioeconomic and geographic boundaries.

Philippines Education Apps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on product type, operating system, and end user.

Product Type Insights:

- Web Based

- Mobile Based

The report has provided a detailed breakup and analysis of the market based on the product type. This includes web based and mobile based.

Operating System Insights:

- iOS and MacOS

- Android

- Windows

A detailed breakup and analysis of the market based on the operating system have also been provided in the report. This includes iOS and macOS, android, and windows.

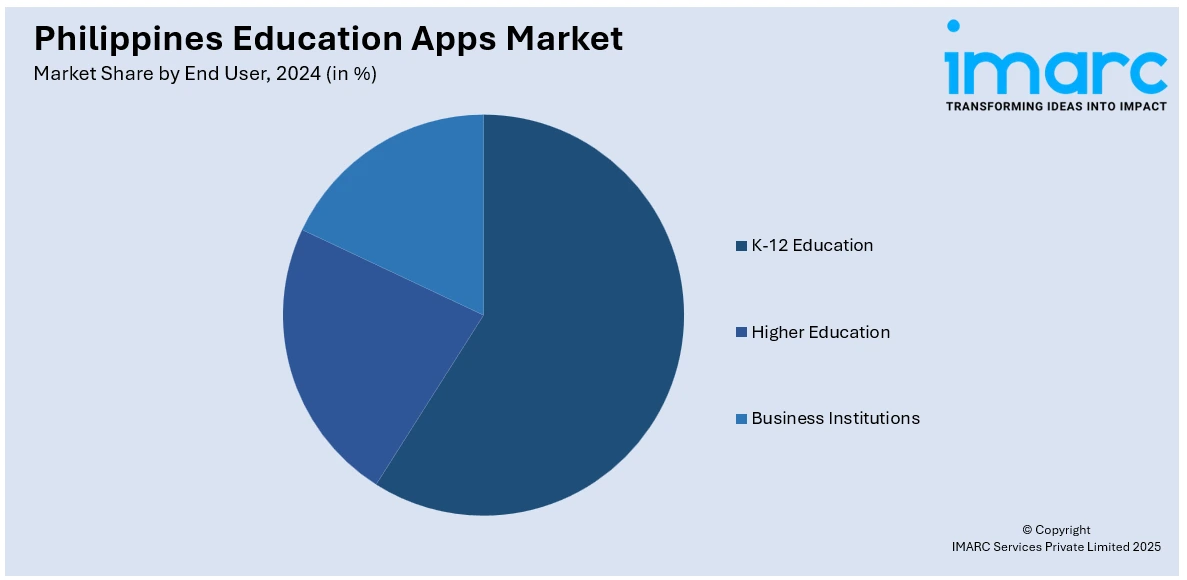

End User Insights:

- K-12 Education

- Higher Education

- Business Institutions

The report has also provided a comprehensive analysis of the market based on end user. This includes K-12 education, higher education, and business institutions.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Education Apps Market News:

- August 2025: Globe announced a partnership with Khan Academy Philippines to launch AI-powered education services within the GlobeOne app. The initiative introduces Khanmigo, an AI assistant designed to support both students and teachers by offering lessons in STEM, digital literacy, online safety, and life skills, with multilingual support in major Philippine languages. The tool also helps reduce teachers’ administrative workload, allowing them to focus more on instruction.

- October 2024: YGG Pilipinas officially launched Metaversity after securing an USD 80,000 grant from Open Campus Accelerator, introducing the Philippines' first Web3 education platform. The innovative program offers gamified and modular learning experiences in emerging technologies including AI, blockchain, and Web3, with plans to train over 5,000 students within its first year of operation.

Philippines Education Apps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Web Based, Mobile Based |

| Operating Systems Covered | iOS and MacOS, Android, Windows |

| End Users Covered | K-12 Education, Higher Education, Business Institutions |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines education apps market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines education apps market on the basis of product type?

- What is the breakup of the Philippines education apps market on the basis of operating system?

- What is the breakup of the Philippines education apps market on the basis of end user?

- What is the breakup of the Philippines education apps market on the basis of region?

- What are the various stages in the value chain of the Philippines education apps market?

- What are the key driving factors and challenges in the Philippines education apps market?

- What is the structure of the Philippines education apps market and who are the key players?

- What is the degree of competition in the Philippines education apps market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines education apps market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines education apps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines education apps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)