Philippines Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Placement, and Region, 2025-2033

Philippines Electric Two-Wheeler Market Overview:

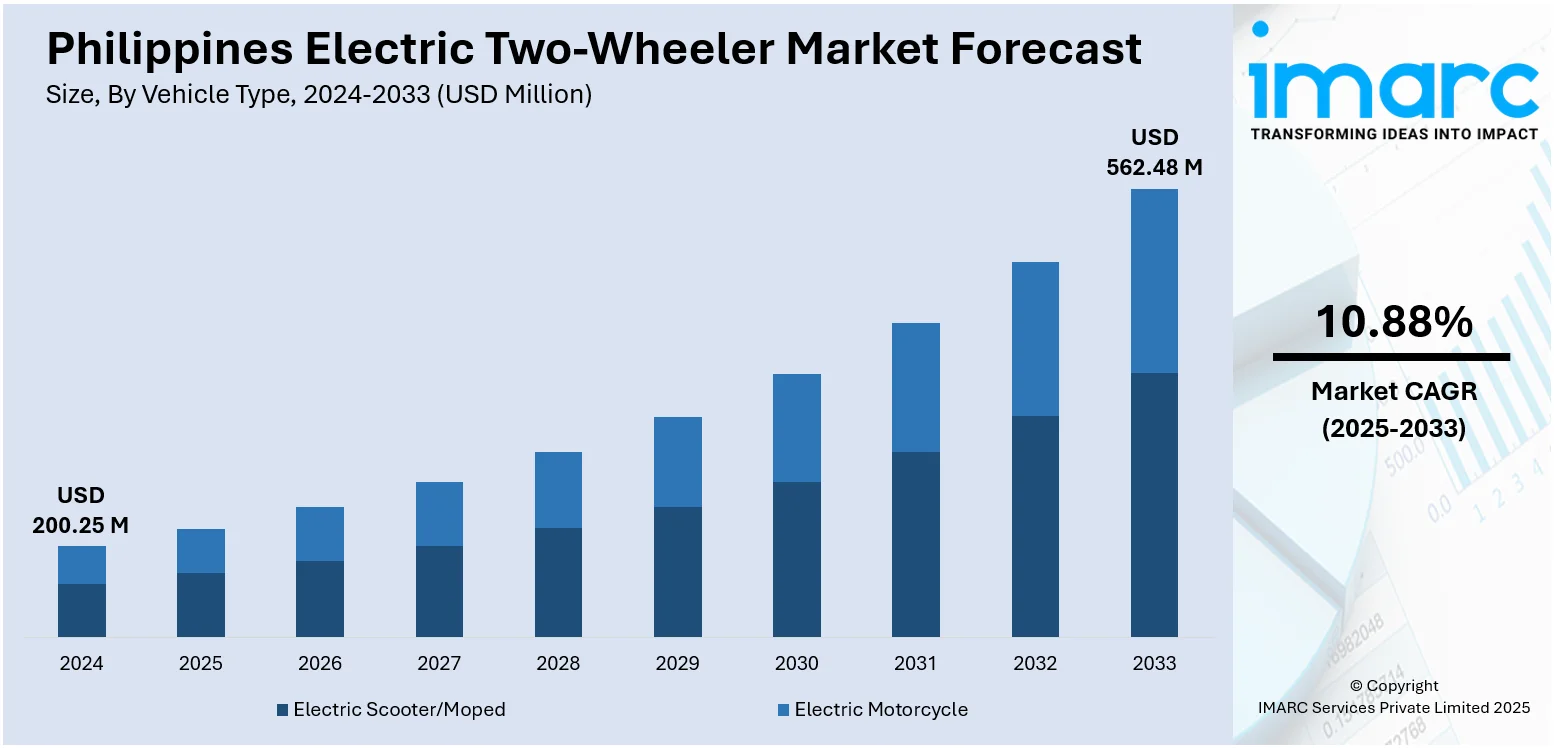

The Philippines electric two-wheeler market size reached USD 200.25 Million in 2024. The market is projected to reach USD 562.48 Million by 2033, exhibiting a growth rate (CAGR) of 10.88% during 2025-2033. The market is driven by rising fuel costs, government initiatives promoting sustainable mobility, and growing environmental awareness among consumers. Increasing urban congestion encourages the adoption of compact, efficient electric scooters and bikes. Advancements in battery technology, reducing charging time and improving range, further support Philippines electric two-wheeler market share. Additionally, expanding charging infrastructure and affordability of entry-level models make electric two-wheelers attractive for daily commuters, while supportive policies and potential tax incentives boost consumer confidence in transitioning to e-mobility solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 200.25 Million |

| Market Forecast in 2033 | USD 562.48 Million |

| Market Growth Rate 2025-2033 | 10.88% |

Philippines Electric Two-Wheeler Market Trends:

Government Initiatives and Supportive Policies

A key Philippines electric two-wheeler market trend is the government’s active role in accelerating adoption through green mobility policies. Initiatives such as reduced tariffs on imported e-motorcycles, proposed tax incentives, and regulatory backing for EV infrastructure development are fostering a supportive market environment. The Department of Energy and local government units are also exploring ways to expand charging stations, particularly in urban hubs. These efforts align with the country's commitment to lowering carbon emissions under international climate agreements. Additionally, certain localities are offering perks like free parking or road-use incentives for e-vehicles, making electric two-wheelers more appealing for city commuters. Government-backed campaigns to raise awareness about sustainable transportation amplify these efforts, helping overcome consumer hesitancy and pushing the market toward faster adoption of electric mobility solutions.

To get more information on this market, Request Sample

Rising Fuel Costs and Cost-Efficiency

One of the strongest drivers for the electric two-wheeler market in the Philippines is the continuous increase in fuel prices, which makes traditional motorcycles and scooters more expensive to operate. As of mid‑2024, the country had only 354 electric motorcycles out of roughly 15,300 total EVs, reflecting penetration well under 1%—indicating significant room for growth despite the heavy reliance on fuel-powered vehicles. Electric two-wheelers offer a significantly lower cost-per-kilometer, making them highly appealing to daily commuters and delivery service providers who depend on affordable transportation. This cost-efficiency is especially valuable in urban areas where short trips dominate travel behavior. With electricity prices relatively more stable than gasoline, the long-term savings potential encourages adoption. Many Filipinos also view electric two-wheelers as protection against unpredictable fuel price fluctuations, while the availability of budget-friendly models and low maintenance needs accelerates Philippines electric two-wheeler market growth.

Urbanization and Traffic Congestion

Rapid urbanization in the Philippines, particularly in Metro Manila and other highly populated cities, has led to severe traffic congestion, making efficient and maneuverable vehicles a necessity. Electric two-wheelers provide a practical solution, allowing riders to navigate crowded streets and narrow lanes faster than cars or larger motorcycles. The growing demand for delivery services, fueled by e-commerce and food delivery platforms, further drives the need for compact, low-cost electric scooters and bikes. These vehicles are ideal for frequent stop-and-go trips common in urban logistics. Furthermore, with local governments actively seeking to reduce traffic congestion and pollution, electric two-wheelers are seen as part of the long-term solution for sustainable urban mobility. Their small size, low noise levels, and zero tailpipe emissions make them well-suited for city environments, encouraging adoption among both individual commuters and businesses.

Philippines Electric Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology, and motor placement.

Vehicle Type Insights:

- Electric Scooter/Moped

- Electric Motorcycle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric scooter/moped and electric motorcycle.

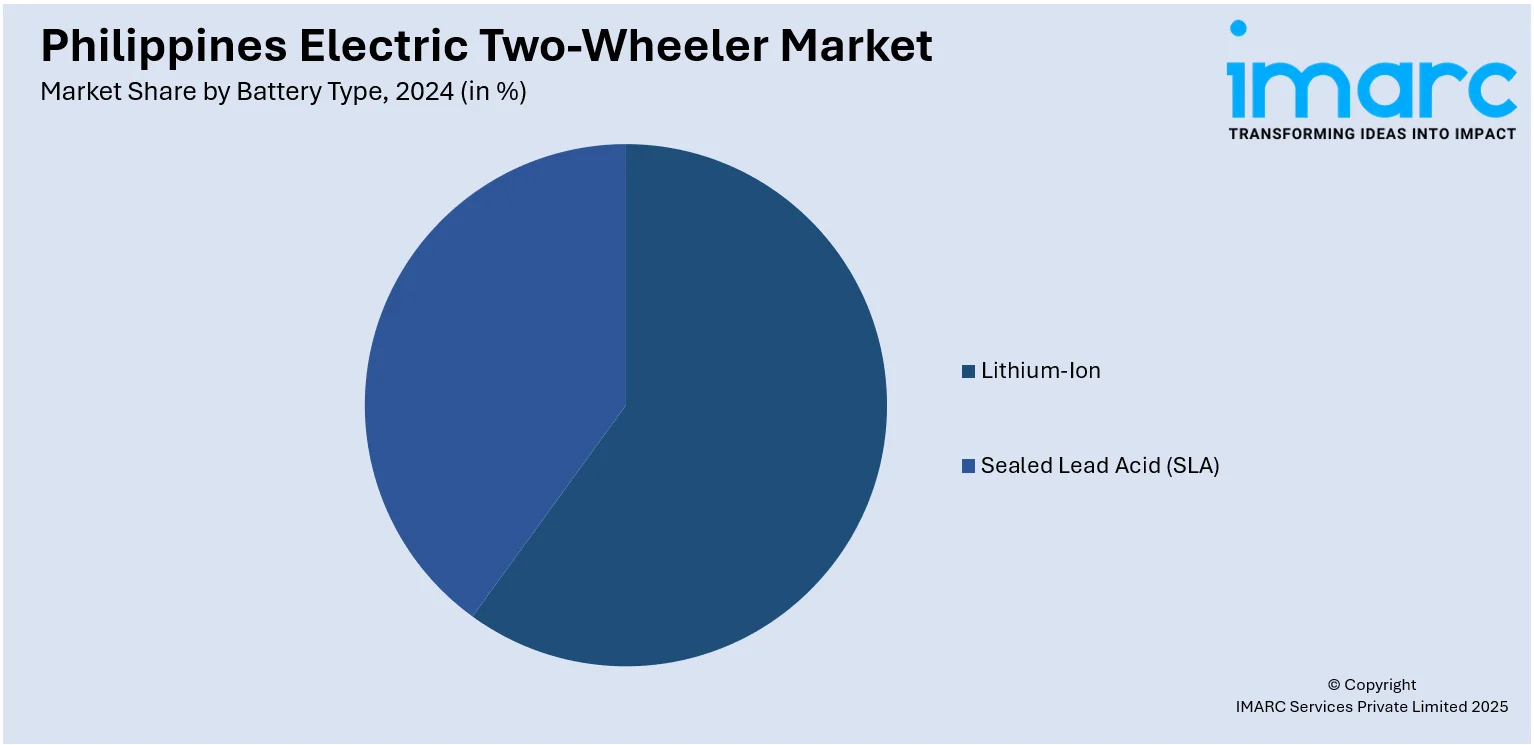

Battery Type Insights:

- Lithium-Ion

- Sealed Lead Acid (SLA)

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion and sealed lead acid (SLA).

Voltage Type Insights:

- <48V

- 48-60V

- 61-72V

- 73-96V

- >96V

A detailed breakup and analysis of the market based on the voltage type have also been provided in the report. This includes <48V, 48-60V, 61-72V, 73-96V, and >96V.

Peak Power Insights:

- <3 kW

- 3-6 kW

- 7-10 kW

- >10 kW

A detailed breakup and analysis of the market based on the peak power have also been provided in the report. This includes <3 kW, 3-6 kW, 7-10 kW, and >10 kW.

Battery Technology Insights:

- Removable

- Non-Removable

A detailed breakup and analysis of the market based on the battery technology have also been provided in the report. This includes removable and non-removable.

Motor Placement Insights:

- Hub Type

- Chassis Mounted

A detailed breakup and analysis of the market based on the motor placement have also been provided in the report. This includes hub type and chassis mounted.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Electric Two-Wheeler Market News:

- In September 2024, Honda Philippines, Inc. (HPI) launched its first fully electric two-wheeler, the Honda EM1 e:, priced at PHP 155,400. Powered by the Honda Mobile Power Pack e: with a high-quality lithium-ion battery, it offers a claimed range of 41.3 km per charge. The launch marks Honda’s entry into the Philippine electric motorcycle market, supporting the country’s push for sustainable urban mobility solutions.

- In May 2024, VinFast officially announced its entry into the Philippine electric vehicle market, with a brand launch set for May 31, 2024, in Manila. The company will introduce electric cars, six motorcycle models, and the VF DrgnFly e-bike, alongside nationwide dealership plans and after-sales services. This expansion supports the Philippines’ green mobility goals, following discussions between President Ferdinand Marcos Jr. and VinFast founder Pham Nhat Vuong earlier this year. Public test drives will be held June 1–2.

Philippines Electric Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48-60V, 61-72V, 73-96V, >96V |

| Peak Powers Covered | <3 kW, 3-6 kW, 7-10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-Removable |

| Motor Placements Covered | Hub Type, Chassis Mounted |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines electric two-wheeler market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines electric two-wheeler market on the basis of vehicle type?

- What is the breakup of the Philippines electric two-wheeler market on the basis of battery type?

- What is the breakup of the Philippines electric two-wheeler market on the basis of voltage type?

- What is the breakup of the Philippines electric two-wheeler market on the basis of peak power?

- What is the breakup of the Philippines electric two-wheeler market on the basis of battery technology?

- What is the breakup of the Philippines electric two-wheeler market on the basis of motor placement?

- What is the breakup of the Philippines electric two-wheeler market on the basis of region?

- What are the various stages in the value chain of the Philippines electric two-wheeler market?

- What are the key driving factors and challenges in the Philippines electric two-wheeler market?

- What is the structure of the Philippines electric two-wheeler market and who are the key players?

- What is the degree of competition in the Philippines electric two-wheeler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines electric two-wheeler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines electric two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines electric two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)