Philippines Electric Vehicle Aftermarket Size, Share, Trends and Forecast by Replacement Part, Propulsion Type, Vehicle Type, Certification, Distribution Channel, and Region, 2025-2033

Philippines Electric Vehicle Aftermarket Overview:

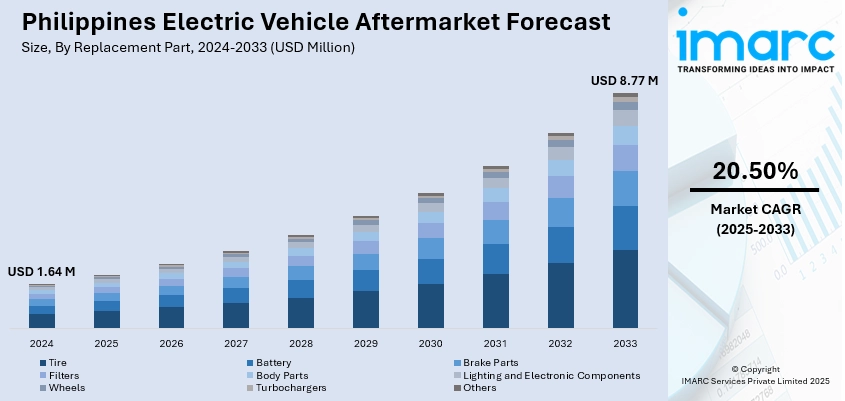

The Philippines electric vehicle aftermarket size reached USD 1.64 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 8.77 Million by 2033, exhibiting a growth rate (CAGR) of 20.50% during 2025-2033. Surging EV ownership, rising consumer demand for customization, and growing local servicing capabilities drive the market. Parts localization, mobile servicing, and training programs support expansion. Partnerships with global component suppliers and regulatory standards reinforce development. These dynamics enhance Philippines electric vehicle aftermarket market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.64 Million |

| Market Forecast in 2033 | USD 8.77 Million |

| Market Growth Rate 2025-2033 | 20.50% |

Philippines Electric Vehicle Aftermarket Trends:

Local Parts Production and Distribution

Domestic manufacturing of EV batteries, charging adapters, and cabin accessories significantly fuels Philippines electric vehicle aftermarket market growth. OEMs partner with Filipino component makers to localize production, reducing cost and lead time. For instance, in January 2025, the Asian Development Bank (ADB) provided a USD 100 Million financing package to Ayala Corporation to boost the Philippines’ electric vehicle (EV) ecosystem. The funds will support the rollout of EV charging stations and procurement of electric vehicles. Ayala’s ACMobility will lead implementation, aiming to reduce emissions, expand green jobs, and improve EV adoption infrastructure nationwide. Central distribution hubs in Luzon and Visayas ensure swift delivery. Aftermarkets stock protective covers, performance modules, and lifestyle accessories tailored to local car models. Tech-enabled retailers operate e‑commerce storefronts with same‑day delivery. Value chain linkages through chambers of commerce promote quality certification. These localized capabilities lower barriers to customization and repair accessibility, stimulating demand and strengthening Philippines electric vehicle aftermarket market growth.

To get more information on this market, Request Sample

Smart Upgrades and Energy Integrations

Consumer appetite for performance and tech upgrades propels Philippines electric vehicle aftermarket market growth. Programmable control units offer drive mode customization, while plug‑in solar trailer generators extend range. Telematics add‑ons for fleet tracking and predictive maintenance integrate with mobile apps. Smart interiors—featuring wireless charging pads, ambient lighting, and infotainment upgrades—enhance brand appeal. Partnerships with renewable energy companies offer home charging station retrofits. Subscription‑based firmware enhancements and OTA tuning services provide incremental improvement options. Retailers incorporate virtual configurators enabling buyers to preview upgrades. These advanced offerings elevate the EV experience and generate recurring revenue—driving Philippines electric vehicle aftermarket market growth. In May 2024, the Philippines extended its zero-tariff policy on electric vehicles, hybrids, e-motorcycles, and e-bicycles until 2028, significantly lowering import costs for advanced EV components and technologies. This move accelerates consumer access to smart upgrades like programmable control units, telematics, and renewable energy integrations, supporting the country’s goal to reduce emissions by 75% by 2030. By making cutting-edge EV parts more affordable, the policy boosts adoption of enhanced, energy-efficient transportation options, driving growth in the Philippines’ electric vehicle aftermarket market.

Philippines Electric Vehicle Aftermarket Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on replacement part, propulsion type, vehicle type, certification, and distribution channel.

Replacement Part Insights:

- Tire

- Battery

- Brake Parts

- Filters

- Body Parts

- Lighting and Electronic Components

- Wheels

- Turbochargers

- Others

The report has provided a detailed breakup and analysis of the market based on the replacement part. This includes tire, battery, brake parts, filters, body parts, lighting and electronic components, wheels, turbochargers, and others.

Propulsion Type Insights:

- Battery Electric Vehicles

- Hybrid Electric Vehicles

- Fuel Cell Electric Vehicles

- Plug-in Hybrid Electric Vehicles

The report has provided a detailed breakup and analysis of the market based on the propulsion type. This includes battery electric vehicles, hybrid electric vehicles, fuel cell electric vehicles, and plug-in hybrid electric vehicles.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars and commercial vehicles.

Certification Insights:

- Genuine Parts

- Certified Parts

- Uncertified Parts

The report has provided a detailed breakup and analysis of the market based on the certification. This includes genuine parts, certified parts, and uncertified parts.

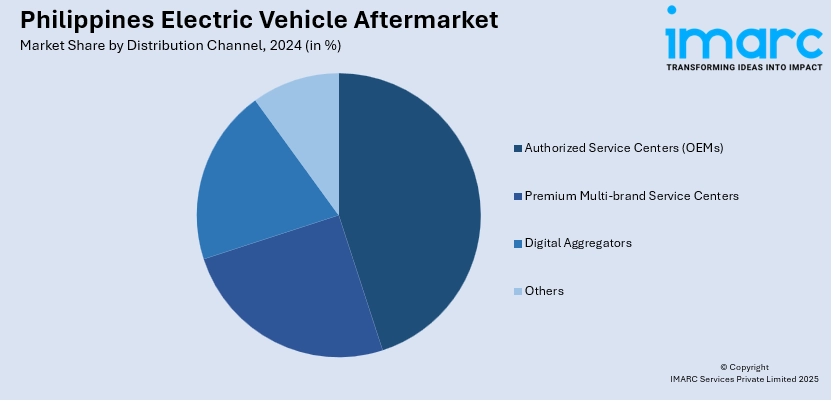

Distribution Channel Insights:

- Authorized Service Centers (OEMs)

- Premium Multi-brand Service Centers

- Digital Aggregators

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes authorized service centers (OEMs), premium multi-brand service centers, digital aggregators, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Electric Vehicle Aftermarket News:

- In April 2025, Rymax Philippines and Dongfeng Motors signed a strategic partnership to advance electric vehicle (EV) growth in the Philippines. The alliance will distribute Dongfeng’s full vehicle range, from EVs to hybrids and ICEs, via Rymax’s nationwide network. A ₱5 Million SME dealership program will empower local entrepreneurs. The collaboration supports national sustainability goals by promoting cleaner mobility and expanding EV access, while also maintaining support for traditional vehicles through Rymax’s lubricant solutions.

- In March 2025, VinFast partnered with Motech to expand its electric vehicle service network in the Philippines. The collaboration aims to certify Motech’s 63 service centers for professional after-sales support, including maintenance and repairs. VinFast also plans to establish over 100 service centers nationwide. This partnership complements its EV rollout—including electric cars, motorcycles, and a battery subscription model—launched in 2024. Through its charging unit V-GREEN, VinFast also plans to deploy 100,000 charging stations across Southeast Asia, addressing range anxiety and boosting EV adoption.

Philippines Electric Vehicle Aftermarket Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Replacement Parts Covered | Tire, Battery, Brake Parts, Filters, Body Parts, Lighting and Electronic Components, Wheels, Turbochargers, Others |

| Propulsion Types Covered | Battery Electric Vehicles, Hybrid Electric Vehicles, Fuel Cell Electric Vehicles, Plug-In Hybrid Electric Vehicles |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Certifications Covered | Genuine Parts, Certified Parts, Uncertified Parts |

| Distribution Channels Covered | Authorized Service Centers (OEMs), Premium Multi-Brand Service Centers, Digital Aggregators, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines electric vehicle aftermarket performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines electric vehicle aftermarket on the basis of replacement part?

- What is the breakup of the Philippines electric vehicle aftermarket on the basis of propulsion type?

- What is the breakup of the Philippines electric vehicle aftermarket on the basis of vehicle type?

- What is the breakup of the Philippines electric vehicle aftermarket on the basis of Certification?

- What is the breakup of the Philippines electric vehicle aftermarket on the basis of Distribution Channel?

- What is the breakup of the Philippines electric vehicle aftermarket on the basis of Region?

- What are the various stages in the value chain of the Philippines electric vehicle aftermarket?

- What are the key driving factors and challenges in the Philippines electric vehicle aftermarket?

- What is the structure of the Philippines electric vehicle aftermarket and who are the key players?

- What is the degree of competition in the Philippines electric vehicle aftermarket?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines electric vehicle aftermarket from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines electric vehicle aftermarket.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines conveyor belt industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)