Philippines Engineering Services Outsourcing Market Size, Share, Trends and Forecast by Service, Location, Application, and Region, 2026-2034

Philippines Engineering Services Outsourcing Market Summary:

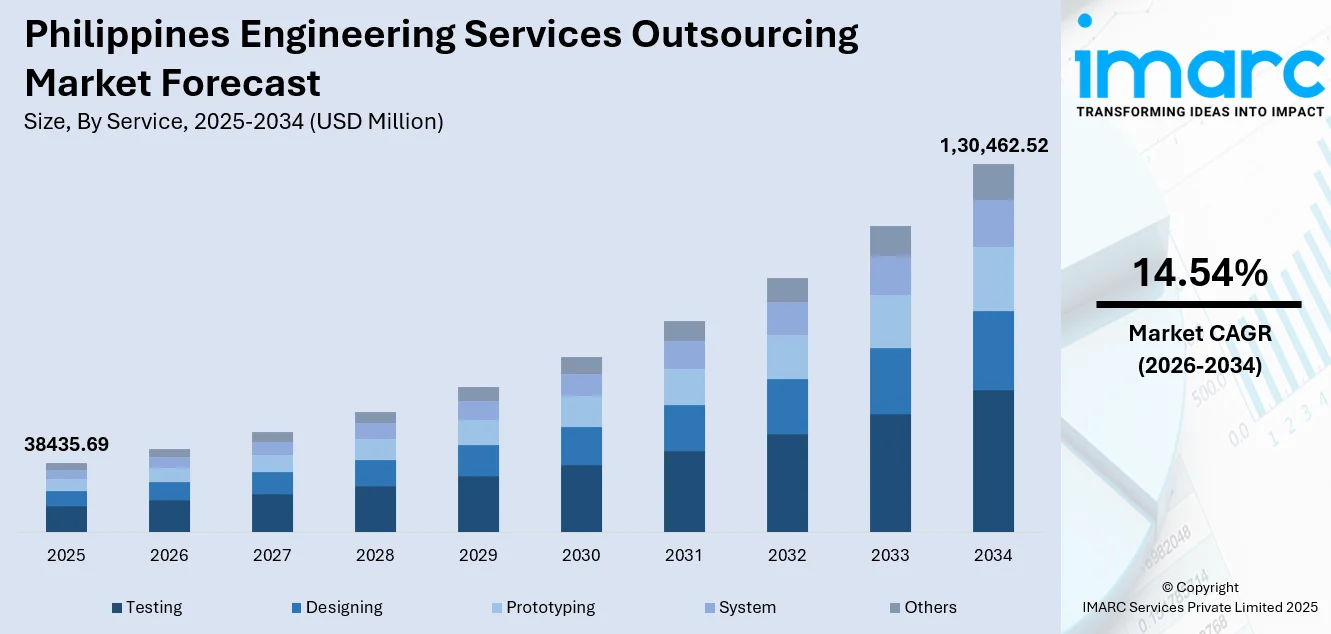

The Philippines engineering services outsourcing market size was valued at USD 38,435.69 Million in 2025 and is projected to reach USD 1,30,462.52 Million by 2034, growing at a compound annual growth rate of 14.54% from 2026-2034.

The Philippines engineering services outsourcing market is experiencing robust expansion driven by the country's highly skilled workforce, competitive labor costs, and strategic geographic positioning. Increasing demand for specialized engineering capabilities across automotive, semiconductor, and electronics industries reinforces market momentum. Government incentives, improved digital infrastructure, and strong cultural alignment with Western clients further enhance the Philippines' appeal as a premier engineering outsourcing destination within the Asia Pacific region.

Key Takeaways and Insights:

- By Service: Testing dominates the market with a share of 32% in 2025, owing to the increasing complexity of automotive systems and electronics components requiring rigorous validation processes. Rising demand for comprehensive quality assurance and compliance testing services continues fueling segment expansion.

- By Location: Offshore leads the market with a share of 63% in 2025. This dominance is driven by significant cost advantages, access to specialized engineering talent pools, and advanced digital collaboration platforms enabling seamless cross-border project execution.

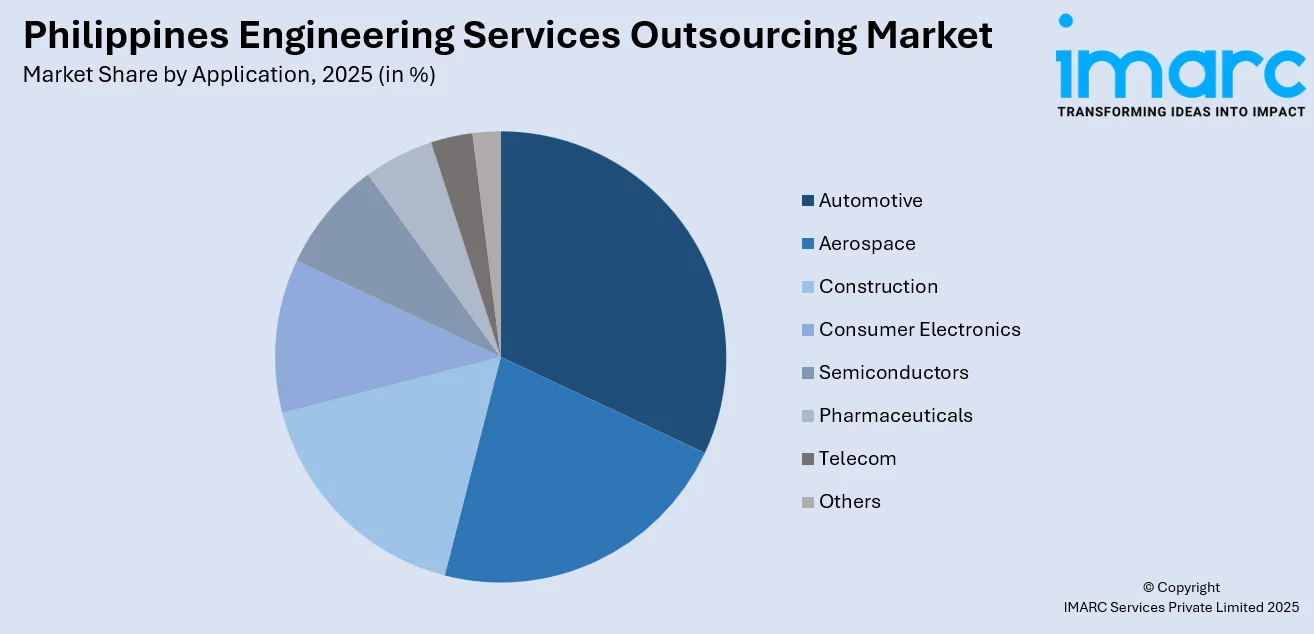

- By Application: Automotive represents the biggest segment with a market share of 21% in 2025, reflecting strong demand for automotive engineering services supporting vehicle design, component testing, and electric vehicle development across global automotive supply chains.

- By Region: Luzon is the largest region with 68% share in 2025, driven by the concentration of engineering talent, established IT parks, and robust infrastructure in Metro Manila and surrounding industrial zones supporting diverse outsourcing operations.

- Key Players: Key players drive the Philippines engineering services outsourcing market by expanding technical capabilities, investing in workforce development programs, and strengthening partnerships with global engineering firms to deliver comprehensive design, testing, and integration solutions across diverse industrial applications.

To get more information on this market Request Sample

The Philippines engineering services outsourcing market continues advancing as the country solidifies its position within the global engineering services value chain. The nation produces substantial numbers of engineering graduates annually, ensuring a steady pipeline of skilled professionals capable of supporting complex technical projects across diverse industries. Government initiatives including workforce development programs and tax incentives foster favorable conditions for foreign investment and domestic capability development. The integration of artificial intelligence, automation technologies, and advanced simulation tools enhances service delivery capabilities while maintaining cost competitiveness. Engineering service providers are increasingly focusing on higher-value offerings including product development, system integration, and specialized testing services that command premium pricing. Regional expansion beyond traditional urban hubs toward emerging technology centers broadens market reach while addressing infrastructure requirements. Strategic partnerships between Philippine engineering firms and multinational corporations strengthen knowledge transfer, elevate service quality standards, and position the country as an essential node in global engineering supply chains.

Philippines Engineering Services Outsourcing Market Trends:

Digital Transformation and AI Integration in Engineering Services

Engineering service providers across the Philippines are rapidly integrating artificial intelligence, machine learning, and automation technologies into their service delivery frameworks. According to IBPAP, approximately 67% of IT-BPM member companies have adopted AI tools as of 2024, enhancing productivity across design, simulation, and quality assurance processes. This technological evolution enables faster project turnaround, improved accuracy in complex engineering calculations, and creation of new revenue streams through advanced analytics offerings.

Expansion to Regional Technology Hubs Beyond Major Urban Centers

The engineering services outsourcing industry is experiencing significant decentralization as operations expand into emerging regional hubs across the country. Government initiatives are actively positioning secondary locations throughout various island groups to absorb the next wave of industry expansion and distribute economic opportunities more broadly. These regional hubs are capturing an increasing share of industry employment as companies seek to access untapped talent pools, reduce operational costs, and mitigate concentration risks associated with operating exclusively in congested metropolitan areas. Infrastructure improvements and connectivity enhancements in provincial cities further accelerate this geographic diversification trend.

Shift Toward Knowledge Process Outsourcing and Specialized Services

The Philippine engineering services sector is transitioning from basic process outsourcing toward sophisticated knowledge-based engineering solutions requiring advanced technical expertise. Service providers are developing specialized capabilities in high-technology domains including chip design, embedded systems development, and advanced product engineering that command premium pricing. This evolution reflects the country's deep integration into global high-technology supply chains and growing demand for engineering expertise supporting complex manufacturing industries. The shift enables Philippine firms to capture higher-value contracts, improve profit margins, and strengthen competitive positioning against regional outsourcing destinations offering similar cost advantages.

Market Outlook 2026-2034:

The Philippines engineering services outsourcing market demonstrates strong growth potential as the country strengthens its competitive positioning within the global engineering services landscape. Rising demand for specialized engineering capabilities across automotive, semiconductor, aerospace, and telecommunications sectors creates substantial opportunities for market expansion. Government support through fiscal incentives, infrastructure investments, and workforce development programs enhances the business environment for engineering service providers. The market generated a revenue of USD 38,435.69 Million in 2025 and is projected to reach a revenue of USD 1,30,462.52 Million by 2034, growing at a compound annual growth rate of 14.54% from 2026-2034. The integration of advanced technologies including artificial intelligence, digital twins, and cloud-based collaboration platforms positions Philippine engineering firms to capture higher-value service contracts while maintaining cost advantages that attract global clients seeking operational efficiency.

Philippines Engineering Services Outsourcing Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Service | Testing | 32% |

| Location | Offshore | 63% |

| Application | Automotive | 21% |

| Region | Luzon | 68% |

Service Insights:

- Designing

- Prototyping

- System Integration

- Testing

- Others

Testing dominates with a market share of 32% of the total Philippines engineering services outsourcing market in 2025.

The testing segment maintains leadership within the Philippines engineering services outsourcing market driven by increasing complexity of automotive systems, consumer electronics, and semiconductor components requiring comprehensive validation and quality assurance processes. Philippine engineering firms have developed specialized capabilities in simulation testing, hardware validation, and compliance certification services that meet international quality standards. The IT-BPM industry in the Philippines generated USD 38 Billion in revenue in 2024, with testing and quality assurance services representing a significant portion of technical engineering offerings delivered to global clients.

Rising demand for electric vehicle testing, embedded systems validation, and telecommunications equipment certification strengthens the testing segment's market position within the Philippines. Engineering service providers invest in advanced testing infrastructure including automated test equipment, environmental simulation chambers, and specialized measurement instrumentation to expand service capabilities. The country's established semiconductor and electronics manufacturing ecosystem creates natural demand for testing services supporting product development cycles, quality control processes, and regulatory compliance requirements across diverse industry applications served through offshore engineering partnerships.

Location Insights:

- Onshore

- Offshore

Offshore leads with a share of 63% of the total Philippines engineering services outsourcing market in 2025.

The offshore segment dominates the Philippines engineering services outsourcing market as international clients leverage significant cost advantages while accessing skilled engineering talent pools unavailable in their domestic markets. Philippine engineering professionals command competitive salaries representing substantial savings compared to equivalent roles in developed economies, enabling companies to optimize engineering budgets without compromising service quality. The country produces large numbers of university graduates annually including substantial engineering graduates, ensuring continuous workforce supply supporting offshore engineering operations across diverse technical disciplines. This abundant talent pipeline allows service providers to scale operations rapidly in response to client requirements while maintaining consistent quality standards across project deliveries.

Advanced digital collaboration platforms, cloud-based project management tools, and high-speed telecommunications infrastructure enable seamless offshore engineering service delivery connecting Philippine teams with global clients. Strong English proficiency throughout the Filipino workforce facilitates effective communication and collaboration with international clients who represent primary demand sources for offshore engineering services. Cultural alignment with Western business practices, favorable time zone positioning for round-the-clock operations, and government support through economic zone incentives further strengthen the offshore segment's competitive positioning within the market.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Aerospace

- Automotive

- Construction

- Consumer Electronics

- Semiconductors

- Pharmaceuticals

- Telecom

- Others

Automotive exhibits a clear dominance with 21% share of the total Philippines engineering services outsourcing market in 2025.

The automotive segment leads application categories within the Philippines engineering services outsourcing market driven by growing demand for vehicle design, component engineering, and electric vehicle development support services. Global automotive manufacturers increasingly outsource engineering functions to Philippine service providers to access specialized capabilities at competitive cost points. Domestic automotive market activity stimulates demand for engineering expertise across design, testing, and system integration services as vehicle manufacturers expand production capacity and introduce new models requiring comprehensive engineering support throughout product development cycles. The increasing complexity of modern vehicles necessitates access to diverse engineering competencies that offshore partnerships efficiently provide.

Philippine engineering firms support automotive clients with comprehensive services spanning computer-aided design, finite element analysis, prototype development, and validation testing for components ranging from powertrain systems to interior trim elements. The transition toward electric vehicles, advanced driver assistance systems, and connected car technologies creates expanding opportunities for specialized engineering services requiring expertise in embedded software development, battery management systems, and electronic control unit programming. Strategic positioning within Asian automotive supply chains enables Philippine service providers to serve regional manufacturing hubs efficiently while maintaining competitive pricing structures.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon represents the leading segment with 68% share of the total Philippines engineering services outsourcing market in 2025.

Luzon dominates the Philippines engineering services outsourcing market with the highest concentration of IT parks, engineering firms, and skilled workforce distributed across multiple industrial regions throughout the island. The region houses the majority of the country's semiconductor facilities and technology infrastructure, benefiting from proximity to major ports and international airports facilitating efficient logistics operations. Luzon's established infrastructure including registered economic zones provides fiscal incentives, streamlined customs processing, and export-oriented logistics platforms supporting engineering services operations across diverse industry verticals requiring specialized technical capabilities.

Major global technology companies maintain significant engineering operations throughout Luzon, employing substantial numbers of Filipino professionals delivering technical services to international clients across multiple industry sectors. The region's comprehensive educational infrastructure produces the largest share of engineering graduates supporting workforce requirements across diverse technical disciplines including mechanical, electrical, electronic, and computer engineering specializations. Government initiatives targeting infrastructure development, digital connectivity enhancement, and workforce upskilling reinforce Luzon's competitive advantages while creating pathways for continued market expansion through the forecast period as engineering service demand intensifies across automotive, semiconductor, and telecommunications applications.

Market Dynamics:

Growth Drivers:

Why is the Philippines Engineering Services Outsourcing Market Growing?

Abundant Skilled Engineering Workforce at Competitive Costs

The Philippines possesses a substantial reservoir of engineering talent that attracts global companies seeking cost-effective technical expertise without compromising service quality. The country produces approximately 850,000 university graduates annually. This continuous talent pipeline ensures adequate workforce supply supporting engineering services expansion across diverse technical domains. Filipino engineers demonstrate strong technical competencies, excellent English communication skills, and cultural alignment with Western clients that facilitate effective collaboration. Competitive labor costs enable companies to savings equivalent engineering roles in developed economies. The combination of technical proficiency, linguistic capability, and cost advantage positions the Philippines as an attractive destination for engineering services outsourcing within the Asia Pacific region.

Supportive Government Policies and Investment Incentives

Government initiatives significantly contribute to the Philippines engineering services outsourcing market growth through favorable policies, fiscal incentives, and infrastructure development programs. Tax reform legislation provides corporate tax benefits and research and development incentives encouraging investment in engineering services capabilities. Registered economic zones have attracted substantial investment approvals, reflecting strong investor confidence in the regulatory environment. Government programs position secondary locations across the archipelago to absorb expanding technology and business process operations, broadening the geographic distribution of engineering services delivery. Public-private partnerships with educational institutions strengthen workforce development programs aligning curriculum with industry requirements. Advisory councils coordinate policies supporting key technology sectors, creating favorable conditions for specialized engineering services growth.

Rising Global Demand for Automotive and Electronics Engineering Services

Increasing complexity of automotive systems, consumer electronics, and semiconductor devices drives expanding demand for engineering services outsourcing to the Philippines. Global electric vehicle adoption, advanced driver assistance systems, and connected vehicle technologies require specialized engineering capabilities that Philippine service providers are developing. Multinational companies including Samsung and General Electric are expanding research and development operations locally, reflecting confidence in Philippine engineering capabilities. Rising content per vehicle in electric and autonomous vehicles increases demand for embedded systems development, software engineering, and validation testing services. The telecommunications equipment certification requirements created by 5G network deployment further expand engineering services opportunities across the Philippine market.

Market Restraints:

What Challenges the Philippines Engineering Services Outsourcing Market is Facing?

Talent Shortages in Emerging Technology Domains

The rapid growth of engineering services outsourcing has created shortages of qualified talent in specialized technology domains including artificial intelligence, data analytics, cybersecurity, and advanced semiconductor design. While the Philippines produces substantial numbers of engineering graduates annually, skills gaps persist in emerging technology areas requiring advanced training and specialized expertise. Competition for experienced professionals intensifies as multiple employers compete for limited talent pools, driving wage inflation and increasing employee turnover rates that impact operational continuity.

Competition from Regional Outsourcing Destinations

The Philippines faces intensifying competition from other Asia Pacific countries including India, Vietnam, and Indonesia that are aggressively developing their engineering services outsourcing capabilities. These competing destinations offer similar cost advantages while investing heavily in infrastructure development, workforce training, and technology adoption. Rising wages in the Philippines may gradually erode cost competitiveness relative to emerging alternatives, requiring continuous productivity improvements and service quality enhancements to maintain market positioning against regional competitors.

Infrastructure Limitations in Emerging Regional Hubs

While Metro Manila and established industrial zones possess adequate infrastructure, expanding engineering services operations into provincial areas encounters limitations in transportation networks, power supply reliability, and telecommunications connectivity. These infrastructure constraints restrict geographic expansion opportunities and limit the industry's ability to fully leverage lower-cost regional labor markets. Addressing infrastructure gaps requires sustained public and private investment in roads, electricity generation, internet backbone capacity, and modern office facilities supporting professional engineering operations.

Competitive Landscape:

The Philippines engineering services outsourcing market demonstrates moderate fragmentation with participation from global system integrators, specialized engineering firms, and domestic service providers. Major international players including Accenture, Cognizant, Infosys, and IBM maintain significant engineering operations throughout the country, leveraging extensive delivery networks and sector expertise to serve multinational clients. These established providers compete on service breadth, technology capabilities, and quality certifications while investing in workforce development and advanced infrastructure. Domestic engineering firms carve specialized niches in areas including semiconductor testing, automotive component design, and telecommunications engineering where local expertise provides competitive advantages. Competition intensifies around talent acquisition as employers compete for skilled engineers, driving innovation in recruitment strategies, training programs, and employee retention initiatives that shape market dynamics.

Philippines Engineering Services Outsourcing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Designing, Prototyping, System Integration, Testing, Others |

| Locations Covered | Onshore, Offshore |

| Applications Covered | Aerospace, Automotive, Construction, Consumer Electronics, Semiconductors, Pharmaceuticals, Telecom, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines engineering services outsourcing market size was valued at USD 38,435.69 Million in 2025.

The Philippines engineering services outsourcing market is expected to grow at a compound annual growth rate of 14.54% from 2026-2034 to reach USD 1,30,462.52 Million by 2034.

Testing dominated the market with a share of 32%, driven by increasing complexity of automotive systems, electronics components, and semiconductor devices requiring comprehensive validation and quality assurance services.

Key factors driving the Philippines engineering services outsourcing market include abundant skilled engineering workforce at competitive costs, supportive government policies through CREATE Act and PEZA incentives, and rising global demand for automotive and electronics engineering services.

Major challenges include talent shortages in emerging technology domains, intensifying competition from regional outsourcing destinations, infrastructure limitations in provincial areas, rising wage pressures, and data security concerns requiring continuous technology investment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)