Philippines Essential Oils Market Size, Share, Trends and Forecast by Product, Application, Sales Channel, and Region, 2026-2034

Philippines Essential Oils Market Summary:

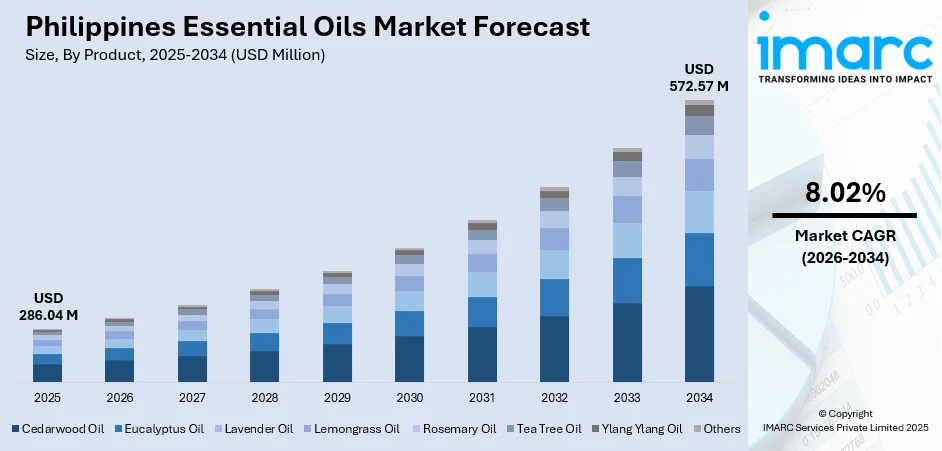

The Philippines essential oils market size was valued at USD 286.04 Million in 2025 and is projected to reach USD 572.57 Million by 2034, growing at a compound annual growth rate of 8.02% from 2026-2034.

The Philippines essential oils market is experiencing robust expansion as consumers increasingly embrace natural wellness solutions, aromatherapy practices, and plant-based personal care products. Rising health consciousness, growing preference for chemical-free alternatives, and the integration of essential oils into traditional Filipino healing practices are strengthening market adoption. Expanding applications across spa and relaxation services, cosmetics formulations, and household cleaning products are reshaping consumer behavior, positioning the archipelago as a dynamic hub for natural aromatic products and supporting the Philippines essential oils market share.

Key Takeaways and Insights:

-

By Product: Tea tree oil dominates the market in 2025, driven by its versatile antimicrobial and anti-inflammatory properties that make it indispensable in skincare, haircare, and wellness formulations across the Philippines.

-

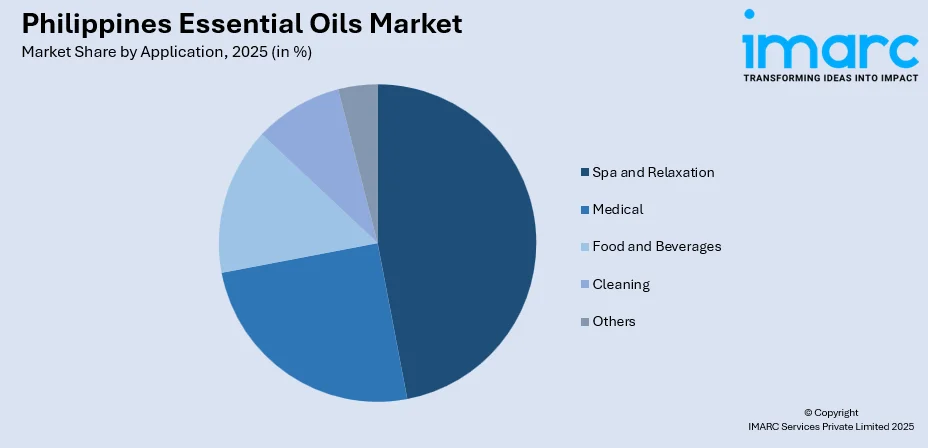

By Application: Spa and relaxation segment leads the market with a share of 46.53% in 2025, reflecting the country's thriving wellness tourism industry and growing consumer demand for aromatherapy and holistic self-care experiences.

-

By Sales Channel: Offline stores hold the largest share at 45.02% in 2025, supported by established pharmacy networks, specialty wellness retailers, and consumer preference for in-person product evaluation before purchase.

-

By Region: Luzon represents the largest segment with a market share of 60% in 2025, driven by Metro Manila's concentration of wellness establishments, higher disposable incomes, and robust retail infrastructure.

-

Key Players: The Philippines essential oils market exhibits moderate fragmentation, with international wellness brands competing alongside regional manufacturers and local artisanal producers across premium, mid-tier, and mass-market segments, fostering innovation in product formulations and distribution strategies.

To get more information on this market Request Sample

The Philippines essential oils market is advancing as traditional healing practices converge with modern wellness trends to create diverse consumption patterns. The country's spa industry has established itself as a crucial component of the broader wellness ecosystem. This infrastructure provides a substantial foundation for essential oil consumption in aromatherapy, massage therapy, and relaxation services. Consumer interest in natural remedies has intensified, with Filipinos increasingly incorporating essential oils into daily routines for stress relief, immune support, and home ambience enhancement. The market benefits from the country's tropical climate supporting indigenous production of ylang-ylang, citronella, and lemongrass oils, while simultaneously importing tea tree, lavender, and eucalyptus oils to meet diversifying demand. Rising urban populations, expanding middle-class purchasing power, and digital wellness education through social media platforms continue accelerating the Philippines essential oils market growth trajectory.

Philippines Essential Oils Market Trends:

Rising Integration of Aromatherapy in Wellness Tourism

The Philippines is witnessing accelerated adoption of aromatherapy across wellness tourism establishments as the country positions itself as a regional health destination. Spa and wellness centers are increasingly incorporating essential oil diffusion, aromatic massage therapies, and custom oil blending services to differentiate their offerings and enhance customer experiences. Traditional Filipino healing practices, including hilot massage, are being enriched with essential oil applications to attract both domestic and international wellness travelers seeking authentic therapeutic journeys rooted in indigenous wellness traditions.

Expansion of Natural Ingredients in Personal Care Formulations

Filipino consumers are demonstrating heightened preference for personal care products formulated with natural essential oils, driving reformulation across skincare, haircare, and cosmetics categories. The demand for clean-label and chemical-free beauty products has intensified, with tea tree oil emerging as a particularly sought-after ingredient for acne treatment and scalp care formulations. Local and international brands are responding by launching essential oil-infused product lines targeting younger demographics through social media marketing. The Philippines beauty and personal care market is expected to reach USD 11.1 Billion by 2034, exhibiting a growth rate (CAGR) of 5.70% during 2026-2034, with natural and organic segments exhibiting accelerated growth as consumers prioritize ingredient transparency and sustainable sourcing practices.

Growing Household Applications for Natural Cleaning and Air Purification

Essential oils are gaining significant traction in Philippine households as natural alternatives for cleaning products and air freshening applications. Consumers are increasingly incorporating citronella, lemongrass, and eucalyptus oils into homemade cleaning solutions and diffuser blends for insect repellent and antibacterial properties. The trend toward DIY aromatherapy and natural home care solutions is particularly pronounced among urban millennials and health-conscious families seeking to reduce synthetic chemical exposure in their living environments while creating pleasant ambient atmospheres that promote relaxation and overall household wellbeing.

Market Outlook 2026-2034:

The Philippines essential oils market is positioned for sustained expansion as wellness consciousness permeates consumer behavior across demographic segments. The Department of Tourism's strategic initiatives to position the Philippines as a premier health and wellness destination are catalyzing infrastructure investments in spa facilities and holistic treatment centers. Government-led promotional campaigns showcasing local essential oil products alongside aromatherapy services signal strong policy commitment to sector development, while rising consumer interest in natural remedies and therapeutic applications continues strengthening long-term market prospects. The market generated a revenue of USD 286.04 Million in 2025 and is projected to reach a revenue of USD 572.57 Million by 2034, growing at a compound annual growth rate of 8.02% from 2026-2034.

Philippines Essential Oils Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Application | Spa and Relaxation | 46.53% |

| Sales Channel | Offline Stores | 45.02% |

| Region | Luzon | 60% |

Product Insights:

- Cedarwood Oil

- Eucalyptus Oil

- Lavender Oil

- Lemongrass Oil

- Rosemary Oil

- Tea Tree Oil

- Ylang Ylang Oil

- Others

Tea tree oil dominates the market share of the Philippines essential oils market in 2025.

Tea tree oil has established itself as the preferred essential oil product category in the Philippines, benefiting from its proven antimicrobial, antifungal, and anti-inflammatory properties that resonate strongly with health-conscious consumers seeking effective natural alternatives. Philippine consumers increasingly incorporate tea tree oil into acne treatment regimens, scalp care routines, and first-aid applications, supported by dermatologist recommendations and social media beauty influencer endorsements actively promoting natural skincare solutions for everyday use.

The product's versatility extends beyond personal care into household applications, where tea tree oil serves as a natural disinfectant and air purifying agent. Local pharmacies, wellness specialty stores, and e-commerce platforms have expanded their tea tree oil product assortments to include pure oils, diluted formulations, and combination blends targeting specific skin concerns. International brands have also established distribution networks across the Philippines, intensifying consumer education initiatives and driving premiumization trends within the tea tree oil segment.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Medical

- Pharmaceutical

- Nutraceuticals

- Food and Beverages

- Bakery and Confectionery

- Beverages

- Meat, Poultry and Seafood

- Others

- Spa and Relaxation

- Aromatherapy

- Personal Care

- Cosmetics

- Toiletries

- Others

- Cleaning

- Kitchen Cleaners

- Floor Cleaners

- Bathroom Cleaner

- Others

- Others

The spa and relaxation segment leads the market with a share of 46.53% of the total Philippines essential oils market in 2025.

The spa and relaxation segment commands the largest share of essential oil consumption in the Philippines, reflecting the country's established wellness infrastructure and deep cultural affinity for therapeutic treatments. These establishments extensively utilize essential oils in aromatherapy sessions, massage therapies, facial treatments, and ambient diffusion to enhance customer relaxation experiences and therapeutic outcomes. The integration of aromatic elements has become standard practice across premium spas, resort wellness centers, and urban day spas nationwide.

Consumer demand for at-home spa experiences has accelerated essential oil adoption beyond professional wellness settings. Filipino households are increasingly investing in essential oil diffusers, aromatherapy candles, and bath products infused with lavender, eucalyptus, and ylang-ylang oils for stress relief and sleep enhancement. This shift toward personal wellness rituals reflects broader lifestyle changes emphasizing self-care practices that deliver relaxation benefits within the comfort of residential environments. Social media platforms have further amplified this trend by showcasing creative aromatherapy applications and inspiring consumers to explore diverse essential oil uses.

Sales Channel Insights:

- Offline Stores

- Online Stores

Offline stores hold the largest share at 45.02% of the total Philippines essential oils market in 2025.

Offline retail channels maintain dominance in essential oil distribution across the Philippines, supported by established pharmacy networks, specialty wellness stores, and department store beauty sections. Consumers demonstrate strong preference for physical retail environments where they can evaluate product quality, test aromas, and receive personalized recommendations from trained staff. The Philippine retail market demonstrates robust brick-and-mortar performance, creating concentrated essential oil distribution opportunities in urban commercial centers where foot traffic and consumer purchasing power remain consistently elevated.

Pharmacy chains serve as primary access points for therapeutic-grade essential oils, benefiting from healthcare-related trust associations that reduce purchasing hesitation. Specialty retailers and direct-selling representatives from international essential oil brands provide extensive product education and application guidance, driving customer loyalty and repeat purchases. The integration of essential oil displays within spa and wellness centers creates experiential retail opportunities where consumers can sample products during treatments before making purchase decisions.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon exhibits clear dominance with a 60% share of the total Philippines essential oils market in 2025.

Luzon commands the largest regional share of essential oil consumption in the Philippines, driven by Metro Manila's concentration of wellness establishments, premium retail infrastructure, and affluent consumer demographics. The National Capital Region's urban population exhibits higher awareness of aromatherapy benefits and greater willingness to invest in natural wellness products compared to provincial counterparts. The region benefits from established logistics networks facilitating efficient essential oil distribution across pharmacies, specialty stores, and e-commerce fulfilment centers serving the densely populated metropolitan area.

The clustering of international essential oil brand offices, spa training academies, and wellness tourism facilities in Luzon creates ecosystem advantages that reinforce regional market leadership. Metro Manila serves as the primary hub for product distribution, brand marketing activities, and consumer education initiatives that drive essential oil awareness across the archipelago. The region's advanced logistics infrastructure, higher concentration of affluent consumers, and established retail networks provide essential oil manufacturers and distributors with superior market access compared to other Philippine regions.

Market Dynamics:

Growth Drivers:

Why is the Philippines Essential Oils Market Growing?

Expanding Wellness Tourism Infrastructure and Government Support

The Philippines is experiencing substantial growth in wellness tourism infrastructure, creating expanded demand channels for essential oil products across spa, resort, and therapeutic establishments. The Department of Tourism has actively positioned the country as an affordable wellness destination, showcasing essential oils and aromatherapy services at the 2nd International Health and Wellness Tourism Congress in October 2024. Government initiatives emphasize the integration of traditional Filipino healing practices with modern wellness services, promoting indigenous essential oils in hilot massage and nature-based retreats. The wellness industry contributed 9.9% to the Philippines GDP in 2023, demonstrating the sector's economic significance and policy priority status that benefits essential oil market development.

Rising Consumer Preference for Natural and Organic Personal Care Products

Filipino consumers are demonstrating accelerated adoption of natural and organic personal care products, driving essential oil integration across skincare, haircare, and cosmetics formulations. Increasing awareness of potential adverse effects from synthetic chemicals has prompted consumers to seek plant-based alternatives that align with clean beauty principles. The Philippines beauty and personal care market, with natural product segments exhibiting premium growth rates as brands reformulate offerings with essential oil ingredients. Social media influence amplifies this trend, with beauty influencers and wellness advocates promoting essential oil benefits for acne treatment, scalp health, and stress relief applications.

Growing Health Consciousness and Holistic Wellness Adoption

The Philippines is witnessing heightened health consciousness among consumers, driving adoption of holistic wellness practices that incorporate essential oils for therapeutic benefits. Urban populations increasingly seek natural solutions for stress management, sleep improvement, and immune support, creating expanded household consumption opportunities. The aromatherapy market is experiencing robust global growth, reflecting intensifying consumer interest in natural relaxation methods. Filipino households are integrating essential oil diffusers and aromatic products into daily routines, supported by growing awareness of mental wellness importance and preference for non-pharmaceutical health maintenance approaches.

Market Restraints:

What Challenges the Philippines Essential Oils Market is Facing?

High Competition from Synthetic Alternatives

The essential oils market faces intense competition from synthetic fragrance alternatives that offer lower price points and consistent aromatic profiles. Synthetic fragrances dominate a substantial portion of the Philippine fragrance market, presenting significant challenges for natural essential oil producers seeking to justify premium pricing to cost-conscious consumers who prioritize affordability over natural ingredient sourcing.

Quality Standardization and Adulteration Concerns

Variability in essential oil quality and purity creates consumer trust challenges within the Philippine market. The absence of comprehensive local quality certification standards enables adulterated or diluted products to enter distribution channels, undermining consumer confidence in product efficacy and potentially damaging category reputation among first-time users exploring natural wellness alternatives.

Limited Consumer Education in Secondary Markets

While Metro Manila and major urban centers demonstrate strong essential oil awareness, secondary markets and rural areas exhibit limited understanding of aromatherapy benefits and proper product applications. This knowledge gap restricts market expansion beyond core consumer segments and necessitates significant educational investments by brands seeking broader geographic penetration.

Competitive Landscape:

The Philippines essential oils market exhibits moderate competitive intensity, characterized by the presence of international wellness brands, regional manufacturers, and local artisanal producers operating across distinct market segments. Global direct-selling companies have established robust distribution networks through independent consultants who provide personalized product education and application guidance. Local brands leverage indigenous botanical ingredients and traditional Filipino wellness heritage to differentiate their offerings from imported alternatives. Competition extends across price tiers, with premium imported oils competing against locally produced alternatives and private-label offerings from pharmacy chains. Market participants focus on product quality certification, sustainable sourcing practices, and digital marketing engagement to build consumer loyalty within an increasingly informed customer base.

Philippines Essential Oils Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Cedarwood Oil, Eucalyptus Oil, Lavender Oil, Lemongrass Oil, Rosemary Oil, Tea Tree Oil, Ylang Ylang Oil, Others |

| Applications Covered |

|

| Sales Channels Covered | Offline Stores, Online Stores |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines essential oils market size was valued at USD 286.04 Million in 2025.

The market is expected to grow at a compound annual growth rate of 8.02% from 2026-2034 to reach USD 572.57 Million by 2034.

Tea tree oil holds the largest share in 2025, due to its versatile antimicrobial and anti-inflammatory properties, widespread use in acne treatment and scalp care, and strong alignment with growing consumer preference for natural skincare solutions.

Key factors driving the Philippines essential oils market include expanding wellness tourism infrastructure, rising consumer preference for natural personal care products, growing health consciousness, increasing aromatherapy adoption, and government support for local essential oil production.

Major challenges include high competition from synthetic fragrance alternatives, quality standardization and adulteration concerns, limited consumer education in secondary markets, and price sensitivity among mass-market consumers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)