Philippines Event Management Software Market Size, Share, Trends and Forecast by Component Type, Deployment Type, Organization Size, End Use Sector, and Region, 2026-2034

Philippines Event Management Software Market Overview:

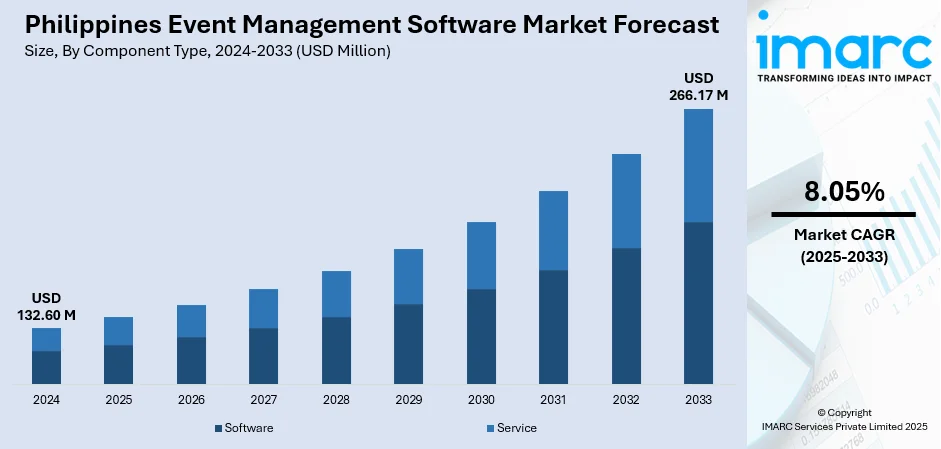

The Philippines event management software market size reached USD 132.60 Million in 2025. The market is projected to reach USD 266.17 Million by 2034, exhibiting a growth rate (CAGR) of 8.05% during 2026-2034. The market is expanding with increasing adoption of hybrid events, digital payment integration, and compliance-driven platforms. Rising demand for mobile-first tools, analytics, and sustainability features continues to strengthen Philippines event management software market share across corporate, educational, and government-led event segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 132.60 Million |

| Market Forecast in 2034 | USD 266.17 Million |

| Market Growth Rate 2026-2034 | 8.05% |

Philippines Event Management Software Market Trends:

Hybrid Events Reshape Demand and Spend

Meetings are returning while remote attendance stays popular, so planners now expect one tool to handle onsite, virtual, and replay in one workflow. Vendors winning in the Philippines focus on mobile-first registration, QR check-ins, session streaming, and post-event content that can be sold or gated for leads. Tourism recovery, corporate training, and government outreach days are feeding steady calendar activity, while 5G rollout and high smartphone use improve attendee engagement features like live polling and chat. Pricing clarity, seat-based models, and freemium trials help small organizers and schools test before scaling. Local reseller support matters for venue coordination and staff training. Integrations with video platforms reduce switching costs, and templates shorten setup time for repeat roadshows. Demand is also rising for booth matchmaking and sponsored microsites that convert interest into meetings. These drivers are lifting Philippines event management software market growth, especially for cloud tools that can run lightweight agendas and handle last-minute changes. Archipelago logistics keep hybrid attractive because travel budgets vary by province; the same agenda can reach regional audiences with minimal extra cost. Tools that simplify certificates, CPD tracking, and feedback loops are becoming standard, tightening renewal rates and multi-year contracts.

To get more information on this market, Request Sample

Payments, Compliance, and Smart Analytics

Merchants want ticketing that accepts local rails and wallets, so platforms that support GCash, Maya, PESONet, and InstaPay clear faster and reduce no-shows. Built-in invoicing and receipt templates help corporate buyers reconcile spend. Data Privacy Act requirements push consent capture, fine-grained permissions, and secure data exports; audit trails, SSO, and MFA are now routine in enterprise bids. Organizers also ask for offline-capable check-ins for venues with unstable connectivity, plus alerting that flags capacity limits, queue buildup, and crowd flow violations. Sponsorship teams need attribution, so UTM tagging, lead scans, and CRM connectors (email tools and sales hubs) are prioritized. AI features are moving from hype to utility: suggested agendas, interest-based recommendations, and de-duplicated leads shorten planning cycles and improve exhibitor ROI. Sustainability fields—waste, energy, digital badges—are included more often in RFPs as companies report on event footprints. Universities and agencies favor vendors with local onboarding and Filipino/English support. Reliability during typhoon season keeps uptime and disaster recovery on procurement checklists. Altogether, payment breadth, compliance depth, and usable analytics now decide renewals, not just feature counts, steering budgets toward platforms that prove revenue lift and cleaner operations.

Philippines Event Management Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on component type, deployment type, organization size, and end use sector.

Component Type Insights:

- Software

- Venue Management Software

- Ticketing Software

- Event Registration Software

- Event Marketing Software

- Event Planning Software

- Others

- Content Management Software

- Visitor Management Software

- Analytics and Reporting Software

- Resource Scheduling Software

- Others

- Services

- Professional Services

- Deployment and Integration

- Construction

- Support and Maintenance

- Managed Services

- Professional Services

The report has provided a detailed breakup and analysis of the market based on the component type. This includes software [venue management software, ticketing software, event registration software, event marketing software, event planning software, and others (content management software, visitor management software, analytics and reporting software, resource scheduling software, and others)] and services [professional services (deployment and integration, construction, support and maintenance) and managed services].

Deployment Type Insights:

- On-Premises

- Cloud

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes on-premises and cloud.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium enterprises and large enterprises.

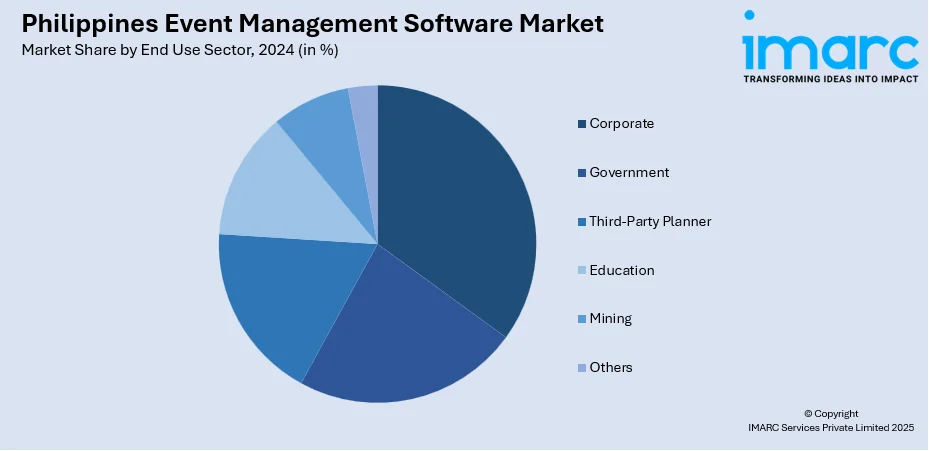

End Use Sector Insights:

- Corporate

- Government

- Third-Party Planner

- Education

- Mining

- Others

A detailed breakup and analysis of the market based on the end use sector have also been provided in the report. This includes corporate, government, third-party planner, education, mining, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Event Management Software Market News:

- August 2025: Xugbo Technologies launched pre-registration for Eventchy, the Philippines’ first AI-integrated event marketplace app, enabling Dream Boards, verified supplier booking, and payments. Suppliers gained digital storefronts and verification badges; clients accessed early features, accelerating event management software adoption, improving trust, and strengthening market competition.

- May 2025: NordCham Philippines adopted Glue Up event management software to centralize registrations, email campaigns, invoicing, and renewals. The platform enabled faster setup, automated reminders, and payment links, improving member experience. The rollout boosted demand as chambers sought scalable, integrated tools, lifting adoption in Philippines.

Philippines Event Management Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered |

|

| Deployment Types Covered | On-Premises, Cloud |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End Use Sectors Covered | Corporate, Government, Third-Party Planner, Education, Mining, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines event management software market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines event management software market on the basis of component type?

- What is the breakup of the Philippines event management software market on the basis of deployment type?

- What is the breakup of the Philippines event management software market on the basis of organization size?

- What is the breakup of the Philippines event management software market on the basis of end use sector?

- What is the breakup of the Philippines event management software market on the basis of region?

- What are the various stages in the value chain of the Philippines event management software market?

- What are the key driving factors and challenges in the Philippines event management software market?

- What is the structure of the Philippines event management software market and who are the key players?

- What is the degree of competition in the Philippines event management software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines event management software market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines event management software market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines event management software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)