Philippines Extended Warranty Market Size, Share, Trends and Forecast by Coverage, Application, Distribution Channel, End User, and Region, 2026-2034

Philippines Extended Warranty Market Overview:

The Philippines extended warranty market size reached USD 2,942.00 Million in 2025. Looking forward, the market is expected to reach USD 4,743.10 Million by 2034, exhibiting a growth rate (CAGR) of 5.45% during 2026-2034. The market is fueled by increasing consumer demand for after-sales insurance, particularly for electronics, appliances, and vehicles. Increasing concern about product durability, combined with limited access to affordable repairs in rural regions, also increases adoption. Retailers and manufacturers are integrating extended warranties as value-added services, while fintech and insurance partners offer flexible, bundled coverage options. These factors collectively enhance customer trust, support repeat business, and contribute to the steady expansion of the Philippines extended warranty market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,942.00 Million |

| Market Forecast in 2034 | USD 4,743.10 Million |

| Market Growth Rate 2026-2034 | 5.45% |

Philippines Extended Warranty Market Trends:

Growing Consumer Electronics and E‑Commerce Expansion

One of the key trends propelling the Philippines market for extended warranties is the expansion of purchases of consumer electronics, particularly online. As per the IMARC Group, the consumer electronics market in the Philippines achieved a size of USD 10.24 Billion in 2024. In the future, the market is expected to attain USD 17.48 Billion by 2033, showing a growth rate (CAGR) of 6.14% from 2025 to 2033. Filipinos are enthusiastic adopters of smartphones, tablets, home appliances, and other technology devices, frequently opting for digital-first shopping channels. This lays fertile ground for extended warranties, as consumers want extra assurance when purchasing high-ticket products through online stores or marketplace websites. Ecommerce sellers ally with after-sales support providers to provide guarantee add-ons at the point of checkout, so coverage is almost frictionless and seamless. The demand is particularly high in metropolitan hubs such as Metro Manila, Cebu, and Davao, where technology fans are used to frequently upgrading devices and where they expect immediate remedy options when complications come up. Extended warranty players are responding by providing flexible, mobile-integrated plans, some even arranging pick-up or doorstep repair, echoing a service model aligned with Filipino expectations of convenience and value. The outcome is a market transitioning toward embedded, customer-first warranty offerings aligned with local shopping habits and tech consumption patterns, which further supports the Philippines extended warranty market growth.

To get more information on this market, Request Sample

Trust and Service Infrastructure in a Fragmented Market

Reliability of service and trust have a substantial effect on the extended warranty value proposition in the Philippines, where repair ecosystems might be unevenly spread. Consumers in rural provinces and secondary cities might struggle with access to authorized service shops, generating demand for warranty packages guaranteeing safe logistics, original components, or service quality. Differentiators on locally customized networks, collaborating with local service centers, mobile mechanics, or manufacturer-certified engineers, establish advantages in both cities and rural areas. Since Filipino consumers place a high premium on craftsmanship and long-term dependability, lengthier warranties that specifically mention rapid, open communication mechanisms and "no-hassle" claim processes resonate particularly well. Brands matching their warranty service options to trusted delivery platforms like courier-supported pick-up and return programs, fulfill expectations throughout archipelagic terrain. The outcome is a warranty market trend influenced by trust ecosystems and access, in which sellers stake their reputations on reliable service delivery, convenient logistics, and authentic coverage, which are three qualities that are critical to capturing Filipino customer trust.

Bundled Finance, Retail Partnerships, and Value Integration

Another dynamic trend of the Philippines extended warranty environment is the intentional bundling of warranty coverages within retail finance and broader purchasing ecosystems. Since appliance and electronics buys are frequently financed through installment plans or credit agreements, retailers and finance firms are increasingly bundling extended warranty provisions with these transactions. This bundling presents a convenient way for consumers to sign up for long-term protection as part of the buying process without having to face an additional barrier or cost. Additionally, lifestyle and department retailers are testing out cross-category bundling, in which guarantees for appliances such as refrigerators, televisions, and washing machines are banded together under one service umbrella, making it easier for customers to manage benefits. In hospitality or property developments, i.e., condos and serviced apartments, the trend is going even further, with extended guaranteed conditions becoming part of amenity packages and after-sales service commitments. By integrating warranties into financial deals and product packages, providers are making what used to be an afterthought extra into a value-focusing add-on, developing customer loyalty, boosting perceived product durability, and defining a wiser, more packaged strategy to post-purchase maintenance in the local market.

Philippines Extended Warranty Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on coverage, application, distribution channel, and end user.

Coverage Insights:

- Standard Protection Plan

- Accidental Protection Plan

The report has provided a detailed breakup and analysis of the market based on the coverage. This includes standard protection plan and accidental protection plan.

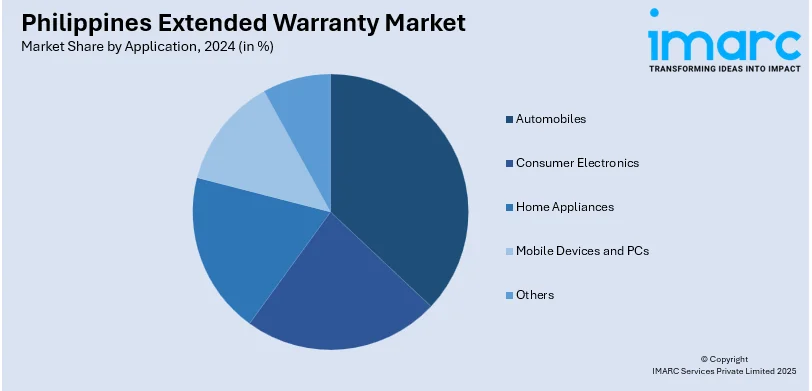

Application Insights:

- Automobiles

- Consumer Electronics

- Home Appliances

- Mobile Devices and PCs

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automobiles, consumer electronics, home appliances, mobile devices and PCs, and others.

Distribution Channel Insights:

- Manufacturers

- Retailers

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes manufacturers, retailers, and others.

End User Insights:

- Individuals

- Business

The report has provided a detailed breakup and analysis of the market based on the end user. This includes individuals and business.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which includes Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Extended Warranty Market News:

- In March 2025, Toyota Motor Philippines (TMP), a top mobility company, introduced the new Toyota 5-Year Warranty. The extended warranty program is applicable to all Toyota vehicles sold after January 1, 2025. Toyota vehicles were previously covered by a three-year warranty or a 100,000-kilometer warranty, whichever came first. Customers who complete the required minimum number of Periodic Maintenance Services (PMS) within the 3-year warranty period, including at least one (1) PMS annually at any Toyota dealership, can obtain up to two (2) additional years or 40,000 kilometers of warranty under the new Toyota 5-Year Warranty.

- In January 2024, Nissan Philippines revealed an extension of the battery warranty for the Nissan Kicks e-POWER from 5 years to 8 years. All Nissan Kicks e-POWER Variants (EL, VE, VL) sold starting August 2022 will receive an extended warranty on its High-voltage Lithium-ion battery for 8 years or 150,000 kilometers, whichever occurs first. This is an important move aimed at improving customer contentment and strengthening the company's standing in the electric vehicle sector.

Philippines Extended Warranty Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Coverages Covered | Standard Protection Plan, Accidental Protection Plan |

| Applications Covered | Automobiles, Consumer Electronics, Home Appliances, Mobile Devices and PCs, Others |

| Distribution Channels Covered | Manufacturers, Retailers, Others |

| End Users Covered | Individuals, Business |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines extended warranty market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines extended warranty market on the basis of coverage?

- What is the breakup of the Philippines extended warranty market on the basis of application?

- What is the breakup of the Philippines extended warranty market on the basis of distribution channel?

- What is the breakup of the Philippines extended warranty market on the basis of end user?

- What is the breakup of the Philippines extended warranty market on the basis of region?

- What are the various stages in the value chain of the Philippines extended warranty market?

- What are the key driving factors and challenges in the Philippines extended warranty market?

- What is the structure of the Philippines extended warranty market and who are the key players?

- What is the degree of competition in the Philippines extended warranty market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines extended warranty market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines extended warranty market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines extended warranty industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)