Philippines Factoring Market Size, Share, Trends and Forecast by Type, Organization Size, Application, and Region, 2026-2034

Philippines Factoring Market Overview:

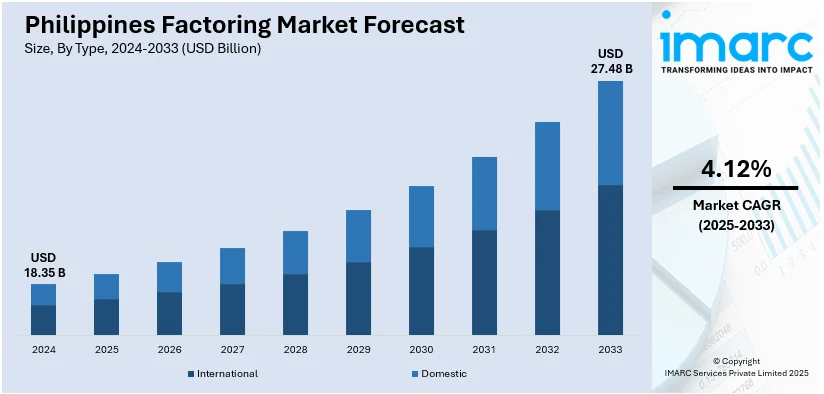

The Philippines factoring market size reached USD 18.35 Billion in 2025. Looking forward, the market is expected to reach USD 27.48 Billion by 2034, exhibiting a growth rate (CAGR) of 4.12% during 2026-2034. The market is driven by small and medium-sized businesses' (SMEs') increasing need for alternative financing since they have less access to traditional bank loans. Growth of e-commerce and supply chain diversification further accelerates the demand for short-term working capital solutions. Such factors, coupled with enhanced financial literacy and fintech innovation, continue to widen the extent and reach of the Philippines factoring market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 18.35 Billion |

| Market Forecast in 2034 | USD 27.48 Billion |

| Market Growth Rate 2026-2034 | 4.12% |

Philippines Factoring Market Trends:

Digital Transformation and Fintech-Driven Efficiency

The Philippines factoring market is transforming at a very fast pace through the impact of digital transformation, as fintech companies reengineer how invoice financing is accessed and delivered. Contrary to conventional factoring schemes that usually necessitate physical paperwork, local fintech players are bringing easy-to-use online platforms where SMEs can upload bills, get approvals, and get funds faster. That resonates well in a nation recognized for its thriving startup ecosystem as well as pervasive smartphone penetration, particularly among young entrepreneurs. The ease of digital onboarding with real-time updates fits the Vietnamese business expectations for ease and agility. Additionally, with increasing MSMEs in sectors such as e-commerce, manufacturing, and services in regions from Metro Manila to Cebu and Davao, digital factoring provides a scalable solution that is positioned for decentralized demand. Using cloud technologies, automation, and efficient payment systems, Philippines factoring market growth continues to evolve into a digital, easy-to-use solution that is suited to the operational pace of local enterprises.

To get more information on this market, Request Sample

SME Outreach and Financial Inclusion

One of the primary trends defining the Philippine factoring market originates from a growing focus on financial inclusion, especially among SMEs in the provincial and underserved regions. With MSMEs taking over the business horizon of both metropolitan cities and provincial provinces, factoring services are being marketed as convenient solutions to ease cash flow shortages resulting from longer payment periods. These small enterprises, most commonly in agriculture, manufacturing, or trading, have already begun to find factoring a convenient replacement for conventional loans when collateral or formal credit backgrounds are not available. Service providers are responding by providing mobile-friendly platforms, local courier pick‑ups, or collaborations with neighborhood lenders to reach daily entrepreneurs. Local factoring providers and marketplaces engineered specifically for SMEs represent a movement of democratizing access to working capital, equipping rural business owners to compete more effectively. As such inclusive services extend their reach into the mainstream beyond their traditional midpoints, they are restructuring the factoring landscape into a more disaggregated equity-based ecosystem focused on the Philippines' heterogeneous business fabric.

Risk Management, Trust and Non‑Recourse Solutions

Another key driver of change in the Philippines factoring market is increasing business demand for more secure, flexible finance structures, particularly non‑recourse factoring, mirroring increased business sensitivity to risk and trust in financial operations. Most local businesses, especially exporters or suppliers to tier‑1 buyers, now appreciate the guarantee that they can be paid without keeping risk if the customer defaults. The popularity of this option has encouraged suppliers to present non‑recourse alternatives in addition to customary recourse factoring arrangements. The negotiation of these contracts requires more discerning evaluations of the creditworthiness of buyers, leading factoring firms to implement more advanced credit analysis equipment. The focus on risk transfer protects SMEs against unforeseen payment defaults and makes factoring more than a short-term liquidity stopgap measure, which is a strategic tool in financial planning. As Philippine enterprises venture more boldly into regional supply chains and global trade, the need for such risk‑managed products further propels the factoring market to a more mature, trust‑based environment based on client protection and long-term dependability.

Philippines Factoring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, organization size, and application.

Type Insights:

- International

- Domestic

The report has provided a detailed breakup and analysis of the market based on the type. This includes international and domestic.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium enterprises, and large enterprises.

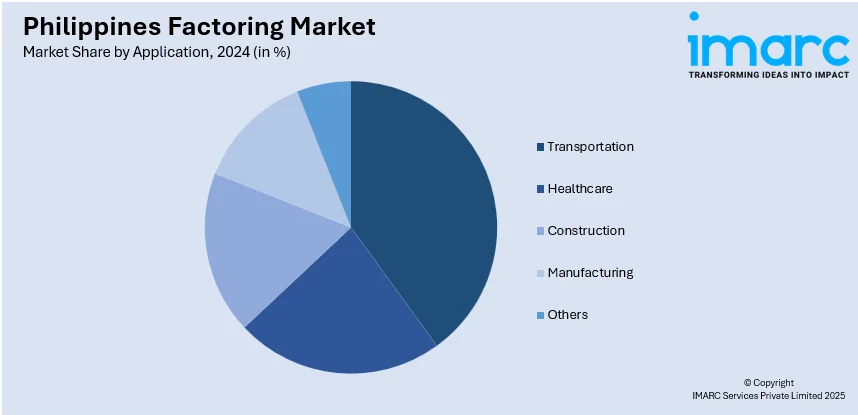

Application Insights:

- Transportation

- Healthcare

- Construction

- Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes transportation, healthcare, construction, manufacturing, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which includes Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Factoring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | International, Domestic |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| Applications Covered | Transportation, Healthcare, Construction, Manufacturing, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines factoring market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines factoring market on the basis of type?

- What is the breakup of the Philippines factoring market on the basis of organization size?

- What is the breakup of the Philippines factoring market on the basis of application?

- What is the breakup of the Philippines factoring market on the basis of region?

- What are the various stages in the value chain of the Philippines factoring market?

- What are the key driving factors and challenges in the Philippines factoring market?

- What is the structure of the Philippines factoring market and who are the key players?

- What is the degree of competition in the Philippines factoring market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines factoring market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines factoring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines factoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)