Philippines Faucet Market Size, Share, Trends and Forecast by Type, Application, Technology, Material, Distribution Channel, End User, and Region, 2026-2034

Philippines Faucet Market Summary:

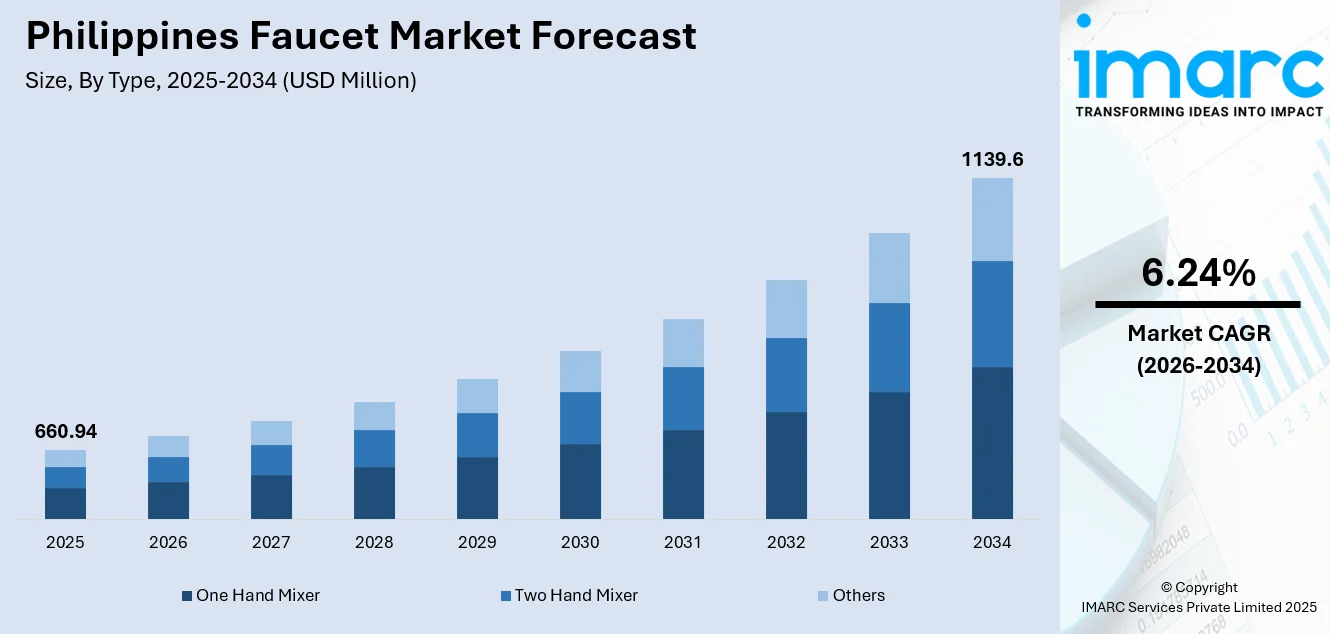

The Philippines faucet market size was valued at USD 660.94 Million in 2025 and is projected to reach USD 1,139.60 Million by 2034, growing at a compound annual growth rate of 6.24% from 2026-2034.

The Philippines faucet market is experiencing steady expansion driven by robust residential and commercial construction activities across the archipelago. Rising urbanization, increasing middle-class disposable incomes, and growing emphasis on modern bathroom and kitchen aesthetics are propelling demand for high-quality faucets throughout the country. Government infrastructure initiatives supporting housing development and the thriving hospitality sector further contribute to sustained market growth, creating opportunities for both domestic manufacturers and international brands.

Key Takeaways and Insights:

- By Type: One hand mixer dominates the market with a share of 55% in 2025, driven by user-friendly single-lever operation and widespread consumer preference for streamlined water control functionality.

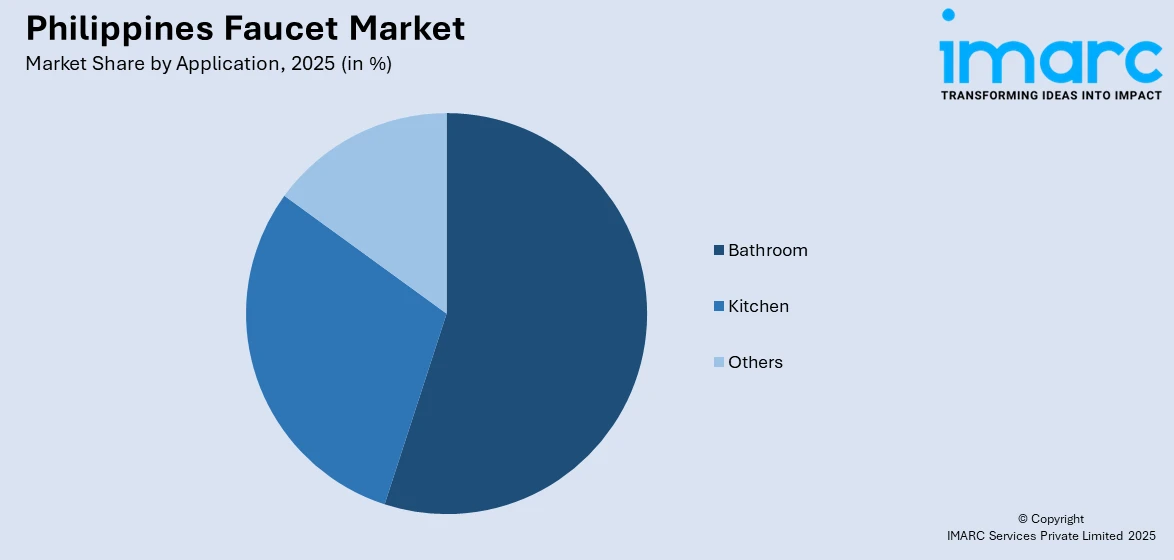

- By Application: Bathroom leads the market with a share of 50% in 2025, attributed to frequent bathroom renovations and heightened focus on hygiene-oriented fixtures in Filipino households.

- By Technology: Ceramic disc represents the largest segment with a market share of 35% in 2025, driven by its superior durability, leak-resistant performance, and long-term cost efficiency.

- By Material: Metal dominates with a market share of 75% in 2025, reflecting consumer preference for durable, corrosion-resistant fixtures that withstand tropical humidity conditions.

- By Distribution Channel: Offline leads the market with a share of 70% in 2025, driven by consumer preference for physical examination of products before purchase and established dealer networks.

- By End User: Residential represents the largest segment with a market share of 60% in 2025, propelled by expanding housing developments and growing homeowner investments in modern plumbing fixtures.

- Key Players: The Philippines faucet market is moderately competitive, with domestic manufacturers and international brands competing for market share. Companies focus on product innovation, quality differentiation, and strategic distribution partnerships to strengthen market presence and appeal to both residential and commercial customers nationwide.

To get more information on this market Request Sample

The Philippines faucet market is witnessing significant transformation influenced by evolving consumer preferences toward modern, water-efficient, and aesthetically pleasing plumbing fixtures. In November 2025, At PHILCONSTRUCTION 2025 in Manila, global manufacturer Slion showcased its lead‑free stainless‑steel faucets and valves tailored to the Philippines market’s growing demand for durable and eco‑friendly plumbing solutions, reflecting increased interest from both local builders and international brands in advanced faucet technology. The nation's construction sector continues to expand, particularly in metropolitan regions, creating sustained demand for quality faucets across residential, commercial, and industrial segments. Government initiatives promoting sustainable water management practices are encouraging adoption of advanced faucet technologies featuring water-saving mechanisms. Additionally, the growing hospitality and tourism industry is driving demand for premium faucet installations in hotels, resorts, and restaurants nationwide. Rising consumer awareness regarding hygiene standards and bathroom aesthetics further supports market expansion.

Philippines Faucet Market Trends:

Growing Preference for Water-Efficient Fixtures

Filipino consumers are increasingly embracing water-saving faucet technologies as environmental awareness grows throughout the archipelago. In the hospitality sector, hotels and resorts across the Philippines have begun installing low‑flow fixtures, such as eco‑efficient faucets and showerheads, to reduce water usage as part of broader sustainability practices aimed at meeting rising guest expectations for environmentally responsible accommodations. Manufacturers are responding by introducing aerator-equipped faucets and flow-restrictive mechanisms that reduce water consumption without compromising user experience. Government advocacy for sustainable water usage practices is accelerating adoption of eco-friendly fixtures nationwide.

Rising Demand for Contemporary Design Aesthetics

Modern Filipino homeowners and property developers are prioritizing contemporary faucet designs that complement evolving interior décor preferences. According to recent coverage in January 2026, on modern bathroom design trends in the Philippines, minimalist aesthetics, featuring clean lines, neutral tones, and wall‑mounted faucets, are becoming a defining characteristic of contemporary Philippine homes, with design platforms noting that such fixtures help create uncluttered and visually appealing spaces that resonate with local preferences for modern interiors. Sleek finishes, minimalist silhouettes, and premium materials are gaining popularity among urban consumers seeking to elevate bathroom and kitchen aesthetics. This trend is driving manufacturers to expand product portfolios featuring innovative designs.

Expansion of Organized Retail and Distribution Networks

The faucet market in the Philippines is experiencing notable expansion through organized retail channels, such as hardware superstores and branded showrooms. For example, major Philippine distributors such as HERCO TRADING have strengthened partnerships with leading modern retail chains like Wilcon Depot, Handyman, Do‑it‑Best, True Value Philippines, and Robinsons DIY stores, giving plumbing fixtures, including faucets, broader visibility and availability across over 200 retail outlets nationwide. Enhanced distribution networks are improving product accessibility across secondary cities and provincial areas. Manufacturers are strengthening partnerships with retailers and plumbing contractors to expand market reach nationwide.

Market Outlook 2026-2034:

The Philippines faucet market is poised for sustained growth throughout the forecast period, underpinned by favorable macroeconomic conditions and expanding construction activities nationwide. Increasing investments in residential housing developments, commercial infrastructure projects, and hospitality establishments are expected to drive consistent demand for faucet fixtures. Rising urbanization trends, growing middle-class populations, and heightened consumer focus on modern bathroom and kitchen aesthetics will continue supporting market expansion. Additionally, government initiatives promoting sustainable water management and infrastructure modernization are creating favorable conditions for manufacturers to introduce advanced, water-efficient faucet solutions across the archipelago. The market generated a revenue of USD 660.94 Million in 2025 and is projected to reach a revenue of USD 1139.60 Million by 2034, growing at a compound annual growth rate of 6.24% from 2026-2034.

Philippines Faucet Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | One Hand Mixer | 55% |

| Application | Bathroom | 50% |

| Technology | Ceramic Disc | 35% |

| Material | Metal | 75% |

| Distribution Channel | Offline | 70% |

| End User | Residential | 60% |

Type Insights:

- One Hand Mixer

- Two Hand Mixer

- Others

The one hand mixer dominates with a market share of 55% of the total Philippines faucet market in 2025.

One hand mixer faucet has emerged as the preferred choice among Filipino consumers due to their intuitive single-lever operation that enables convenient temperature and flow adjustment. Contemporary kitchen and bathroom mixers sold in the Philippines increasingly feature single‑lever controls that allow users to adjust both flow and temperature with one motion, reflecting broader market preference for simple, ergonomic operation in everyday fixtures. These faucets offer practical functionality suited to fast-paced modern lifestyles, allowing users to operate fixtures with minimal effort while multitasking. Their streamlined design reduces mechanical complexity, resulting in lower maintenance requirements and enhanced long-term reliability.

The widespread adoption of one hand mixer faucets reflects broader consumer preferences for space-efficient bathroom and kitchen solutions. Manufacturers are continuously innovating with ergonomic handle designs and smooth cartridge mechanisms that deliver precise water control. The segment benefits from strong demand across residential applications and commercial establishments seeking user-friendly plumbing fixtures.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Bathroom

- Kitchen

- Others

The bathroom leads with a share of 50% of the total Philippines faucet market in 2025.

Bathroom applications dominate the Philippines faucet market, driven by the central role bathrooms play in daily hygiene routines and personal grooming activities. Filipino households typically prioritize bathroom upgrades during home renovations, allocating significant budgets toward quality fixtures that enhance functionality and visual appeal. Growing awareness regarding sanitation standards is further reinforcing demand for modern bathroom faucets. The increasing focus on creating spa-like bathroom experiences in residential settings continues supporting segment growth.

The segment's strength is bolstered by expanding residential construction that incorporates multiple bathrooms per housing unit. Property developers recognize bathroom quality as a key differentiating factor influencing buyer decisions. Additionally, the hospitality sector's emphasis on superior guest bathroom amenities contributes to sustained demand for premium bathroom faucet installations. Rising consumer expectations for durable, aesthetically pleasing fixtures are encouraging manufacturers to introduce innovative bathroom faucet designs nationwide.

Technology Insights:

- Cartridge

- Compression

- Ceramic Disc

- Ball

The ceramic disc dominates with a market share of 35% of the total Philippines faucet market in 2025.

Ceramic disc technology has gained substantial market traction owing to its exceptional durability and superior sealing capabilities that minimize leakage risks. These faucets utilize precision-engineered ceramic plates that withstand extensive usage cycles without degradation, making them particularly suitable for high-traffic applications. Filipino consumers increasingly recognize the long-term value proposition offered by ceramic disc mechanisms. The technology's smooth operation and precise water flow control further enhance user satisfaction across residential and commercial installations.

The technology's resistance to mineral deposits commonly found in Philippine water supplies enhances its appeal among quality-conscious buyers. Ceramic disc faucets require minimal maintenance compared to traditional rubber washer alternatives, reducing lifetime ownership costs. Manufacturers continue expanding ceramic disc product offerings across various price segments to capture broader market opportunities. Growing consumer awareness regarding fixture longevity and performance reliability is driving preference toward ceramic disc technology throughout the archipelago.

Material Insights:

- Metal

- Plastics

The metal leads with a share of 75% of the total Philippines faucet market in 2025.

Metal faucets command the largest market share, reflecting strong consumer preference for durable, corrosion-resistant fixtures capable of withstanding the Philippines' humid tropical climate. Premium brands such as KOHLER highlight the importance of high‑quality metal finishes, like polished chrome and stainless steel, because advanced physical vapor deposition (PVD) processes bond finishes to the faucet surface for enhanced corrosion and scratch resistance, helping these fixtures maintain both performance and appearance in humid conditions common in the tropics. Brass, stainless steel, and zinc alloy constructions offer superior strength and longevity compared to plastic alternatives, justifying premium price positioning among discerning buyers. Metal finishes also provide versatile aesthetic options complementing diverse interior design schemes. The material's ability to maintain structural integrity under continuous water exposure reinforces its popularity across residential and commercial applications.

The material segment benefits from established manufacturing infrastructure and reliable supply chains supporting consistent product availability. Metal faucets maintain perceived quality advantages that resonate strongly with Filipino consumers prioritizing long-term fixture performance. Growing demand from commercial and industrial applications further reinforces the segment's dominant market position. Additionally, the availability of various metal finishes including chrome, brushed nickel, and matte options enables consumers to match faucets with contemporary bathroom and kitchen designs throughout the country.

Distribution Channel Insights:

- Online

- Offline

The offline dominates with a market share of 70% of the total Philippines faucet market in 2025.

Offline distribution channels maintain market leadership, reflecting Filipino consumers' preference for physical product examination before purchase decisions. Hardware stores, plumbing supply outlets, and branded showrooms provide tactile shopping experiences enabling buyers to assess fixture quality, finish, and operational mechanisms directly. Knowledgeable sales staff offer valuable guidance assisting customers in selecting appropriate products for specific applications. The ability to compare multiple brands and models side-by-side enhances consumer confidence in purchasing decisions across all market segments.

The offline channel's strength is reinforced by established contractor and plumber relationships that influence product recommendations during construction and renovation projects. Wholesaler networks efficiently supply provincial markets where e-commerce infrastructure remains developing. Despite growing online retail presence, offline channels continue dominating through superior customer service and immediate product availability. Traditional retail formats also facilitate after-sales support services including warranty claims and replacement parts access that remain important considerations for Filipino consumers investing in quality plumbing fixtures.

End User Insights:

- Residential

- Commercial

- Industrial

The residential leads with a share of 60% of the total Philippines faucet market in 2025.

The residential segment leads the Philippines faucet market, propelled by sustained housing construction addressing the nation's growing population and expanding middle class. Single-family homes, condominiums, and townhouse developments collectively generate substantial demand for bathroom and kitchen faucet installations. Filipino homeowners increasingly prioritize quality fixtures as integral components of comfortable living spaces. The growing trend toward modern home aesthetics encourages investment in stylish faucet designs that complement contemporary interior décor preferences across urban and suburban residential developments.

Rising disposable incomes among Filipino households enable greater spending on premium faucet products offering enhanced functionality and contemporary designs. Home renovation activities focused on bathroom and kitchen upgrades contribute significantly to residential replacement demand. Government housing programs expanding affordable housing access further support the segment's continued growth trajectory. Additionally, increasing awareness regarding water conservation is driving residential consumers toward efficient faucet technologies that reduce utility costs while maintaining optimal performance standards throughout Filipino homes.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon dominates the Philippines faucet market, accounting for the largest regional share driven by Metro Manila's concentrated urban development and robust construction activities. The National Capital Region's dense population and commercial infrastructure generate substantial demand across residential and commercial segments. Expanding industrial zones in Calabarzon and Central Luzon further support sustained market growth.

Visayas represents a growing faucet market driven by accelerating urbanization in Cebu, Iloilo, and Bacolod metropolitan areas. The region's thriving tourism industry creates sustained demand for quality faucet fixtures in hotels, resorts, and hospitality establishments. Expanding residential developments serving the rising middle-class population contribute to steady market expansion.

Mindanao presents emerging growth opportunities for the Philippines faucet market, supported by infrastructure development initiatives and improving economic conditions. Davao City's rapid modernization drives increasing demand for quality plumbing fixtures across residential and commercial sectors. Government investments in regional development are enhancing construction activities and expanding the addressable market.

Market Dynamics:

Growth Drivers:

Why is the Philippines Faucet Market Growing?

Accelerating Urbanization and Construction Activities

The Philippines is experiencing rapid urbanization with millions migrating to metropolitan areas seeking employment and improved living standards. This demographic shift is driving unprecedented residential construction activity, particularly condominium developments and affordable housing projects addressing growing urban populations. In October 2025, under the government’s Pambansang Pabahay Para sa Pilipino (4PH) housing program, authorities are ramping up construction of hundreds of thousands of affordable homes, including vertical and medium‑rise units in urban centers like Metro Manila, Cebu, and Davao, to help bridge the substantial housing gap and support urban growth. Each new housing unit requires complete plumbing fixture installations, creating sustained faucet demand throughout the construction value chain. Metro Manila, Cebu, and Davao continue expanding their built environments, generating consistent market opportunities for faucet manufacturers. Government infrastructure programs supporting housing development further amplify construction sector growth and corresponding faucet requirements across the archipelago.

Rising Disposable Incomes and Consumer Upgrading

Growing prosperity among Filipino households is enabling increased spending on home improvements and quality plumbing fixtures. According to reports, with the Philippines’ middle class expanding and urban consumers gaining more disposable income, spending on household goods, including home furnishings and improvement products, has been forecast to rise as this demographic increasingly invests in enhancing their living spaces. The expanding middle class demonstrates willingness to invest in premium faucets offering superior functionality, durability, and aesthetic appeal. This consumer upgrading trend drives demand for technologically advanced products featuring water-saving mechanisms and contemporary designs. Rising living standards encourage homeowners to replace outdated fixtures with modern alternatives complementing upgraded interior spaces. Manufacturers are responding by introducing diverse product portfolios catering to various price segments and evolving consumer preferences throughout the country.

Expanding Hospitality and Tourism Infrastructure

The Philippines thriving tourism industry is driving significant investments in hospitality infrastructure including hotels, resorts, and vacation properties. According to reports, developers and hospitality firms are expanding hotel capacity aggressively to meet rising demand, with industry projections indicating that hotel room supply will need to exceed 456,000 keys by 2028, a major increase from the current inventory of just over 335,000, highlighting the scale of ongoing and planned construction across key destinations nationwide. These establishments require high-quality faucet installations meeting international hospitality standards and guest expectations. Tourist destinations throughout the archipelago are witnessing substantial construction activity creating concentrated demand for premium plumbing fixtures. The hospitality sector's emphasis on bathroom amenities and guest experience quality prioritizes durable, aesthetically pleasing faucet selections. Continued tourism industry expansion promises sustained demand growth throughout the forecast period nationwide.

Market Restraints:

What Challenges the Philippines Faucet Market is Facing?

Price Sensitivity Among Mass Market Consumers

Significant portions of the Filipino consumer base remain highly price-sensitive, limiting premium faucet adoption despite quality advantages. Budget constraints push many buyers toward lower-cost alternatives that may sacrifice durability and performance. This pricing pressure challenges manufacturers seeking to introduce advanced technologies and premium materials commanding higher price points. Economic uncertainties further reinforce conservative purchasing behaviors among cost-conscious consumers.

Competition from Unbranded and Counterfeit Products

The Philippines faucet market faces challenges from unbranded products and counterfeit goods offering lower prices without quality assurances. These products undercut established manufacturers' pricing strategies while potentially delivering inferior performance. Consumer difficulty distinguishing genuine products from counterfeits complicates purchasing decisions and erodes brand value. The proliferation of substandard products also raises concerns regarding long-term fixture reliability.

Infrastructure Limitations in Provincial Markets

Distribution challenges persist in provincial areas where transportation infrastructure and retail networks remain underdeveloped. Limited product availability and higher logistics costs constrain market expansion beyond major metropolitan centers. Remote communities face reduced access to quality faucet products and professional installation services. These geographic barriers hinder manufacturers' efforts to achieve comprehensive nationwide market coverage.

Competitive Landscape:

The Philippines faucet market exhibits a moderately fragmented competitive structure featuring domestic manufacturers alongside established international brands pursuing market penetration strategies. Market participants compete across product quality, pricing, design innovation, and distribution network strength to capture consumer attention and contractor loyalty. Leading players leverage brand recognition and comprehensive product portfolios spanning budget to premium segments addressing diverse market requirements. Strategic investments in retail partnerships and showroom presence enhance visibility among end consumers and trade professionals influencing product specifications. Manufacturers increasingly emphasize water-efficient technologies and sustainable materials responding to evolving regulatory requirements and environmental consciousness. The competitive environment encourages continuous product development and service enhancement as market participants seek differentiation opportunities.

Recent Developments:

- In July 2025, Environmental watchdog EcoWaste Coalition and 26 civil society groups urged the Department of Environment and Natural Resources (DENR) and Department of Trade and Industry (DTI) to regulate toxic metals (lead and cadmium) in water faucets and plumbing fixtures sold locally, after tests found dangerous levels in products sampled from stores and online.

Philippines Faucet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | One Hand Mixer, Two Hand Mixer, Others |

| Applications Covered | Bathroom, Kitchen, Others |

| Technologies Covered | Cartridge, Compression, Ceramic Disc, Ball |

| Materials Covered | Metal, Plastics |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines faucet market size was valued at USD 660.94 Million in 2025.

The Philippines faucet market is expected to grow at a compound annual growth rate of 6.24% from 2026-2034 to reach USD 1139.60 Million by 2034.

One hand mixer dominated the market with a 55% market share, driven by consumer preference for convenient single-lever operation enabling easy temperature and flow adjustment.

Key factors driving the Philippines faucet market include accelerating urbanization and construction activities, rising disposable incomes enabling consumer upgrading, expanding hospitality and tourism infrastructure, growing emphasis on modern bathroom aesthetics, increasing government housing initiatives, and heightened consumer awareness regarding water-efficient plumbing fixtures nationwide.

Major challenges include price sensitivity among mass market consumers, competition from unbranded and counterfeit products, infrastructure limitations in provincial distribution, consumer awareness gaps regarding water-efficient technologies, limited after-sales service networks, and difficulty accessing quality fixtures in remote areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)