Philippines Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Region, 2026-2034

Philippines Fintech Market Summary:

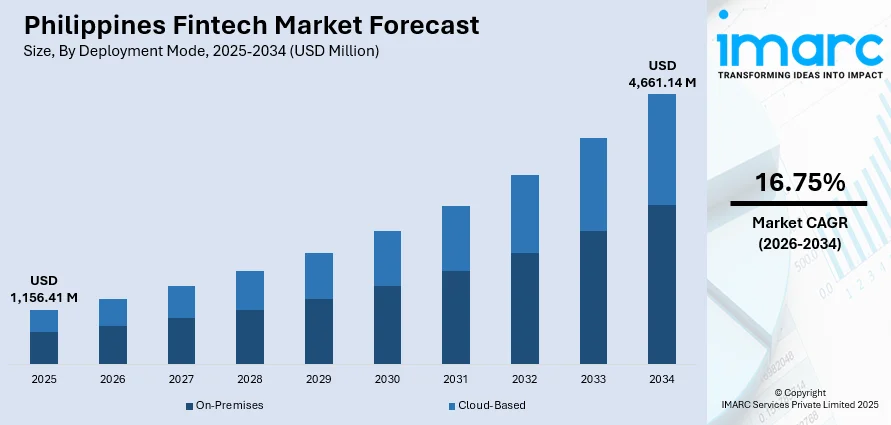

The Philippines fintech market size was valued at USD 1,156.41 Million in 2025 and is projected to reach USD 4,661.14 Million by 2034, growing at a compound annual growth rate of 16.75% from 2026-2034.

The Philippines fintech market is experiencing transformative growth fueled by the nation's push toward financial inclusion and the rapid digitalization of banking services. Expanding smartphone penetration and improving internet connectivity are enabling seamless access to digital payment platforms, lending applications, and wealth management tools across urban and rural populations. The regulatory environment continues to evolve favorably, creating a conducive ecosystem for innovation while maintaining consumer protection standards that build trust in digital financial services.

Key Takeaways and Insights:

-

By Deployment Mode: On-premises dominates the market with a share of 35% in 2025, driven by enterprise preference for data sovereignty and customized security protocols in financial operations.

-

By Technology: Application programming interface leads the market with a share of 25% in 2025, supporting open banking initiatives and enabling seamless integration between financial service providers.

-

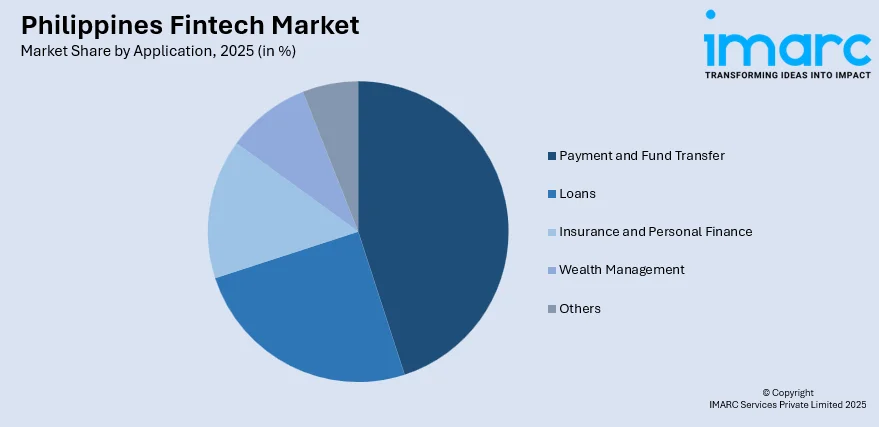

By Application: Payment and fund transfer represent the largest segment with a market share of 45% in 2025, reflecting the widespread adoption of digital wallets and QR-based payment systems nationwide.

-

By End User: Banking exhibits clear dominance with a 50% share in 2025, as traditional financial institutions accelerate digital transformation to meet evolving customer expectations.

-

By Region: Luzon dominates the market with 65% revenue share in 2025, owing to the concentration of financial infrastructure and tech-savvy consumers in Metro Manila and surrounding provinces.

-

Key Players: The Philippines fintech market exhibits a moderately competitive landscape, with established banks competing alongside emerging digital-native startups and international payment processors. Market participants are differentiating through innovative product offerings, strategic partnerships with telecommunications providers, and investments in artificial intelligence capabilities to enhance customer experience and operational efficiency.

To get more information on this market Request Sample

The Philippines represents one of Southeast Asia's most dynamic fintech markets, characterized by a young, mobile-first population embracing digital financial services at an accelerating pace. The government's National Retail Payment System has been instrumental in creating interoperable payment infrastructure, with the QR Ph standard facilitating seamless transactions across diverse financial institutions. Central bank initiatives promoting financial inclusion have catalyzed innovation, particularly in underserved communities where traditional banking access remains limited. Cross-border payment solutions are gaining traction as the overseas Filipino worker community drives demand for efficient remittance services. The convergence of banking and technology continues to reshape consumer expectations, with embedded finance solutions emerging across e-commerce, transportation, and retail sectors. Strategic collaborations between fintech companies and established financial institutions are accelerating product development cycles while expanding distribution networks.

Philippines Fintech Market Trends:

Expansion of Embedded Finance Ecosystems

Financial services are increasingly being integrated directly into non-financial platforms, creating seamless user experiences across e-commerce, ride-hailing, and retail applications. Super-app models are gaining prominence as consumers prefer unified platforms offering payments, lending, and insurance products within familiar digital environments. This integration enables contextual financial offerings at the point of need, reducing friction and improving conversion rates for financial products while expanding access beyond traditional banking channels. For instance, in May 2025, GCash evolved from a basic mobile payment service into the Philippines’ leading financial platform, now catering to over 94 million registered users nationwide. Managed by Mynt, a company partially owned by Globe Telecom, GCash capitalized on widespread mobile connectivity and the expanding digital economy to create an ecosystem that addresses key gaps in the country’s banking sector.

Rise of Alternative Credit Scoring Models

Digital lenders are leveraging non-traditional data sources to assess creditworthiness among populations lacking formal credit histories. Behavioral analytics, transaction patterns, and device usage metrics are being combined with machine learning algorithms to generate risk profiles for previously unbanked segments. These alternative scoring methodologies are expanding credit access to micro-entrepreneurs, gig economy workers, and young professionals entering the financial system for the first time. For instance, in August 2025, the Bangko Sentral ng Pilipinas (BSP), in collaboration with the Japan International Cooperation Agency (JICA), introduced a credit risk database system to assist financial institutions in evaluating the creditworthiness of small and medium-sized enterprises (SMEs).

Acceleration of Real-Time Payment Infrastructure

Instant payment capabilities are becoming the expected standard for domestic and cross-border transactions, driven by evolving consumer expectations and regulatory mandates. Interoperability frameworks are being strengthened to enable frictionless money movement across different payment service providers, reducing settlement times from days to seconds. Regional integration efforts are connecting Philippine payment systems with neighboring markets, facilitating faster and more affordable remittance flows. For instance, in August 2025, Visa teamed up with Rizal Commercial Banking Corporation (RCBC) to introduce Visa Direct in the Philippines. This initiative is designed to provide real-time payment services and seamless money transfer solutions across the region. Established more than a decade ago, Visa Direct leverages collaborations with partners such as Thunes, TerraPay, and Tencent to enhance digital wallet adoption and promote financial inclusion across more than 190 countries and territories, supporting transactions in 160 different currencies.

Market Outlook 2026-2034:

The Philippines fintech sector is positioned for sustained expansion as digital adoption penetrates deeper into provincial markets and underserved demographics. Regulatory clarity around digital banking licenses and open finance frameworks is expected to attract continued investment, while infrastructure improvements in connectivity will reduce barriers to entry for new market participants. The market generated a revenue of USD 1,156.41 Million in 2025 and is projected to reach a revenue of USD 4,661.14 Million by 2034, growing at a compound annual growth rate of 16.75% from 2026-2034.

Philippines Fintech Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Deployment Mode | On-Premises | 35% |

| Technology | Application Programming Interface | 25% |

| Application | Payment and Fund Transfer | 45% |

| End User | Banking | 50% |

| Region | Luzon | 65% |

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The on-premises dominates with a market share of 35% of the total Philippines fintech market in 2025.

The on-premises segment holds the largest share in the Philippines fintech market primarily due to heightened data security, regulatory compliance, and operational control requirements. Financial institutions and large enterprises often prefer on-premises deployments to maintain direct oversight of sensitive customer data, transaction processing, and risk management systems, particularly in a market where cybersecurity concerns and fraud risks remain high. On-premises infrastructure allows organizations to implement customized security protocols aligned with local regulations and internal governance standards.

Additionally, legacy banking systems across the Philippines are more compatible with on-premises architectures, making integration smoother and less disruptive compared to full cloud migration. Many established banks and financial service providers have already invested heavily in physical data centers, reducing incentives to shift entirely to cloud-based models. Inconsistent internet connectivity in certain regions further supports on-premises adoption, as localized systems ensure operational continuity. These factors collectively sustain strong demand for on-premises fintech solutions, especially among large banks, payment processors, and regulated financial institutions.

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

The application programming interface leads with a share of 25% of the total Philippines fintech market in 2025.

The application programming interface (API) segment holds the largest share in the Philippines fintech market due to its critical role in enabling seamless integration between financial institutions, fintech platforms, merchants, and third-party service providers. APIs allow banks and non-bank financial players to rapidly launch digital payment, lending, remittance, and wallet services without fully overhauling legacy systems, reducing development time and costs.

In the Philippines, growing demand for interoperable payment systems, open banking initiatives, and real-time fund transfers has increased reliance on API-based architectures. APIs support secure data sharing, account authentication, transaction processing, and compliance with regulatory requirements, making them essential for scalable fintech operations. The rise of e-commerce, digital marketplaces, and super-apps has further driven API adoption, as these platforms require continuous connectivity with multiple financial services. Additionally, increased collaboration between traditional banks and fintech startups favors API-led models, as they enable modular, flexible, and secure service expansion across diverse customer segments, reinforcing the API segment’s dominant market position.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

The payment and fund transfer represents the largest segment with a market share of 45% of the total Philippines fintech market in 2025.

The payment and fund transfer segment holds the largest share in the Philippines fintech market due to its direct alignment with everyday consumer and business financial needs. A large unbanked and underbanked population has accelerated the adoption of mobile wallets and digital payment platforms as accessible alternatives to traditional banking. These solutions enable users to send, receive, and store money conveniently without requiring full bank accounts, supporting rapid user growth.

Strong domestic and international remittance flows further drive demand for digital fund transfer services, as fintech platforms offer faster processing times and lower transaction costs compared to conventional channels. The rapid expansion of e-commerce, ride-hailing, food delivery, and online services has increased the frequency of small-value digital transactions, reinforcing daily usage of payment apps. Government initiatives promoting cashless transactions and interoperable payment systems have also boosted acceptance among merchants and consumers. Additionally, widespread smartphone adoption and improving mobile internet coverage enable seamless access to payment services, making this segment the most scalable and widely used across demographic and income groups.

End User Insights:

- Banking

- Insurance

- Securities

- Others

The banking exhibits a clear dominance with a 50% share of the total Philippines fintech market in 2025.

The banking segment holds the largest share in the Philippines fintech market due to its central role in digital financial adoption and its ability to scale services nationwide. Banks have been early adopters of fintech solutions, integrating mobile banking, digital wallets, online lending, and automated payment systems into their core offerings. Their established customer bases and strong brand trust enable faster uptake of digital services compared to standalone fintech players.

Regulatory support from the Bangko Sentral ng Pilipinas has encouraged banks to digitize operations while maintaining consumer protection and system stability. Banks also benefit from access to customer data, capital resources, and existing infrastructure, allowing them to invest heavily in technology, cybersecurity, and compliance. Additionally, the rise of digital-only banks and bank–fintech partnerships has expanded service reach to underbanked populations. Since banking services form the foundation for payments, savings, credit, and remittances, fintech innovation in the Philippines is largely channeled through the banking ecosystem, reinforcing its dominant market share.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon dominates with a market share of 65% of the total Philippines fintech market in 2025.

The fintech market in Luzon is driven primarily by its role as the Philippines’ economic and financial center, anchored by Metro Manila. The region has the country’s highest concentration of digitally connected consumers, banks, corporates, and government agencies, creating strong demand for digital payments, e-wallets, online banking, and lending solutions. High smartphone penetration, improving broadband coverage, and greater financial literacy support rapid adoption of app-based financial services among urban and peri-urban populations.

In addition, government initiatives promoting financial inclusion and cashless transactions, along with interoperable payment systems, have accelerated fintech usage across Luzon. A large base of micro, small, and medium enterprises increasingly relies on fintech platforms for payments, credit access, payroll, and working capital management. Strong remittance flows, rising e-commerce activity, and the presence of fintech startups, investors, and skilled technology talent further reinforce Luzon’s position as the leading growth engine for the Philippines fintech market.

Market Dynamics:

Growth Drivers:

Why is the Philippines Fintech Market Growing?

Expanding Financial Inclusion Initiatives

The Philippine government's commitment to financial inclusion is creating unprecedented opportunities for fintech expansion across underserved populations. National strategies targeting increased account ownership and digital transaction adoption are driving coordinated efforts between public and private sector stakeholders. Mobile money platforms and agent banking networks are extending financial services to remote communities where traditional branch infrastructure remains economically unfeasible. These initiatives are transforming how millions of previously unbanked Filipinos access savings, credit, and payment services through digital channels.

Rising Smartphone Penetration and Digital Literacy

Increasing smartphone ownership combined with improving digital literacy levels is accelerating fintech adoption across demographic segments and geographic regions. The Philippines smartphone market size reached USD 563.5 Million in 2025. Looking forward, the market is projected to reach USD 588.1 Million by 2034. Affordable mobile devices and competitive data plans are democratizing access to financial applications among mass-market consumers. Younger generations entering the workforce demonstrate strong preferences for mobile-first financial services, driving demand for intuitive digital experiences. Educational initiatives and user-friendly application designs are reducing barriers to entry for first-time digital finance users.

Supportive Regulatory Environment

Progressive regulatory frameworks are providing clarity and confidence for fintech investment and innovation in the Philippine market. The central bank has demonstrated commitment to balancing innovation encouragement with appropriate consumer protection safeguards. Sandbox programs enable emerging technologies to be tested under supervised conditions before broader market deployment. Clear licensing pathways for digital banks, payment service providers, and electronic money issuers are attracting both domestic entrepreneurs and international market entrants seeking growth opportunities in the archipelago.

Market Restraints:

What Challenges is the Philippines Fintech Market Facing?

Infrastructure Limitations in Remote Areas

Geographic dispersion across numerous islands creates significant connectivity challenges, restricting fintech service penetration in remote communities. Uneven internet coverage and unreliable power supply in provincial and rural areas limit consistent access to digital financial services. High infrastructure development and maintenance costs in sparsely populated regions further reduce commercial viability, discouraging private players from expanding services beyond major urban centers.

Cybersecurity and Fraud Concerns

Rising volumes of digital transactions have increased exposure to advanced cyber threats and fraudulent activities targeting financial institutions and users. Concerns over data security, privacy breaches, and unauthorized access negatively affect consumer confidence, particularly among risk-averse users. To counter these threats, fintech firms must invest continuously in security systems, compliance measures, and fraud detection, increasing operational complexity and costs.

Cash Culture and Behavioral Resistance

Strong dependence on cash among specific demographic groups continues to hinder digital payment adoption. Limited availability of digital payment infrastructure among small merchants and traditional retailers reduces everyday usability for consumers. Additionally, participants in the informal economy often struggle to transition to formal digital systems due to documentation requirements, regulatory compliance, and limited financial literacy, slowing broader adoption.

Competitive Landscape:

The Philippines fintech market demonstrates a dynamic competitive environment characterized by diverse participant categories pursuing distinct strategic approaches. Traditional financial institutions are investing heavily in digital transformation while acquiring or partnering with technology innovators to accelerate capabilities development. Digital-native challengers compete on user experience and agility, targeting underserved segments overlooked by established players. International payment processors and technology platforms are expanding Philippine operations, recognizing market growth potential. Competitive differentiation increasingly centers on ecosystem breadth, with leading participants building comprehensive product suites spanning payments, lending, insurance, and investment services through unified platforms.

Recent Developments:

-

July 2025: Payop, an international payment service provider, allied with Dragonpay, a Philippine payment platform, to enhance online operations for businesses and consumers in Southeast Asia. The partnership enables global merchants to offer Filipino consumers preferred local payment methods, including leading banks and e-wallets, at checkout.

-

May 2025: Philippine fintech firm Billease secured a significant corporate notes facility arranged by Security Bank Capital Investment Corporation to accelerate its mission of enhancing financial inclusion. The initiative aims to expand digital lending services nationwide and provide accessible financial solutions to underserved communities.

Philippines Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines fintech market size was valued at USD 1,156.41 Million in 2025.

The Philippines fintech market is expected to grow at a compound annual growth rate of 16.75% from 2026-2034 to reach USD 4,661.14 Million by 2034.

Payment and fund transfer dominated the market with a 45% share in 2025, reflecting the widespread adoption of digital wallets, mobile banking applications, and QR-based payment systems, enabling seamless transactions across the archipelago.

Key factors driving the Philippines fintech market include expanding financial inclusion initiatives, rising smartphone penetration and digital literacy, supportive regulatory frameworks, increasing e-commerce adoption, and growing demand for convenient digital payment solutions.

Major challenges include infrastructure limitations in remote island communities, cybersecurity and fraud concerns, persistent cash culture among certain demographics, limited merchant acceptance in traditional retail environments, and regulatory compliance complexity for emerging business models.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)