Philippines Fish & Seafood Market Size, Share, Trends, and Forecast by Product, Form, Distribution Channel, and Region, 2026-2034

Philippines Fish & Seafood Market Overview:

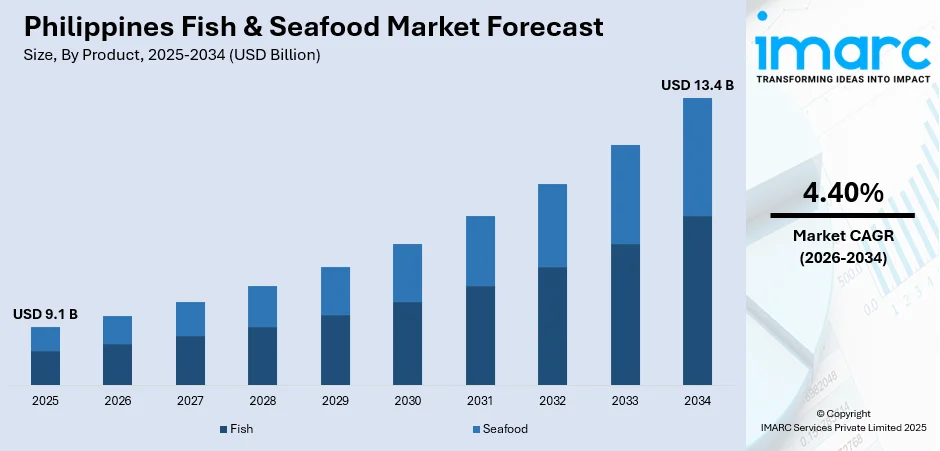

The Philippines fish & seafood market size reached USD 9.1 Billion in 2025. Looking forward, the market is expected to reach USD 13.4 Billion by 2034, exhibiting a growth rate (CAGR) of 4.40% during 2026-2034. The market is growing due to rising consumer demand, surging export opportunities, increasing government support, aquaculture expansion, boosting sustainable fishing initiatives, improved cold chain logistics, and increasing health consciousness, driving industry growth and investment in processing, distribution, and value-added seafood products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 9.1 Billion |

| Market Forecast in 2034 | USD 13.4 Billion |

| Market Growth Rate 2026-2034 | 4.40% |

Key Trends of Philippines Fish & Seafood Market:

Growth in Aquaculture and Sustainable Fishing Practices

The Philippine government has adopted enhanced aquaculture operations to meet rising seafood market requirements while promoting environmental sustainability objectives. Fishermen focus on producing tilapia milkfish and shrimp as their primary fish products because wild fish populations have decreased through overfishing. In addition, the Blue Economy framework serves alongside mariculture park investments as part of sustainable fish farming initiatives launched by the government. For instance, in October 2024, the Department of Agriculture's Bureau of Fisheries and Aquatic Resources (DA-BFAR) launched a comprehensive five-year plan to advance the Philippine aquaculture industry. This strategic roadmap focuses on developing a competitive aquaculture sector capable of meeting both local and global seafood demands. The combination of automated feeding systems with disease control technologies using modern technology leads to higher aquaculture output. Moreover, Philippine seafood exports gain competitive strength through rising participation in international certifications such as the Marine Stewardship Council (MSC) and Best Aquaculture Practices (BAP). As a result, the monitored fishing areas and community-run fisheries management systems together gain increased promotion due to environmental problems and climate change, requiring safeguards for seafood resources and natural ecosystems. This is significantly enhancing the Philippines fish & seafood market outlook.

To get more information on this market, Request Sample

Rising Seafood Exports and International Market Expansion

The Philippines is increasing its seafood exports, driven by global demand for high-quality fish and seafood products. The United States stands alongside Japan, South Korea, and the European Union as the principal export markets for Filipino seafood products as the demand for tuna shrimp and processed seafood is significantly rising. In confluence with this, by joining the Regional Comprehensive Economic Partnership (RCEP) and other free trade agreements the country improves its market competition. For example, in February 2025, the Norwegian Embassy in Manila, along with the Norwegian Seafood Council and Philippine government agencies, hosted the first Seafood Roundtable to streamline fish trade and accelerate the utilization of the free trade agreement between the Philippines and Norway under EFTA-FTA. Also, modernized seafood processing units supported by international food safety standards such as Hazard Analysis and Critical Control Points (HACCP) and European Union (EU) regulations enable Filipino exporters to build their global market presence. Apart from this, the premium seafood market consisting of organic and sustainably sourced fish is expanding in international markets which positions the Philippines as a vital player within the global seafood industry, thus boosting the Philippines fish & seafood market share.

Increasing Consumer Demand for Value-Added and Ready-to-Eat Seafood

The Philippines is experiencing an increasing demand for practical seafood products due to rapid urbanization and changing consumer lifestyles. In line with this, convenient marine food items such as marinated fish fillets together with breaded shrimp, and pre-packaged sushi are gaining popularity among working people and younger consumers. Moreover, consumer demand for healthier eating habits leads to higher demand for seafood with omega-3 content plant-based seafood replacements and enriched seafood products. According to reports, each Filipino consumes about 93.90 grams of fish and seafood products per day, making up 11.68% of their overall food intake, highlighting the growing preference for seafood as an essential part of their diet. Besides this, retailers and online stores continue to enlarge their selection of seafood products so consumers can easily obtain processed products of high seafood quality. Furthermore, food delivery services along with cloud kitchens have raised seafood-based meal consumption rates, propelling the growth of processed and packaged seafood products, thereby expanding the Philippines fish & seafood market growth.

Growth Drivers of Philippines Fish & Seafood Market:

Rich Marine Biodiversity and Geographic Advantage

The Philippines' strategic geographical configuration, with an archipelago of more than 7,000 islands, grants it massive access to coastal and marine resources. Enveloped by large marine ecosystems such as the Coral Triangle, the country boasts one of the highest biodiversities in the globe, with which to sustain wild-caught and farmed fish and seafood. This natural wealth allows the nation to host a great range of marine commodities like tuna, milkfish (bangus), tilapia, and shellfish. The people in the local communities have traditionally relied on fishing as a main source of livelihood, and these historic practices are now being supplemented by formalized aquaculture and fisheries management programs. The synergy of auspicious sea conditions, marine biodiversity, and established fishing tradition ensures that there is a strong platform for expansion in the fish and seafood industry. With adequate investment and sustainability practices, the marine riches of the country continue to fuel domestic consumption and export potential, which further contributes to the Philippines fish & seafood market demand.

Growing Domestic Consumption and Well-being Consciousness

Growing health awareness about the nutritional benefits of fish and seafood is changing food preference in the Philippines, particularly in the urban middle class of Metro Manila, Cebu, and Davao. Filipinos are transitioning from red meat and processed food to leaner protein sources and are increasingly viewing fish as a healthier option. Government health organizations and health agencies are actively encouraging seafood consumption as a part of a balanced diet because of its omega-3 composition and nutritional properties. Further, the rich gastronomic tradition that includes seafood as a part of daily meals like grilled fish and seafood stews, promises consistent demand across socioeconomic groups. With increasing incomes, consumers are becoming quality-conscious and sensitive to freshness as well as sustainability, which is driving innovation in processing, packaging, and distribution. The sustained cultural popularity of seafood, coupled with health-oriented buying habits, puts the local market on track for consistent and long-term volume and value expansion.

Construction of Cold Chain and Distribution Infrastructure

According to the Philippines fish & seafood market analysis, among the most vital drivers of market expansion in the sector is the enhancement of cold chain logistics and distribution infrastructure. Typically, most coastal and rural communities struggled to supply fresh catches to the larger urban areas because of the lack of proper refrigeration, storage, and transportation infrastructure. Recent investments in cold storage units, upgraded road infrastructure, and upgraded fish ports have, however, started filling the gap. These increases assist in minimizing post-harvest losses, add shelf life to the products, and provide consistent quality, which are elements vital for both local and export markets. Increased distribution networks also facilitate the growth of seafood in inland provinces and outlying areas beyond, increasing access for consumers. The continued modernization of supply chain infrastructure enhances the competitiveness of local manufacturers while also bringing new investment into processing and packaging plants. This supply evolution is one of the main drivers of growth that allows the industry to expand responsibly and cost-effectively.

Philippines Fish & Seafood Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product, form, and distribution channel.

Product Insights:

- Fish

- Seafood

The report has provided a detailed breakup and analysis of the market based on the product. This includes fish and seafood.

Form Insights:

- Fresh

- Frozen

- Canned

- Cured

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes fresh, frozen, canned, and cured.

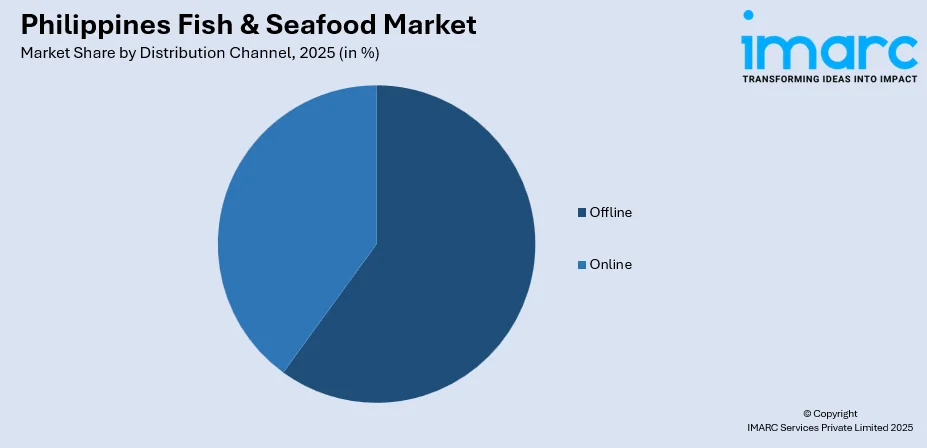

Distribution Channel Insights:

- Offline

- Online

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline and online.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Fish & Seafood Market News:

- In November 2024, the Department of Agriculture (DA) approved the importation of an additional 8,000 MT of fish. This decision was made in response to the P1-billion damage to the fisheries sector caused by successive typhoons and to address supply gaps during the closed fishing season.

- In October 2024, the Bureau of Fisheries and Aquatic Resources (BFAR) announced the importation of 30,000 metric tons (MT) of fish to stabilize supply during the annual closed fishing season from November 1 to January 31. This measure aims to maintain affordable fish prices and ensure sufficient supply in local markets.

Philippines Fish & Seafood Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Fish, Seafood |

| Forms Covered | Fresh, Frozen, Canned, Cured |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines fish & seafood market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines fish & seafood market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines fish & seafood industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines fish & seafood market was valued at USD 9.1 Billion in 2025.

The Philippines fish & seafood market is projected to exhibit a CAGR of 4.40% during 2026-2034.

The Philippines fish & seafood market is expected to reach a value of USD 13.4 Billion by 2034.

Key trends in the Philippines fish and seafood market include the shift toward sustainable fishing practices, growth in aquaculture, and rising demand for value-added and ready-to-cook seafood products. Consumers are also prioritizing freshness, traceability, and health benefits, while digital platforms and modern retail channels are enhancing seafood accessibility nationwide.

The Philippines fish and seafood market is driven by abundant marine biodiversity, rising health-conscious consumption, and improved cold chain infrastructure. The country’s coastal geography supports diverse fisheries, while growing demand for fresh, nutritious protein and better distribution systems are expanding both local accessibility and export potential for seafood products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)