Philippines FMCG Market Size, Share, Trends, and Forecast by Product Type, Demographics, Sales Channel, and Region, 2026-2034

Philippines FMCG Market Overview:

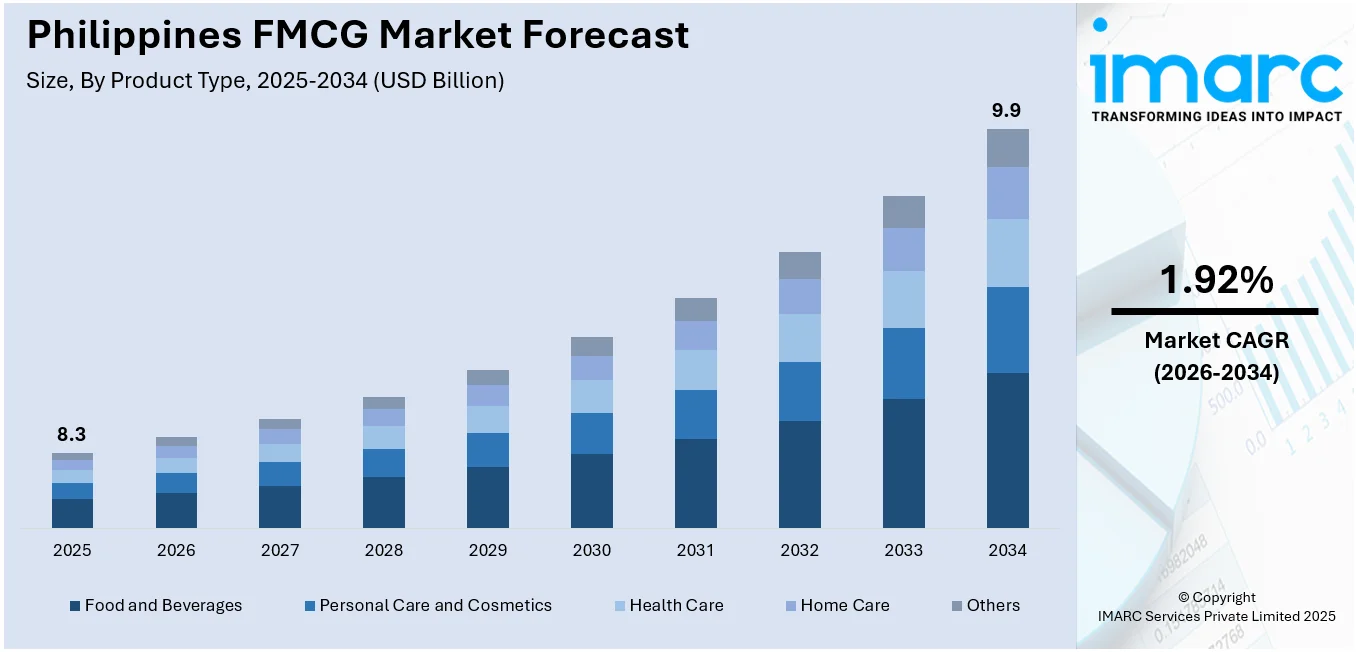

The Philippines FMCG market size reached USD 8.3 Billion in 2025. Looking forward, the market is expected to reach USD 9.9 Billion by 2034, exhibiting a growth rate (CAGR) of 1.92% during 2026-2034. The market is expanding due to rising consumer spending, urbanization, and demand for convenient packaged goods. Growth in modern retail formats, digital commerce, and product innovation supports wider distribution and stronger brand engagement, enhancing competitiveness and accessibility across regions while strengthening overall Philippines FMCG market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8.3 Billion |

| Market Forecast in 2034 | USD 9.9 Billion |

| Market Growth Rate (2026-2034) | 1.92% |

Key Trends of Philippines FMCG Market:

Rapid Urbanization

Urban dwellers, especially working professionals, prioritize convenience due to their busy schedules. Fast-moving consumer goods (FMCG) products, such as ready-to-eat (RTE) meals, toiletries, and cleaning supplies, are designed for adaptability, helping buyers save time and effort. Most FMCG products are affordable, making them accessible to a wide range of customers across different income groups. Health-conscious people in cities may choose functional or fortified food options, further catalyzing the demand for FMCG products. Moreover, rapid urbanization is creating the need for the development of advanced infrastructure, such as roads and transportation networks, which facilitate efficient FMCG supply chains. FMCG products are utilized regularly due to their nature, creating consistent demand and ensuring businesses stability in the market. Furthermore, FMCG companies are introducing new and innovative products, tailored as per personalized needs, such as organic food items and specialized health products. Rapid urbanization is also creating opportunities for targeted advertising and brand promotions. Companies often leverage billboards, digital ads, and social media campaigns to engage urban buyers. According to the data published on the official website of the World Bank in 2024, the urban population in Philippines will grow by over 50 million in next five decades, and by 2050, approximately 102 million people will live in cities.

To get more information on this market Request Sample

Expansion of E-Commerce

In the Philippines, the expansion of e-commerce is reshaping buyer behavior and providing opportunities for brands to extend their market space. With the rising number of e-commerce platforms, people can easily purchase FMCG products online and have them delivered to their doorsteps. According to the Philippines FMCG market analysis, e-commerce platforms give buyers the convenience to navigate and purchase FMCG products conveniently from their homes, without the hassle of visiting physical stores. They can compare product features, prices, and reviews across multiple sellers to make informed and suitable decisions. They bridge the gap between FMCG companies and geographically isolated areas, where physical retail infrastructure may be limited. Affordable delivery fees encourage people in rural areas to adopt e-commerce for FMCG purchases. Online retailers frequently offer discounts, promotions, and seasonal sales, providing buyers with more opportunities to save money. Furthermore, the increasing adoption of digital payment systems is making online FMCG transactions seamless, encouraging more consumers to shop online. E-commerce platforms offer a range of payment options, such as cash on delivery (COD), debit as well as credit cards, bank transfers, and digital wallets, enhancing the convenience of transactions. E-commerce platforms collect data on consumer preferences, enabling FMCG brands to create targeted marketing campaigns and personalized recommendations. This helps in building buyer trust and brand loyalty, which benefits both buyers and businesses. Moreover, managing an online store generally involves reduced overhead expenditure in comparison to a physical storefront, increasing profitability for retailers. As per the IMARC Group’s report, the Philippines retail sector market is expected to reach US$ 133.2 Billion by 2032.

Growth Drivers of Philippines FMCG Market:

Rising Disposable Income and Middle-Class Expansion

The Philippines' growing middle class and increasing disposable income levels are creating significant opportunities for FMCG market expansion across diverse product categories. Economic growth, overseas Filipino worker remittances, and improving employment rates contribute to enhanced purchasing power among Filipino consumers. This population change allows consumers to move from essentials to value FMCG products, such as branded personal care products, organic foods, and specialty health supplements. The growing middle class shows increased purchasing power to pay a premium for quality, convenience, and brand, translating to top-line growth for incumbent FMCG players. Moreover, enhanced financial knowledge and the availability of credit lines enable consumers to purchase more and invest in home appliances that contribute to quality-of-life improvement, driving continued Philippines FMCG market demand expansion across various FMCG categories across the archipelago.

Increasing Health and Wellness Consciousness

Increasing health awareness among Filipino consumers is driving substantial demand for functional foods, organic products, and wellness-oriented FMCG items across urban and rural markets. The COVID-19 pandemic accelerated consumer focus on immunity-boosting products, nutritional supplements, and natural ingredients, creating lasting behavioral changes in purchasing patterns. Health-conscious consumers now prioritize products with reduced sugar, organic certifications, and added vitamins or minerals, encouraging FMCG companies to reformulate existing products and launch health-focused alternatives. Rising obesity rates and chronic disease awareness motivate consumers to seek healthier food and beverage options, expanding Philippines FMCG market growth opportunities for low-calorie, low-sodium, and fortified FMCG products. This wellness trend extends beyond food to include natural personal care products, eco-friendly cleaning supplies, and mental health-supporting items, creating diverse growth avenues for innovative FMCG companies targeting health-conscious Filipino consumers.

Infrastructure Development and Supply Chain Optimization

The Philippine government's significant investments in transportation infrastructure, logistics networks, and digital connectivity are dramatically improving FMCG product accessibility across the country's numerous islands. Enhanced road networks, modernized ports, and expanded airport facilities reduce distribution costs and enable FMCG companies to reach previously underserved rural markets more efficiently. The "Build, Build, Build" infrastructure program facilitates faster product movement from manufacturing centers to retail outlets, reducing inventory costs and improving product freshness for perishable FMCG items. Digital infrastructure improvements, including expanded internet coverage and mobile network reliability, support e-commerce growth and enable innovative distribution models such as social commerce and direct-to-consumer sales. These infrastructure enhancements lower barriers to market entry for both domestic and international FMCG brands while enabling existing companies to expand their geographic reach and optimize supply chain operations for improved profitability and market penetration.

Philippines FMCG Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, demographics, and sales channel.

Product Type Insights:

- Food and Beverages

- Juices and Drinks

- Tea and Coffee

- Fresh Food

- Others

- Personal Care and Cosmetics

- Body Care

- Hair Care

- Oral Care

- Skin Care

- Baby Care

- Health Care

- Feminine Care

- Over the Counter (OTC)

- Others

- Home Care

- Cleaning Products

- Fragrance

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes food and beverages (juices and drinks, tea and coffee, fresh food, and others), personal care and cosmetics (body care, hair care, oral care, skin care, and baby care), health care (feminine care, over the counter (OTC), and others), home care (cleaning products, fragrance, and others), and others.

Demographics Insights:

- Urban

- Rural

A detailed breakup and analysis of the market based on the demographics have also been provided in the report. This includes urban and rural.

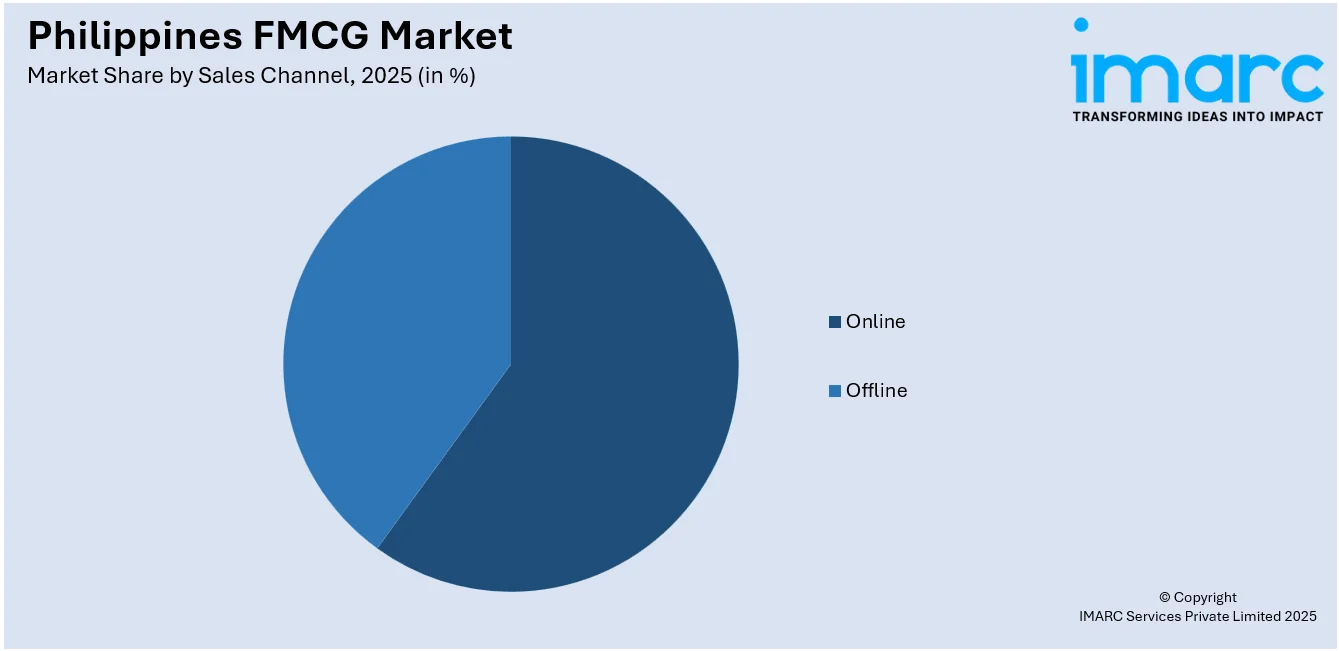

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes online and offline.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines FMCG Market News:

- September 2024: Starbucks announced its collaboration with Sanrio, the Japanese entertainment company to celebrate the golden anniversary of the famous character, Hello Kitty and launch a range of unique merchandise and apple-flavored beverages, crafted with hands. This partnership aims to expand markets to various regions of Asia-Pacific, including Philippines.

- March 2024: Venturi Partners, the leading growth equity firm unveiled its investment in DALI Discount, a prominent hard discount retail chain established in the Philippines to expand its project of selling high-quality and affordable groceries in pocket-friendly prices.

Philippines FMCG Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Demographics Covered | Urban, Rural |

| Sales Channels Covered | Online, Offline |

| Regions Covered | Luzon, Visayas, and Mindanao. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines FMCG market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines FMCG market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines FMCG industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines FMCG market was valued at USD 8.3 Billion in 2025.

The Philippines FMCG market is projected to exhibit a CAGR of 1.92% during 2026-2034.

The Philippines FMCG market is projected to reach a value of USD 9.9 Billion by 2034.

The market experiences growth driven by widespread digital payment adoption, increasing urban development, and continuous e-commerce expansion. Traditional trade remains dominant while online platforms steadily gain importance, supported by rising consumer preference for convenience, seamless transactions, and easy accessibility across diverse shopping channels in both metropolitan and emerging retail environments.

The Philippines FMCG market is driven by rising disposable income from the growing middle class and overseas worker remittances, increasing health consciousness accelerated by pandemic awareness, and infrastructure development through the government's "Build, Build, Build" program, enhancing distribution efficiency and market accessibility nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)