Philippines Folding Bike Market Size, Share, Trends and Forecast by Product Type, Drive Type, Size, Price Range, Distribution Channel, and Region, 2026-2034

Philippines Folding Bike Market Summary:

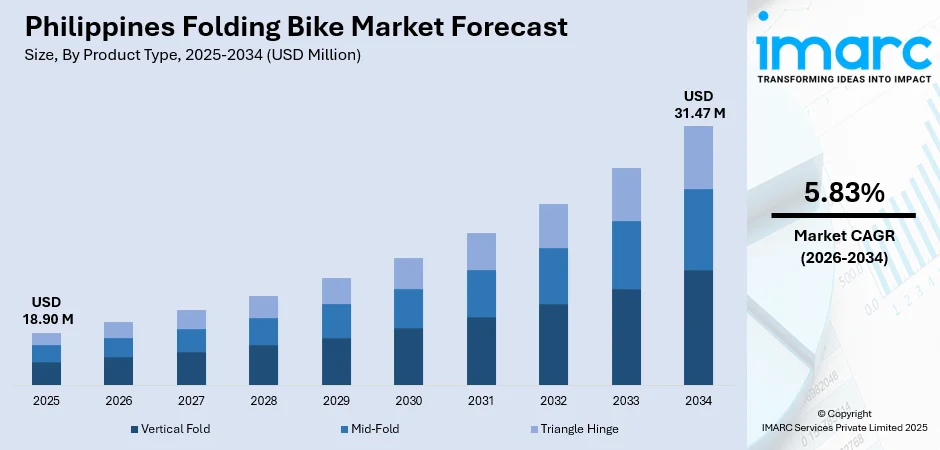

The Philippines folding bike market size was valued at USD 18.90 Million in 2025 and is projected to reach USD 31.47 Million by 2034, growing at a compound annual growth rate of 5.83% from 2026-2034.

The market is driven by increasing urbanization and traffic congestion in major metropolitan areas, rising environmental awareness among Filipino consumers, and growing preference for compact, portable transportation solutions. The demand is further fueled by expanding cycling infrastructure initiatives and shifting consumer attitudes toward healthier commuting alternatives that offer convenience and cost efficiency, contributing to the Philippines folding bike market share.

Key Takeaways and Insights:

- By Product Type: Vertical fold dominates the market with a share of 38% in 2025, driven by superior portability features, ease of storage in compact urban spaces, and widespread retail availability.

- By Drive Type: Conventional leads the market with a share of 74% in 2025, owing to affordability compared to electric alternatives, lower maintenance requirements, and established consumer preference for traditional cycling.

- By Size: 20” represents the largest segment with a market share of 45% in 2025, driven by optimal balance between portability and riding comfort, suitability for diverse rider heights, and transit compatibility.

- By Price Range: Economy dominates the market with a share of 46% in 2025, owing to price-sensitive Filipino consumers, wider accessibility for middle-income households, and growing availability of quality affordable options.

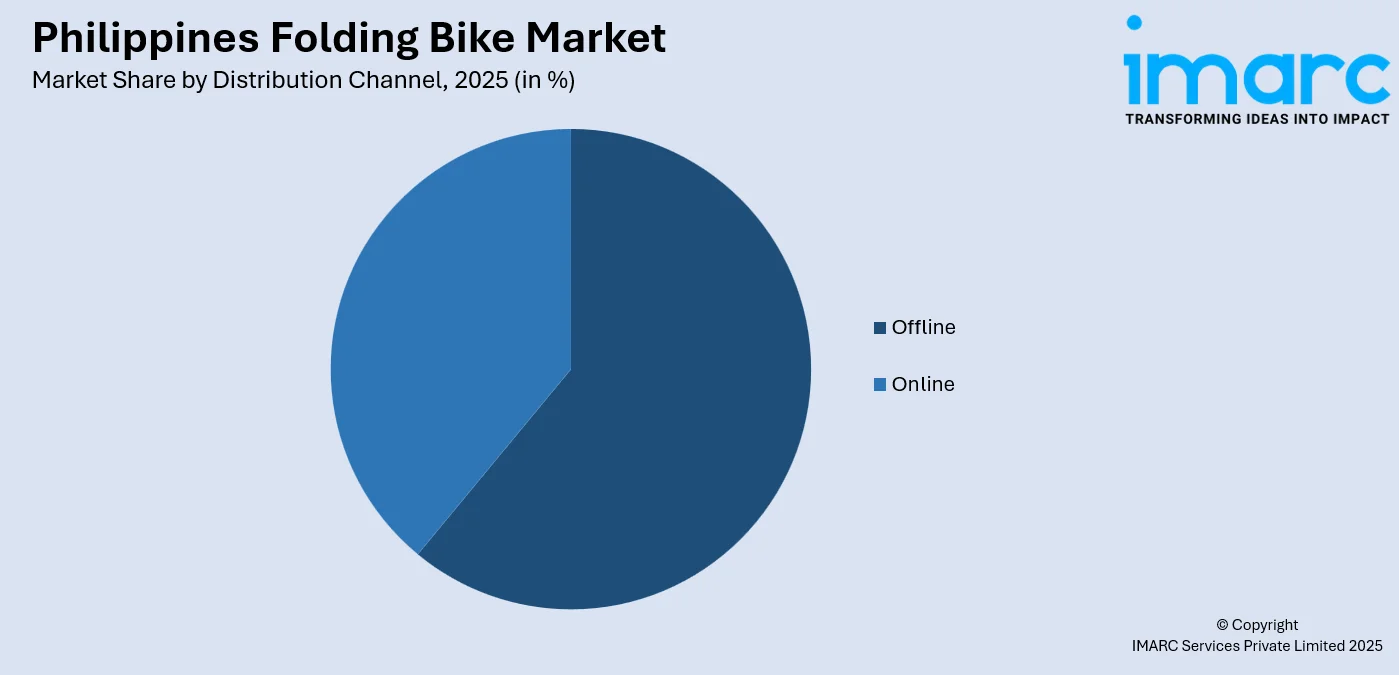

- By Distribution Channel: Offline leads the market with a share of 61% in 2025, driven by consumer preference for physical product inspection, importance of test rides, and widespread specialty bicycle shop presence.

- By Region: Luzon dominates the market with a share of 46% in 2025, owing to concentration of urban centers including Metro Manila, higher population density, and superior cycling infrastructure development.

- Key Players: The Philippines folding bike market exhibits a moderate competitive intensity, with international manufacturers competing alongside local assemblers across various price segments, emphasizing product differentiation through design innovation and after-sales support.

To get more information on this market Request Sample

The Philippines folding bike market has experienced remarkable growth trajectory, propelled by fundamental shifts in urban mobility preferences and transportation habits across the archipelago. The escalating traffic congestion in metropolitan areas, particularly in Metro Manila and rapidly urbanizing regional centers, has prompted Filipino consumers to explore alternative commuting solutions that bypass vehicular gridlock. According to reports, the Philippines’ 2024 national budget allocated P1 Billion specifically for protected bike lanes and pedestrian walkways under the Department of Transportation’s Active Transport and Safe Pathways Program to support cycling infrastructure nationwide. Moreover, folding bikes have emerged as a compelling proposition, offering the unique advantage of multimodal transportation integration where riders can seamlessly combine cycling with public transit systems. The growing health and fitness consciousness among the Filipino population has further amplified interest in cycling as both a commuting tool and recreational activity. Government initiatives promoting sustainable transportation and the development of dedicated cycling lanes have created an enabling environment for market expansion.

Philippines Folding Bike Market Trends:

Integration with Public Transportation Networks

The Philippine transportation landscape is witnessing a significant trend toward multimodal commuting solutions, with folding bikes emerging as the preferred last-mile connectivity option. Urban commuters increasingly combine folding bikes with trains, buses, and other public transit modes to navigate congested city environments efficiently. In November 2025, the Light Rail Transit Authority (LRTA) publicly confirmed that folding bicycles are welcome on LRT Line 2 trains, with specific guidelines on placement and capacity to support combined bike-rail commuting. Furthermore, this integration is facilitated by the lightweight and compact nature of folding bikes, which can be easily carried onto public vehicles without occupying excessive space. Transit authorities are recognizing this synergy, leading to more accommodating policies for cyclists using public transportation systems.

Emergence of Cycling Communities and Social Networks

A vibrant ecosystem of cycling communities and social groups has emerged across the Philippines, creating powerful networks that promote folding bike adoption and usage. These communities organize regular group rides, cycling tours, and social events that foster camaraderie among enthusiasts while attracting newcomers to the folding bike lifestyle. As per sources, in June 2025, SM Cares launched “Pedal Power” across 26 malls nationwide to mark World Bicycle Day, bringing together cyclists for community rides and sustainability activities. Moreover, online platforms and social media groups dedicated to folding bikes facilitate knowledge sharing about maintenance tips, route recommendations, and product reviews. The community aspect addresses safety concerns by promoting group riding and establishing support networks for cyclists.

Customization and Personalization Culture

Filipino folding bike enthusiasts have developed a distinctive culture of customization and personalization, transforming standard factory models into unique expressions of individual style and functionality. Owners purchase aftermarket parts that improve the appearance as well as performance of these folding bicycles. Furthermore, this trend encompasses upgraded drivetrain components and premium folding mechanisms to custom paint jobs and personalized accessories. Local fabricators and specialty shops have emerged to cater to this demand, offering custom solutions tailored to Philippine riding conditions and preferences.

Market Outlook 2026-2034:

The Philippines folding bike market is positioned for sustained expansion throughout the forecast period, supported by favorable demographic trends and evolving urban mobility patterns. Market revenue is expected to demonstrate consistent growth as urbanization continues accelerating across the archipelago and transportation challenges intensify in major metropolitan areas. Infrastructure investments in cycling lanes and bike-friendly facilities will enhance the practical viability of folding bikes for daily commuting. The younger demographic cohort, characterized by environmental consciousness and openness to alternative transportation modes, will increasingly drive market revenue growth. The market generated a revenue of USD 18.90 Million in 2025 and is projected to reach a revenue of USD 31.47 Million by 2034, growing at a compound annual growth rate of 5.83% from 2026-2034.

Philippines Folding Bike Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Vertical Fold | 38% |

| Drive Type | Conventional | 74% |

| Size | 20” | 45% |

| Price Range | Economy | 46% |

| Distribution Channel | Offline | 61% |

| Region | Luzon | 46% |

Product Type Insights:

- Vertical Fold

- Mid-Fold

- Triangle Hinge

Vertical fold dominates with a market share of 38% of the total Philippines folding bike market in 2025.

The vertical fold commands the leading position in the Philippines folding bike market, reflecting strong consumer preference for this practical design configuration. Vertical fold mechanisms allow bikes to collapse into compact, upright configurations that occupy minimal floor space, making them ideal for storage in tight urban living environments common across Philippine cities. As per sources, in 2024, Brompton bikes in the Philippines experienced over 30% sales growth in the past two years, driven by urban commuters seeking compact, portable, and customizable folding bicycles for city travel. Furthermore, the design enables quick folding and unfolding sequences that appeal to commuters requiring rapid transitions between cycling and other transportation modes. Manufacturers offering vertical fold designs have established strong distribution networks and brand recognition among Filipino consumers.

The segment benefits from continuous design refinements that improve folding speed, structural integrity, and overall user experience. Consumer education efforts have successfully communicated the practical advantages of vertical folding systems for daily urban use. The vertical fold configuration accommodates various wheel sizes and frame geometries, providing options across different price points and performance levels. Retail establishments prioritize vertical fold models in their inventory due to consistent demand and positive customer feedback regarding functionality and durability in Philippine operating conditions.

Drive Type Insights:

- Conventional

- Electrical

Conventional leads with a share of 74% of the total Philippines folding bike market in 2025.

The conventional maintains dominant market position, reflecting the fundamental preferences and economic considerations of Filipino consumers. Non-electric folding bikes offer significant cost advantages over electric alternatives, aligning with the budget-conscious purchasing behavior prevalent across Philippine consumer segments. As per sources, a Social Weather Stations survey found 36 percent of Filipino households use bicycles, totalling 10 Million families, with more bike owners than car owners nationwide, highlighting strong conventional adoption. Moreover, the simplicity of conventional drivetrain systems reduces maintenance requirements and eliminates concerns about battery replacement costs, charging infrastructure availability, and electronic component reliability.

The segment benefits from established supply chains and widespread availability of replacement parts and service expertise throughout the Philippines. Conventional folding bikes maintain lighter weight profiles compared to electric variants, enhancing portability for multimodal commuters navigating stairs, transit platforms, and pedestrian areas. Physical fitness benefits derived from human-powered cycling resonate with health-conscious consumers seeking active transportation solutions. Market penetration in provincial areas, where electric charging infrastructure remains limited, further reinforces the conventional segment dominance across diverse geographic markets.

Size Insights:

- 20”

- 24”

- 26”

- Others

20” exhibits a clear dominance with a 45% share of the total Philippines folding bike market in 2025.

The 20" represents the optimal compromise between portability and riding performance, securing its position as the market leader. This wheel diameter provides sufficient rolling efficiency for urban commuting distances while maintaining the compact folded dimensions essential for practical storage and transportation. The sizing accommodates a broad range of rider heights through adjustable seat posts and handlebar configurations, maximizing market addressability across demographic segments. Filipino consumers recognize the versatility of twenty-inch configurations for diverse riding scenarios spanning daily commutes, recreational outings, and occasional longer distances.

Manufacturing economies of scale around the 20" standard ensure competitive pricing and extensive product variety at this wheel size. Component availability and aftermarket support are strongest for twenty-inch specifications, facilitating maintenance and customization activities popular among Filipino cycling enthusiasts. The wheel diameter meets the practical requirements of public transit integration, fitting within space constraints while remaining easily maneuverable in crowded stations. Retailer expertise and consumer familiarity concentrate around this segment, creating self-reinforcing market dynamics that sustain leadership position.

Price Range Insights:

- Low

- Economy

- Premium

Economy leads with a market share of 46% of the total Philippines folding bike market in 2025.

The economy captures the largest market share, reflecting the purchasing power distribution and value orientation characteristic of Philippine consumer markets. Economy-priced folding bikes provide accessible entry points for first-time buyers exploring cycling as a transportation alternative without substantial upfront investment commitments. As per sources, the 2025 edition of Bilang Siklista bicycle count recorded 218,866 people cycling across 15 Philippine cities, highlighting the strong commuter base that supports demand for affordable folding bikes. Furthermore, manufacturers serving this segment have optimized production processes and component sourcing strategies to deliver acceptable quality and functionality at competitive price points. The segment attracts diverse consumer profiles including students, young professionals, and budget-conscious households seeking practical mobility solutions.

Economic considerations remain paramount in Filipino purchasing decisions, with value-for-money calculations driving brand and model selections within budget parameters. The segment benefits from extensive distribution through both specialty bicycle retailers and general merchandise outlets, maximizing market accessibility. Financing arrangements and installment payment options further enhance affordability within this segment. Quality improvements among economy offerings have narrowed performance gaps with premium alternatives, strengthening value propositions and supporting volume growth within this price category.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

Offline dominates with a market share of 61% of the total Philippines folding bike market in 2025.

The offline maintains market leadership, reflecting consumer preferences for physical retail experiences when purchasing folding bikes. Filipino buyers place substantial value on the ability to physically inspect products, assess build quality, test riding characteristics, and receive personalized guidance from knowledgeable sales staff. According to reports, 77% of Filipino consumers prefer a hands-on, in-store approach when evaluating unfamiliar products, highlighting why offline retail remains crucial for folding bike purchases. Furthermore, specialty bicycle shops provide comprehensive services including professional fitting, assembly verification, and ongoing maintenance support that enhance overall ownership experiences. The tactile nature of bicycle selection, where comfort and ergonomics significantly influence satisfaction, favors in-person evaluation over remote purchasing.

Offline cultivates relationships with cycling communities, sponsoring events and providing gathering spaces that strengthen customer loyalty and generate referral business. The service capabilities available through physical retail locations address post-purchase needs including repairs, component upgrades, and warranty claims more effectively than online alternatives. Provincial and regional markets, where e-commerce penetration remains developing, depend predominantly on offline channels for folding bike access. Established specialty retailers leverage accumulated expertise and supplier relationships to maintain competitive positions against emerging online competition.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon represents with a market share of 46% of the total Philippines folding bike market in 2025.

Luzon commands the largest regional market share, driven by demographic concentration and economic factors favoring folding bike adoption. Metro Manila, as the national capital region, represents the epicenter of market demand where traffic congestion severity, population density, and income levels create optimal conditions for folding bike utilization. The greater Luzon area benefits from superior cycling infrastructure development including dedicated bike lanes, secure parking facilities, and bike-friendly commercial establishments. Urban professionals in Luzon metropolitan areas increasingly embrace folding bikes as sophisticated solutions to chronic mobility challenges.

The region hosts the strongest concentration of specialty retailers, distribution centers, and after-sales service networks supporting the folding bike market. Cycling communities in Luzon maintain the highest levels of organization and activity, generating sustained enthusiasm and attracting new participants to the folding bike lifestyle. Income levels across Luzon generally exceed national averages, supporting consumer capacity for discretionary transportation investments. The demonstration effects of visible folding bike usage in Luzon urban centers influence adoption patterns in other regions as successful practices diffuse through social networks and media coverage.

Market Dynamics:

Growth Drivers:

Why is the Philippines Folding Bike Market Growing?

Rising Urbanization and Traffic Congestion

The Philippines continues experiencing rapid urbanization, with population increasingly concentrated in metropolitan centers where transportation infrastructure struggles to accommodate demand. Traffic congestion has reached critical levels in major urban areas, imposing substantial time costs on commuters relying on conventional motor vehicle transportation. As per sources, the Department of Transportation (DOTr) expanded the national bicycle lane network under its Active Transport and Safe Pathways Program to promote cycling and safer alternative mobility options amid worsening urban congestion. Moreover, this congestion creates powerful incentives for alternative mobility solutions that can circumvent vehicular gridlock while providing reliable point-to-point connectivity. Folding bikes address these needs by enabling users to navigate through congested streets efficiently.

Growing Environmental Awareness and Sustainability Consciousness

Environmental consciousness among Filipino consumers has expanded significantly, driven by increased exposure to climate change discussions, pollution concerns, and sustainable lifestyle concepts through media and educational channels. Younger demographic cohorts particularly embrace environmental values, seeking consumption choices aligned with sustainability principles and reduced ecological footprints. Folding bikes represent tangible expressions of environmental commitment, providing zero-emission transportation alternatives to motor vehicles for appropriate journey types. In June 2025, Shell Philippines installed 110 bike racks made from 3 metric tons of upcycled plastic waste across Metro Manila and Southern Luzon, promoting sustainable mobility and circular economy solutions. Furthermore, the visible nature of cycling allows users to signal environmental values within their social networks, creating additional adoption incentives.

Infrastructure Development and Cycling-Friendly Policies

Philippine government authorities at national and local levels have increasingly recognized cycling as a legitimate transportation mode deserving infrastructure investment and policy support. Protected bike lanes, cycling paths, and shared road facilities have expanded across major metropolitan areas, improving safety conditions and practicality for daily cycling commutes. Further, secure bicycle parking installations at transit stations and commercial centers address storage concerns that previously deterred potential cyclists. Policy discussions have explored additional supportive measures including cycling subsidies and tax incentives for bicycle purchases. The establishment of cycling as an officially recognized transportation alternative legitimizes folding bike adoption within mainstream consumer segments.

Market Restraints:

What Challenges the Philippines Folding Bike Market is Facing?

Higher Initial Cost Compared to Traditional Bicycles

Folding bikes typically command price premiums over comparable standard bicycles due to specialized folding mechanisms, compact component designs, and engineering complexity required for reliable functionality. This cost differential presents barriers for price-sensitive Filipino consumers who may consider traditional bicycles as more affordable alternatives despite reduced portability.

Limited Awareness in Provincial Markets

Consumer awareness and product familiarity regarding folding bikes remain concentrated in major metropolitan areas, with provincial and rural markets exhibiting lower recognition of benefits and applications. Distribution networks and specialty retail presence thin considerably outside primary urban centers, restricting product accessibility for interested provincial consumers.

Component Quality and Durability Perceptions

Consumer perceptions regarding folding bike durability and long-term reliability present market development challenges, particularly among potential buyers unfamiliar with modern folding mechanism technologies. Concerns about folding joint integrity, frame fatigue, and component longevity under daily use conditions influence purchasing hesitancy among risk-averse consumer segments.

Competitive Landscape:

The Philippines folding bike market demonstrates a moderately fragmented competitive structure characterized by diverse participant categories spanning international premium brands, regional manufacturers, and local assemblers serving various market segments. Competition occurs across multiple dimensions including price positioning, product quality and features, distribution coverage, brand recognition, and after-sales service capabilities. International participants leverage brand equity, engineering expertise, and global supply chain efficiencies while local competitors emphasize price competitiveness, market understanding, and service accessibility. Distribution partnerships and retail relationships represent critical competitive assets determining market access and consumer visibility. Product differentiation strategies emphasize folding mechanism innovation, material quality, riding performance, and aesthetic design elements appealing to target consumer segments.

Recent Developments:

- In October 2025, Popcycle launched its first branded e-bike, the Friend, during a community ride in Metro Manila. The lightweight, trifold model features hydraulic disc brakes, up to 45 km range (135 km with range extender), and easy portability for multimodal commuting. It is priced at P65,000–P80,000 and available nationwide.

Philippines Folding Bike Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vertical Fold, Mid-Fold, Triangle Hinge |

| Drive Types Covered | Conventional, Electrical |

| Sizes Covered | 20”, 24”, 26”, Others |

| Price Ranges Covered | Low, Economy, Premium |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines folding bike market size was valued at USD 18.90 Million in 2025.

The Philippines folding bike market is expected to grow at a compound annual growth rate of 5.83% from 2026-2034 to reach USD 31.47 Million by 2034.

Vertical fold held the largest market share driven by superior portability features, ease of storage in compact urban living spaces, widespread availability across retail channels, quick-folding mechanisms preferred by urban commuters, and compatibility with multimodal transportation systems.

Key factors driving the Philippines folding bike market include rising urbanization and severe traffic congestion in metropolitan areas, growing environmental awareness among consumers, expanding cycling infrastructure, and increasing preference for multimodal transportation solutions.

Major challenges include higher initial costs compared to traditional bicycles, limited consumer awareness in provincial markets, durability perceptions among unfamiliar buyers, restricted distribution networks outside major urban centers, and competition from alternative transportation modes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)