Philippines Forage Market Size, Share, Trends and Forecast by Crop Type, Product Type, Animal Type, and Region, 2025-2033

Philippines Forage Market Overview:

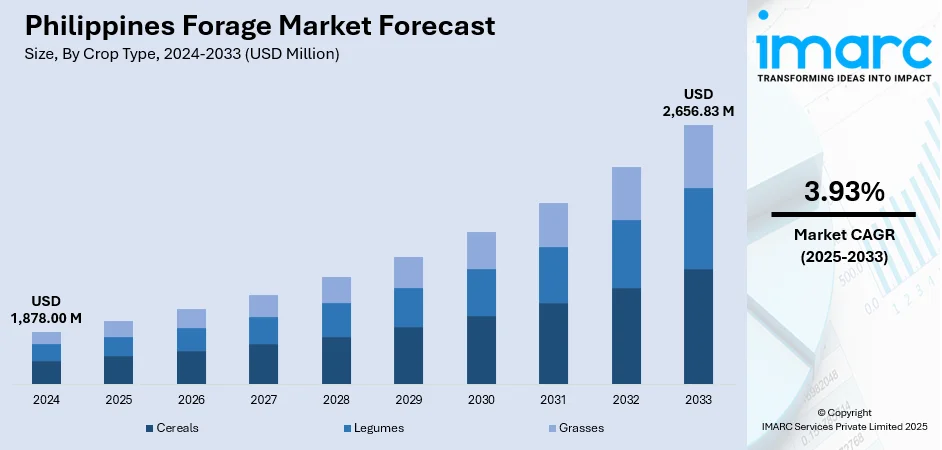

The Philippines forage market size reached USD 1,878.00 Million in 2024. The market is projected to reach USD 2,656.83 Million by 2033, exhibiting a growth rate (CAGR) of 3.93% during 2025-2033. Rising livestock populations, growing demand for dairy and meat, and government initiatives to improve feed quality are supporting forage adoption. Enhanced awareness of animal nutrition, rising investments in silage infrastructure, and climate-resilient crop varieties also drive demand, strengthening Philippines forage market share across key regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,878.00 Million |

| Market Forecast in 2033 | USD 2,656.83 Million |

| Market Growth Rate 2025-2033 | 3.93% |

Philippines Forage Market Trends:

Integration of High-Yield Forage Varieties

Research institutions and agricultural agencies are promoting high-yield forage crops such as Napier grass, maize, and hybrid sorghum to improve productivity per hectare. These crops are resilient to pests, offer rapid regrowth cycles, and ensure higher nutritional values for ruminants. The introduction of drought-tolerant and disease-resistant varieties is particularly important in regions prone to weather disruptions. Demonstration farms are showcasing improved yield outcomes and cost benefits, encouraging wider adoption among rural communities. Seed distribution programs and partnerships with local governments are supporting farmer access to these improved varieties. This transition to high-performance forages ensures a more sustainable livestock industry, reduces dependence on imported feeds, and reinforces steady Philippines forage market growth over the forecast period. For instance, a Department of Science and Technology (DoST)-funded project in the Philippines is trialing nine alfalfa varieties in Misamis Oriental to boost forage availability for the dairy sector. Conducted by the University of Science and Technology of Southern Philippines, the initiative aims to introduce tropical-adapted alfalfa varieties, inspired by Thailand’s success. Alfalfa, known for its superior nutritional value, could reduce local milk production costs. The varieties include both temperate and subtropical strains such as Lucerne and Bulldog series.

To get more information on this market, Request Sample

Expansion of Commercial Livestock Operations

The Philippines' National Dairy Authority (NDA) is allocating nearly PHP 500 Million to establish four dairy cattle breeding farms in Luzon and Mindanao, aiming to boost milk sufficiency. Each site will support 150 cattle and include forage development. The initiative seeks to raise local milk production to 80 million liters by 2028, addressing heavy import reliance and malnutrition. The Philippines has witnessed steady growth in commercial livestock farms, particularly in poultry, cattle, and swine. As farm sizes expand, reliance on organized forage supply chains becomes more critical to sustain productivity levels. Large agribusinesses are investing in mechanized harvesting, silage storage facilities, and feed processing technologies to secure consistent supply. Partnerships between feed mills and forage producers are also emerging, improving value chain efficiency. The rising consumption of meat and dairy products in urban centers drives demand for higher-quality forage inputs. Government support for agribusiness modernization, coupled with credit facilities for capital investment, further stimulates capacity growth. These developments collectively enhance supply stability and support sustained Philippines forage market growth.

Philippines Forage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on crop type, product type, and animal type.

Crop Type Insights:

- Cereals

- Legumes

- Grasses

The report has provided a detailed breakup and analysis of the market based on the crop type. This includes cereals, legumes, and grasses.

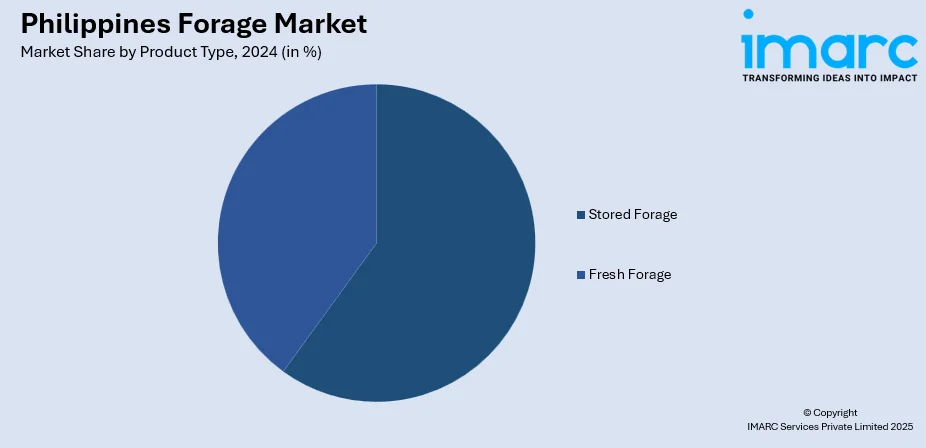

Product Type Insights:

- Stored Forage

- Fresh Forage

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes stored forage and fresh forage.

Animal Type Insights:

- Ruminants

- Swine

- Poultry

- Others

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes ruminants, swine, poultry, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Forage Market News:

- In August 2025, Golden Forage, an agriculture startup in the Philippines, revolutionized feed storage for small dairy farmers through compact silage balers and wrap technology. This innovation enhances feed preservation, reduces seasonal shortages, and simplifies transport across rural and island communities. The company highlights the model’s potential to modernize supply chains, establish decentralized baling centers, and improve feed consistency. Despite challenges like limited infrastructure and low awareness, Golden Forage aims to build a scalable, farmer-led forage ecosystem tailored for smallholder conditions.

Philippines Forage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Crop Types Covered | Cereals, Legumes, Grasses |

| Product Types Covered | Stored Forage, Fresh Forage |

| Animal Types Covered | Ruminants, Swine, Poultry, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines forage market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines forage market on the basis of crop type?

- What is the breakup of the Philippines forage market on the basis of product type?

- What is the breakup of the Philippines forage market on the basis of animal type?

- What is the breakup of the Philippines forage market on the basis of region?

- What are the various stages in the value chain of the Philippines forage market?

- What are the key driving factors and challenges in the Philippines forage market?

- What is the structure of the Philippines forage market and who are the key players?

- What is the degree of competition in the Philippines forage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines forage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines forage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines forage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)