Philippines Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2026-2034

Philippines Foreign Exchange Market Summary:

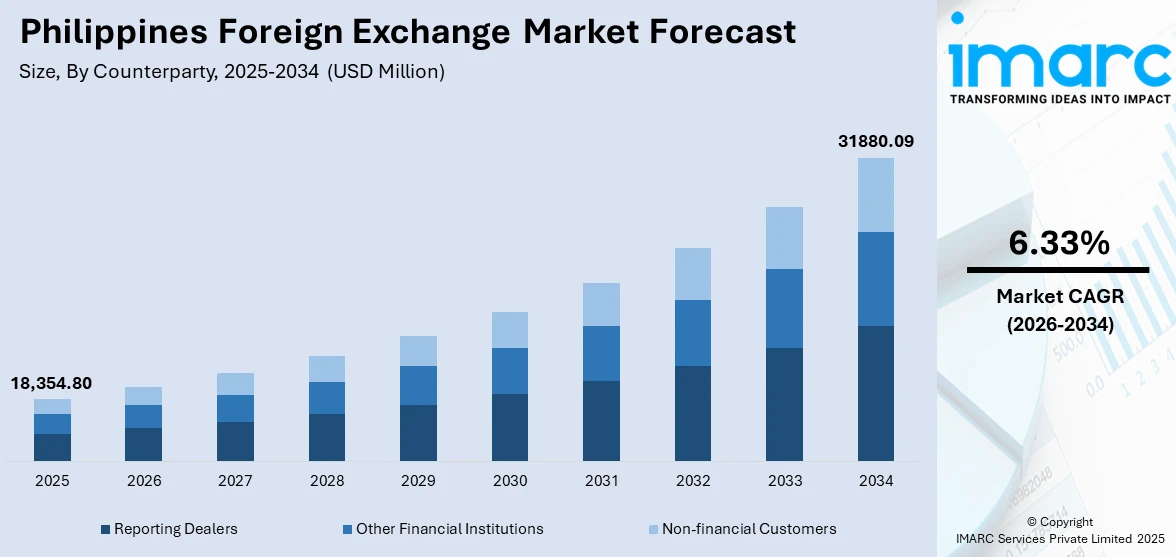

The Philippines foreign exchange market size was valued at USD 18,354.80 Million in 2025 and is projected to reach USD 31,880.09 Million by 2034, growing at a compound annual growth rate of 6.33% from 2026-2034.

The Philippines foreign exchange market is experiencing robust expansion, driven by sustained overseas Filipino worker remittance inflows, growing cross-border trade activities, and increasing adoption of digital banking platforms. Rising foreign direct investment (FDI) flows, expanding business process outsourcing sector, and strengthening tourism industry contribute to heightened foreign exchange demand. The proliferation of fintech solutions and enhanced payment connectivity initiatives are transforming transaction efficiency.

Key Takeaways and Insights:

- By Counterparty: Reporting dealers dominate the market with a share of 45% in 2025, owing to their central role in facilitating interbank transactions, providing liquidity to institutional clients, and executing large-volume foreign exchange operations that support international trade and investment activities.

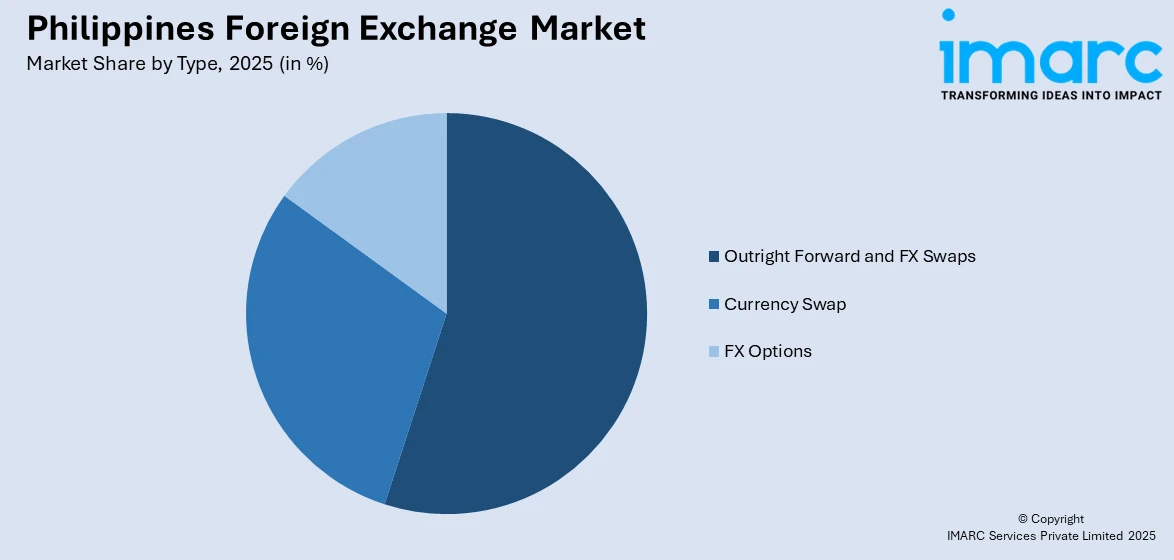

- By Type: Outright forward and FX swaps lead the market with a share of 55% in 2025. This dominance is driven by corporate hedging requirements, banks' liquidity management needs, and increasing demand from exporters and importers seeking protection against currency volatility.

- By Region: Luzon comprises the largest region with 70% share in 2025, due to Manila’s role as the financial hub, high trade activity, concentration of banks, multinational firms, remittances, and strong import-export transactions.

- Key Players: Key players drive the Philippines foreign exchange market by expanding digital transaction capabilities, enhancing hedging solutions, and strengthening correspondent banking networks. Their investments in technology infrastructure, regulatory compliance, and strategic partnerships with international institutions accelerate market development and ensure efficient currency exchange services across diverse customer segments.

To get more information on this market Request Sample

The Philippines foreign exchange market is experiencing substantial growth, propelled by multiple converging factors that enhance transaction volumes and market participation. The consistent inflow of personal remittances from overseas filipinos, which reached a record USD 38.34 Billion in 2024 according to the Philippine central bank data, remains a fundamental driver sustaining foreign currency liquidity and supporting household consumption. The expanding digital payment ecosystem facilitates more efficient currency conversion and cross-border transfers. The growing business process outsourcing industry generates substantial foreign exchange receipts, while rising FDI in the manufacturing and infrastructure sectors creates hedging demand. Increasing tourism activities continue to contribute to forex inflows as international visitor arrivals increase. Additionally, progressive regulatory reforms, including foreign exchange liberalization measures and enhanced derivatives frameworks, improve market accessibility and transparency.

Philippines Foreign Exchange Market Trends:

Digital Transformation of Foreign Exchange Services

The Philippines foreign exchange market is witnessing accelerated digitalization, as financial institutions integrate advanced technology platforms for currency transactions. Mobile banking applications and digital wallets facilitate real-time foreign exchange conversions, enabling consumers and businesses to access competitive rates instantly. As per IMARC Group, the Philippines digital wallet market size reached USD 11.6 Billion in 2024. The proliferation of digital banks is expanding the market reach while fintech innovations reduce transaction costs and processing times significantly.

Cross-Border Payment Integration Initiatives

Cross-border payment integration initiatives are driving the Philippines foreign exchange market by improving transaction efficiency, reducing settlement costs, and increasing transparency in international transfers. Enhanced payment connectivity supports faster remittance flows, trade settlements, and business transactions with regional and global partners. As digital payment platforms and interoperable systems expand, demand for real-time currency conversion and liquidity management rises. These initiatives strengthen confidence among banks, exporters, importers, and overseas Filipinos, stimulating higher foreign exchange volumes and reinforcing the country’s role in regional financial networks.

Central Bank Market Intervention Framework Development

Central Bank market intervention framework development is driving the Philippines foreign exchange market by enhancing stability, confidence, and liquidity management. The central bank maintains a managed float exchange rate system, utilizing gross international reserves that reached USD 112.0 Billion in September 2024, to temper excessive peso movements. This structured intervention approach reduces volatility, supports orderly market conditions, and reassures investors and traders. Clear policy signaling and timely interventions help balance capital flows, safeguard external trade competitiveness, and strengthen the overall resilience of the foreign exchange market.

Market Outlook 2026-2034:

The Philippines foreign exchange market demonstrates promising growth prospects, driven by structural economic factors and evolving financial infrastructure. The market generated a revenue of USD 18,354.80 Million in 2025 and is projected to reach a revenue of USD 31,880.09 Million by 2034, growing at a compound annual growth rate of 6.33% from 2026-2034. The sustained expansion of overseas worker deployment, projected growth in business process outsourcing revenues, and increasing FDI inflows will support transaction volumes. Technological advancements in digital banking, mobile payment platforms, and blockchain-enabled remittance solutions will enhance market accessibility and reduce transaction costs. The BSP's continued regulatory modernization, including forex liberalization measures and derivatives market development, will attract broader participation while maintaining financial stability throughout the forecast period.

Philippines Foreign Exchange Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Counterparty |

Reporting Dealers |

45% |

|

Type |

Outright Forward and FX Swaps |

55% |

|

Region |

Luzon |

70% |

Counterparty Insights:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

Reporting dealers dominate with a market share of 45% of the total Philippines foreign exchange market in 2025.

Reporting dealers constitute the primary counterparty segment in the Philippines foreign exchange market, encompassing major universal and commercial banks authorized to conduct interbank currency transactions. These institutions serve as market makers, providing continuous bid-ask quotes and ensuring liquidity across peso-dollar and cross-currency pairs. The Philippine Dealing and Exchange Corporation facilitates electronic trading among Bankers Association of the Philippines member banks, enabling near-instantaneous price discovery and trade confirmations. BDO Unibank, Inc. reported a net income of PHP82 Billion in 2024, an increase of 12% compared to 2023, reflecting the banking system’s strong financial capacity to support large-volume foreign exchange operations.

The dominance of reporting dealers stems from their extensive correspondent banking networks, sophisticated treasury operations, and regulatory compliance infrastructure required for international settlements. These institutions process corporate foreign exchange requirements, manage proprietary trading positions, and execute central bank interventions. Their investment in digital platforms enables real-time currency conversion services for retail and institutional clients. This central role reinforces market efficiency, transparency, and stability across the domestic foreign exchange ecosystem.

Type Insights:

Access the comprehensive market breakdown Request Sample

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

Outright forward and FX swaps lead with a share of 55% of the total Philippines foreign exchange market in 2025.

Outright forwards and FX swaps represent the predominant type in the Philippines foreign exchange market, providing essential hedging mechanisms for businesses engaged in international trade and investment. Forward contracts enable corporations to lock exchange rates for future currency purchases or sales, eliminating uncertainty in import payment obligations and export revenue projections. FX swaps serve liquidity management purposes, allowing banks and corporations to temporarily exchange currencies while agreeing to reverse transactions at specified future dates.

The segment's leadership reflects Philippine corporate sector demand for currency risk mitigation amid peso volatility. In October 2024, the Philippines announced plans to reintroduce interest rate swaps and boost bond repurchase agreement market to create alternative benchmarks for loan pricing, signaling regulatory support for derivatives market development. Major banks offer comprehensive derivatives suites, encompassing forward contracts, cross-currency swaps, and non-deliverable forwards to institutional clients. The growing sophistication of treasury operations among Philippine conglomerates, coupled with increasing FDI requiring currency hedging, sustains demand growth for these instruments throughout the forecast period.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon exhibits a clear dominance with a 70% share of the total Philippines foreign exchange market in 2025.

Luzon commands the overwhelming majority of Philippines foreign exchange transactions, anchored by Metro Manila's role as the nation's financial capital and primary commercial hub. The National Capital Region hosts headquarters of major universal banks, foreign bank branches, and the Philippine Dealing and Exchange Corporation that facilitates interbank currency trading. Makati City's central business district concentrates multinational corporations, business process outsourcing operations, and export-oriented enterprises generating substantial foreign exchange demand.

The region's dominance extends beyond institutional transactions to encompass retail foreign exchange activities serving overseas Filipino workers' families and small-medium enterprises engaged in import trade. Luzon accounts for the majority of registered remittance centers, authorized money changers, and digital payment access points enabling currency conversion services. The concentration of international airports, seaports, and economic zones in the region generates continuous foreign exchange flows supporting trade finance and tourism receipts.

Market Dynamics:

Growth Drivers:

Why is the Philippines Foreign Exchange Market Growing?

Sustained Overseas Filipino Worker Remittance Inflows

Overseas Filipino worker remittances constitute a fundamental driver of the Philippines foreign exchange market, providing consistent dollar inflows that support currency liquidity and household consumption. These remittance flows strengthen foreign exchange supply, helping stabilize the peso and support balance-of-payments resilience. Funds sent by overseas workers fuel domestic spending on housing, education, healthcare, and consumer goods, indirectly increasing foreign exchange turnover through imports and service payments. The steady nature of remittances reduces market volatility during periods of external uncertainty. Additionally, the growing use of digital remittance channels and banking platforms accelerates conversion activity within the formal financial system. This sustained inflow enhances confidence among financial institutions, supports reserve accumulation, and reinforces the structural depth of the Philippines foreign exchange market.

Expanding Digital Banking and Fintech Ecosystem

The rapid adoption of digital payments and fintech solutions is transforming accessibility and transaction efficiency in the Philippines foreign exchange market. As per IMARC Group, the Philippines digital payments market size reached USD 616.3 Million in 2025. Mobile wallets, digital banks, and fintech platforms are enabling faster currency conversion, real-time remittances, and seamless cross-border payments for consumers and businesses. Regulatory support for digital banking expansion has widened financial inclusion and increased competition, improving service quality and pricing transparency. Leading digital platforms integrate payments, savings, and investment services, strengthening user engagement within the formal financial system. Overall, fintech-driven innovations are enhancing liquidity, accelerating foreign exchange turnover, and modernizing currency transaction channels across the Philippines. These developments also reduce reliance on informal exchange channels, increasing market transparency and regulatory oversight.

Progressive Regulatory Reforms and Market Liberalization

The BSP’s progressive regulatory reforms are enhancing the development of the Philippines foreign exchange market through gradual liberalization and infrastructure modernization. The central bank has implemented multiple rounds of foreign exchange policy easing, simplifying documentation requirements and improving access to foreign currency for legitimate transactions. Regulatory updates have streamlined foreign investment-related foreign exchange transactions for banks and their subsidiaries, strengthening market efficiency. The BSP is also refining its market intervention framework, limiting intervention to periods of genuine market stress and allowing the peso to respond more effectively to economic fundamentals. Additionally, participation in regional payment connectivity initiatives is improving cross-border settlement efficiency and reducing transaction costs. Collectively, these reforms encourage broader market participation, improve transparency, and enhance liquidity while maintaining strong prudential safeguards against excessive speculation and systemic risk.

Market Restraints:

What Challenges the Philippines Foreign Exchange Market is Facing?

Currency Volatility and External Economic Pressures

The Philippine peso faces ongoing volatility due to external monetary tightening, global economic uncertainty, and domestic trade imbalances. Shifts in international interest rates, geopolitical developments, and commodity price fluctuations influence capital flows and exchange rate stability. These pressures increase hedging complexity for businesses and raise import costs, particularly for energy and raw materials. Persistent current account imbalances further expose the currency to depreciation risks, challenging policymakers and market participants to manage foreign exchange stability effectively.

Limited Derivatives Market Depth and Sophistication

The Philippines foreign exchange market remains relatively shallow, restricting effective risk management for corporates and investors. Most derivative transactions are conducted over the counter through banks, with limited availability of standardized, exchange-traded instruments. Underdeveloped market infrastructure and modest participation from market makers constrain liquidity and pricing efficiency. While regulatory efforts are underway to expand derivatives offerings, slow adoption and limited product diversity continue to hinder market sophistication.

Cybersecurity Risks and Digital Fraud Concerns

Rapid digitalization of foreign exchange services has increased exposure to cybersecurity threats and online fraud. Expanding use of digital wallets, online banking, and cross-border payment platforms creates vulnerabilities that can undermine consumer trust. Financial institutions face rising compliance burdens related to cybersecurity, anti-money laundering, and customer verification requirements. Smaller market participants are particularly affected by higher operational costs, making robust risk management and digital security investments essential for market stability.

Competitive Landscape:

The Philippines foreign exchange market features a concentrated competitive landscape, dominated by major universal banks with extensive domestic branch networks and international correspondent relationships. Leading institutions invest substantially in treasury infrastructure, digital platform capabilities, and regulatory compliance systems to maintain market positions. Competition intensifies around transaction pricing, execution speed, and value-added services, including hedging advisory and trade finance integration. Digital banks and fintech entrants are disrupting traditional channels by offering competitive exchange rates and lower fees for retail transactions. Market participants differentiate through technology investments enabling real-time currency conversion, mobile accessibility, and seamless integration with payment ecosystems. Strategic partnerships between domestic banks and international financial institutions expand product offerings while regulatory requirements ensure all participants maintain adequate capital, risk management frameworks, and consumer protection standards.

Recent Developments:

- In October 2025, the Bank of the Philippine Islands launched BPI Remit, offering free direct fund transfers from the United States for amounts above USD 250, targeting approximately 4.6 Million Filipinos residing in America. The service aimed to reduce remittance costs and enhance accessibility for overseas Filipino workers sending money home through digital channels. Families in the Philippines who received money via BPI Remit could quickly access the funds in their BPI accounts. They could additionally gain from favorable exchange rates.

Philippines Foreign Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Other Financial Institutions, Non-Financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | Luzon, Visayas, Mindanao. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines foreign exchange market size was valued at USD 18,354.80 Million in 2025.

The Philippines foreign exchange market is expected to grow at a compound annual growth rate of 6.33% from 2026-2034 to reach USD 31,880.09 Million by 2034.

Reporting dealers dominated the market with a share of 45%, driven by their central role in facilitating interbank transactions, providing institutional liquidity, and executing large-volume currency operations supporting international trade.

Key factors driving the Philippines foreign exchange market include sustained overseas Filipino worker remittance inflows, expanding digital banking adoption, progressive regulatory reforms, and the growing cross-border trade activities.

Major challenges include currency volatility amid global monetary policy divergence, limited derivatives market depth compared to regional peers, persistent current account deficits, escalating cybersecurity threats, and digital fraud concerns affecting consumer confidence in electronic channels.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)