Philippines Freight and Logistics Market Size, Share, Trends and Forecast by Logistics Function, End Use Industry, and Region, 2026-2034

Philippines Freight and Logistics Market Size and Share:

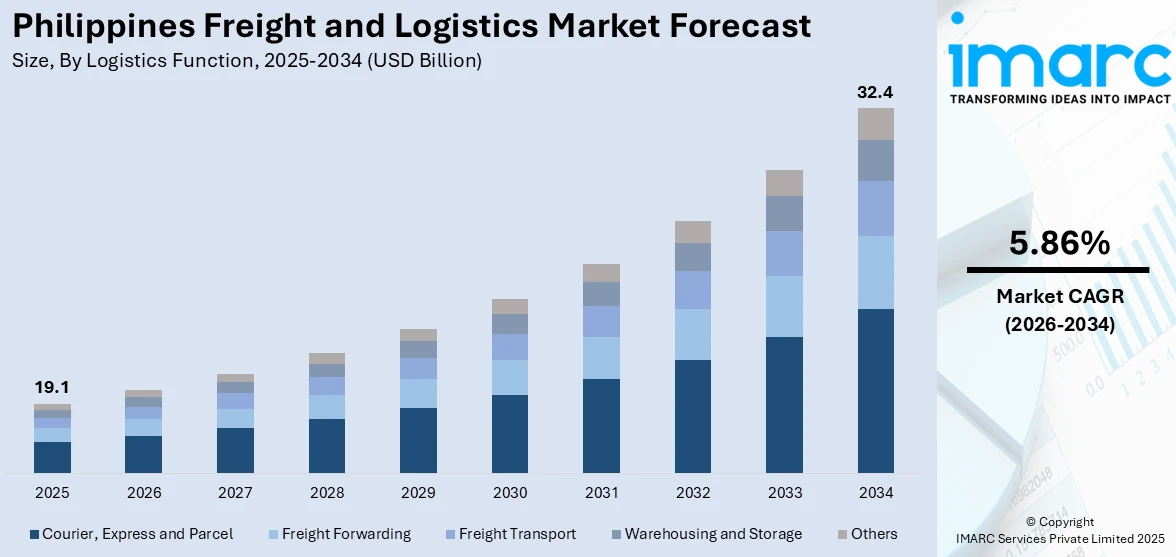

The Philippines freight and logistics market size reached USD 19.1 Billion in 2025. Looking forward, the market is expected to reach USD 32.4 Billion by 2034, exhibiting a growth rate (CAGR) of 5.86% during 2026-2034. The market is propelled by the growing e-commerce industry and online retail demand, infrastructure development and government initiatives, expansion of international trade and exports, and increasing demand for cold chain logistics in the food and pharmaceutical sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 19.1 Billion |

| Market Forecast in 2034 | USD 32.4 Billion |

| Market Growth Rate (2026-2034) | 5.86% |

Key Trends of Philippines Freight and Logistics Market:

Growing E-Commerce and Online Retail Sector

The rapid expansion of e-commerce in the Philippines is a major driver of the freight and logistics market. Growing smartphone penetration has fueled online shopping, increasing the need for efficient logistics solutions. E-commerce platforms require fast and reliable delivery networks, prompting logistics companies to enhance their operations with innovative strategies. Same-day and last-mile delivery services have become essential, driving investments in fleet management and distribution centers. Businesses are also streamlining operations by partnering with third-party logistics providers to expedite deliveries. Additionally, cross-border e-commerce is gaining momentum, with 50% of Filipino shoppers purchasing from international retailers, primarily in China, the United States, and South Korea. This trend is boosting demand for international freight services, further strengthening the country’s logistics sector.

To get more information on this market Request Sample

Infrastructure Development and Government Support

Continued infrastructure growth and government spending are propelling the Philippines freight and logistics market growth. The Build, Build, Build initiative has seen enormous investments in roads, seaports, airports, and bridges. This has significantly enhanced the transport network within the country. Increased connectivity between regions eases the flow of goods and shortens transit times. This significantly enhances logistics operations. Government initiatives encouraging trade and streamlining procedures at customs have also accelerated the growth of the industry. Public-private partnerships have also played an active role in upgrading infrastructure, making freight operations highly efficient and cost-effective. These advancements draw foreign investments and create a competitive logistics sector. This allows companies to address the increasing demand for smooth supply chain solutions. With continued government assistance, the logistics and freight industry is set for strong growth.

Increasing Demand for Cold Chain Logistics

Another key driver of the Philippines freight and logistics market demand is the growing demand for cold chain logistics. Increasing requirements for temperature-sensitive products are making advanced cold storage and transport facilities imperative. The expanding pharmaceutical industry also emphasizes the need for advanced cold chain infrastructure to ensure product integrity. Besides this, food exports also rely on cold chain systems to maintain quality during transit. According to the Philippine Statistics Authority, the total agricultural exports of the country recorded a growth of 21.8% from July to September 2024 as compared to the same period in the previous year. Consequently, third-party logistics firms are investing in the procurement of chilled trucks, freezers, as well as supervising technologies so that they can meet the orders from this field. Collaboration with food and pharma companies add even more scopes for cold chains services. As consumer preferences shift toward fresh and frozen products, the cold chain logistics segment is growing as an integral part of the Philippines freight and logistics industry, thus facilitating overall industry expansion.

Growth Drivers of Philippines Freight and Logistics Market:

Strategic Geographic Location

Located at the crossroads of Southeast Asia and the Pacific, the Philippines holds a geographically strategic position that enhances its appeal as a logistics and trade hub. Its proximity to economic powerhouses such as China, Japan, and ASEAN member states position it as a favorable transit and distribution point for regional and international shipments. This advantageous location supports both air and maritime cargo operations, helping to streamline import-export routes. As global trade volumes increase, the Philippines is poised to play a more significant role in international supply chains. This geographic strength continues to attract investments in logistics infrastructure and services, boosting the overall growth of the country’s freight and logistics sector.

Rising Industrialization and Export Activities

The Philippines is witnessing steady industrial growth, particularly in sectors such as electronics, textiles, processed food, and agricultural exports. As domestic manufacturing expands and more companies tap into global markets, freight volume is rising significantly. According to the Philippines freight and logistics market analysis, this trend is prompting a higher demand for comprehensive logistics support, including warehousing, customs handling, and multi-modal transport. Export-driven industries rely heavily on reliable and timely delivery networks to remain competitive, further encouraging logistics firms to scale operations. In addition, trade agreements and government incentives for export development are strengthening the logistics landscape. The shift towards higher production capacity and cross-border trade continues to fuel the need for efficient supply chain and freight solutions.

Digitalization and Technology Integration

The Philippine logistics sector is undergoing a transformation through increasing adoption of digital technologies. Tools such as GPS-based tracking, automated inventory systems, digital freight platforms, and AI-powered fleet management are being integrated to enhance operational efficiency. These advancements enable logistics providers to offer real-time tracking, optimize delivery routes, reduce costs, and improve customer service. Digital solutions also help overcome common industry challenges such as delays, inefficient route planning, and a lack of shipment visibility. By embracing automation and digital connectivity, logistics companies can streamline operations and offer more competitive, scalable services. This growing trend toward tech-enabled logistics is not only reshaping business models but also accelerating overall market growth in the country.

Opportunities of Philippines Freight and Logistics Market:

Inter-Island Connectivity Solutions

Given the Philippines' archipelagic geography of over 7,000 islands, enhancing inter-island freight connectivity presents a major opportunity for logistics development. The country can benefit significantly from improved coastal shipping, expanded air freight networks, and the creation of regional logistics hubs. These advancements would allow for faster, more reliable, and cost-effective movement of goods across provinces, helping to reduce delays and strengthen supply chain efficiency. Strengthening inter-island logistics not only improves domestic trade but also ensures that remote regions have better access to markets and essential goods. Investing in multi-modal transport systems can bridge logistical gaps, promote regional growth, and position the Philippines as a more connected and competitive player in Southeast Asia’s freight ecosystem.

Green and Sustainable Logistics

As sustainability becomes a global priority, the logistics sector in the Philippines is increasingly exploring eco-conscious solutions. There's a growing opportunity to implement electric delivery vehicles, adopt carbon-neutral shipping strategies, and use recyclable or biodegradable packaging materials. These environmentally friendly initiatives align with both global climate goals and local environmental policies. Moreover, sustainable logistics practices can enhance brand reputation, attract eco-conscious consumers, and meet the expectations of international partners who prioritize green supply chains. Companies that invest early in low-emission technologies and cleaner operations stand to gain a competitive edge, which is further fueling the Philippines freight and logistics market share. As environmental responsibility becomes a critical market differentiator, green logistics is emerging as a significant growth area for the industry.

Logistics Innovation and Startup Ecosystem

The logistics landscape in the Philippines is evolving rapidly, fueled by the rise of innovation-driven startups, incubators, and venture studios. These entities are introducing disruptive technologies like artificial intelligence for route optimization, blockchain for supply chain transparency, and digital platforms for freight matching and order tracking. Such innovations provide scalable and flexible solutions for both small and large logistics providers, enhancing service delivery and operational efficiency. The growing startup ecosystem is not only modernizing logistics but also attracting investment and fostering collaboration across the value chain. This surge in tech-enabled logistics solutions signals a shift toward smarter, faster, and more adaptive supply chains, offering vast potential for long-term market transformation.

Challenges of Philippines Freight and Logistics Market:

Fragmented Logistics Networks

The logistics sector in the Philippines is highly fragmented, with numerous small to mid-sized operators working independently rather than as part of an integrated system. This lack of coordination leads to redundant operations, poor resource utilization, and inconsistent service quality across different regions, especially for long-distance or nationwide deliveries. Such fragmentation makes it difficult to maintain efficiency, transparency, and service reliability in an increasingly complex supply chain environment. Addressing this challenge requires fostering stronger partnerships, standardizing processes, and implementing shared logistics infrastructure. Building a more collaborative and unified logistics ecosystem is essential for improving performance, reducing costs, and meeting the growing demands of businesses and consumers across the country.

Regulatory and Customs Bottlenecks

One of the key challenges in the Philippine logistics market lies in complex regulatory frameworks and inefficient customs procedures. Inconsistent enforcement of import-export laws, cumbersome documentation processes, and bureaucratic delays often disrupt cargo movement and raise operational costs. These issues particularly affect time-sensitive shipments and discourage international businesses from investing in local supply chain operations. The resulting delays and uncertainty hinder the overall competitiveness of the logistics industry. Streamlining customs protocols, improving transparency, and embracing digital solutions for document processing are critical to overcoming these bottlenecks. A more efficient regulatory environment would enhance trade facilitation, attract foreign investments, and ensure smoother cross-border logistics operations across the Philippines.

Talent Shortage and Skills Gap

The logistics industry in the Philippines faces a pressing shortage of skilled professionals, especially in areas such as supply chain management, fleet optimization, data analytics, and warehouse automation. As the sector becomes increasingly technology-driven, the demand for talent with digital proficiency and strategic planning capabilities continues to rise. However, current training systems and workforce development programs are not keeping pace with these evolving requirements. Without a robust pipeline of qualified personnel, logistics providers risk operational inefficiencies and reduced adaptability to innovation. Addressing this gap will require partnerships between industry players, educational institutions, and government agencies to upskill the workforce, enhance technical training, and promote careers in modern logistics and supply chain management.

Philippines Freight and Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on logistics function and end use industry.

Logistics Function Insights:

- Courier, Express and Parcel

- Destination Type

- Domestic

- International

- Destination Type

- Freight Forwarding

- Mode of Transport

- Air

- Sea and Inland Waterways

- Others

- Mode of Transport

- Freight Transport

- Mode of Transport

- Air

- Pipelines

- Rail

- Road

- Sea and Inland Waterways

- Mode of Transport

- Warehousing and Storage

- Temperature Control

- Non-Temperature Controlled

- Temperature Controlled

- Temperature Control

- Others

The report has provided a detailed breakup and analysis of the market based on the logistics function. This includes courier, express and parcel (destination type: domestic, international), freight forwarding (mode of transport: air, sea and inland waterways, others), freight transport (mode of transport: air, pipelines, rail, road, sea and inland waterways), warehousing and storage (temperature control: non-temperature controlled, temperature controlled), and others.

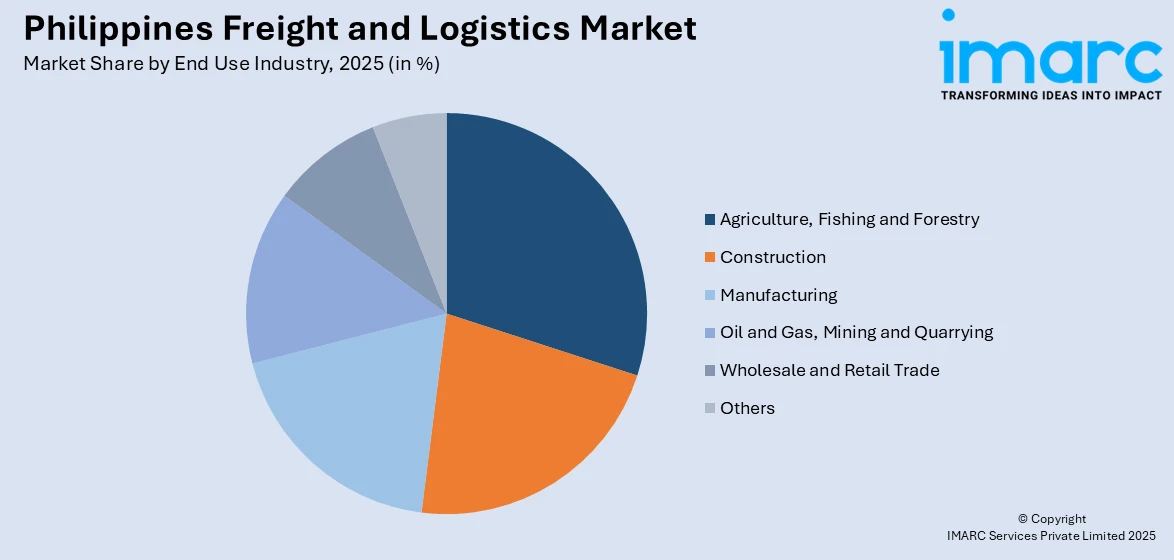

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Agriculture, Fishing and Forestry

- Construction

- Manufacturing

- Oil and Gas, Mining and Quarrying

- Wholesale and Retail Trade

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes agriculture, fishing and forestry, construction, manufacturing, oil and gas, mining and quarrying, wholesale and retail trade, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Freight and Logistics Market News:

- June 2025, Philippine Airlines (PAL) revealed the rebranding of its freight and logistics division as PAL Cargo, highlighting the national carrier’s ongoing push for digital innovation. PAL Cargo now provides a comprehensive suite of cargo services designed to meet the diverse requirements of individuals, freight forwarders, corporations, and large enterprises.

- April 2025, FAST Logistics, in collaboration with Evodine Company Builder, introduced the Philippines’ first startup incubator focused exclusively on driving innovation in the logistics sector. The Revv-Evodine Venture Studio aims to deliver breakthrough solutions to overcome interoperability issues within the nation's logistics and supply chain ecosystem.

- November 2024: Through Maersk Contract Logistics in the Philippines, A. P. Moller-Maersk (Maersk) has opened its largest distribution center to date, a 10-hectare facility in Calamba, Laguna. The building is known as the Maersk Optimus Distribution Center and will enhance the support for its customer inventory network in a vital transportation corridor.

- June 2024: International logistics company C.H. Robinson is expanding its footprint in Asia Pacific with the inauguration of its office in the Philippines. The opening of this facility aligns with C.H. Robinson's mission to deliver unmatched, customized services in crucial markets across the globe and strengthens support for the nation's expanding logistics and transportation industries.

- April 2024: The Philippine Postal Corporation (PHLPost) has strengthened its logistics operations by acquiring a new transportation fleet consisting of 22 brand-new trucks. The fleet, consisting of eighteen 6-wheeler and 10 4-wheeler trucks, is the result of continuous re-fleeting of the Philippines' mail transportation system, and it will soon speed up the delivery of numerous packages and mails across the country.

- December 2023: A.P. Moller-Maersk (Maersk) has promised an investment of more than USD 500 Million to its logistics infrastructure for sustaining the growth of Southeast Asia as a center of consumption and manufacturing. Maersk's three-year investment plan will largely be concentrated on its Logistics & Services division.

- April 2023, Ninja Van Philippines introduced ‘Logistics+’, a comprehensive supply chain management solution tailored for micro, small, and medium enterprises (MSMEs) across Southeast Asia, to bolster the country’s logistics development and boost local MSME growth.

Philippines Freight and Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Logistics Functions Covered | Courier, Express and Parcel (Destination Type: Domestic, International) Freight Forwarding (Mode of Transport: Air, Sea and Inland Waterways, Others) Freight Transport (Mode of Transport: Air, Pipelines, Rail, Road, Sea and Inland Waterways) Warehousing and Storage (Temperature Control: Non-Temperature Controlled, Temperature Controlled) Others |

| End Use Industries Covered | Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines freight and logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines freight and logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines freight and logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The freight and logistics market in the Philippines was valued at USD 19.1 Billion in 2025.

The Philippines freight and logistics market is projected to exhibit a CAGR of 5.86% during 2026-2034.

The Philippines freight and logistics market is projected to reach a value of USD 32.4 Billion by 2034.

The key trend of the Philippines freight and logistics market is increased digitalization, adoption of automation and real-time tracking, expansion of third-party logistics services, and growing focus on sustainable and tech-driven supply chain solutions across domestic and international trade routes.

Rising industrial output, expanding regional trade partnerships, increased demand for efficient last-mile delivery, and the emergence of logistics tech startups are key factors propelling the growth of the Philippines freight and logistics market, alongside strong consumer demand and evolving distribution networks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)