Philippines Furniture Market Size, Share, Trends and Forecast by Material, Distribution Channel, End Use, and Region, 2026-2034

Philippines Furniture Market Overview:

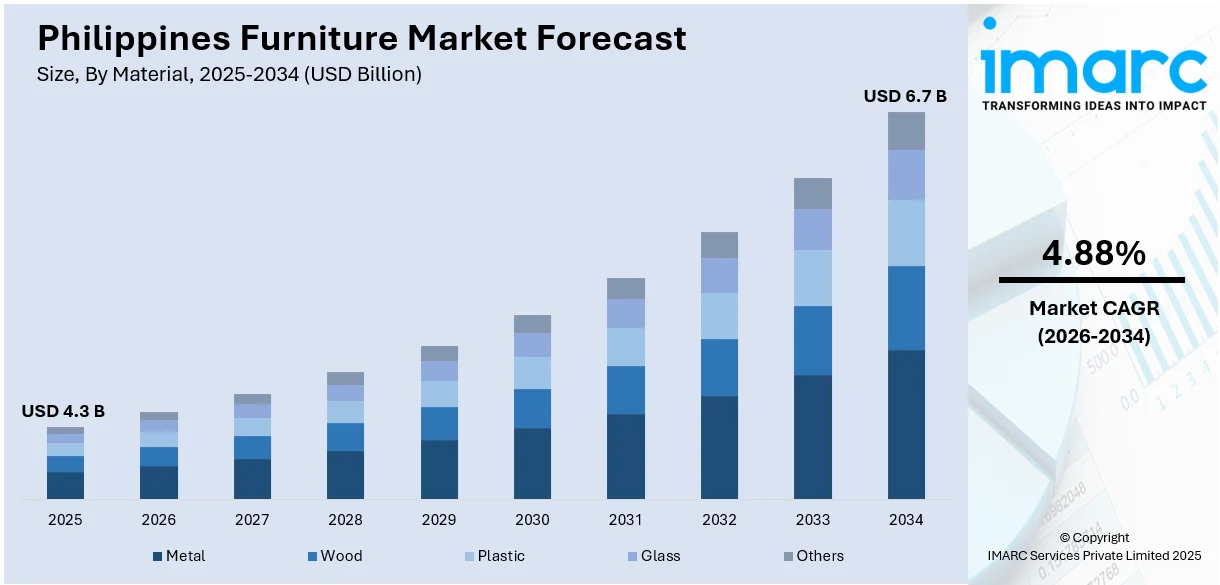

The Philippines furniture market size reached USD 4.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 6.7 Billion by 2034, exhibiting a growth rate (CAGR) of 4.88% during 2026-2034. Urbanization, growing disposable incomes, and a growing middle class are the main factors driving the market. The market is expanding due to rising demand for locally made, environmentally friendly furniture as well as growing interest in interior design and home décor. Additionally, furniture dealers now have a wider audience because of the growing trend of e-commerce.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.3 Billion |

| Market Forecast in 2034 | USD 6.7 Billion |

| Market Growth Rate (2026-2034) | 4.88% |

Key Trends of Philippines Furniture Market:

Surge in Online Furniture Sales

The shift towards e-commerce in the Philippines has revolutionized the furniture market. Increasing internet penetration, combined with a growing preference for convenience, has led to the expansion of online furniture retailers. For instance, industry reports state that as of early 2024, the Philippines had 86.98 Million internet users, representing an internet penetration rate of 73.6%. Additionally, there were 117.4 Million active cellular mobile connections, equivalent to 99.3% of the country's total population. Consequently, consumers are now able to browse a wide variety of products, compare prices, and make informed purchasing decisions from the comfort of their homes. Additionally, home delivery services are provided by online platforms, making purchases even more convenient. Additionally, to help customers feel more confident about their selections, online shops use digital techniques like augmented reality (AR) to offer virtual furniture try-ons. Online furniture sales are therefore anticipated to keep growing in popularity throughout the ensuing years.

To get more information on this market Request Sample

Shift Toward Sustainable and Locally Made Furniture

In the Philippines, there is a noticeable trend toward eco-friendly, sustainable furniture solutions. Customers are become more aware of how their purchases affect the environment as a result of growing environmental consciousness. Because of this, there is a growing desire for locally produced furniture made of ecological and renewable resources like bamboo, repurposed wood, and organic textiles. Local producers are cutting waste, lowering their carbon footprints, and implementing eco-friendly production techniques. Furthermore, this tendency has been reinforced by government laws and incentives that encourage the use of locally sourced materials and ecologically friendly manufacturing techniques. For instance, in March 2024, the Forest Products Research and Development Institute (FPRDI) of the Department of Science and Technology (DOST) addressed health and safety concerns regarding locally-made furniture, especially in government facilities like airports. The initiative focused on extending the service life of non-timber forest products (NTFPs), such as rattan, which are susceptible to biodeterioration from bed bugs, fungi, and termites. FPRDI is implementing both chemical and eco-friendly methods, including wood preservatives and thermal modification, to protect furniture and woodwork, ensuring durable, bug-free Filipino craftsmanship.

Growing Interest in Locally Sourced Materials

The Philippines furniture industry has a significant trend towards the utilization of materials such as rattan, bamboo, and acacia wood. These materials are valued for their availability, long lifespan, sustainability, and beauty. They harmoniously fit traditional skills with contemporary tastes in design, and they attract both local and foreign consumers. Local craftsmen are constantly refining their weaving and carving capabilities, giving the furniture a distinguishing character. Consumers are drawn more and more towards products that hold cultural value and have a smaller ecological impact. Such a preference serves to boost local economies and is also in line with the international movement toward sustainable living. The growing emphasis on indigenous materials is a significant factor driving the Philippines furniture market demand.

Growth Drivers of Philippines Furniture Market:

Rapid Urbanization and Housing Growth

With a growing population in urban areas of the Philippines, the need for housing is on the rise. This surge in residential projects, particularly in the form of condominiums and mid-rise buildings, is fueling the demand for furniture. New homeowners are choosing pieces that are both functional and aesthetically pleasing, tailored to fit smaller urban spaces. Additionally, builders and developers are looking to furnish model units and lobbies, which further increases overall demand. The rise in homeownership among young professionals has also heightened interest in modern, minimalist, and space-efficient designs. This shift plays a significant role in the Philippines furniture market share, as furniture becomes essential for urban living and lifestyle improvements.

Rising Middle-Class Income

With the growing middle class in the Philippines, their capacity to invest in interior design and furnishings also follows. With improving financial health, more families are breaking past the realm of basic needs to buy furnishings that speak to their own sensibilities and comfort levels. This has resulted in increased demand for higher quality materials, expert craftsmanship, and bespoke designs. Made-to-order furniture is gaining momentum with consumers looking for furniture that reflects their lifestyle, living area, and style. Consumers are increasingly ready to spend money on solid, high-quality products rather than compromising on mass-market products. This change is redefining the market, pushing manufacturers towards offering more variety, design freedom, and high-end products in line with the shifting expectations linked to growing income levels.

Tourism and Hospitality Expansion

The ongoing increase in tourism in the Philippines has resulted in a consistent growth in the number of hotels, resorts, and dining venues. These establishments necessitate substantial quantities of furniture that can endure heavy use while still being visually appealing. With a focus on guest comfort and interior design, there is a significant demand for pieces that are both attractive and resilient. Many hospitality projects also opt for tailored furniture to embody specific themes or brand identities. This trend fosters large-scale manufacturing and specialized craftsmanship within the domestic industry. According to the Philippines furniture market analysis, the expansion of the hospitality sector significantly influences order volumes, design innovation, and investment in top-quality furnishing solutions.

Philippines Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on material, distribution channel, and end use.

Material Insights:

- Metal

- Wood

- Plastic

- Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes metal, wood, plastic, glass, and others.

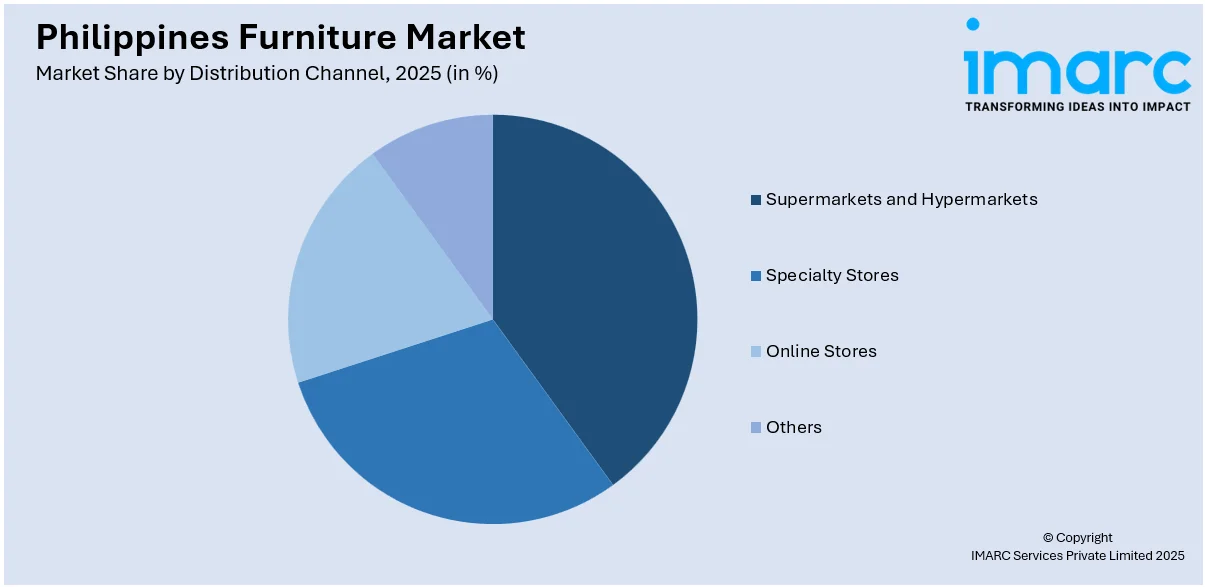

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

End Use Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential and commercial.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Furniture Market News:

- In August 2024, LKL International Bhd partnered with the Philippines-based Karl Group to explore hospital furniture manufacturing opportunities in the country. The agreement involves LKL providing technical expertise, technology, and training for hospital furniture production, while also assisting in securing potential investors and financial support. The memorandum of understanding (MoU) aims to expand LKL's business presence in the Philippines, aligning with the growing demand for quality healthcare solutions and furniture.

- In March 2024, Japanese furniture retailer Nitori Holdings announced that it is expanding into the Philippines with plans to open its first store in Manila. The 1,100-square-meter shop will be located in the Mitsukoshi BGC shopping center. Nitori aims to open 50 stores across the country by 2032 as part of its broader strategy to strengthen its presence in Asia.

Philippines Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Metal, Wood, Plastic, Glass, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| End Uses Covered | Residential, Commercial |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines furniture market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines furniture market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The furniture market in the Philippines was valued at USD 4.3 Billion in 2025.

The Philippines furniture market is projected to exhibit a compound annual growth rate (CAGR) of 4.88% during 2026-2034.

The Philippines furniture market is expected to reach a value of USD 6.7 Billion by 2034.

Rising disposable incomes, housing development, and increased spending on home improvement are key growth drivers. The expansion of the tourism sector, government support for local manufacturing, and export opportunities also contribute. Growing awareness about interior aesthetics and the shift to remote work are further fueling demand for high-quality, purpose-driven furniture.

Consumers are showing stronger interest in minimalist designs, tech-integrated furniture, and customization options. Demand is growing for ergonomic products and sustainable materials. Online furniture shopping is expanding, and urban living is influencing compact, multi-functional furniture choices tailored to smaller spaces and modern interiors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)