Philippines Government Cloud Market Size, Share, Trends and Forecast by Component, Deployment Model, Service Model, Application and Region, 2025-2033

Philippines Government Cloud Market Overview:

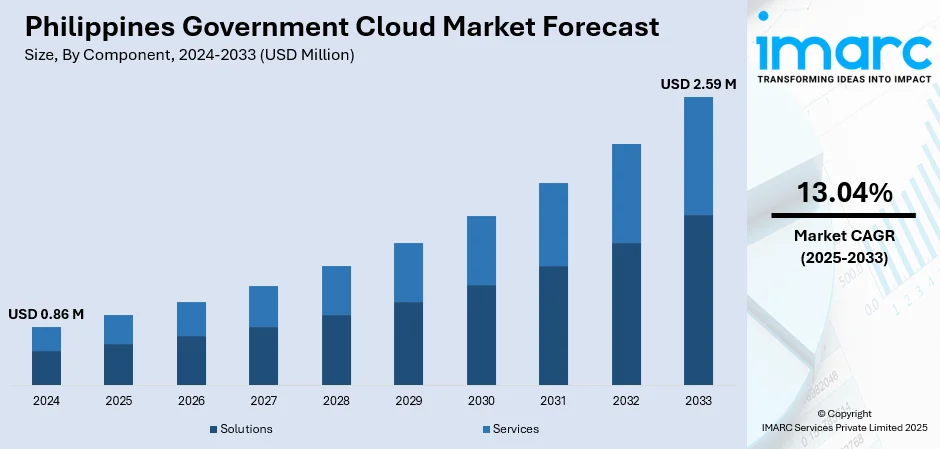

The Philippines government cloud market size reached USD 0.86 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2.59 Million by 2033, exhibiting a growth rate (CAGR) of 13.04% during 2025-2033. Digital government initiatives, data sovereignty, and cloud modernization drive the market. Mandates for e‑Gov, centralized platforms, and cybersecurity investments support the trend. Partnerships with global and local providers improve capability, advancing Philippines government cloud market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.86 Million |

| Market Forecast in 2033 | USD 2.59 Million |

| Market Growth Rate 2025-2033 | 13.04% |

Philippines Government Cloud Market Trends:

E‑government Mandates and Consolidation

In October 2024, the Philippines advanced 16 places in the UN’s E-Government Development Index by adopting a cloud-first strategy and “once-only” principle, led by the Department of Information and Communications Technology (DICT). This shift centralizes digital infrastructure, eliminates redundant systems, and streamlines services via platforms like the eGov PH Super App. Emphasizing data sovereignty, the government invests in secure local datacenters to safeguard citizen data. These efforts lay a strong digital foundation, improving efficiency, integration, and service delivery across national and local agencies. The Philippines government cloud market growth is accelerating due to executive orders advocating inter-agency cloud migration and shared services platforms. Departments consolidating data centers under secure cloud regimes reduce duplication and increase efficiency. Shared applications for e‑procurement, digital identity, and disaster‑response coordination promote standardization. Central cloud tenants hosted in government clouds enhance compliance with data localization laws. These structural reforms rationalize ICT, reduce costs, and elevate service delivery—driving Philippines government cloud market growth.

To get more information on this market, Request Sample

Cybersecurity and Sovereign Infrastructure

Heightened cyber threats and data privacy concerns propel Philippines government cloud market growth. Defense and health agencies adopt isolated, accredited cloud enclaves with encryption-at-rest and in-transit protections. The Department of Information and Communications Technology implements public‑private pilot programs for sovereign cloud and secure edge nodes. Multi‑factor authentication, zero‑trust frameworks, and local identity management systems improve trust. Cloud infrastructure providers integrate with Open‑Gov platforms using Filipino language interfaces. Frequent audits and continuous monitoring reassure sensitive program stakeholders. These protective technologies underpin trust and resilience, accelerating Philippines government cloud market growth. Building on this momentum, ePLDT, the ICT arm of PLDT, recently launched the country’s first sovereign cloud platform, ePLDT Pilipinas Cloud (ePPC), to host sensitive government data and applications in a secure, locally managed environment. Aligned with national cybersecurity priorities, ePPC ensures compliance with Philippine data protection laws, enhances operational efficiency, and reduces dependency on foreign infrastructure. By enabling secure, scalable, and regulation-aligned digital services, ePPC is set to transform public sector operations and elevate citizen service delivery across the Philippines.

Philippines Government Cloud Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, deployment model, service model, and application.

Component Insights:

- Solutions

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions and services.

Deployment Model Insights:

- Hybrid Cloud

- Private Cloud

- Public Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes hybrid cloud, private cloud, and public cloud.

Service Model Insights:

- Infrastructure as a Service

- Platform as a Service

- Software as a Service

The report has provided a detailed breakup and analysis of the market based on the service model. This includes infrastructure as a service, platform as a service, and software as a service.

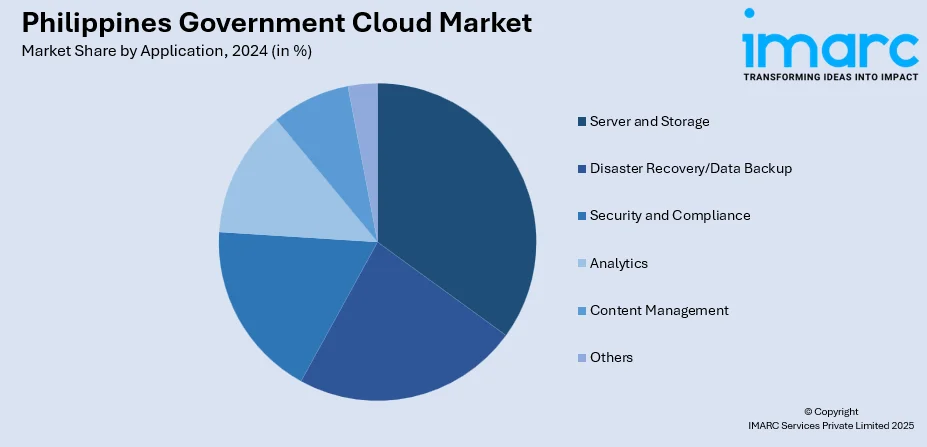

Application Insights:

- Server and Storage

- Disaster Recovery/Data Backup

- Security and Compliance

- Analytics

- Content Management

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes server and storage, disaster recovery/data backup, security and compliance, analytics, content management, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Government Cloud Market News:

- In August 2025, Tata Consultancy Services (TCS) partnered with NOW Corporation’s telecom arm, Now Telecom, to develop the Philippines’ Sovereign Data Cloud and boost financial inclusivity. The collaboration focuses on building secure, scalable digital infrastructure aligned with national goals for data sovereignty, cyber defense, and reduced foreign dependency. The partnership will enhance cloud technology, develop AI capabilities, and enable citizen-centric services like healthcare and digital banking. Backed by the Department of Information and Communications Technology, it supports the country’s push toward a future-ready digital economy.

Philippines Government Cloud Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solutions, Services |

| Deployment Models Covered | Hybrid Cloud, Private Cloud, Public Cloud |

| Service Models Covered | Infrastructure as a Service, Platform as a Service, Software as a Service |

| Applications Covered | Server and Storage, Disaster Recovery/Data Backup, Security and Compliance, Analytics, Content Management, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines government cloud market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines government cloud market on the basis of component?

- What is the breakup of the Philippines government cloud market on the basis of deployment model?

- What is the breakup of the Philippines government cloud market on the basis of service model?

- What is the breakup of the Philippines government cloud market on the basis of application?

- What is the breakup of the Philippines government cloud market on the basis of region?

- What are the various stages in the value chain of the Philippines government cloud market?

- What are the key driving factors and challenges in the Philippines government cloud market?

- What is the structure of the Philippines government cloud market and who are the key players?

- What is the degree of competition in the Philippines government cloud market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines government cloud market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines government cloud market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines government cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)