Philippines Gypsum Board Market Size, Share, Trends and Forecast by Product Type, End Use, and Region, 2026-2034

Philippines Gypsum Board Market Summary:

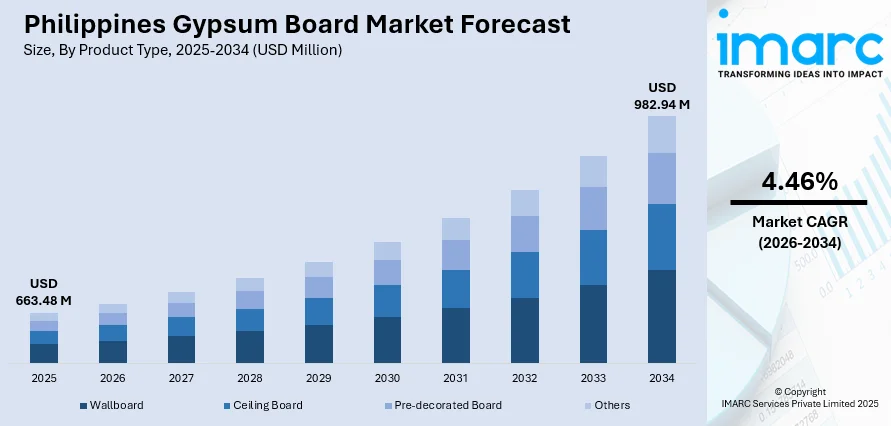

The Philippines gypsum board market size was valued at USD 663.48 Million in 2025 and is projected to reach USD 982.94 Million by 2034, growing at a compound annual growth rate of 4.46% from 2026-2034.

The Philippines gypsum board market is experiencing robust growth, driven by the nation's accelerating construction activities and government-backed housing initiatives. Rapid urbanization, particularly in metropolitan regions, is fueling the demand for lightweight and fire-resistant interior construction materials. The rising focus on sustainable building practices and green certifications is promoting the adoption of gypsum-based solutions across residential and commercial developments.

Key Takeaways and Insights:

-

By Product Type: Wallboard dominates the market with a share of 51.76% in 2025, owing to its widespread application in interior wall and ceiling construction, fire-resistant properties, cost-effectiveness, and ease of installation that accelerates project completion timelines across residential and commercial developments.

-

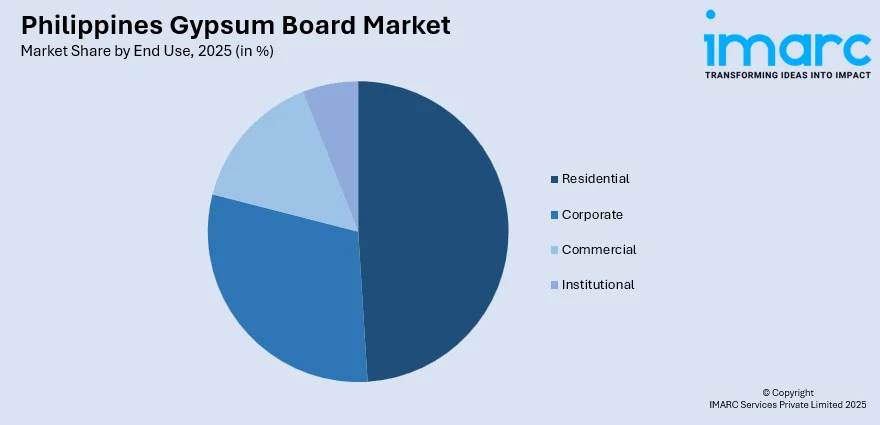

By End Use: Residential leads the market with a share of 48.92% in 2025. This dominance is driven by the government's flagship housing programs targeting affordable shelter provision, rising urbanization rates, and increasing middle-class preference for modern interior finishing materials.

-

By Region: Luzon represents the largest region with a market share of 55.04% in 2025, reflecting the concentration of construction activities in Metro Manila and surrounding provinces, major infrastructure developments, and the highest population density requiring extensive housing and commercial spaces.

-

Key Players: Key players drive the Philippines gypsum board market by expanding production capacities, enhancing product quality through technological innovations, and strengthening distribution networks. Their investments in sustainable manufacturing practices, training programs for installation professionals, and strategic partnerships with construction companies boost awareness and ensure consistent product availability.

To get more information on this market Request Sample

The Philippines gypsum board market is propelled by a confluence of favorable factors anchored in the nation's dynamic construction landscape. As per IMARC Group, the Philippines construction market size reached USD 41.3 Billion in 2025. Government infrastructure initiatives are generating unprecedented demand for interior finishing materials. The residential construction sector benefits from ambitious affordable housing programs designed to address the housing backlog affecting millions of Filipino families. Commercial construction is experiencing revitalization, as multinational corporations establish regional headquarters and expand office footprints in major business districts. Rising awareness about fire safety regulations mandating use of fire-resistant construction materials further strengthens gypsum board adoption. The shift towards dry construction methods offering faster installation, reduced labor requirements, and superior acoustic insulation properties positions gypsum boards as preferred materials across diverse building applications throughout the Philippines.

Philippines Gypsum Board Market Trends:

Growing Adoption of Green Building Certifications

The Philippines construction industry is witnessing an accelerating trend of green building certifications, with developers increasingly pursuing Leadership in Energy and Environmental Design (LEED) and Building for Ecologically Responsive Design Excellence (BERDE) credentials for commercial and residential projects. This sustainability movement is driving the demand for eco-friendly construction materials, including gypsum boards that contribute to energy efficiency, indoor air quality, and reduced environmental impact. Major office developments and institutional buildings are incorporating certified sustainable materials to meet corporate environmental commitments and attract environmentally conscious tenants.

Expansion of Vertical Housing Developments

Urbanization pressures and limited land availability in metropolitan areas are propelling the construction of high-rise residential buildings and condominium complexes. As per macrotrends, in the Philippines, the urban population reached 55,477,513 in 2023. This vertical housing trend favors lightweight construction materials that reduce structural loading while providing excellent fire resistance and acoustic insulation. Gypsum boards are becoming preferred choices for interior partitions and ceiling applications in multi-story developments, enabling developers to maximize usable floor space while meeting stringent building safety requirements.

Integration of Smart Building Technologies

Modern commercial and institutional construction projects are increasingly incorporating smart building technologies that enhance energy efficiency and occupant comfort. This trend creates demand for interior construction materials compatible with integrated building management systems, including gypsum board solutions that accommodate electrical conduits, communication cables, and sensor installations. Developers are specifying materials that facilitate technology integration while maintaining aesthetic appeal and meeting fire safety standards.

Market Outlook 2026-2034:

The Philippines gypsum board market outlook remains strongly positive through the forecast period, underpinned by sustained government infrastructure spending and robust private sector construction investments. The market generated a revenue of USD 663.48 Million in 2025 and is projected to reach a revenue of USD 982.94 Million by 2034, growing at a compound annual growth rate of 4.46% from 2026-2034. Continued expansion of residential housing programs, modernization of commercial spaces, and development of institutional facilities will sustain demand growth. The emphasis on fire safety compliance and sustainable construction practices positions gypsum boards as essential materials in the evolving Philippine construction landscape.

Philippines Gypsum Board Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Wallboard | 51.76% |

| End Use | Residential | 48.92% |

| Region | Luzon | 55.04% |

Product Type Insights:

- Wallboard

- Ceiling Board

- Pre-decorated Board

- Others

Wallboard dominates with a market share of 51.76% of the total Philippines gypsum board market in 2025.

Wallboard leads the Philippines gypsum board market due to its wide usage in real estate projects, driven by rapid urbanization and housing demand. As per IMARC Group, the Philippines real estate market size reached USD 94.4 Billion in 2025. Wallboard is preferred for interior walls and ceilings because of its cost effectiveness, lightweight nature, and simpler installation relative to conventional materials. Growing condominium projects, office spaces, and retail developments favor wallboard for faster project completion, reduced structural load, and improved space utilization, supporting its dominant market position nationwide.

Additionally, wallboard offers design flexibility and compatibility with modern construction practices, including modular and dry construction methods. It supports smooth finishes, quick repairs, and easy integration of electrical and heating, ventilation, and air conditioning (HVAC) systems, making it attractive to contractors and developers. Increasing awareness about fire-resistant, moisture-resistant, and sound-insulating wallboard variants further strengthens demand. These functional advantages, combined with efficient supply chains and widespread availability, continue to reinforce wallboard’s leadership in the Philippines gypsum board market.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Corporate

- Commercial

- Institutional

Residential leads with a share of 48.92% of the total Philippines gypsum board market in 2025.

The residential segment maintains leadership in the Philippines gypsum board market as housing construction accelerates to address the country's substantial shelter needs. The government's 4PH Program aims to build one million housing units annually by 2028, creating sustained demand for interior finishing materials, including gypsum boards. Condominium developments in Metro Manila and surrounding urban centers increasingly specify gypsum-based wall and ceiling systems to achieve faster unit completion and enable flexible interior layouts that appeal to modern homebuyers.

Beyond large-scale housing programs and urban condominiums, residential dominance is supported by widespread renovation and home improvement activities across the Philippines. Homeowners increasingly adopt gypsum boards for ceiling upgrades, room partitions, and aesthetic enhancements due to their affordability and ease of installation. The material’s compatibility with modern lighting designs, air-conditioning systems, and acoustic treatments makes it suitable for compact living spaces. Additionally, growing awareness about fire safety and moisture control in homes is driving the demand for specialized gypsum board variants, further strengthening residential consumption across both new and existing housing stock.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon exhibits a clear dominance with a 55.04% share of the total Philippines gypsum board market in 2025.

Luzon commands the largest share of gypsum board consumption, driven by Metro Manila's concentrated construction activities and surrounding regions' industrial development. The Luzon Economic Corridor initiative, launched in April 2024 through trilateral partnership between the Philippines, United States, and Japan, aims to enhance connectivity between Subic Bay, Clark, Manila, and Batangas. This infrastructure program accelerates construction across residential, commercial, and industrial sectors, generating substantial demand for building materials throughout the region.

Luzon’s market leadership is reinforced by its dense population base and higher purchasing power compared to other regions. The presence of leading real estate developers, contractors, and gypsum board distributors ensures efficient supply chains and consistent material availability. Luzon also hosts a large share of high-rise developments, business parks, hospitals, and educational institutions that favor gypsum boards for interior construction. Additionally, faster adoption of modern building practices and stringent quality standards in Luzon continue to drive higher gypsum board usage across diverse construction applications.

Market Dynamics:

Growth Drivers:

Why is the Philippines Gypsum Board Market Growing?

Expansion of Commercial and Institutional Construction Activities

Growth in commercial and institutional construction is significantly driving the Philippines gypsum board market. Rising investments in offices, retail centers, hotels, healthcare facilities, and educational institutions are increasing demand for efficient interior construction solutions. As of March 2024, IHG managed five hotels in the Philippines, with four belonging to the Holiday Inn brand family, and planned to introduce new brands, such as InterContinental Hotels & Resorts and Six Senses. Gypsum boards are widely used in commercial projects due to their quick installation, design flexibility, and ability to accommodate electrical, HVAC, and data cabling systems. Hospitality and retail developments favor gypsum board ceilings and partitions to achieve clean finishes and modern interiors. In hospitals and schools, specialized gypsum boards with fire-resistant and sound-insulating properties support safety and comfort requirements. Commercial developers also value gypsum boards for ease of maintenance and future space reconfiguration. As service-sector expansion continues and institutional infrastructure modernizes, the demand for gypsum board solutions in non-residential buildings continues to rise.

Adoption of Modern Construction Techniques and Drywall Systems

The increasing adoption of modern construction techniques is a key driver of the market expansion in the Philippines. Builders are shifting from traditional wet construction methods to drywall and prefabricated systems to improve efficiency and reduce project timelines. Gypsum board-based drywall systems require less curing time, generate minimal site waste, and support cleaner construction environments. These advantages are particularly important in dense urban areas where speed and space efficiency are critical. Drywall systems also allow easier modifications during and after construction, supporting flexible building design. As contractors and developers become more familiar with drywall technologies, acceptance of gypsum boards continues to increase. Training programs and improved installer skills are further supporting wider adoption. This transition towards modern construction practices is accelerating gypsum board penetration across residential, commercial, and mixed-use projects nationwide.

Strong Distribution Networks and Availability of Product Variants

Well-established retail distribution networks and a wide range of gypsum board products are supporting growth of the Philippines gypsum board market. As per IMARC Group, the Philippines retail market size reached USD 69.42 Billion in 2024. Manufacturers and suppliers have expanded dealer networks to ensure consistent product availability across major cities and provincial areas. Availability of standard, moisture-resistant, fire-rated, and impact-resistant boards allows developers to select solutions tailored to specific applications. Competitive pricing and local warehousing reduce procurement lead times and logistics costs. Technical support, installer training, and after-sales services further encourage adoption among contractors. As product accessibility improves and awareness about different gypsum board applications increases, demand continues to rise across construction segments. This strong supply-side support reinforces sustained growth of the gypsum board market in the Philippines.

Market Restraints:

What Challenges is the Philippines Gypsum Board Market Facing?

Competition from Imported Products

The Philippines gypsum board market faces competitive pressure from imported products, particularly from regional manufacturers with established production capacities. Price competition from imports affects domestic manufacturing margins and market share. Trade policy measures are required to ensure fair competition while maintaining adequate supply for the construction industry's requirements.

Raw Material Sourcing Challenges

The absence of commercial natural gypsum mining operations in the Philippines necessitates reliance on imported raw materials for domestic gypsum board production. Import dependencies expose manufacturers to international price fluctuations, shipping cost variations, and supply chain disruptions. Securing consistent raw material supply at competitive prices presents ongoing operational challenges for domestic manufacturers.

Limited Awareness in Rural Construction Markets

Traditional construction practices utilizing concrete blocks and masonry remain prevalent in rural and provincial areas, limiting gypsum board penetration outside metropolitan centers. Skilled installation labor availability and awareness about gypsum board advantages remain limited in developing construction markets. Education and training initiatives are required to expand adoption beyond established urban markets.

Competitive Landscape:

The Philippines gypsum board market features a combination of domestic manufacturing and import distribution channels serving diverse construction industry requirements. Market participants compete on product quality, pricing, distribution reach, and technical support services. Domestic manufacturing capabilities provide advantages in supply reliability and responsiveness to local market requirements. International manufacturers leverage established brand recognition and product innovation capabilities. Competition extends beyond product sales to encompass technical training, installation support, and project specification services that influence material selection decisions. Trade policy developments affect competitive dynamics between domestic and imported products. Market participants invest in distribution network expansion to reach provincial markets and training programs to develop skilled installation workforces, supporting the market growth.

Philippines Gypsum Board Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Wallboard, Ceiling Board, Pre-decorated Board, Others |

| End Uses Covered | Residential, Corporate, Commercial, Institutional |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines gypsum board market size was valued at USD 663.48 Million in 2025.

The Philippines gypsum board market is expected to grow at a compound annual growth rate of 4.46% from 2026-2034 to reach USD 982.94 Million by 2034.

Wallboard dominated the market with a share of 51.76%, driven by its widespread application in interior wall and ceiling construction, fire-resistant properties, and ease of installation across residential and commercial developments.

Key factors driving the Philippines gypsum board market include government infrastructure and housing programs, expanding commercial construction, stringent fire safety regulations, growing adoption of green building certifications, and shift towards modern dry construction methods.

Major challenges include competition from imported products, raw material sourcing dependencies, limited awareness in rural construction markets, traditional construction practice preferences, and skilled installation labor availability outside metropolitan areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)