Philippines Halal Food Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

Philippines Halal Food Market Overview:

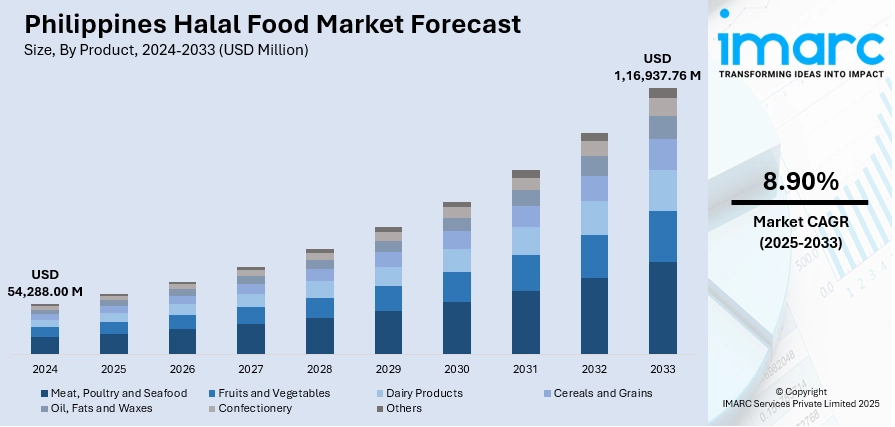

The Philippines halal food market size reached USD 54,288.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,16,937.76 Million by 2033, exhibiting a growth rate (CAGR) of 8.90% during 2025-2033. At present, consistent growth in its Muslim population, especially in Mindanao and other southern provinces, is constantly driving the demand for food that is halal certified. Besides this, Philippine government is taking a pivotal role in rolling out policies, regulatory systems, and certification schemes that are harmonizing halal practices. Furthermore, rising demand for high-quality food products is expanding the Philippines halal food market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 54,288.00 Million |

| Market Forecast in 2033 | USD 1,16,937.76 Million |

| Market Growth Rate 2025-2033 | 8.90% |

Philippines Halal Food Market Trends:

Growing Muslim Population and Increased Domestic Demand

The Philippines has seen consistent growth in its Muslim population, especially in Mindanao and other southern provinces, and this changing demography is constantly driving the demand for food that is halal-certified. At this year’s Halal in Travel Global Summit, the Philippines was acknowledged as an emerging Muslim-friendly destination, with a country official and a Filipino hotel chain receiving awards for their efforts in advancing halal tourism. Being one of the largest religions in the country, Muslim consumers are increasingly looking for foodstuffs that are in accordance with their religious and cultural traditions. Local food producers, retailers, and restaurants are answering this demand by increasing their halal-certified products in categories ranging from meat and beverages to packaged foods and ready-to-eat meals. Meanwhile, increased exposure to halal certification is gaining ground among younger generations, who pay more attention to religious compliance in everyday consumption. This population-driven demand not only reinforces local consumption but is also stimulating investment in halal infrastructure, certification bodies, and distribution channels.

To get more information on this market, Request Sample

Government Initiatives and Regulatory Support

The Philippine government is taking a pivotal role in the development of the halal food market by rolling out policies, regulatory systems, and certification schemes that harmonize halal practices. Through institutions like the Department of Trade and Industry (DTI) and the National Commission on Muslim Filipinos (NCMF), the government is actively promoting halal certification processes to enhance credibility and access to markets. These programs are making food producers and exporters compliant with global halal standards, thus enhancing the competitiveness of local products in foreign markets like the Middle East and Southeast Asia. The government is also investing in halal hubs, training, and awareness campaigns that are continuously informing businesses and consumers about halal requirements. This aggressive regulatory climate not only is fueling local consumption but also is creating export possibilities, thus propelling overall growth in the Philippines halal food industry. In 2025, the Mindanao Development Authority (MinDA) declared the arrival of Malaysian food brand Abang J in the Philippines. This is one of the results of the Philippine Business Mission to Kota Kinabalu held in February, organized by the Philippine Chamber of Commerce and Industry (PCCI)–Mindanao and MinDA. Jetsin Sdn Bhd, a distributor of groceries and frozen foods in Kota Kinabalu, created the Abang J product line, featuring halal-certified meals that are ready to eat and ready to cook.

Increasing Global Halal Trade and Export Opportunities

The rising demand for high-quality food products is supporting the Philippines halal food market growth. Filipino exporters of food are targeting halal-aware consumers worldwide, particularly in Asia, the Middle East, and Europe, where being certified halal is becoming the entry point in the market. By going in line with global halal requirements, Philippine manufacturers are boosting their competitiveness in global food trade, especially in processed foods, seafood, and agri-products. This is encouraging companies to pursue halal certification, enhance supply chain traceability, and invest in quality assurance systems. With increasing global halal trade, Philippine businesses are enjoying wider access to foreign markets, which is consolidating the significance of compliance with halal requirements. This export-led opportunity is thus becoming a strong driver that is fueling the market growth.

Philippines Halal Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Meat, Poultry and Seafood

- Fruits and Vegetables

- Dairy Products

- Cereals and Grains

- Oil, Fats and Waxes

- Confectionery

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes meat, poultry and seafood, fruits and vegetables, dairy products, cereals and grains, oil, fats and waxes, confectionery, and others.

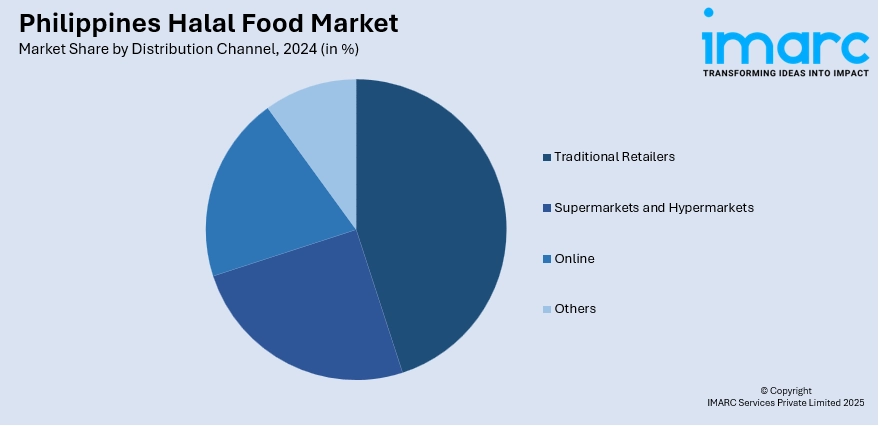

Distribution Channel Insights:

- Traditional Retailers

- Supermarkets and Hypermarkets

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes traditional retailers, supermarkets and hypermarkets, online, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Halal Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Meat, Poultry and Seafood, Fruits and Vegetables, Dairy Products, Cereals and Grains, Oil, Fats and Waxes, Confectionery, Others |

| Distribution Channels Covered | Traditional Retailers, Supermarkets and Hypermarkets, Online, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines halal food market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines halal food market on the basis of product?

- What is the breakup of the Philippines halal food market on the basis of distribution channel?

- What is the breakup of the Philippines halal food market on the basis of region?

- What are the various stages in the value chain of the Philippines halal food market?

- What are the key driving factors and challenges in the Philippines halal food market?

- What is the structure of the Philippines halal food market and who are the key players?

- What is the degree of competition in the Philippines halal food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines halal food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines halal food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines halal food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)