Philippines HDPE Pipes Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Philippines HDPE Pipes Market Overview:

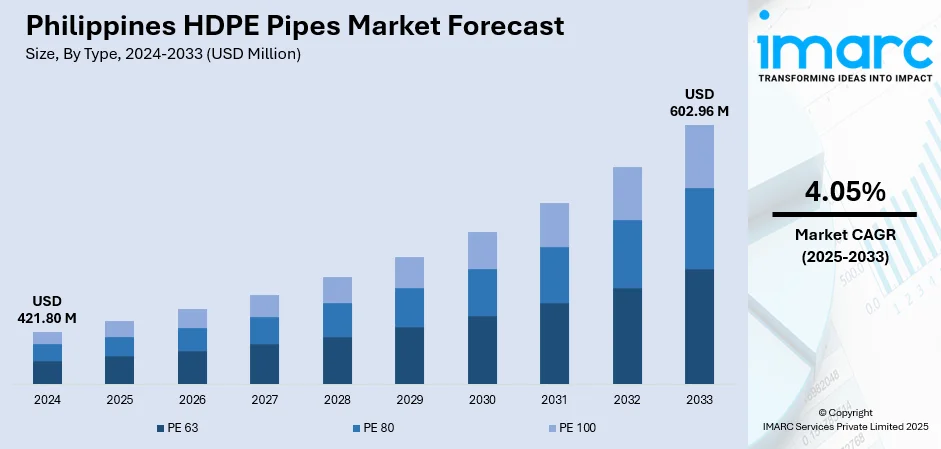

The Philippines HDPE pipes market size reached USD 421.80 Million in 2024. The market is projected to reach USD 602.96 Million by 2033, exhibiting a growth rate (CAGR) of 4.05% during 2025-2033. The market in the Philippines is experiencing steady development, supported by increased infrastructure activities and demand for efficient fluid transportation systems. The material’s durability, chemical resistance, and low maintenance requirements make it a preferred choice across applications such as water supply, sewage, and industrial projects. Continued efforts in urban development and sustainable construction are driving further growth. Industry participants are focusing on quality and compliance to strengthen their position in the evolving landscape of the Philippines HDPE pipes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 421.80 Million |

| Market Forecast in 2033 | USD 602.96 Million |

| Market Growth Rate 2025-2033 | 4.05% |

Philippines HDPE Pipes Market Trends:

Infrastructure Expansion Boosts Pipe Demand

The Philippines is accelerating its infrastructure investments, especially in water systems, which is fueling new opportunities for high-quality piping materials like HDPE. These pipes, known for their flexibility and resistance to corrosion, are increasingly being used in a wide range of public works from rural irrigation networks to urban flood control systems. In February 2024, national media reported that the government launched 44 flagship water projects under its “Build Better More” program, marking a strong commitment to improving long-term water access and disaster resilience. As infrastructure development expands across cities and provinces, the demand for pipes that can endure extreme conditions and require low maintenance is rising. HDPE pipes are meeting these demands due to their long lifespan and sustainability benefits. With public funding flowing into construction and water management systems, HDPE is becoming the material of choice. These infrastructure upgrades are also aligned with broader national goals for climate adaptation and urban planning, setting a strong foundation for sustained Philippines HDPE pipes market growth.

To get more information on this market, Request Sample

Sustainability Driving Material Choice

Sustainability is influencing infrastructure policy in the Philippines, leading to a transition toward materials that are as durable as they are environmentally conscious. HDPE pipes are gaining popularity due to recyclability, resistance to chemicals, and minimal impact on ecosystems. In June 2024, news reported on the opening of the Cordova Desalination Plant in Cebu the first of its kind in the nation where project developers selected HDPE piping systems for their resistance to saline environments and lower environmental disruption. This project illustrates an increasing trend for coastal and urban areas, where infrastructure is to be longer-lasting and compatible with standards of sustainability. With municipalities and agencies embracing green procurement practices, demand for HDPE is becoming more widespread. The policies favor infrastructure solutions that demonstrate longevity and lower lifecycle emissions, both of which are HDPE strengths. For drainage, water supply, or treatment systems, HDPE flexibility makes it an intelligent decision under sustainability-based planning. This momentum is supporting long-term trends in design and buying habits, highlighting Philippines HDPE pipes market trends.

Policy Shifts Support Circular Economy

The Philippines is reinforcing its commitment to a circular economy, with policy initiatives increasingly favoring recyclable, durable materials in infrastructure development. HDPE pipes renowned for their resilience and recyclability are well-aligned with this direction, especially as the construction and water sectors integrate eco-conscious standards. In January 2025, the Department of Environment and Natural Resources launched the National Plastic Action Partnership, a public–private platform meant to address plastic waste from multiple angles and support sustainable supply chains. The initiative also reinforces compliance with the Extended Producer Responsibility Act, under which companies are required to manage and reduce their plastic footprints, creating additional incentives to choose materials like HDPE that support long-term waste reduction goals. By embedding circular principles into procurement policies and infrastructure guidelines, policymakers are steering decision-makers toward sustainable alternatives. This approach not only meets emerging environmental priorities but also strengthens material performance in the long run. As infrastructure design evolves under circularity mandates, HDPE’s recyclability and durability stand out as practical solutions. These shifts in regulation and procurement are reinforcing Philippines HDPE pipes market.

Philippines HDPE Pipes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- PE 63

- PE 80

- PE 100

The report has provided a detailed breakup and analysis of the market based on the type. This includes PE 63, PE 80, and PE 100.

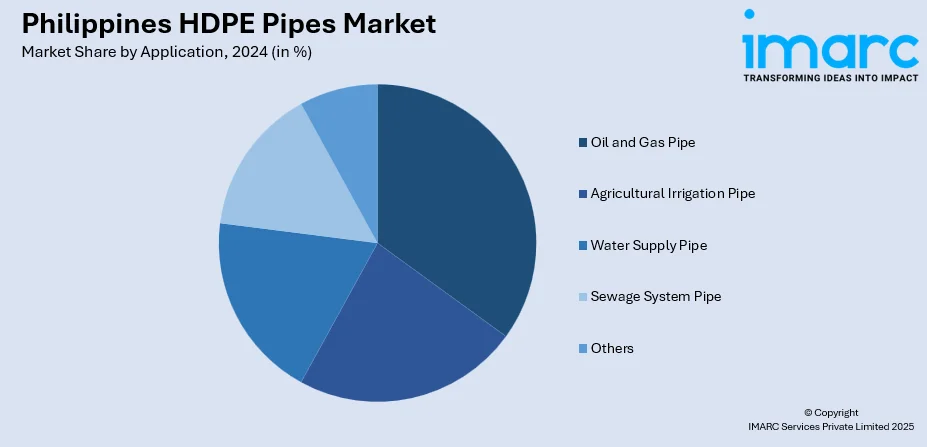

Application Insights:

- Oil and Gas Pipe

- Agricultural Irrigation Pipe

- Water Supply Pipe

- Sewage System Pipe

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes oil and gas pipe, agricultural irrigation pipe, water supply pipe, sewage system pipe, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines HDPE Pipes Market News:

- February 2025: Far East Advance Plastics Corporation (FEAPC), the Philippines' top thermoplastics producer, has become ISO certified. The certification was conducted at FEAPC's facility in Carmona, Cavite, by Ms. Wendy Silang, Account Executive of TÜV SÜD. This feat highlights FEAPC's dedication to quality, efficiency in operations, and sustainability. In embracing international standards, FEAPC reiterates its image as a reliable partner in the plastics producing industry, both within and outside the Philippines.

Philippines HDPE Pipes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | PE 63, PE 80, PE 100 |

| Applications Covered | Oil and Gas Pipe, Agricultural Irrigation Pipe, Water Supply Pipe, Sewage System Pipe, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines HDPE pipes market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines HDPE pipes market on the basis of type?

- What is the breakup of the Philippines HDPE pipes market on the basis of application?

- What is the breakup of the Philippines HDPE pipes market on the basis of region?

- What are the various stages in the value chain of the Philippines HDPE pipes market?

- What are the key driving factors and challenges in the Philippines HDPE pipes market?

- What is the structure of the Philippines HDPE pipes market and who are the key players?

- What is the degree of competition in the Philippines HDPE pipes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines HDPE pipes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines HDPE pipes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines HDPE pipes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)