Philippines Healthcare CRM Market Size, Share, Trends and Forecast by Product, Application, Technology, End Use, and Region, 2025-2033

Philippines Healthcare CRM Market Overview:

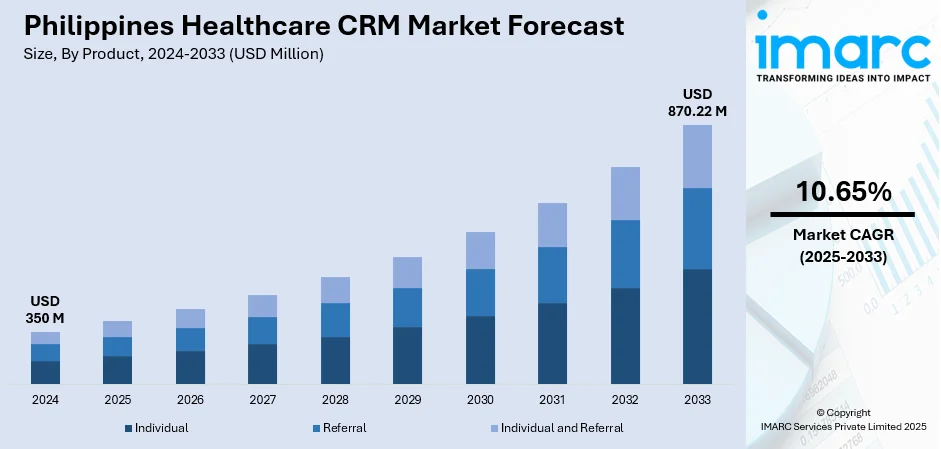

The Philippines healthcare CRM market size reached USD 350 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 870.22 Million by 2033, exhibiting a growth rate (CAGR) of 10.65% during 2025-2033. The increasing healthcare spending and consistent investments from public and private sources are impelling the market growth. Apart from this, healthcare providers are getting more concerned about patient-centric care, which is supporting the market growth. Additionally, the rapid digital transformation and technology adoption in the healthcare sector are expanding the Philippines healthcare CRM market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 350 Million |

| Market Forecast in 2033 | USD 870.22 Million |

| Market Growth Rate 2025-2033 | 10.65% |

Philippines Healthcare CRM Market Trends:

Increased Need for Patient-Centric Care

The Philippines healthcare customer relationship management (CRM) sector is witnessing rapid growth as healthcare providers are getting more concerned about patient-centric care. Clinics, specialty centers, and hospitals are giving priority to personalized communication, active outreach, and efficient service delivery to enhance patient satisfaction. Healthcare CRM products are allowing organizations to monitor patient interactions, follow up in a timely manner, and personalize care journeys, making the patients feel special and engaged at every stage of their treatment journey. This trend is gaining momentum as patients are becoming increasingly health-conscious about healthcare decisions and demanding better service standards. By adopting CRM platforms, providers are bringing together appointment scheduling, reminders, and feedback mechanisms that are enhancing efficiency and lightening administrative loads. While doing so, the increasing competition among healthcare facilities is compelling them to incorporate digital platforms for enhancing relationships and loyalty. In 2025, Makati City emerged as the initial local government unit in the Philippines to introduce a comprehensive, round-the-clock digital healthcare system. The updated system integrates virtual appointments, telehealth consultations, hospital diagnostics, and electronic medical records into one cohesive network available to all residents.

To get more information on this market, Request Sample

Rapid Digital Transformation and Technology Adoption

The Philippine healthcare industry is rapidly transforming digitally, driving the implementation of CRM solutions. Organizations are increasingly using digital platforms, cloud computing, and mobile apps to streamline operations and improve patient care. For instance, in 2024, Senti AI reported that it had entered into a memorandum of agreement with Karl Group Holdings. Senti and Karl Group's IT subsidiary, Techne Systems, made the decision to deliver AI healthcare solutions to the Philippines through this agreement. Healthcare institutions are implementing CRM systems to consolidate electronic health records (EHR), telemedicine interfaces, and data management capabilities into one interface, enabling smoother coordination and better decision-making. The steady digitalization of healthcare procedures is making patient data accessible in real-time, which is bolstering clinical results and operational effectiveness. Moreover, the growing smartphone penetration and internet connectivity across the nation are prompting patients to go digital in their interactions with healthcare professionals. This trend is pushing hospitals and clinics to invest in CRM solutions capable of handling omnichannel communication, remote consultation support, and digital payment facilities. While digital health ecosystems grow, healthcare CRM adoption is increasing in the Philippines.

Increased Healthcare Spending and Institutional Investments

The Philippine healthcare CRM market growth is propelled by increasing healthcare spending and consistent investments from public and private sources. The government is repeatedly augmenting funding for healthcare, while private clinics and hospitals are also allotting bigger budgets for the upgrade of infrastructure and the implementation of advanced technology. These investments are prompting institutions to spend on CRM products that improve patient interaction and optimize processes. Simultaneously, insurance companies and healthcare administrators are putting money into systems that can streamline claims handling, monitor patient histories, and enhance coordination among stakeholders. With increasing healthcare expenditure, CRM solutions are becoming necessary instruments for promoting efficiency, transparency, and accountability in the delivery of services. International investors and technology vendors, in addition to this, are partnering with local healthcare providers, thus promoting the use of CRM even further.

Philippines Healthcare CRM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, application, technology, and end use.

Product Insights:

- Individual

- Referral

- Individual and Referral

The report has provided a detailed breakup and analysis of the market based on the product. This includes individual, referral, and individual and referral.

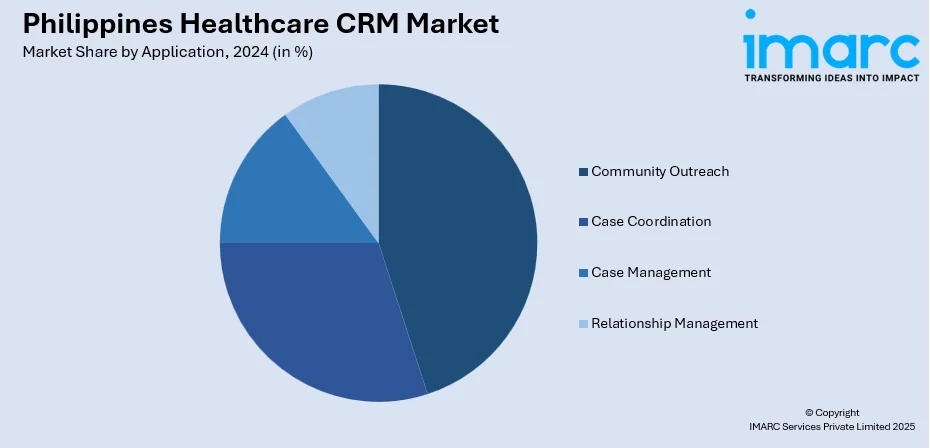

Application Insights:

- Community Outreach

- Case Coordination

- Case Management

- Relationship Management

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes community outreach, case coordination, case management, and relationship management.

Technology Insights:

- Cloud Based

- Mobile

- Social

- Collaborative

- Predictive

The report has provided a detailed breakup and analysis of the market based on the technology. This includes cloud based, mobile, social, collaborative, and predictive.

End Use Insights:

- Payers

- Providers

- Life Science Companies

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes payers, providers, and life science companies.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Healthcare CRM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Individual, Referral, Individual and Referral |

| Applications Covered | Community Outreach, Case Coordination, Case Management, Relationship Management |

| Technologies Covered | Cloud-based, Mobile, Social, Collaborative, Predictive |

| End Uses Covered | Payers, Providers, Life Science Companies |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines healthcare CRM market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines healthcare CRM market on the basis of product?

- What is the breakup of the Philippines healthcare CRM market on the basis of application?

- What is the breakup of the Philippines healthcare CRM market on the basis of technology?

- What is the breakup of the Philippines healthcare CRM market on the basis of end use?

- What is the breakup of the Philippines healthcare CRM market on the basis of region?

- What are the various stages in the value chain of the Philippines healthcare CRM market?

- What are the key driving factors and challenges in the Philippines healthcare CRM market?

- What is the structure of the Philippines healthcare CRM market and who are the key players?

- What is the degree of competition in the Philippines healthcare CRM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines healthcare CRM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines healthcare CRM market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines healthcare CRM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)