Philippines Home Decor Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Philippines Home Decor Market Size and Share:

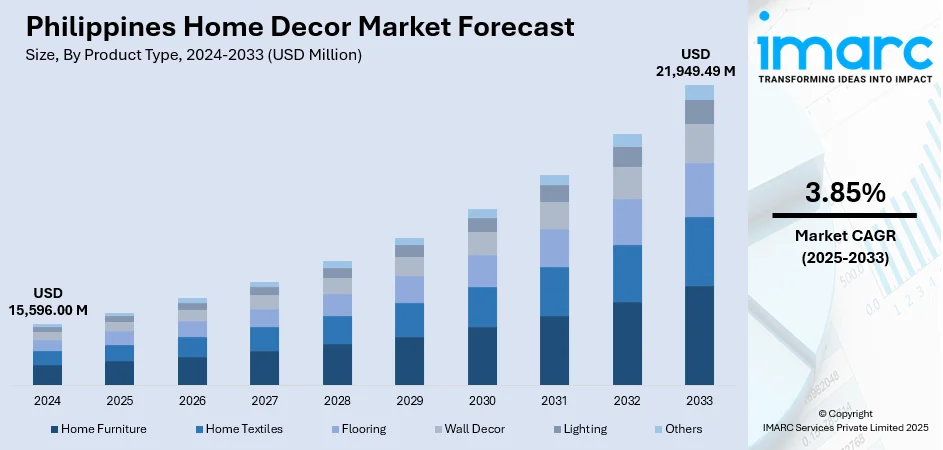

The Philippines home decor market size reached USD 15,596.00 Million in 2024. The market is projected to reach USD 21,949.49 Million by 2033, exhibiting a growth rate (CAGR) of 3.85% during 2025-2033. The market is driven by urbanization, increasing disposable income, growing consumer demand for personalized living spaces, and the rise of e-commerce platforms. These factors are reshaping consumer behavior and boosting the demand for both modern and traditional home decor products, impacting the Philippines home decor market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15,596.00 Million |

| Market Forecast in 2033 | USD 21,949.49 Million |

| Market Growth Rate 2025-2033 | 3.85% |

Philippines Home Decor Market Trends:

Influence of Traditional Filipino Designs

Traditional Filipino home decor is experiencing a resurgence in the market, as consumers seek to blend cultural heritage with modern interior aesthetics. This trend is marked by a growing appreciation for indigenous materials such as rattan, bamboo, and capiz shells, which are being integrated into contemporary designs. Filipino homeowners are increasingly incorporating elements like woven textiles, handcrafted furniture, and local art pieces into their living spaces to evoke a sense of national pride. This fusion of tradition and modernity allows consumers to create homes that reflect both their cultural roots and modern lifestyles. As demand for these unique and meaningful products rises, the traditional home decor market is expected to contribute significantly to the Philippines home decor market share. For instance, the Philippine International Furniture Show (PIFS) and Interior & Design Manila (IDM) showcased the country’s growing design prowess in March 2025. The events featured over 3,000 high-quality items, including custom-made furniture and sophisticated lighting solutions. With the theme “Philippines: An Archipelago of Design,” they emphasized Filipino craftsmanship and sustainability, attracting global buyers. Key activities included art installations, design-forward pavilions, and discussions on Philippine regional styles. The event highlighted the Philippines’ ambition to be the "Milan of Asia" by promoting local talents and fostering international collaborations.

To get more information on this market, Request Sample

Digitalization and E-commerce Growth

The speedy expansion of online shopping platforms has left an indelible mark on the Philippines home decor business. As more consumers embrace online shopping, they can now conveniently access a vast range of home decor items from domestic as well as foreign brands. This shift to online shopping has facilitated customers to browse through designs, shop around for the best prices, and make purchases from the comfort of their own residences. The trend of using online platforms has also resulted in increased dependence upon digital marketing and influencer partnerships to advertise home decor companies. As more consumers embrace the convenience and variety that e-commerce offers, the Philippines home decor market growth is expected to accelerate further. For instance, in February 2024, IKEA expanded its online presence in the Philippines by introducing services like e-truck delivery and "Click & Collect" in cities such as Davao, Cagayan de Oro, and Iloilo. This allows customers to shop online and have products delivered to their doorsteps. IKEA also emphasizes sustainability with 100% electric vehicle deliveries.

Philippines Home Decor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Home Furniture

- Home Textiles

- Flooring

- Wall Decor

- Lighting

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes home furniture, home textiles, flooring, wall decor, lighting, and others.

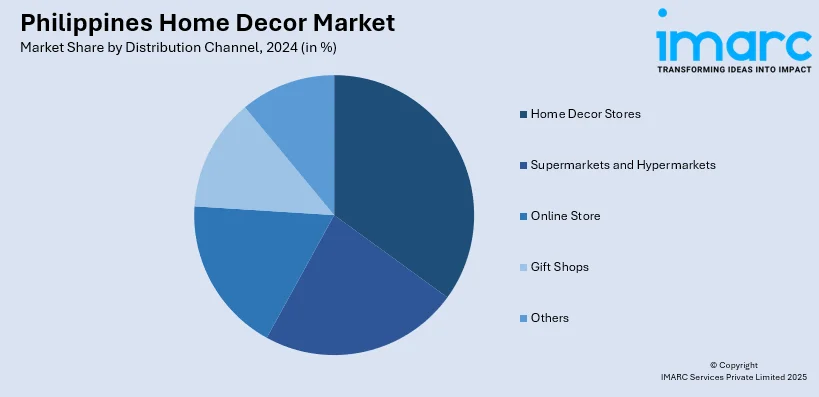

Distribution Channel Insights:

- Home Decor Stores

- Supermarkets and Hypermarkets

- Online Store

- Gift Shops

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes home decor stores, supermarkets and hypermarkets, online store, gift shops, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Home Decor Market News:

- In October 2024, Filipino home decor brand ATIN opened its first boutique at Kultura in SM Makati, featuring a curated collection of its signature products. The shop-in-shop showcases popular items such as the Philippine Bird Series and Home Ceramic Line inspired by Filipino art. The boutique's design balances simplicity with cultural depth.

- In May 2024, Opulence Design Concept introduced Dolce & Gabbana Casa to the Philippines, marking a significant expansion of Italian luxury homeware in the region. The collection, renowned for its vibrant colors and traditional craftsmanship, was made available at a dedicated pop-up store in Greenbelt 5, Makati City. This launch underscores Opulence Design Concept's commitment to offering exclusive European design pieces to Filipino consumers.

Philippines Home Decor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Home Furniture, Home Textiles, Flooring, Wall Décor, Lighting, Others |

| Distribution Channels Covered | Home Decor Stores, Supermarkets and Hypermarkets, Online Store, Gift Shops, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines home decor market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines home decor market on the basis of product type?

- What is the breakup of the Philippines home decor market on the basis of distribution channel?

- What is the breakup of the Philippines home decor market on the basis of region?

- What are the various stages in the value chain of the Philippines home decor market?

- What are the key driving factors and challenges in the Philippines home decor market?

- What is the structure of the Philippines home decor market and who are the key players?

- What is the degree of competition in the Philippines home decor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines home decor market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines home decor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines home decor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)