Philippines Hot Sauce Market Size, Share, Trends and Forecast by Product Type, Application, Packaging, Distribution Channel, End Use, and Region, 2025-2033

Philippines Hot Sauce Market Overview:

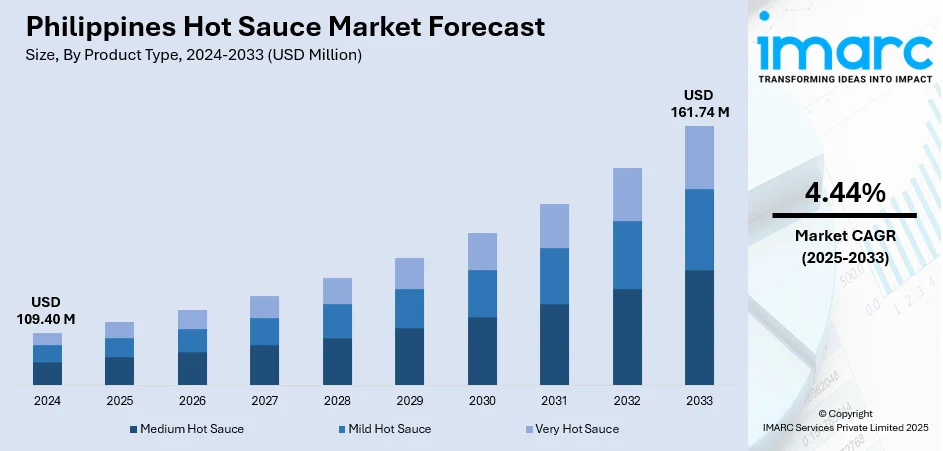

The Philippines hot sauce market size reached USD 109.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 161.74 Million by 2033, exhibiting a growth rate (CAGR) of 4.44% during 2025-2033. At present, growing demand from consumers for spicier food is positively influencing the market. Apart from this, the popularity of foreign cuisines is contributing to the growth of the market. Furthermore, the fast growth of retail channels and expansion of e-commerce platforms is expanding the Philippines hot sauce market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 109.40 Million |

| Market Forecast in 2033 | USD 161.74 Million |

| Market Growth Rate 2025-2033 | 4.44% |

Philippines Hot Sauce Market Trends:

Increasing Consumer Demand for Spicy Foods

The Philippines hot sauce market is witnessing rapid growth as a result of the growing demand from consumers for spicier food. Filipinos are increasingly craving hot, bold flavors in their foods, showing a general pattern of culinary desire toward hot cuisine. Younger generations are driving this demand, as they are more experimental and adventurous with their foods, trying out a range of global cuisines that feature hot sauce. Local cuisine, which already boasts spicy fare such as sinigang and adobo, is embracing spiciness even more as a fundamental ingredient in everyday meals. With this trend growing stronger, hot sauce companies are taking advantage of this movement by expanding their product line, developing new flavors, and promoting them to suit both traditional and modern palates. In 2025, Granja Jordana announced its plans of expanding its footprint in the Philippines’ condiment sector, by introducing its flagship hot sauce In-DANG! in retail shops.

To get more information on this market, Request Sample

Increased Demand for International Cuisine

The market for hot sauce in the Philippines is being greatly impacted by the popularity of foreign cuisines, especially those from Mexico, Korea, and America. As people are increasingly embracing the trend of globalization and exposure to other foreign food cultures, consumers are constantly experimenting with new flavors and spices added to their foods. The popularity of global food chains, local eateries, and social media personalities featuring hot sauce-laced foods is supporting this Philippines hot sauce market growth. Hot sauces are becoming a staple condiment for Filipino consumers to pair with a broad range of foods, from tacos and burgers to fried chicken and noodles. With these international cuisines gaining popularity, demand for hot sauce offerings that complement these foods is also growing, leading local and foreign brands to increase their presence in the Philippines. This movement is not only leading to higher consumption but also broadening the range of hot sauces offered.

Growing Retail Channels and E-Commerce Development

The Philippines market is experiencing the fast growth of retail channels and expansion of e-commerce platforms. Traditional stores, including supermarkets, grocery stores, and specialty food stores, are becoming more likely to sell a variety of hot sauce brands and types to meet consumer demand. Concurrently, e-commerce websites are also bolstering the growth of the market by offering consumers a convenient option to access a variety of hot sauce products that perhaps cannot be accessed in local markets. Online shopping is allowing consumers to browse different brands, read comments, and buy products from home with ease. The growing use of online shopping by Filipinos is broadening the market coverage of hot sauce brands, enabling them to reach a wider market, particularly in areas that are far and underserved. This increased accessibility is promoting a more competitive market environment. IMARC Group predicts that the Philippines e-commerce market is projected to attain USD 75.59 Billion by 2033.

Philippines Hot Sauce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, application, packaging, distribution channel, and end use.

Product Type Insights:

- Medium Hot Sauce

- Mild Hot Sauce

- Very Hot Sauce

The report has provided a detailed breakup and analysis of the market based on the product type. This includes medium hot sauce, mild hot sauce, and very hot sauce.

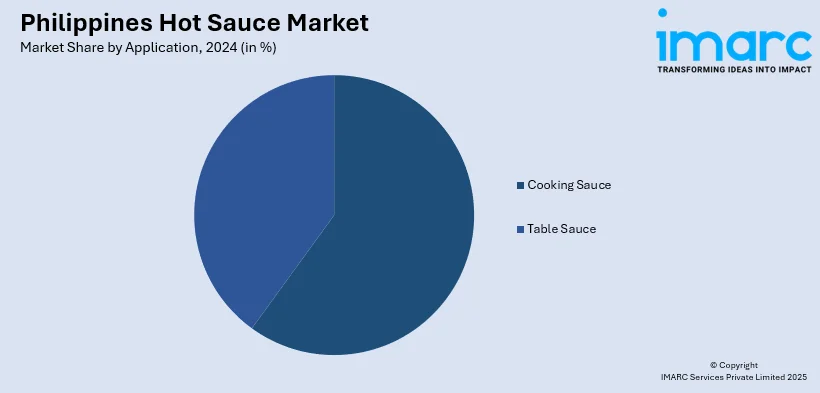

Application Insights:

- Cooking Sauce

- Table Sauce

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cooking sauce and table sauce.

Packaging Insights:

- Jars

- Bottles

- Others

A detailed breakup and analysis of the market based on the packaging have also been provided in the report. This includes jars, bottles, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Traditional Grocery Retailers

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, traditional grocery retailers, online stores, and others.

End Use Insights:

- Commercial

- Household

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial and household.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Hot Sauce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Medium Hot Sauce, Mild Hot Sauce, Very Hot Sauce |

| Applications Covered | Cooking Sauce, Table Sauce |

| Packagings Covered | Jars, Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Traditional Grocery Retailers, Online Stores, Others |

| End Uses Covered | Commercial, Household |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines hot sauce market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines hot sauce market on the basis of product type?

- What is the breakup of the Philippines hot sauce market on the basis of application?

- What is the breakup of the Philippines hot sauce market on the basis of packaging?

- What is the breakup of the Philippines hot sauce market on the basis of distribution channel?

- What is the breakup of the Philippines hot sauce market on the basis of end use?

- What is the breakup of the Philippines hot sauce market on the basis of region?

- What are the various stages in the value chain of the Philippines hot sauce market?

- What are the key driving factors and challenges in the Philippines hot sauce market?

- What is the structure of the Philippines hot sauce market and who are the key players?

- What is the degree of competition in the Philippines hot sauce market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines hot sauce market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines hot sauce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines hot sauce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)