Philippines Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033

Philippines Insurtech Market Overview:

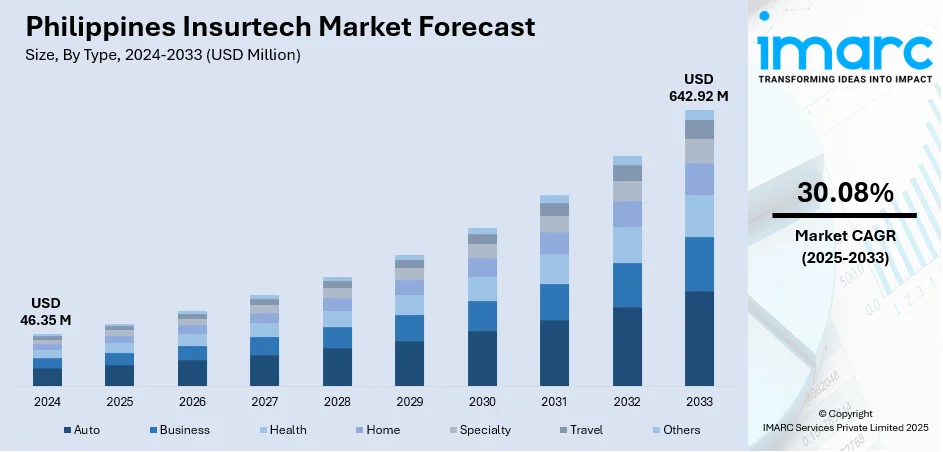

The Philippines Insurtech market size reached USD 46.35 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 642.92 Million by 2033, exhibiting a growth rate (CAGR) of 30.08% during 2025-2033. The growth of the Insurtech market in Philippines is attributed to partnerships with e-commerce and fintech platforms, increasing internet and mobile penetration, and government-backed initiatives. These factors enhance the accessibility, visibility, and convenience of digital insurance, fostering broader client engagement, and contributing to the expansion of the Philippines Insurtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 46.35 Million |

| Market Forecast in 2033 | USD 642.92 Million |

| Market Growth Rate 2025-2033 | 30.08% |

Philippines Insurtech Market Trends:

Partnerships with E-commerce and Fintech Platforms

The increasing partnership between Insurtech firms and e-commerce or fintech platforms is a crucial factor impelling the market growth. With the rise of e-commerce platforms, Insurtech startups are leveraging these collaborations to provide insurance products directly to users while they shop online or engage in digital financial activities. This method enables insurers to smoothly incorporate their offerings into platforms that are already trusted and utilized by a significant, tech-savvy audience. These partnerships enhance the visibility and accessibility of insurance, as individuals are more inclined to buy products through platforms they recognize. Additionally, collaboration with fintech platforms allows for the utilization of adaptable payment options, such as mobile wallets or credit card installments, simplifying and enhancing the purchasing experience. This trend is exemplified by the robust e-commerce market in the Philippines, which as per the IMARC Group attained a value of USD 24.53 Billion in 2024. This substantial expansion presents Insurtech firms an excellent opportunity to access a broader user base and deliver insurance options to a more diverse audience. The accessibility, along with the convenience of buying insurance during online transactions, greatly enhances client participation and confidence in digital insurance solutions, accelerating the adoption of Insurtech products nationwide.

To get more information on this market, Request Sample

Growing Internet and Mobile Penetration

With increasing access to smartphones and dependable internet, more people in the country can readily interact with digital insurance platforms. This change allows insurers to connect with clients in distant regions who were not adequately served before, providing them with customized insurance products and streamlining digital transactions. With the rapid adoption of technology, insurance firms are utilizing mobile applications, websites, and social media networks to provide services that are more convenient and accessible. This change is not only simplifying the insurance process and making it more user-friendly but also increasing its efficiency. Furthermore, the governing body is proactively backing this movement with increasing efforts to improve connectivity in underprivileged areas. For instance, in 2024, the government instructed the Department of Information and Communications Technology (DICT) to focus on enhancing connectivity in distant and isolated locations, intending to increase free wireless fidelity (Wi-Fi) availability in underprivileged areas. This initiative aimed to enhance digital infrastructure nationwide, facilitating increased internet accessibility and promoting a more interconnected setting. With the enhancement of digital connectivity, the process of purchasing, managing, and claiming insurance is changing, providing Insurtech firms with increased opportunities to flourish and broaden their clientele, strengthening the Philippines Insurtech market growth.

Philippines Insurtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, service, and technology.

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes auto, business, health, home, specialty, travel, and others.

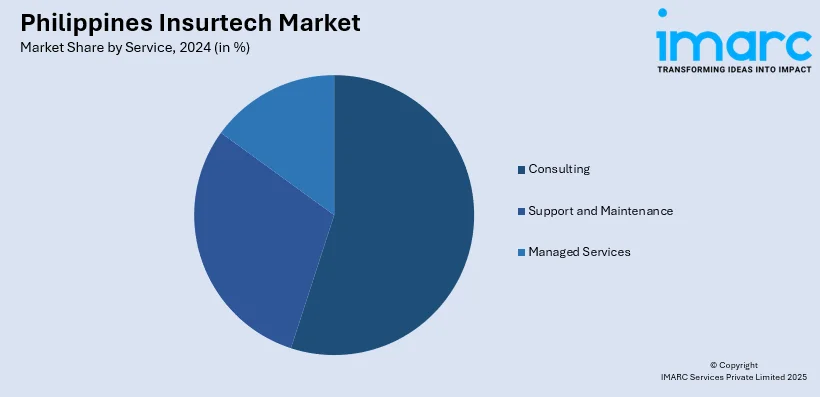

Service Insights:

- Consulting

- Support and Maintenance

- Managed Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes consulting, support and maintenance, and managed services.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes block chain, cloud computing, IoT, machine learning, robo advisory, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Insurtech Market News:

- In August 2024, Insurtech firm Igloo announced its expansion in the Philippines, leveraging strategic partnerships to drive growth in the country’s underinsured market. With backing from a $19 million Series B round, Igloo partnered with companies like Etiqa, Shopee, and GCash, facilitating over 60 million protection plans. The company's aimed to make insurance accessible, especially to underserved groups like gig workers and MSMEs.

- In May 2024, Swiss-based Insurtech firm discovermarket launched in the Philippines, partnering with Globe Telecom to offer embedded Personal Cyber Insurance targeting cybercrime. The product protected clients against online threats like identity theft and fraud. This marked the company's first step in expanding its affordable, digital-first insurance solutions in the country.

Philippines Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines Insurtech market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines Insurtech market on the basis of type?

- What is the breakup of the Philippines Insurtech market on the basis of service?

- What is the breakup of the Philippines Insurtech market on the basis of technology?

- What is the breakup of the Philippines Insurtech market on the basis of region?

- What are the various stages in the value chain of the Philippines Insurtech market?

- What are the key driving factors and challenges in the Philippines Insurtech market?

- What is the structure of the Philippines Insurtech market and who are the key players?

- What is the degree of competition in the Philippines Insurtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines Insurtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines Insurtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines Insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)