Philippines IT Services Market Size, Share, Trends and Forecast by Service Type, Enterprise Size, Deployment Mode, End Use Industry, and Region, 2026-2034

Philippines IT Services Market Overview:

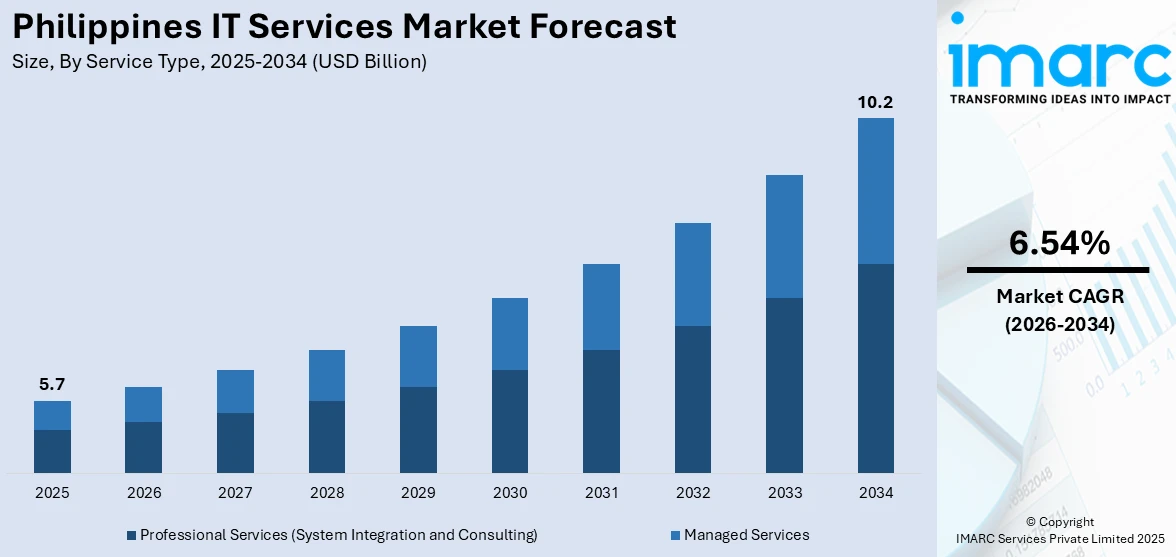

The Philippines IT services market size reached USD 5.7 Billion in 2025. Looking forward, the market is projected to reach USD 10.2 Billion by 2034, exhibiting a growth rate (CAGR) of 6.54% during 2026-2034. The market is experiencing strong growth, driven by an increasing demand for cloud computing, cybersecurity, and digital transformation. Key factors include a growing outsourcing industry, tech-savvy workforce, and government initiatives promoting ICT infrastructure development and innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.7 Billion |

| Market Forecast in 2034 | USD 10.2 Billion |

| Market Growth Rate (2026-2034) | 6.54% |

Key Trends of Philippines IT Services Market:

Expansion of Cloud Computing Services

Cloud computing is rapidly emerging as a pivotal trend in the Philippines IT services industry, typically propelled by magnified utilization of digital techniques across major sectors. Businesses are gravitating from conventional on-premise services to adaptable and scalable cloud-based platforms to significantly lower infrastructure expenditures, enhance efficacy, and improve remote alliances. This inclination is also boosted by the magnifying need for platform-as-a-service (PaaS), cloud storage applications, and software-as-a-service (SaaS) offerings. In parallel, public cloud sector in Philippines is witnessing robust expansion, with anticipated valuation to grow around USD 1256 Million in the year 2024. Moreover, the notable emergence of health tech, e-commerce, or fintech platforms in the region further heightens the requirement for cloud services, with organizations actively navigating for safe, dependable, and cost-efficient options. The Philippine government’s encouragement for digitalization through the "Philippine Development Plan 2023-2028" has further facilitated cloud adoption, guaranteeing uninterrupted incorporation of government services and facilitating business robustness. As more companies are inclining toward the use of cloud services to manage their operations, service providers are expanding to provide incorporated solutions that encompass disaster recovery, infrastructure management, and data analytics.

To get more information on this market Request Sample

Growing Demand for Cybersecurity Solutions

As the Philippines is establishing itself as a hub for digital transformation, the requirement for resilient cybersecurity policies is elevating. With an escalation in digital infrastructures, online transactions, and remote work models, several enterprises are rapidly developing susceptibility to cyber threats. Cyberattacks, encompassing data breaches, phishing, and ransomware are boosting companies to actively focus on cybersecurity services to safeguard sensitive data, comply with regulatory frameworks, and maintain customer trust. For instance, as per industry reports, a four-fold elevation, i.e., 325%, has been observed in cyberattacks across Philippines during Q1 2024, in comparison to same period during 2023. In response, local IT service providers are enhancing their offerings to include advanced threat detection, encryption, multi-factor authentication, and network security management. The government's proactive stance through initiatives has also contributed to raising awareness about the risks associated with cyber threats and promoting the adoption of cybersecurity measures. As digitalization accelerates, businesses are investing heavily in cybersecurity, positioning it as a critical aspect of their long-term IT strategies, especially in highly regulated sectors such as finance, healthcare, and telecommunications.

Expansion of Outsourcing and BPO IT Services

The Philippines is solidifying its reputation as a top global outsourcing hub with IT-enabled services having a significant role in facilitating business processes worldwide. This expansion in outsourcing and BPO IT services is driven by the country's highly skilled workforce, proficiency in English, and cost-effective models for service delivery. Foreign firms are increasingly outsourcing IT work such as software programming, technical services, data management, and back-office operations to Philippine providers. The business is also moving beyond the traditional call center incorporating more advanced services like cloud services, cyber-security, and AI analytics. Diversification builds competitiveness and addresses the growing digital transformation requirements of worldwide businesses. With ongoing investments in digital infrastructure and workforce development, the Philippines IT services market demand for outsourcing and BPO services is projected to stay robust and grow even further.

Growth Drivers of Philippines IT Services Market:

Skilled Workforce and Cost Advantage

The Philippines remains a world-class IT services center due to its rich talent pool and competitive salary scales. The country has a high output of graduates in IT, computer science, and engineering fields, providing a steady supply of skilled workers. What is more, the labor pool is noted for its good command of the English language, making it possible to communicate with overseas clients. Combined with its lower operational expenses than other major IT hubs in the world, these elements make the Philippines an attractive destination for multinational corporations. Firms can provide top-quality output without compromising too much, making the nation a reliable source of IT services. This union of competence and affordability makes the Philippines a stalwart partner for firms who need effective and scalable IT services.

Global Business Partnerships

The growth of global business partnerships has emerged as a crucial factor for the advancement of the Philippines' IT services sector. Strengthening collaborations with multinational firms grants local companies access to cutting-edge technologies, best practices, and international markets. These alliances enhance service delivery standards and bolster the nation’s competitive edge on a global scale. Outsourcing arrangements are transforming into strategic partnerships, where innovation and value-added services take precedence. Local IT providers gain from knowledge sharing, exposure to new business models, and the capability to rapidly scale services to meet global demand. According to Philippines IT services market analysis, the surge in international collaborations is fostering a more dynamic and future-ready IT industry, establishing long-term prospects for sustainable growth and technological progress.

Government Support for Digitalization

Government initiatives play a vital role in driving the growth of IT services in the Philippines. By advocating for digitalization across various sectors, the government stimulates demand for contemporary IT solutions, ranging from cloud technology to cybersecurity measures. National policies like the E-Government Master Plan and the Digital Transformation Strategy motivate both domestic businesses and global investors to adopt advanced technologies. Additionally, investment incentives, infrastructure improvements, and support for ICT education enhance the overall ecosystem. These actions draw foreign enterprises and empower local players to compete on a global stage. With a continued focus on the growth of the digital economy, the government’s proactive stance ensures that the IT services market remains strong, innovative, and well-equipped to seize emerging opportunities in a swiftly changing digital environment.

Philippines IT Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on service type, enterprise size, deployment mode, and end use industry.

Service Type Insights:

- Professional Services (System Integration and Consulting)

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes professional services (system integration and consulting) and managed services.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small and medium-sized enterprises, and large enterprises.

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

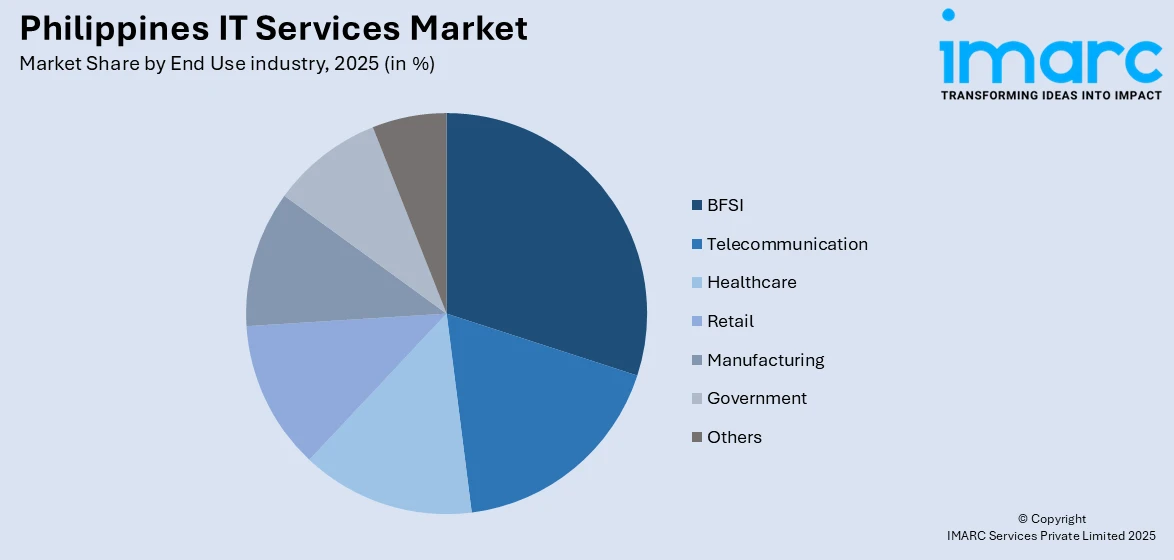

End Use industry Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- Telecommunication

- Healthcare

- Retail

- Manufacturing

- Government

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, Telecommunication, healthcare, retail, manufacturing, government, others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines IT Services Market News:

- In August 2024, Viber announced plans to introduce Viber Pay, its digital payment service, across Philippines that will enable customers to receive as well as send money seamlessly.

- In August 2024, Tata Consultancy Services, a prominent IT company, launched its Pace Studio in Philippines. This facility is developed to advance collaboratively with consumers to formulate customized solutions for their business requirements, bolstering digital enhancement.

Philippines IT Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Professional Services (System Integration and Consulting), Managed Services |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Deployment Modes Covered | On-premises, Cloud-based |

| End Use Industries Covered | BFSI, Telecommunication, Healthcare, Retail, Manufacturing, Government, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines IT services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines IT services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines IT services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The IT services market in Philippines was valued at USD 5.7 Billion in 2025.

The Philippines IT services market is projected to exhibit a compound annual growth rate (CAGR) of 6.54% during 2026-2034.

The Philippines IT services market is expected to reach a value of USD 10.2 Billion by 2034.

The Philippines IT services market is witnessing growth through rising digital transformation, cloud adoption, and demand for cybersecurity solutions. Expansion of outsourcing, integration of AI-driven tools, and emphasis on agile IT models are shaping service delivery, making the industry more competitive and globally relevant.

Key growth drivers include a skilled workforce with cost advantages, government-led digitalization programs, and increasing foreign investment. Strong global partnerships and the expanding BPO sector further strengthen service capabilities, while rising demand for customized IT solutions across industries supports sustained market growth and broader digital innovation in the Philippines.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)