Philippines Laundry Detergent Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Application, and Region, 2025-2033

Philippines Laundry Detergent Market Overview:

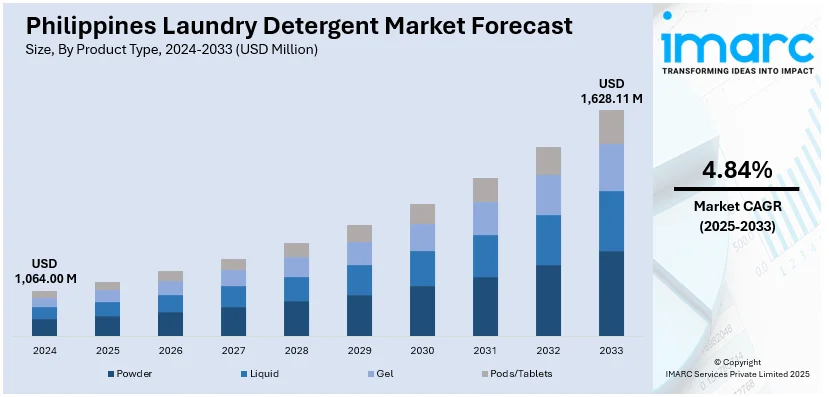

The Philippines laundry detergent market size reached USD 1,064.00 Million in 2024. The market is projected to reach USD 1,628.11 Million by 2033, exhibiting a growth rate (CAGR) of 4.84% during 2025-2033. The market is growing steadily as consumers embrace new lifestyles and prioritize convenience and effectiveness. More consumers are showing a growing preference for environmentally friendly products, as shoppers increasingly look for green options. Increased retail accessibility is being achieved through different shopping channels to bring brands closer to more consumers. Innovation and competitive pricing still influence consumer purchases, defining the marketplace. Such changing trends are impacting the Philippines laundry detergent market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,064.00 Million |

| Market Forecast in 2033 | USD 1,628.11 Million |

| Market Growth Rate 2025-2033 | 4.84% |

Philippines Laundry Detergent Market Trends:

Shift Toward Eco-Friendly Detergents

Consumer demand for green laundry detergents is gradually expanding in the Philippines. Consumers are opting for products that do less damage to the environment, such as biodegradable products, phosphate-free materials, and plant-derived surfactants. The environmentally friendly alternatives tend to be in biodegradable packaging, a demonstration of increased focus on minimizing plastic litter and chemical effluent. This is more prominent among consumers in cities who have greater access to information on environmental concerns and sustainability. The government has also promoted greener consumption habits, helping transform the market. In a report issued in 2024, sales of environmentally friendly household products, such as laundry detergents, demonstrated significant growth fueled by consumer preference for sustainability. Increased environmental consciousness is driving manufacturers and retailers to increase sustainable product ranges to match changing consumer demands. The shift means that ethical product decisions are becoming a key determining factor in purchasing decisions. Overall, the incorporation of environmental-friendly products is a prime driver influencing the Philippines laundry detergent market trends going forward.

To get more information on this market, Request Sample

Expansion of Digital Retail Channels

The Philippines laundry detergent market is experiencing a notable transformation as consumers increasingly turn to digital retail channels for their household shopping needs. Online platforms, including e-commerce marketplaces and digital grocers, are now preferred for their convenience, transparency in pricing, and access to a broader assortment including eco-friendly, concentrated, and specialty detergent options. This transition reflects evolving consumer behavior, particularly within urban populations that value efficiency and choice during busy daily schedules. In May 2024, a prominent industry analysis reported a surge in e-commerce payments, driven by rising internet penetration and growing consumer confidence in digital transactions, indicating a wider shift toward online purchasing of household products. The resulting digital exposure is helping retailers enhance service offerings including doorstep delivery, subscription models, and promotional bundles tailored to customer needs. As these factors continue to reshape sales patterns and logistics strategies, the digital landscape becomes an increasingly essential avenue for the distribution and accessibility of laundry detergents. These developments contribute directly to accelerating Philippines laundry detergent market growth in both urban and emerging regional markets.

Increasing Demand for Specialized and Convenient Laundry Solutions

The Philippines laundry detergent market is seeing increasing demand for specialty products that meet specific consumer requirements. This encompasses detergents for sensitive skin, gentle ingredients for delicate clothes, and options tailored to various types of washing machines, including front-loading or high-efficiency washers. With increasing health consciousness among Filipino consumers, hypoallergenic and dermatologically tested products have become popular, especially among households with young children and people with allergies. Moreover, convenience is one of the top drivers of purchasing decisions as consumers increasingly prefer concentrated detergents and single-dose pods that make laundry easier. The changing preferences are encouraging manufacturers to expand their product portfolios, providing innovative solutions that balance performance with care. Retailers have also increased assortment, both in store and online, making the niche products more readily available to consumers. This trend indicated a more mature market wherein consumer needs go beyond simple cleaning efficacy to health, fabric care, and simplicity of use, which will define the future growth direction of the laundry detergent market in the Philippines.

Philippines Laundry Detergent Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and application.

Product Type Insights:

- Powder

- Liquid

- Gel

- Pods/Tablets

The report has provided a detailed breakup and analysis of the market based on the product type. This includes powder, liquid, gel, and pods/tablets.

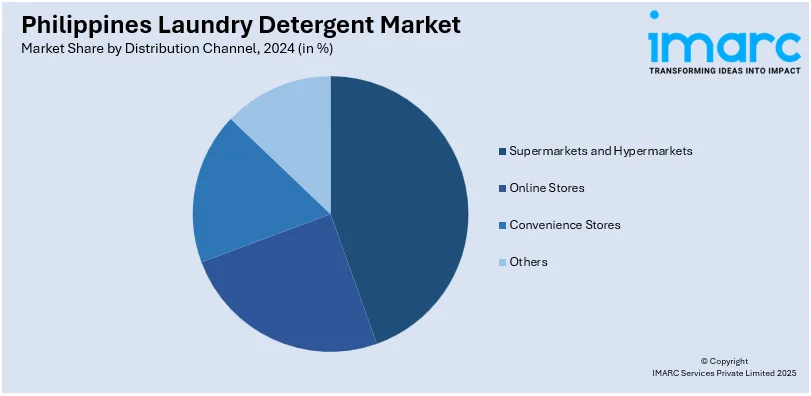

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Online Stores

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, online stores, convenience stores, and others.

Application Insights:

- Industrial

- Household

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes industrial and household.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Laundry Detergent Market News:

- April 2024: Procter & Gamble's Ariel introduced the "Cycles of Care" program in the Philippines to benefit Super Typhoon Carina-affected communities. Collaborating with Save5 Laundromat and Beko, the program offered complimentary laundry services to underprivileged families. Ariel restored decency to homes by providing clean clothing and linens, which are imperative for individuals without access to electricity and clean water, over several days. The initiative highlights Ariel's dedication to the well-being of people in times of adversity.

Philippines Laundry Detergent Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Powder, Liquid, Gel, Pods/Tablets |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Online Stores, Convenience Stores, Others |

| Applications Covered | Industrial, Household |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines laundry detergent market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines laundry detergent market on the basis of product type?

- What is the breakup of the Philippines laundry detergent market on the basis of distribution channel?

- What is the breakup of the Philippines laundry detergent market on the basis of application?

- What is the breakup of the Philippines laundry detergent market on the basis of region?

- What are the various stages in the value chain of the Philippines laundry detergent market?

- What are the key driving factors and challenges in the Philippines laundry detergent market?

- What is the structure of the Philippines laundry detergent market and who are the key players?

- What is the degree of competition in the Philippines laundry detergent market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines laundry detergent market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines laundry detergent market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines laundry detergent industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)