Philippines LED Market Report by Product Type (Panel Lights, Down Lights, Street Lights, Tube Lights, Bulbs, and Others), Application (Commercial, Residential, Institutional, Industrial), Installation Type (New Installation, Retrofit Installation) 2025-2033

Philippines LED Market Size and Share:

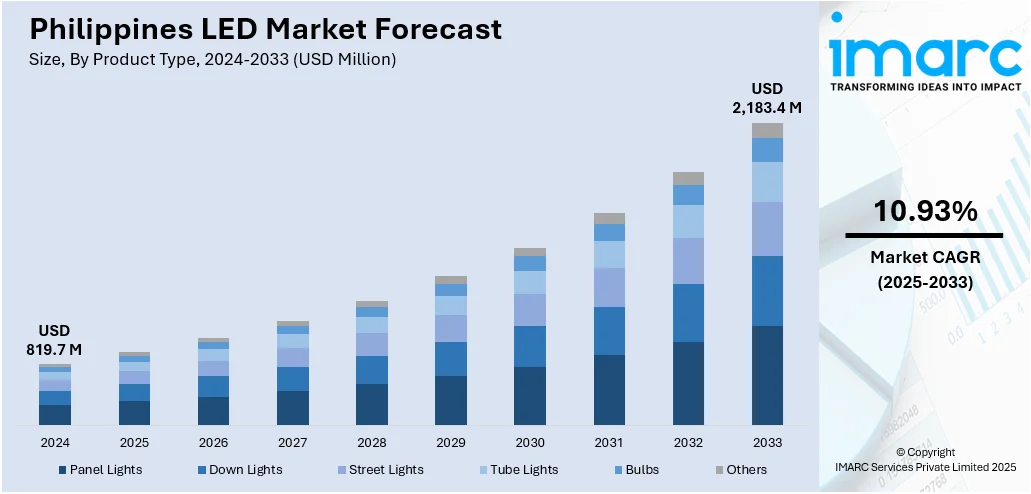

The Philippines LED market size reached USD 819.7 Million in 2024. Looking forward, the market is expected to reach USD 2,183.4 Million by 2033, exhibiting a growth rate (CAGR) of 10.93% during 2025-2033. Rapid urbanization, increasing infrastructure projects, rising environmental consciousness among consumers and businesses, growing awareness of the benefits of LEDs, and ongoing innovations in LED technology are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 819.7 Million |

| Market Forecast in 2033 | USD 2,183.4 Million |

| Market Growth Rate 2025-2033 | 10.93% |

LED stands for "Light Emitting Diode," which is a semiconductor device that emits light when an electric current passes through it. LEDs are gaining widespread popularity due to their energy efficiency, longevity, and versatility. They generate light by electroluminescence, a process where electrons recombine with electron holes within the device, releasing energy in the form of visible light. LEDs are used in various applications, including lighting for residential, commercial, and industrial spaces, as well as in displays, signage, automotive lighting, and consumer electronics. Their low energy consumption, long lifespan, and compact size position LEDs as a leading technology in the lighting industry, which contributes to energy savings and environmental sustainability.

To get more information on this market, Request Sample

The rising emphasis on energy efficiency represents one of the key factors driving the growth of the market across the Philippines. This is primarily attributed to LED technology's low energy consumption aligns with national sustainability goals and cost-saving endeavors which is further driving the market growth. In line with this, government initiatives and policies promoting energy-efficient lighting solutions play a pivotal role in encouraging widespread LED adoption across residential, commercial, and industrial sectors. The market is also driven by the expanding urbanization and infrastructure development drive demand for modern lighting solutions, positioning LEDs as a viable choice for efficient and innovative illumination. In addition to this, the rising awareness of environmental concerns is leading to a preference for LEDs, given their lower carbon footprint and reduced hazardous materials. Moreover, the ongoing advancements in LED technology, including improved efficiency, color options, and smart capabilities, are creating a positive outlook for the market across the country.

Key Trends of Philippines LED Market:

Rise in Energy Efficiency

The rise in energy efficiency is a primary driver of the Philippines' LED market growth. LED lighting solutions are renowned for their significantly lower energy consumption as compared to traditional lighting options. As energy costs continue to escalate, businesses and consumers are turning to LED technology to achieve substantial energy savings without compromising lighting quality. The rising emphasis on environmental sustainability further fuels the adoption of LED lighting, which is contributing to reduced carbon footprints. This trend aligns with the Philippines' commitment to energy conservation and sustainable development, thus making LED lighting an integral component of the country's efforts to enhance energy efficiency and minimize environmental impact.

Rising Government Initiatives

The government's commitment to energy efficiency, sustainability, and reducing carbon emissions is leading to the implementation of policies that encourage the adoption of LED lighting solutions. According to the Philippines LED market analysis, initiatives, such as energy efficiency programs, incentives, and regulations promoting the use of energy-saving technologies like LEDs are driving the shift towards more efficient and environmentally friendly lighting solutions. These government-driven efforts not only contribute to the modernization of lighting infrastructure but also align with global trends toward sustainable development and reduced energy consumption.

Rising Infrastructural Developments

As the country undergoes rapid urbanization and infrastructure expansion, the demand for advanced lighting solutions is on the rise, which is acting as a major growth-inducing factor in the market. LED technology is being integrated into various infrastructure projects, including roads, bridges, public spaces, and commercial buildings. LED lighting offers efficiency, durability, and reduced maintenance costs, thus making it an ideal choice for enhancing visibility, safety, and aesthetics in these developments. This trend not only aligns with the country's modernization goals but also positions LED technology as a pivotal component in creating vibrant and sustainable urban environments that cater to the needs of a growing population.

Growth Drivers of Philippines LED Market:

Rapid Urbanization and Infrastructure Modernization

The Philippines' accelerating urbanization rate, with over 54% of the population now residing in urban areas, creates substantial demand for modern lighting infrastructure across cities and municipalities. Large-scale infrastructure projects, including new airports, highways, shopping centers, and residential developments, require efficient, long-lasting lighting solutions that LED technology provides. Government initiatives such as the "Build, Build, Build" program and smart city development projects prioritize energy-efficient lighting systems, driving LED adoption in public spaces, street lighting, and transportation hubs. This urban expansion necessitates reliable lighting solutions capable of withstanding tropical climate conditions while maintaining low operational costs, making LEDs the preferred choice for planners and developers seeking sustainable urban development solutions.

Cost-Effectiveness and Return on Investment Appeal

LED lighting systems deliver compelling financial benefits through reduced electricity consumption, lower maintenance costs, and extended operational lifespans compared to traditional lighting technologies. Businesses and homeowners recognize that while initial LED investment costs may be higher, the total cost of ownership over 15-25 years significantly favors LED technology through energy savings of up to 80% compared to incandescent bulbs. Decreasing LED manufacturing costs have made these technologies more accessible to middle-income consumers, while financing programs and leasing options for commercial applications further accelerate adoption. The combination of immediate energy bill reductions and long-term maintenance savings creates strong economic incentives for LED adoption across all market segments, supporting sustained Philippines LED market demand.

Environmental Consciousness and Climate Change Response

Growing environmental awareness among Filipino consumers and businesses drives preference for LED lighting as part of broader sustainability initiatives and carbon footprint reduction efforts. LEDs contain no harmful mercury or toxic substances found in fluorescent lighting, supporting waste reduction and environmental protection goals increasingly important to environmentally conscious consumers. Corporate sustainability commitments and green building certification requirements encourage businesses to adopt LED lighting as part of comprehensive environmental management strategies. Government climate change mitigation policies and international environmental commitments create regulatory pressure favoring energy-efficient technologies like LEDs. This environmental imperative, combined with social responsibility trends and consumer preference for eco-friendly products, establishes LED lighting as an essential component of sustainable development strategies across the Philippines.

Philippines LED Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Philippines LED market report, along with forecasts for the period 2025-2033. Our report has categorized the market based on product type, application, and installation type.

Breakup by Product Type:

- Panel Lights

- Down Lights

- Street Lights

- Tube Lights

- Bulbs

- Others

Panel lights dominates the market

The report has provided a detailed breakup and analysis of the market based on the product type. This includes panel lights, down lights, street lights, tube lights, bulbs, and others. According to the report, panel light represented the largest segment.

The adoption of panel lights in the Philippines LED market is driven by several influential factors. Primarily, panel lights utilize LED technology, which inherently consumes less energy while providing uniform and bright illumination. This aligns with the Philippines' emphasis on energy conservation and cost reduction, thus making panel lights an attractive choice for residential, commercial, and industrial spaces. The aesthetics and versatility of panel lights drive their use. Their sleek and modern design complements various architectural styles, enhancing the visual appeal of spaces. Additionally, panel lights are available in different sizes and color temperatures, allowing for customization to suit diverse lighting preferences. Moreover, the emphasis on enhanced productivity and well-being is a significant factor. Panel lights provide uniform and glare-free lighting, reducing eye strain and improving concentration, particularly in workplaces and educational settings.

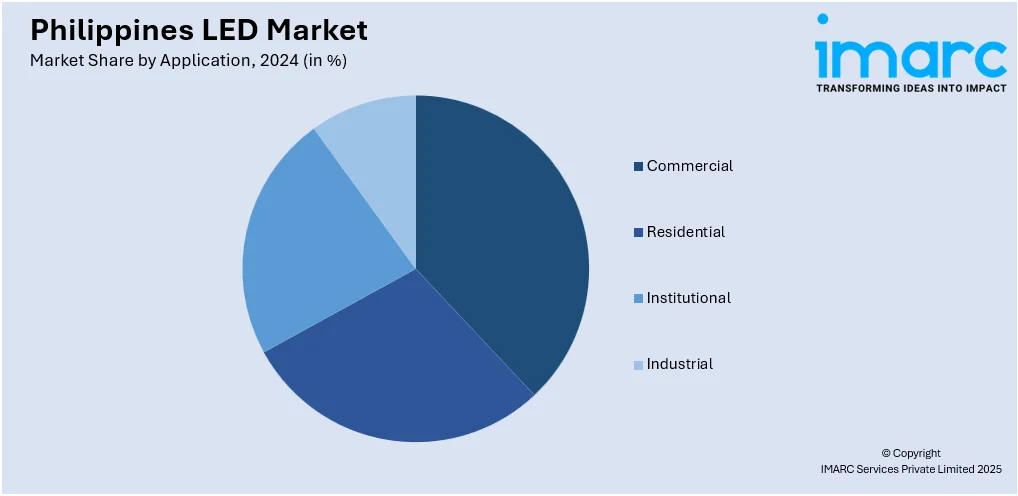

Breakup by Application:

- Commercial

- Residential

- Institutional

- Industrial

Residential represents the largest market segment

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes custom commercial, residential, institutional, and industrial. According to the report, residential accounted for the largest market share.

LED technology consists of diverse and impactful uses in residential applications, revolutionizing the way homes are illuminated and enhancing overall living experiences. LED lighting solutions are extensively employed for general illumination, such as in ceiling fixtures, pendant lights, and chandeliers, providing efficient and versatile lighting options for various rooms. LEDs are also popular for task lighting, like under-cabinet lights in kitchens and reading lamps in bedrooms. Their focused and directional light output aids in enhancing visibility and functionality in specific areas. Smart LED solutions, incorporating wireless controls and compatibility with home automation systems, empower residents to manage lighting remotely, enhancing convenience and energy management. Incorporating LED lighting into residential spaces not only ensures efficient and visually appealing illumination but also aligns with sustainable living practices. These multifaceted uses establish LEDs as an indispensable element in modern home lighting, reflecting the market research company's role as an informed authority in the realm of LED applications.

Breakup by Installation Type:

- New Installation

- Retrofit Installation

Retrofit Installation dominates the market

A detailed breakup and analysis of the market based on element type has also been provided in the report. This includes new installation and retrofit installation. According to the report, retrofit installation accounted for the largest market share.

Retrofitting traditional lighting fixtures with LED technology offers a direct pathway to significant energy savings, aligning with the country's emphasis on reducing energy consumption and lowering utility costs. Cost savings play a pivotal role. LEDs' extended lifespan and reduced maintenance requirements translate to long-term financial benefits for consumers and businesses. The lower frequency of replacements and decreased need for maintenance efforts contribute to substantial cost reductions over time. Environmental considerations amplify the demand for retrofit installations. By replacing energy-intensive incandescent or fluorescent bulbs with energy-efficient LEDs, carbon emissions are reduced, supporting the Philippines' commitment to sustainable practices. Furthermore, the simplicity of retrofitting makes it an attractive option. The compatibility of LED retrofits with existing fixtures ensures a hassle-free transition, requiring minimal modifications to the infrastructure.

Competitive Landscape:

In the Philippines LED market, key players are strategically leveraging several initiatives to establish their prominence and meet evolving consumer demands. Leading companies are prioritizing research and development to innovate new LED products with enhanced efficiency, longevity, and advanced features. They are actively collaborating with local partners to ensure efficient distribution and access to their products across diverse regions of the country. Moreover, these players are engaging in robust marketing campaigns to educate consumers and businesses about the benefits of LED technology, emphasizing energy savings, environmental sustainability, and superior lighting quality. Some companies are investing in local manufacturing facilities, thereby contributing to domestic production, and fostering job creation. Additionally, partnerships with government entities and participation in energy efficiency programs underline their commitment to aligning with regulatory frameworks and national objectives. These key players are also embracing digitalization and smart lighting solutions, capitalizing on the growing trend of intelligent and interconnected lighting systems. By strategically combining product innovation, market education, partnerships, and sustainability, these prominent players assert their authority and influence within the Philippines LED market.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

Recent Developments:

- In May 2018, Sharp Philippines Corporation (SPC), a leading global manufacturer of electronics and home appliances, through its President and General Manager, Kazuo Kito, unveiled in the country the 'world first' AQUOS 8K LED TV.

- In June 2023, TCL Introduced New Mini LED QLED TVs, Soundbars, and Smart Home Devices, Delivering Immersive Entertainment to Audiences in the Philippines

- In April 2023, TVS Motor rolls out the NTORQ 125 Race Edition scooter in the Philippines.

Philippines LED Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Panel Lights, Down Lights, Street Lights, Tube Lights, Bulbs, Others |

| Applications Covered | Commercial, Residential, Institutional, Industrial |

| Installation Types Covered | New Installation, Retrofit Installation |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines LED market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Philippines LED market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the LED industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines LED market was valued at USD 819.7 Million in 2024.

We expect the Philippines LED market to exhibit a CAGR of 10.93% during 2025-2033.

The rising demand for energy-efficient lighting technology, such as LEDs, as they offer better light quality, minimum maintenance, possess a longer shelf life, and are non-toxic in nature, is primarily driving the Philippines LED market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary closure of various manufacturing units for LEDs.

Based on the product type, the Philippines LED market can be categorized into panel lights, down lights, street lights, tube lights, bulbs, and others. Currently, panel lights account for the majority of the total market share.

Based on the application, the Philippines LED market has been segregated into commercial, residential, institutional, and industrial. Among these, residential currently exhibits a clear dominance in the market.

Based on the installation type, the Philippines LED market can be bifurcated into new installation and retrofit installation. Currently, retrofit installation holds the largest market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)