Philippines Lithium-ion Battery Market Size, Share, Trends and Forecast by Product Type, Power Capacity, Application, and Region, 2026-2034

Philippines Lithium-ion Battery Market Summary:

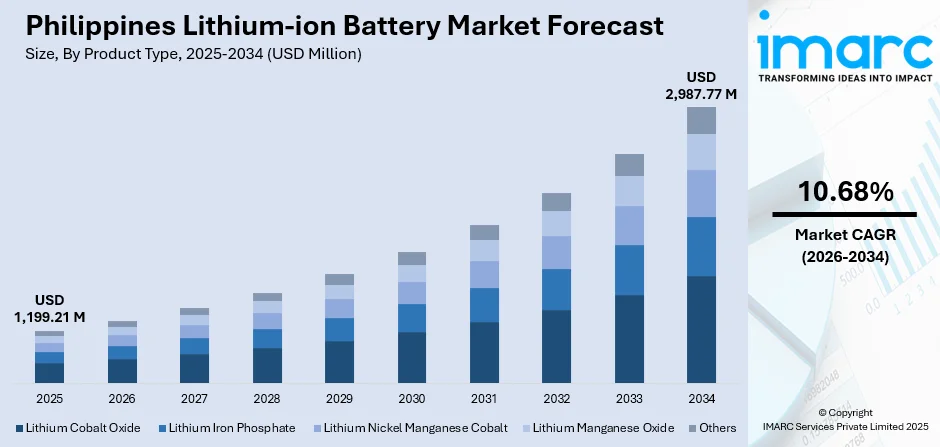

The Philippines lithium-ion battery market size was valued at USD 1,199.21 Million in 2025 and is projected to reach USD 2,987.77 Million by 2034, growing at a compound annual growth rate of 10.68% from 2026-2034.

The remarkable expansion of the market is primarily driven by accelerating electric vehicle (EV) adoption supported by government zero-tariff policies under the Electric Vehicle Industry Development Act, rapid deployment of renewable energy projects requiring integrated battery storage solutions, and surging demand for consumer electronics powered by rising smartphone penetration and internet connectivity across the archipelago, collectively expanding the Philippines lithium-ion battery market share.

Key Takeaways and Insights:

-

By Product Type: Lithium iron phosphate dominates the market with a share of 30.09% in 2025, as it provides superior safety, thermal stability, and cost-effectiveness, making it ideal for electric vehicles (EV) and energy storage.

-

By Power Capacity: 0 to 3000mAh leads the market with a share of 40.15% in 2025, since it powers smartphones, wearables, and portable electronics, dominating the Philippines' mobile-first digital economy and consumer market.

-

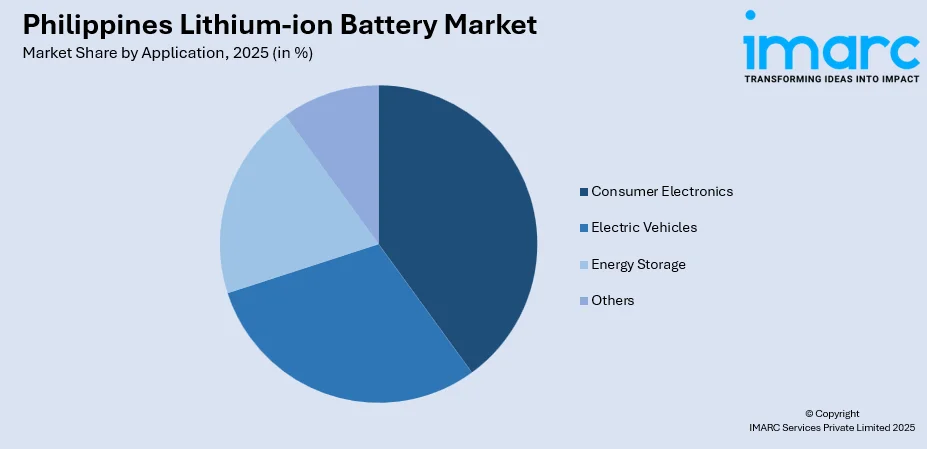

By Application: Consumer electronics represent the largest segment with a market share of 35.14% in 2025, driven by smartphone penetration, laptops, tablets, and wearables supporting the country’s digital transformation.

-

By Region: Luzon leads the market with a share of 58% in 2025, as the region hosts Metro Manila, manufacturing facilities, renewable projects, and StB Giga Factory, concentrating economic activity and infrastructure.

-

Key Players: Market players in the Philippines are ramping up local battery production capacity, investing in advanced battery chemistries, supporting energy storage integration with renewable projects, forming partnerships across EV and storage sectors, and exploring recycling and supply chain expansion to meet rising demand.

To get more information on this market Request Sample

The Philippines lithium-ion battery market is experiencing transformative growth fueled by the convergence of electric mobility transition, renewable energy expansion, and digital connectivity proliferation. Government initiatives through the Electric Vehicle Industry Development Act enacted in 2022 and subsequent zero-tariff policies implemented in 2024 have catalyzed unprecedented market momentum, with electric vehicle registrations reaching 29,715 units by July 2025. Concurrently, the nation's aggressive renewable energy targets mandating utilities to source power from renewables in 2025, are driving massive investments in battery energy storage systems. The establishment of domestic battery manufacturing capabilities represents a strategic inflection point as the Philippines' first advanced lithium iron phosphate battery manufacturing plant with an initial production capacity of 300 megawatt-hours annually. This facility symbolizes the country's evolution from a raw material exporter to an active participant in the battery value chain, positioning the Philippines as an emerging hub for smart and sustainable industries.

Philippines Lithium-ion Battery Market Trends:

Accelerating Electric Vehicle Adoption Transforming Automotive Landscape

The Philippine electric vehicle market is witnessing explosive growth driven by favorable government policies and increasing consumer acceptance of battery-powered mobility solutions. Electric vehicle sales increased 62.1% on a monthly basis to 3603 units as per the data provided by Chamber of Automotive Manufacturers of the Philippines Inc. (CAMPI). As of April 2025, the government has recognized and accredited 687 battery electric vehicles, 55 plug-in hybrid electric vehicles, 88 hybrid electric vehicles, and 80 light electric vehicles. This rapid electrification is fundamentally altering lithium-ion battery demand dynamics across power capacities and chemistries, with international players capturing a remarkable portion of the market share in the battery electric vehicle segment through competitive pricing strategies and aggressive dealership network expansion.

Expansion of Renewable Energy Storage Infrastructure Driving Grid-Scale Demand

The Philippines is experiencing unprecedented growth in renewable energy deployment coupled with battery energy storage systems to address grid stability challenges and intermittency issues associated with solar and wind power generation. The Department of Energy targeted adding 1.98 gigawatts of solar capacity alongside 590 megawatts of battery storage in 2024 as part of over 4.2 gigawatts of renewable energy projects. The government's National Renewable Energy Programme has established clear goals of achieving at least 35% renewable energy share in the power generation mix by 2030, aspiring to increase this to at least 50 percent by 2040, with solar accounting for the largest share of new clean generation projects requiring power capacity including both utility-scale and rooftop installations.

Establishment of Domestic Battery Manufacturing Capabilities Through Strategic Investments

The Philippines is transitioning from a purely raw material exporter to an active participant in battery manufacturing, marking a significant evolution in the country's battery value chain positioning. In 2024, President Ferdinand Marcos Jr. inaugurated the StB Giga Factory at Filinvest Innovation Park in New Clark City, Tarlac, representing the Philippines' first manufacturing plant for advanced lithium iron phosphate batteries. Funded by Brisbane-based private equity firm StB Capital Partners, the facility has an initial production capacity of 300 megawatt-hours annually, equivalent to approximately 6,000 electric vehicle batteries or 60,000 home battery systems in developing countries, with plans to reach full production capacity of 2 gigawatt-hours per year by 2030. The factory expects to create direct and indirect jobs in engineering, technical, finance, and administrative sectors.

Market Outlook 2026-2034:

The Philippines lithium-ion battery market is poised for sustained expansion throughout the forecast period, propelled by the convergence of electric mobility proliferation, renewable energy infrastructure buildout, and consumer electronics penetration deepening across socioeconomic segments. The market generated a revenue of USD 1,199.21 Million in 2025 and is projected to reach a revenue of USD 2,987.77 Million by 2034, growing at a compound annual growth rate of 10.68% from 2026-2034. The establishment of domestic manufacturing capabilities signals the maturation of local production ecosystems that will reduce import dependencies and strengthen supply chain resilience.

Philippines Lithium-ion Battery Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Lithium Iron Phosphate |

30.09% |

|

Power Capacity |

0 to 3000mAh |

40.15% |

|

Application |

Consumer Electronics |

35.14% |

|

Region |

Luzon |

58% |

Product Type Insights:

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Lithium Manganese Oxide

- Others

Lithium iron phosphate dominates with a market share of 30.09% of the total Philippines lithium-ion battery market in 2025.

Lithium Iron Phosphate batteries have emerged as the dominant chemistry in the Philippines lithium-ion battery market due to their superior safety characteristics, exceptional thermal stability, longer cycle life, and cost-effectiveness compared to alternative chemistries, making them particularly suitable for electric vehicle and stationary energy storage applications that prioritize reliability and longevity over energy density maximization. The establishment of domestic manufacturing infrastructure specifically targeting lithium iron phosphate technology has accelerated market adoption, exemplified by President Marcos inaugurating the StB Giga Factory at Filinvest Innovation. This strategic focus on lithium iron phosphate chemistry aligns with the government's electric vehicle ambitions under the Electric Vehicle Industry Development Act, as these batteries offer optimal balance between performance, safety, and affordability for the price-sensitive Philippine market, while simultaneously supporting the renewable energy sector's requirements for robust, long-duration battery energy storage systems capable of withstanding the tropical climate conditions and providing reliable grid stabilization services for solar and wind integration.

Power Capacity Insights:

- 0 to 3000mAh

- 3000mAh to 10000mAh

- 10000mAh to 60000mAh

- More than 60000mAh

0 to 3000mAh leads with a share of 40.15% of the total Philippines lithium-ion battery market in 2025.

The 0 to 3000mAh power capacity segment commands the largest market share in the Philippines lithium-ion battery market, driven predominantly by the exponential growth of portable consumer electronics including smartphones, wearable devices, wireless earphones, and compact power banks that have become ubiquitous across urban and increasingly rural Filipino communities. The proliferation of these battery-powered devices is fundamentally linked to the Philippines' mobile-first digital economy, where smartphone penetration has increased and continues ascending as affordable handset options flood the market alongside expanding 4G and emerging 5G telecommunications infrastructure.

Consumer electronics original equipment manufacturers and assemblers represent the leading end-user segment due to continuous demand for portable devices and gadgets assembled in or imported into the Philippines, which rely heavily on lithium-ion cells in this capacity range to power daily communications, entertainment, productivity, and financial transactions. The segment benefits from robust domestic consumption patterns characterized by frequent device upgrades driven by evolving feature requirements, planned obsolescence cycles, and aspirational brand preferences, particularly among the country's youthful demographic profile, creating sustained replacement demand for batteries in this power capacity range across diverse product categories.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Consumer Electronics

- Electric Vehicles

- Energy Storage

- Others

Consumer electronics exhibits a clear dominance with a 35.14% share of the total Philippines lithium-ion battery market in 2025.

Consumer Electronics represents the largest application segment in the Philippines lithium-ion battery market, reflecting the archipelago's profound digital transformation and mobile-first connectivity patterns that have positioned smartphones, laptops, tablets, and wearable technology as essential tools for communication, education, commerce, and entertainment across all socioeconomic strata. The consumer electronics original equipment manufacturers and assemblers segment leads market demand due to the continuous flow of portable devices and gadgets assembled domestically or imported into the Philippines, all of which rely heavily on lithium-ion and lithium-polymer cells for power delivery.

According to GSMA Intelligence, the Philippines had 142 million mobile cellular connections at the start of 2025. This is supported by rising internet connectivity penetration rates and mobile-first usage patterns that have made handheld devices the primary gateway to digital services for millions of Filipinos who increasingly conduct banking transactions, online shopping, social media engagement, and remote work activities through these battery-powered platforms. The consumer electronics sector in the Philippines is, driven by increased smartphone and gadget usage, with demand further amplified by the country's young demographic profile where tech-savvy consumers exhibit strong appetites for device upgrades and premium features including enhanced battery life, fast charging capabilities, and improved energy efficiency that collectively drive sustained replacement cycles and incremental capacity growth in lithium-ion cell requirements across diverse product categories.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon leads with a share of 58% of the total Philippines lithium-ion battery market in 2025.

Luzon dominates the Philippines lithium-ion battery market with 58 percent share, driven by the concentration of economic activity, population density, manufacturing facilities, and infrastructure development on the country's largest and most populous island. Metro Manila, the national capital region located in Luzon, serves as the primary hub for technology companies, automotive dealerships, electronics assembly operations, and commercial energy storage projects, creating dense demand clusters for lithium-ion batteries across consumer electronics, electric vehicle, and stationary storage applications. The region's dominance is further reinforced by major renewable energy projects, representing one of the largest integrated solar and battery storage facilities.

The region benefits from superior charging infrastructure relative to other Philippine regions, with higher concentrations of electric vehicle charging stations primarily deployed across Metro Manila and surrounding provinces to support the growing fleet of battery electric vehicles and plug-in hybrid electric vehicles. Additionally, Luzon's high population density and concentration of technology-savvy consumers with higher average incomes relative to other regions translate into stronger consumer electronics adoption rates, creating sustained demand for smartphones, laptops, tablets, and wearable devices that collectively drive lithium-ion battery consumption in smaller power capacity ranges.

Market Dynamics:

Growth Drivers:

Why is the Philippines Lithium-ion Battery Market Growing?

Government Support Through Electric Vehicle Industry Development Act and Zero-Tariff Policies

The Philippine government has implemented comprehensive policy frameworks that provide powerful fiscal and non-fiscal incentives to catalyze electric vehicle adoption and battery industry development, fundamentally transforming market economics and accelerating lithium-ion battery penetration across automotive, renewable energy, and consumer electronics applications. The Electric Vehicle Industry Development Act, enacted in April 2022 as Republic Act No. 11697, established an enabling environment for competitive, equitable, and non-discriminatory private sector participation in the electric vehicle ecosystem, with preference for indigenous technologies to attain long-term goals of energy security, energy sufficiency, and stable energy prices. The comprehensive roadmap established under this legislation includes four critical components encompassing electric vehicles and electric vehicle charging stations, manufacturing capabilities, human resource development, and research and development initiatives, providing a holistic framework for industry maturation. In May 2024, the National Economic and Development Board approved an extension of the most-favored-nation zero-tariff rate on battery electric vehicles and components, upholding the decision to impose temporary zero-tariff import rates on 34 battery electric vehicle products until 2028, which were initially introduced through Executive Order No. 12 in February 2023 following a one-year review period.

Renewable Energy Portfolio Standards and Grid Storage Requirements

The Philippines has established ambitious renewable energy targets accompanied by specific portfolio standards and grid storage mandates that are generating substantial demand for large-scale lithium-ion battery systems to address intermittency challenges, enhance grid stability, and enable higher renewable energy penetration rates across the national power infrastructure. The government has implemented renewable energy portfolio standards requiring utilities to ensure that 35% of their annual power supply comes from renewable sources by 2030. In July 2024, the Department of Energy announced plans to launch competitive solicitation for variable renewable energy paired with energy storage before year-end, specifically targeting integrated renewable energy with energy storage systems to be procured through the fourth wave of the Green Energy Auction Program, demonstrating the government's proactive steps to accelerate battery storage deployment at the national level and create sustained market opportunities for lithium-ion battery suppliers and project developers.

Surging Consumer Electronics Demand

The Philippines lithium-ion battery market is experiencing robust growth propelled by the exponential expansion of consumer electronics adoption across all socioeconomic segments, fueled by the archipelago's rapid digital transformation, mobile-first internet usage patterns, and the proliferation of affordable smartphones and connected devices that have become essential tools for communication, commerce, education, and entertainment. As per IMARC Group, the consumer electronics sector in the Philippines is projected to reach USD 17.48 Billion by 2033. This growth is primarily driven by increased smartphone and gadget usage, with the market experiencing particularly strong growth in portable device categories including smartphones, tablets, laptops, wearable technology, wireless earphones, and power banks that all rely on lithium-ion batteries for portable power delivery.

Market Restraints:

What Challenges the Philippines Lithium-ion Battery Market is Facing?

Limited Charging Infrastructure Outside Metropolitan Areas

The Philippines lithium-ion battery market faces significant constraints due to inadequate charging infrastructure deployment beyond major urban centers, creating psychological barriers around range anxiety that discourage potential electric vehicle purchasers and limit battery-powered mobility adoption despite favorable government policies and growing consumer interest in sustainable transportation alternatives. As of late 2024, electric vehicle charging stations nationwide remained far below the estimated locations needed by 2030 to support projected electric vehicle growth trajectories, with existing infrastructure concentrated primarily in Metro Manila and select provincial capitals while vast rural and island communities lack accessible public charging options. This scarcity creates a classic chicken-and-egg problem where consumers hesitate to purchase electric vehicles due to concerns about finding charging stations during trips beyond their home charging range, while infrastructure investors remain reluctant to build charging networks without sufficient electric vehicle volumes to generate adequate utilization rates and financial returns on capital deployed.

Raw Material Price Volatility and Supply Chain Concentration

The Philippines lithium-ion battery market is constrained by significant price volatility of critical battery raw materials including lithium, nickel, cobalt, manganese, and graphite, driven by geopolitical factors, environmental regulations, production disruptions, and demand-supply imbalances in global commodity markets that create uncertainty around battery production costs and potentially undermine the economic competitiveness of battery-powered solutions relative to conventional fossil fuel alternatives. In 2024 and 2025, the lithium market specifically faced significant bearish pressure with weak downstream buying activity, while nickel markets experienced modest price increases despite ongoing oversupply concerns, creating divergent commodity price trends that complicate procurement strategies and financial planning for battery manufacturers and electric vehicle producers.

Integration Challenges with Existing Energy Infrastructure

The Philippines lithium-ion battery market confronts substantial technical and regulatory obstacles related to integrating battery energy storage systems into existing power grid infrastructure, requiring resolution of compatibility issues, establishment of appropriate market mechanisms, and development of standardized operating protocols to enable efficient grid-scale storage deployment and maximize the value proposition of battery investments for utility operators and independent power producers. Incorporating battery energy storage systems effectively into the power grid requires addressing technical compatibility with existing generation assets, transmission infrastructure, and distribution networks, as well as developing sophisticated control systems capable of managing charge and discharge cycles, frequency regulation, voltage support, and other ancillary services that battery systems can provide to enhance grid stability and reliability. Regulatory frameworks governing battery energy storage systems remain under development, creating uncertainty around ownership models, grid connection requirements, performance standards, safety protocols, and compensation mechanisms for services provided by storage assets, which can delay project approvals and limit investor confidence in the economic returns achievable from battery storage investments.

Competitive Landscape:

Key market players in the Philippines lithium-ion battery market are focusing on scaling domestic manufacturing to reduce import reliance and improve supply security. Investments are flowing into energy storage systems supporting solar and wind projects, driven by grid stability needs and off-grid electrification. Companies are aligning operations with electric vehicle adoption by developing batteries suited for two-wheelers, public transport, and fleet use. Strong attention is placed on battery management systems to improve safety, lifespan, and performance under tropical conditions. Players are also working with government bodies to align with clean energy targets and local content requirements. Recycling and second-life battery applications are gaining traction as firms prepare for future waste management obligations. Supply chain partnerships are expanding across Southeast Asia to secure raw materials and control costs. Skills development and technology transfer initiatives are underway to support long-term industry capability and attract foreign investment into advanced battery manufacturing and energy storage solutions.

Recent Developments:

-

In October 2025, Voltai, a venture within AboitizPower’s 1882 Energy Ventures, has launched the first extensive battery swapping ecosystem for electric two-wheelers in the Philippines, aiming at companies that depend on fleet operations. Launched at Cleanfuel Pasig City on October 22, 2025, the innovative business-to-business (B2B) approach intends to boost e-mobility integration within logistics, delivery, and ride-hailing companies by providing a quicker, more economical option compared to fuel-based fleets. Voltai's system integrates rented electric motorcycles, interchangeable lithium-ion batteries, and a digital management system. Riders can track battery health, find the closest swap station using Google Maps, and view their trip and swap history through mobile and web applications. Fleet managers can obtain information on mileage, emission reductions, and driver performance.

Philippines Lithium-ion Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt, Lithium Manganese Oxide, Others |

| Power Capacities Covered | 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, More than 60000mAh |

| Applications Covered | Consumer Electronics, Electric Vehicles, Energy Storage, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines lithium-ion battery market size was valued at USD 1,199.21 Million in 2025.

The Philippines lithium-ion battery market is expected to grow at a compound annual growth rate of 10.68% from 2026-2034 to reach USD 2,987.77 Million by 2034.

Lithium iron phosphate holds the largest market share at 30.09%, driven by its superior safety characteristics, exceptional thermal stability, longer cycle life, and cost-effectiveness. The establishment of the StB Giga Factory in September 2024 as the Philippines' first advanced lithium iron phosphate battery manufacturing plant has further strengthened this segment's market position through domestic production capabilities and reduced import dependencies.

Key factors driving the Philippines lithium-ion battery market include government zero-tariff policies under the Electric Vehicle Industry Development Act, renewable energy portfolio standards requiring clean power by 2040, and surging consumer electronics demand with high smartphone penetration.

Major challenges include inadequate charging infrastructure beyond urban centers with stations far below the required number needed by 2030, raw material price volatility for lithium and nickel, and technical complexities integrating battery storage systems into existing power grids.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)