Philippines Livestock and Poultry Market Size, Share, Trends and Forecast by Animal Type, Product Type, Farming Type, Distribution Channel, and Region, 2025-2033

Philippines Livestock and Poultry Market Overview:

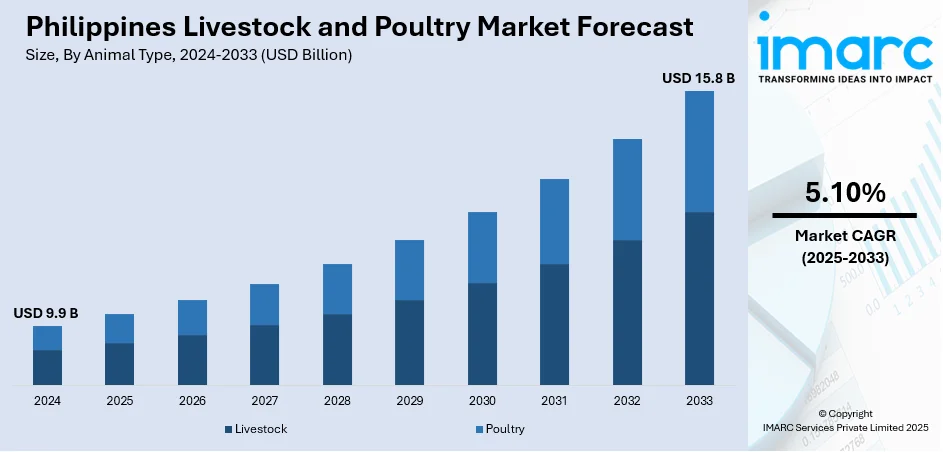

The Philippines livestock and poultry market size reached USD 9.9 Billion in 2024. Looking forward, the market is expected to reach USD 15.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5.10% during 2025-2033. The market is growing, fueled by rising demand for meat products, government incentives, and advances in farming technology. In line with this, investments in animal feed manufacturing, biosecurity, and disease management are major factors favoring sector growth and food security.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.9 Billion |

| Market Forecast in 2033 | USD 15.8 Billion |

| Market Growth Rate 2025-2033 | 5.10% |

Key Trends of Philippines Livestock and Poultry Market:

Technological Advancements in Livestock Production

The livestock and poultry sector of the Philippines is on the growth path with the creation of production technologies. The production technologies are improving the sustainability and efficiency of farm production, resulting in increased market supply and strengthening the meat industry of the nation. Further, the enhanced application of precision farming, automated systems, and technology-based data has raised productivity, making farmers better able to scale up operations and promote animal well-being. In addition, these technologies enable improved monitoring of farm animals, healthier animals, and higher-quality meat products. For instance, in September 2024, Aboitiz Foods inaugurated its USD 45 Million animal feed plant in Long An, Vietnam, which had a direct impact on its Southeast Asian operations, including the Philippines. This new plant, with an annual capacity of 300,000 Tons, assists in creating more quality feeds and supports the growing demand for poultry and livestock production in the region. Aboitiz's investment is an affirmation of its commitment to expanding the agricultural market, most especially in the Philippines, which lies at the core of the company's development. These innovations also provide a guaranteed supply of quality animal feed that has a direct effect on the livestock and poultry sector. Furthermore, they supplement the Philippine government's drive toward food security since they are included in the nation's growing self-sufficiency in animal protein production.

To get more information on this market, Request Sample

Government Support and Market Expansion

Government policies also drive the growth of the Philippines' livestock and poultry industry. Government policies aimed at promoting food security and better sustainable agriculture practices have provided immense support to the industry. Furthermore, policies that encourage investments in feed production, animal health, and infrastructure are central to ensuring competitiveness in the livestock and poultry sectors. The past few years have seen the Philippine Department of Agriculture (DA) undertake initiatives to address challenges such as African Swine Fever (ASF) and Highly Pathogenic Avian Influenza (HPAI), which have pushed the industry off track. Through actions such as the introduction of ASF vaccines, the strengthening of border control measures, and augmenting aid to local farmers, the government is attempting to reduce risks of disease and improve market stability. Along with this, the DA's programs are paying dividends, leading the industry to heal and expand. Companies like Aboitiz Foods, with its animal feed factories, are set to benefit from these beneficial policies. Since the market continues to develop, such investments will help enhance general productivity and have a steady supply of quality meat products, benefiting the consumers as well as the general economy.

Growth Drivers of Philippines Livestock and Poultry Market:

Rising Domestic Protein Consumption

The Philippines is witnessing a consistent rise in demand for meat, poultry, and eggs based on an increase in the middle-class demographic with greater disposable incomes and changing dietary habits. Consumers are turning towards more health-oriented diets with high protein intake and demanding fresh, safe, and quality animal products. This trend is also complemented by increased knowledge about balanced nutrition, which has resulted in increased consumption of lean meats and eggs as part of daily meals. Both urban and rural homes are fueling this increasing demand, leading producers to increase production capacity and upgrade quality standards. With population expansion and income enhancements set to persist, the livestock and poultry industry is poised to ride enhanced domestic demand for protein-rich food ingredients.

Urbanization and Cold Chain Development

Rapid urbanization in the Philippines is transforming the livestock and poultry market, as expanding cities create larger, more concentrated consumer bases. To meet this growing demand, the development of modern cold chain infrastructure has become essential. Investments in refrigerated transport, cold storage facilities, and temperature-controlled retail environments are enabling the efficient distribution of meat and poultry while preserving product freshness and safety. Improved logistics reduce spoilage, extend shelf life, and allow producers to serve markets beyond their immediate regions. These advancements not only improve domestic supply chains but also support export readiness, ensuring products meet international quality standards, which further drives the Philippines livestock and poultry market demand. Together, urban growth and cold chain expansion are strengthening market access and reliability for both producers and consumers.

Integration of Commercial Farming Practices

The Philippine livestock and poultry industry is increasingly adopting commercial, large-scale, and vertically integrated farming models to enhance productivity and market competitiveness. By consolidating breeding, feeding, processing, and distribution under a single operational framework, agribusinesses can achieve greater efficiency, quality consistency, and cost control. These integrated systems enable steady supply throughout the year, minimize production risks, and ensure traceability—a key factor for both domestic consumers and export buyers. Modern farming practices also encourage the use of advanced genetics, automated feeding systems, and sustainable resource management. As more producers embrace these methods, the sector becomes better equipped to meet rising demand, expand export potential, and maintain competitive pricing in an evolving regional and global market.

Opportunities of Philippines Livestock and Poultry Market:

Export Market Expansion

The Philippines has strong potential to grow its livestock and poultry exports, driven by increasing demand for high-quality meat and animal products in regional markets, particularly within ASEAN. Rising incomes and shifting dietary preferences in neighboring countries are fueling higher consumption of pork, chicken, and processed meat. This creates an opportunity for Filipino producers to position themselves as reliable suppliers, especially if they meet stringent international standards on food safety and quality. Investments in cold chain logistics, processing facilities, and certification programs can help boost competitiveness abroad. Expanding trade partnerships and leveraging free trade agreements will further enhance export potential, enabling the sector to diversify revenue sources while reducing reliance on domestic market fluctuations.

Value-Added Product Development

Transforming raw livestock and poultry into value-added products such as ready-to-cook marinated meats, pre-seasoned cuts, or ready-to-eat meals offers a lucrative growth path for the Philippines, which is driving the Philippines livestock and poultry market growth. This strategy caters to urban consumers and busy households seeking convenience without sacrificing taste or nutrition. By investing in processing technology, innovative packaging, and food safety compliance, producers can extend shelf life, reduce waste, and create differentiated offerings that appeal to modern lifestyles. Value-added products also open opportunities for branding and premium positioning, both in domestic retail and export markets. In addition, targeting niche segments like healthy meal kits or gourmet meat products can further expand customer reach and profitability while strengthening the country’s meat processing capabilities.

Sustainable and Organic Farming Niches

The rising consumer shift toward organic, antibiotic-free, and ethically raised livestock is creating new high-margin opportunities for Philippine producers, which is fueling the Philippines livestock and poultry market share. Health-conscious buyers and environmentally aware consumers are increasingly willing to pay premium prices for meat products that meet these standards. By adopting sustainable farming practices, such as free-range systems, eco-friendly waste management, and natural feed, farmers can tap into both domestic and export markets seeking cleaner, traceable food sources. Certification programs, farm-to-table marketing, and partnerships with specialty retailers can enhance credibility and brand value. While transitioning to organic or sustainable systems requires investment and careful planning, it offers long-term benefits in market differentiation, consumer trust, and alignment with global trends toward responsible and ethical food production.

Challenges of Philippines Livestock and Poultry Market:

Disease Outbreaks and Biosecurity Risks

The Philippines livestock and poultry sector faces ongoing threats from infectious diseases such as African swine fever (ASF) and avian influenza, which can severely disrupt production cycles and supply chains. Outbreaks often result in mass culling, reduced stock numbers, and significant revenue losses for farmers and suppliers. These incidents also affect consumer confidence, leading to lower demand and price instability. Weak biosecurity measures in smaller farms, coupled with limited veterinary resources in rural areas, make controlling the spread of pathogens more difficult. Strengthening surveillance systems, improving farm-level hygiene protocols, and investing in rapid response capabilities are essential to minimizing disease impact. Without sustained efforts in prevention and containment, such risks can undermine both domestic supply stability and export potential.

Feed Cost Volatility

Feed costs remain one of the largest expenses for livestock and poultry producers in the Philippines, heavily influenced by the global prices of corn, soy, and other key ingredients. Since the country relies significantly on imported feed materials, fluctuations in international commodity markets, currency exchange rates, and shipping costs directly impact production expenses. Even minor increases in feed prices can erode profit margins, especially for small and medium-scale farmers who lack economies of scale. According to the Philippines livestock and poultry market analysis, this volatility also makes long-term planning and price stability difficult, forcing producers to adjust herd sizes or production cycles in response. To reduce exposure, the sector is exploring locally sourced feed alternatives, feed efficiency innovations, and improved storage systems to manage costs more effectively and maintain competitiveness.

Climate and Environmental Pressures

The livestock and poultry industry in the Philippines operates in a climate highly vulnerable to extreme weather events such as typhoons, flooding, and drought. These conditions can damage infrastructure, disrupt supply chains, and affect feed availability, directly impacting production output. Rising temperatures and unpredictable rainfall patterns also influence animal health, fertility, and mortality rates. Beyond climate risks, environmental regulations aimed at controlling waste management, greenhouse gas emissions, and land use place additional operational requirements on farms. Compliance often demands investment in modern facilities and sustainable practices, which may strain smaller producers’ budgets. Building climate-resilient infrastructure, adopting eco-friendly waste treatment systems, and implementing water-efficient operations are crucial for maintaining stable production while meeting environmental sustainability goals.

Philippines Livestock and Poultry Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on animal type, product type, farming type, and distribution channel.

Animal Type Insights:

- Livestock

- Cattle

- Swine

- Goat

- Poultry

- Broilers

- Layers

- Ducks

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes livestock (cattle, swine, and goat) and poultry (broilers, layers, and ducks).

Product Type Insights:

- Meat

- Beef

- Pork

- Chicken

- Eggs and Dairy Products

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes meat (beef, pork, chicken) and eggs and dairy products.

Farming Type Insights:

- Commercial Farming

- Backyard Farming

A detailed breakup and analysis of the market based on the farming type have also been provided in the report. This includes commercial farming and backyard farming.

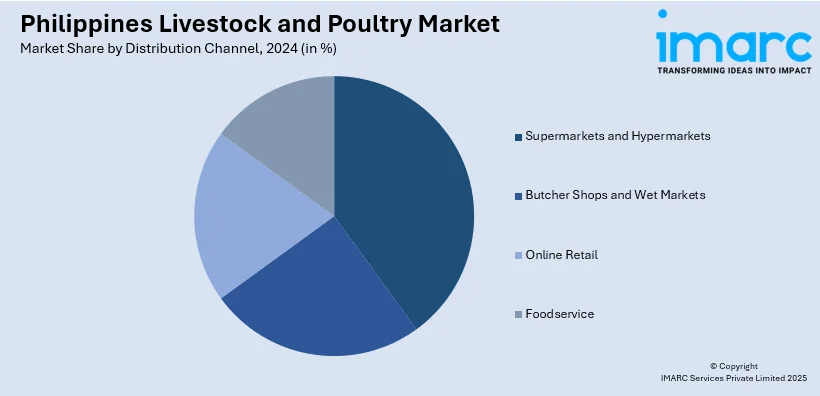

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Butcher Shops and Wet Markets

- Online Retail

- Foodservice

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, butcher shops and wet markets, online retail, and foodservice.

Regional Insights:

-

Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Livestock and Poultry Market News:

- October 2024: The Department of Agriculture (DA) launched the National Livestock and Poultry Month in the Philippines. The initiative, aimed at enhancing food security and empowering farmers, addressed challenges like ASF and HPAI, promoting sustainable practices and increasing competitiveness in the livestock and poultry sectors.

- September 2024: Aboitiz Foods inaugurated a USD 45 Million animal feed plant in Long An, Vietnam. The facility, with an annual capacity of 300,000 Tons, expanded Aboitiz's feed production to 1.1 Million Tons in Vietnam, supporting growth in the livestock and poultry markets across Asia.

Philippines Livestock and Poultry Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Animal Types Covered |

|

| Product Types Covered |

|

| Farming Types Covered | Commercial Farming, Backyard Farming |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Butcher Shops and Wet Markets, Online Retail, Foodservice |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines livestock and poultry market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines livestock and poultry market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines livestock and poultry industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The livestock and poultry market in the Philippines was valued at USD 9.9 Billion in 2024.

The Philippines livestock and poultry market is projected to exhibit a CAGR of 5.10% during 2025-2033.

The Philippines livestock and poultry market is projected to reach a value of USD 15.8 Billion by 2033.

The Philippines livestock and poultry market is seeing a shift toward modernized farming practices and technological advancements to improve efficiency and biosecurity. Increasing consumer shift toward organic, antibiotic-free, and ethically raised livestock is further creating new high-margin opportunities for Philippine producers that will propel the market.

The Philippines livestock and poultry market is driven by rising domestic demand for meat and eggs due to population growth and increasing disposable incomes. Government support for food security and modern farming, coupled with technological advancements in production and disease management, are also key growth factors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)