Philippines Logistics Market Report by Model Type (2 PL, 3 PL, 4 PL), Transportation Mode (Roadways, Seaways, Railways, Airways), End Use (Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, and Others), and Region 2026-2034

Philippines Logistics Market Overview:

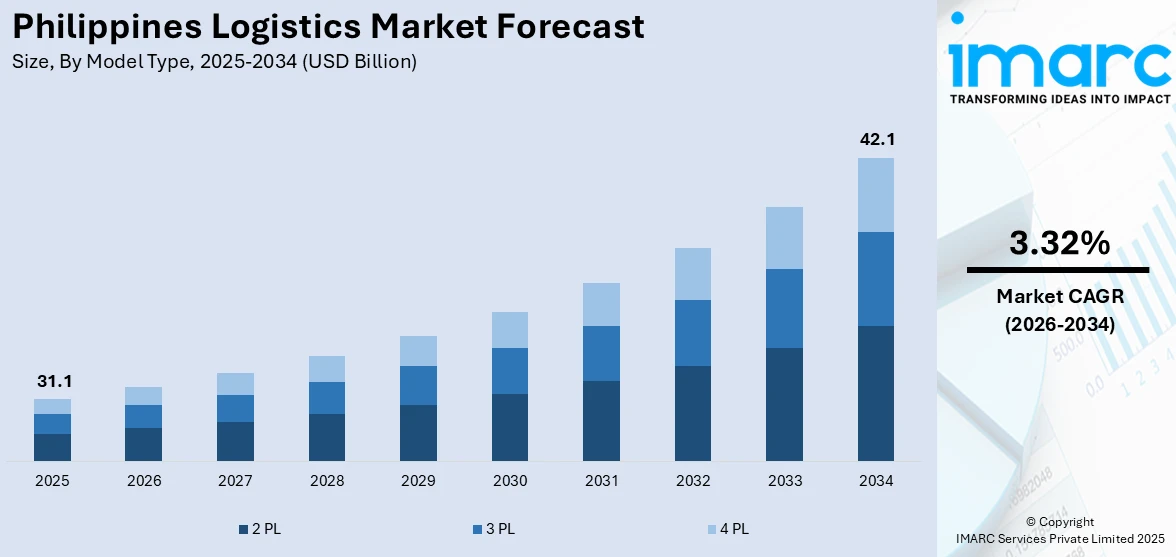

The Philippines logistics market size reached USD 31.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 42.1 Billion by 2034, exhibiting a growth rate (CAGR) of 3.6% during 2026-2034. The growing e-commerce activities, enhancements in transportation infrastructure, and government policies that aim to improve trade efficiency and establish the country as a key logistics center in Southeast Asia are some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 31.1 Billion |

| Market Forecast in 2034 | USD 42.1 Billion |

| Market Growth Rate (2026-2034) | 3.32% |

Philippines Logistics Market Trends:

Growing Popularity of E-commerce

According to the International Trade Administration, the e-commerce market in the Philippines saw sales of $17 billion in 2021, mainly due to 73 million active online users. It is predicted to increase to $24 billion, with a 17% rise, by 2025. The increasing number of online shoppers is driving the need for effective logistics services, especially in last-mile deliveries and warehousing. In order to handle this increase in demand, logistics firms are making significant investments in intelligent warehouses and enlarging their distribution networks. These investments are focused on improving the speed and efficiency of order processing and delivery, which are essential for meeting user demands for timely service. The changing logistics environment due to e-commerce expansion requires more flexibility and digital technology incorporation in logistics operations. This shift is not only about responding to present needs but also about ensuring the logistics industry is prepared for an ever-changing digital business environment.

To get more information on this market, Request Sample

Sustainable and Green Logistics Initiatives

The Philippines is actively promoting sustainable and eco-friendly logistics efforts to address environmental concerns and comply with global benchmarks. The shift towards sustainable logistics involves using electric vehicles (EVs), incorporating renewable energy sources in warehouses and transportation, and utilizing eco-friendly packaging choices. Implementing eco-friendly measures reduces the carbon footprint of logistics and meets the needs of eco-conscious individuals and businesses. The logistics industry in the Philippines is not only reducing its environmental impact but also encouraging innovation and creating opportunities for green logistics services through a focus on sustainability. For instance, in July 2023, Payo decided to make a sustainable change by adding EV cargo tricycles to Agila Logistics and Delivery Express's lineup in an effort to decrease carbon emissions. The initiative is part of a broader effort of Payo to promote environment-friendly logistics solutions, including bike deliveries and biodegradable pouches.

Growing Focus on Collaborations and Partnerships

In the Philippines, the logistics industry is seeing a rise in partnerships and collaborations in order to improve services and expand technological capabilities. These collaborations are vital for merging knowledge in different logistics areas like shipping, storing, and managing supply chains, allowing businesses to deliver customized solutions for a range of industry requirements. Collaborative initiatives also help open new markets by merging local companies with international corporations that bring in cutting-edge technologies and worldwide market knowledge. Additionally, these alliances help in cost reduction and risk-sharing, making significant investments more manageable and mitigating potential losses. These strategic partnerships are essential for maintaining competitiveness in a global marketplace, guaranteeing operational efficiency, and adhering to intricate regulatory requirements. In September 2023, Sojitz Fuso Philippines Corp. (SFP) and Bespoke Logistics partnered to improve automotive logistics in the Philippines, marked by a contract-signing ceremony. Bespoke Logistics offered comprehensive services, such as vehicle transport, storage management, and last-mile delivery, while SFP utilized its varied international business knowledge.

Philippines Logistics Market News:

- September 2023: Ninja Van Philippines improved its operational abilities by inaugurating a new 3,700 square meter warehouse in Cabuyao, Laguna, aimed at aiding small businesses in warehousing and inventory control. The service provided full Fulfillment services and smoothly connected with Ninja Van's final mile delivery, guaranteeing effective inventory control and quick parcel processing.

- February 2023: DHL Express Philippines enhanced its fleet by switching from an A300 to an A330-300, increasing cargo capacity from 42 to 55 tons and allowing for quicker shipments to Manila and Cebu. This investment greatly reduced delivery times, with inbound flights in Manila arriving up to 15 hours earlier and in Cebu up to 9 hours earlier.

Philippines Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on model type, transportation mode, and end use.

Model Type Insights:

- 2 PL

- 3 PL

- 4 PL

The report has provided a detailed breakup and analysis of the market based on the model type. This includes 2 PL, 3 PL, and 4 PL.

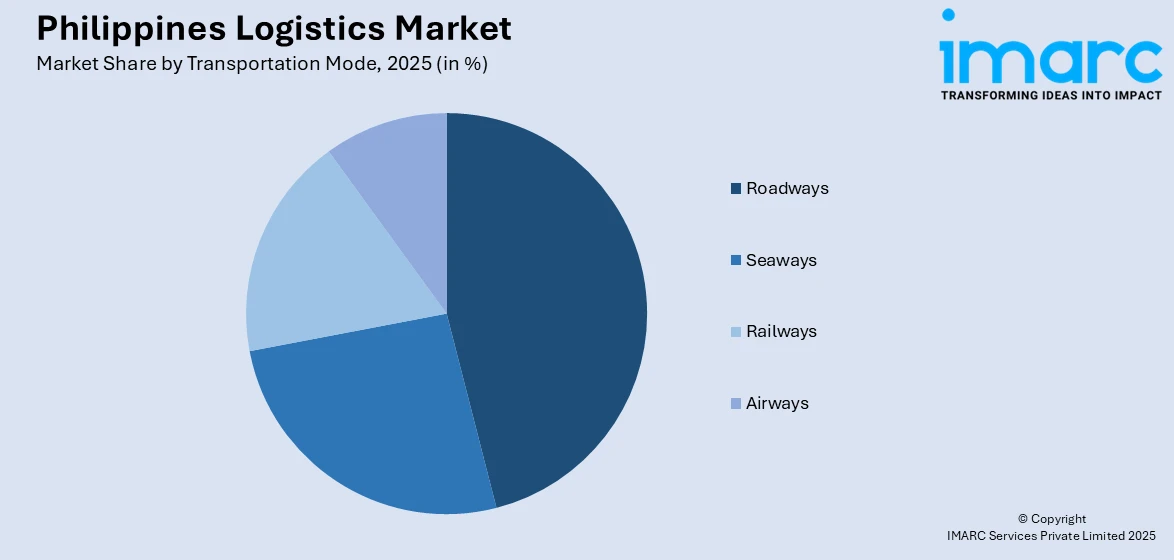

Transportation Mode Insights:

Access the comprehensive market breakdown Request Sample

- Roadways

- Seaways

- Railways

- Airways

A detailed breakup and analysis of the market based on the transportation mode have also been provided in the report. This includes roadways, seaways, railways, and airways.

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Users Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines logistics market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Philippines logistics market?

- What is the breakup of the Philippines logistics market on the basis of model type?

- What is the breakup of the Philippines logistics market on the basis of transportation mode?

- What is the breakup of the Philippines logistics market on the basis of end use?

- What are the various stages in the value chain of the Philippines logistics market?

- What are the key driving factors and challenges in the Philippines logistics?

- What is the structure of the Philippines logistics market and who are the key players?

- What is the degree of competition in the Philippines logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)