Philippines Luxury Fashion Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

Philippines Luxury Fashion Market Overview:

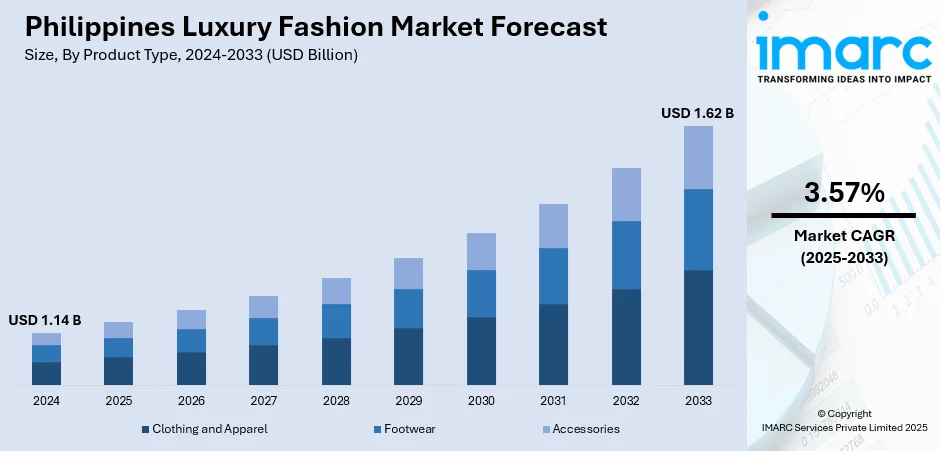

The Philippines luxury fashion market size reached USD 1.14 Billion in 2024. The market is projected to reach USD 1.62 Billion by 2033, exhibiting a growth rate (CAGR) of 3.57% during 2025-2033. The market is driven by growing disposable incomes of the urban population, greater exposure to international fashion trends via social media, and the increasing number of premium retail store launches. Additionally, rising tourism, particularly in metro cities such as Manila and Cebu, has also fueled demand for high-end fashion clothing and accessories. Furthermore, the rise of a younger consumer base desiring status and identity through luxury consumption further expands the Philippines luxury fashion market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.14 Billion |

| Market Forecast in 2033 | USD 1.62 Billion |

| Market Growth Rate 2025-2033 | 3.57% |

Philippines Luxury Fashion Market Trends:

Digitalization and E-Commerce Integration

Luxury fashion brands in the Philippines are increasingly adopting digital platforms as part of their retail strategy. This shift is driven by the changing behavior of affluent consumers who now expect seamless online experiences that mirror the exclusivity of in-store shopping. Moreover, high-end labels are enhancing their digital presence through personalized websites, mobile apps, and collaborations with curated online marketplaces. Besides this, luxury e-commerce platforms have also expanded their reach to Filipino customers, supported by improvements in logistics and payment infrastructure. Also, local luxury retailers are investing in virtual styling consultations, augmented reality (AR) fitting rooms, and private live-stream shopping events to recreate the premium feel of physical boutiques. Apart from this, social media channels, especially Instagram and TikTok, play a central role in brand engagement. According to industry reports, in January 2025, the Philippines recorded 90.8 Million social media user identities, covering 78% of the overall population. For individuals aged 18 and above, the usage rate surpassed 100%, reaching 116.6%, reflecting the prevalence of multiple accounts per user. With such high activity levels in the country, social media influencers are increasingly shaping consumer purchase decisions and directing traffic toward official retail channels. Furthermore, the integration of omnichannel services, including click-and-collect, flexible delivery, and concierge-level customer service, reflects the growing emphasis on convenience without sacrificing exclusivity. This trend signals a long-term redefinition of how luxury is marketed and sold in the Philippines.

To get more information on this market, Request Sample

Rising Influence of the Young Affluent Segment

Younger high-income consumers in the Philippines, particularly those aged 25–40, are significantly contributing to the Philippines luxury fashion market growth. Industry reports indicate that 17.1% of the population fell within the 25 to 34 age group, representing a sizable and influential consumer segment. Unlike older generations who associate luxury with formality and traditional displays of wealth, this group prioritizes self-expression, aesthetics, and cultural relevance. Their preferences lean toward distinctive pieces that highlight personal style over conventional status symbols, with strong interest in emerging designer brands, capsule collections, and lifestyle-driven luxury offerings. Moreover, this demographic is also highly engaged with digital culture, influencing how and where they discover luxury. They respond more to digital storytelling, authenticity, and sustainability messaging, prompting brands to evolve their communications and product strategies. In addition to this, experiences now matter as much as the product itself; pop-up events, limited-access product drops, and immersive brand spaces tailored to this audience are becoming more common. Also, financial accessibility tools such as luxury buy-now-pay-later schemes or installment-based credit card programs are increasing luxury's appeal among this segment. This shift toward a younger, digitally fluent, and value-conscious buyer base is reshaping the demand profile in the Philippine luxury market.

Philippines Luxury Fashion Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Clothing and Apparel

- Jackets and Coats

- Skirts

- Shirts and T-Shirts

- Dresses

- Trousers and Shorts

- Denim

- Underwear and Lingerie

- Others

- Footwear

- Accessories

- Gems and Jewellery

- Belts

- Bags

- Watches

The report has provided a detailed breakup and analysis of the market based on the product type. This includes clothing and apparel (jackets and coats, skirts, shirts and T-shirts, dresses, trousers and shorts, denim, underwear and lingerie, and others), footwear, and accessories (gems and jewellery, belts, bags, and watches).

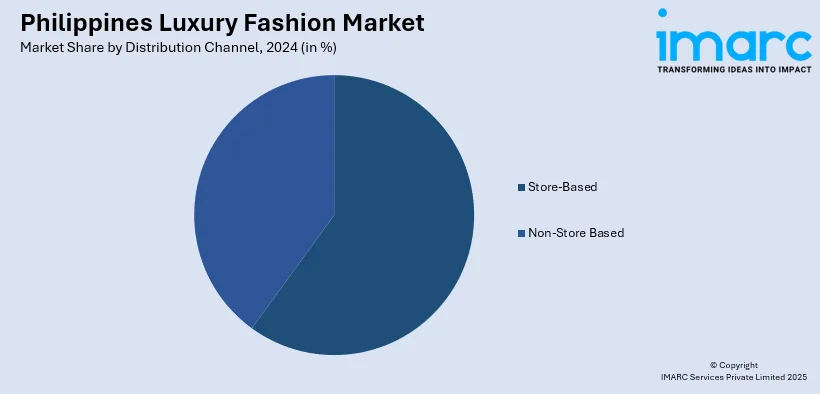

Distribution Channel Insights:

- Store-Based

- Non-Store Based

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes store-based and non-store based.

End User Insights:

- Men

- Women

- Unisex

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and unisex.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Luxury Fashion Market News:

- June 2025: French contemporary fashion label Sandro opened its first boutique in the Philippines, located at Greenbelt 5 in Manila, as part of its Southeast Asian expansion. The Paris‑based brand, founded in 1984 by Évelyne Chetrite, brings its signature blend of minimalist sophistication and trend‑forward design, offering ready‑to‑wear apparel, accessories, and footwear. The launch will deliver a “slice of Parisian elegance” to style-conscious Filipino consumers.

Philippines Luxury Fashion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Store-Based, Non-Store Based |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines luxury fashion market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines luxury fashion market on the basis of product type?

- What is the breakup of the Philippines luxury fashion market on the basis of distribution channel?

- What is the breakup of the Philippines luxury fashion market on the basis of end user?

- What is the breakup of the Philippines luxury fashion market on the basis of region?

- What are the various stages in the value chain of the Philippines luxury fashion market?

- What are the key driving factors and challenges in the Philippines luxury fashion market?

- What is the structure of the Philippines luxury fashion market and who are the key players?

- What is the degree of competition in the Philippines luxury fashion market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines luxury fashion market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines luxury fashion market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines luxury fashion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)