Philippines Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2026-2034

Philippines Meat Market Size and Share:

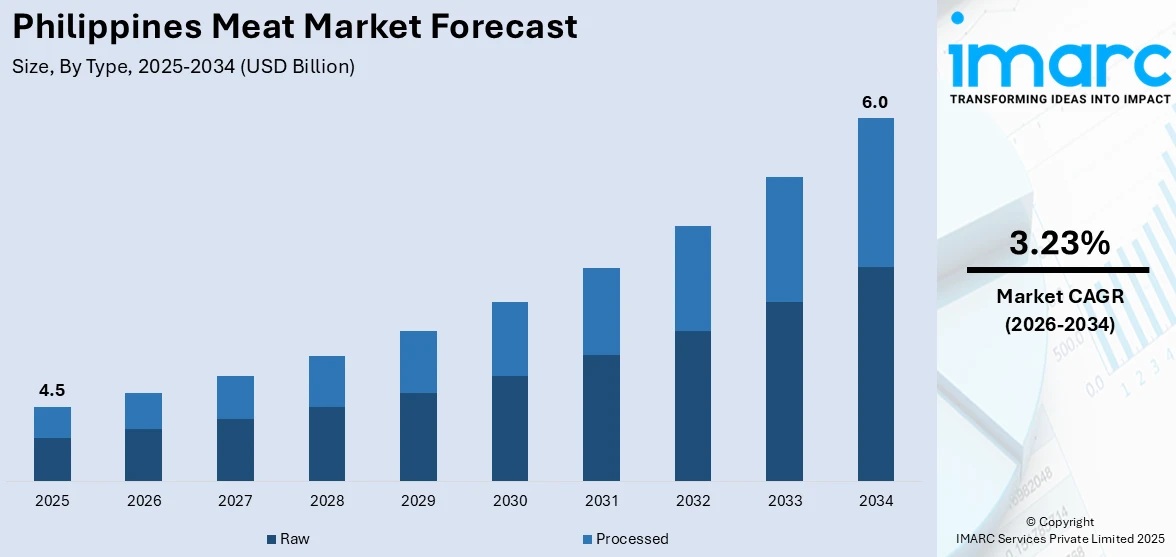

The Philippines meat market size reached USD 4.5 Billion in 2025. Looking forward, the market is expected to reach USD 6.0 Billion by 2034, exhibiting a growth rate (CAGR) of 3.23% during 2026-2034. The rising disposable incomes, rapid urbanization, evolving dietary preferences, expanding retail networks, robust food service demand, and increasing consumer interest in processed and value-added meat products are some of the key factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.5 Billion |

| Market Forecast in 2034 | USD 6.0 Billion |

| Market Growth Rate (2026-2034) | 3.23% |

Key Trends of Philippines Meat Market:

Increased Demand for Convenience and Processed Meat Products

Increasing preference towards the consumption of convenient and available ready-to-eat (RTE) meat products due to rapid urbanization which causes more dual-income households is said to become a significant factor contributing to market growth in the country. The busy lifestyles leaving little time for the preparation of meals are making consumers spend more on finished products like sausages, bacon, and frozen cuts. Local and global brands are joining in as they develop products that meet the Filipino palate, such as tocino and longganisa, which are significant to the culture, which is fueling the Philippines meat market share. For instance, in 2024, the Philippines witnessed a 20.4% rise in meat imports, totaling 1.45 billion kg. Pork led with a 23.96% increase, followed by chicken at 10.69% and beef, which surged 40.62%, indicating growing reliance on foreign meat supplies. Furthermore, the rapid growth of supermarkets and convenience stores in urban and semi-urban areas is making these products more accessible, solidifying their place as a household staple. This surging demand for convenience and time-saving food options is propelling the meat market forward.

To get more information on this market Request Sample

Rising Popularity of Sustainable and Ethical Meat Production

The environmental and ethical concerns of the consumers, in addition to the rising incidences of awareness towards climate change and animal welfare, have fueled the Philippines meat market growth. Following this, producers are adopting improved farming practices aimed at reducing carbon footprints and providing organic and grass-fed options. In the growing minds of middle and higher-income people, a health and sustainability issue mobilizes antibiotic-free and hormone-free meat products demand. For instance, in October 2024, San Miguel Corp will expand its poultry operations, opening more mega farms in Quezon and Bataan, as part of a US$1.2 billion investment to ensure affordable, healthy chicken supply and support food security. Furthermore, collaborations between local farmers and food chains are enhancing traceability and quality assurance, boosting consumer confidence in these premium offerings. This trend is reflecting the broader global movement toward eco-conscious consumption in the Philippines, which is contributing to the market expansion.

Expansion of Online Meat Retailing and Delivery Services

E-commerce platforms have changed the way consumers in the Philippines buy meat products by offering fresh and processed options through convenient digital channels. According to the Philippines meat market analysis, online meat retailers and grocery platforms provide complete solutions for the tech-savvy user who seeks fast and easy solutions to shopping. Furthermore, enhanced cold-chain logistics and improved packaging solutions ensure that meat is carried fresh and safe in transit, addressing concerns about the quality of meat by consumers. For instance, in December 2024, Growtheum Capital Partners invested P7 billion ($121 million) in Mets Logistics to expand its cold storage network in the Philippines, supporting food supply security. The cold chain sector's capacity is set to grow by 10-15% annually. Also, the offers, markdowns, and a different assortment of products on the cyberspace platforms are attracting more users-the customers-into going for online meat shopping. Most of the sensation is currently in urban and semi-urban areas, where digital infiltration and smartphone usage are at a higher percentage, making this market grow.

Growth Drivers of Philippines Meat Market:

Rising Disposable Income and Urbanization

As income levels climb and urban populations expand, Filipino consumers are increasingly able to afford and demand a wider variety of meat products. Urban lifestyles favor more frequent consumption of fresh and premium meats, prompting retailers and suppliers to offer upscale options. This shift encourages investment in refrigerated logistics, specialty cuts, and gourmet offerings. Urban consumers also influence retail strategies toward modern supermarkets and meat counters, improving accessibility to quality meats. These evolving consumer preferences support broader distribution channels and premium product lines, fueling expansion in the meat sector. As wealth and city living become more widespread, the meat market continues to benefit from consistent, elevated consumption patterns.

Growth of Foodservice and Quick-Service Restaurants

The rapid proliferation of restaurants, fast-food chains, and casual dining outlets in the Philippines is significantly boosting Philippines meat market demand. These establishments rely heavily on a consistent supply of proteins like chicken, pork, and beef to sustain menu variety and frequency. As the foodservice industry scales to accommodate rising demand from urban and suburban diners, suppliers and distributors are expanding cold-chain systems and contract farming arrangements. Restaurants' preference for quality, safety, and traceability is encouraging improved standards in livestock farming and meat processing. This symbiotic growth between meat producers and the foodservice industry creates stable, large-scale procurement channels and elevates the market potential for suppliers across the value chain.

Technological Advancements in Livestock Farming

Modern technologies in animal husbandry—such as automated feeding systems, improved breeding techniques, and precision farming—are enhancing meat productivity and quality in the Philippines. Farms are adopting innovations like sensor-driven environmental controls, health monitoring, and nutrition management to optimize livestock growth and reduce disease outbreaks. These improvements result in safer, more consistent meat supply and lower production costs. Investment in farm-level technology also enables smaller producers to meet regulatory and industry standards, gaining access to larger commercial and institutional markets. As the agriculture-food-tech ecosystem grows, these advancements reinforce supply chain efficiency and support scalable meat production, benefiting the overall meat market's resilience and growth trajectory.

Philippines Meat Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, product, and distribution channel.

Type Insights:

- Raw

- Processed

The report has provided a detailed breakup and analysis of the market based on the type. This includes raw and processed.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes chicken, beef, pork, mutton, and others.

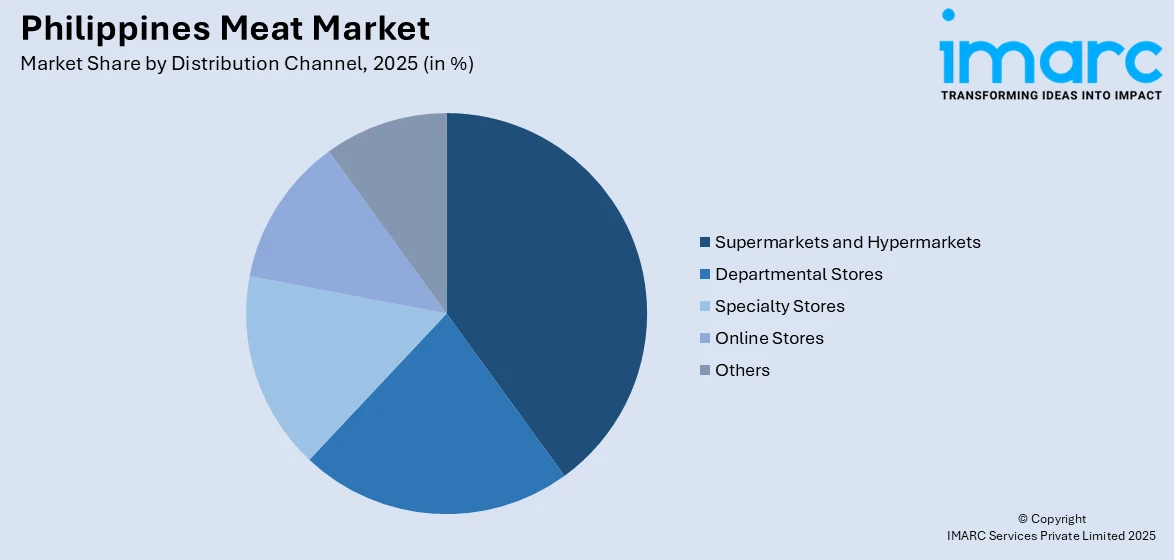

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, department stores, specialty stores, online stores, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Meat Market News:

- In June 2025, 7-Eleven introduced ready-to-eat meals and products made with plant-based meat and seafood from Indonesia’s Green Rebel Foods in the Philippines. The convenience store chain is expanding its offerings to include sustainable, meat-free alternatives in response to shifting consumer preferences.

- In June 2025, Spain obtained a three-year certification allowing it to export chicken and turkey to the Philippines. According to the Department of Agriculture (DA), this move is expected to enhance the country’s meat supply across the archipelago.

- In September 2024, Monde Nissin announced an investment of P17.5 million in Amico Innovations Inc., a homegrown startup. The company's intent is to venture into new market segments while cushioning losses to alternative meat brand Quorn Foods. The acquisition seeks to explore startup opportunities in new categories and businesses while minimizing costs for Quorn and focusing on efficiencies to attract more customers back to the fake meat category. This is a significant step for the Philippines in strengthening its food sector, fostering innovation, and enhancing local production capabilities in that industry.

- In January 2023, Philippines-based food tech startup WTH Foods unveiled Umani, a fully frozen line of plant-based meat alternatives. The company highlights that its new product developments (NPDs) are rich in protein and fiber, contain no cholesterol or trans fats, and are crafted using ingredients such as microalgae, soy, and wheat protein.

Philippines Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Department Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Luzon, Visayas, and Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines meat market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines meat market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The meat market in the Philippines was valued at USD 4.5 Billion in 2025.

The Philippines meat market is projected to exhibit a CAGR of 3.23% during 2026-2034.

The Philippines meat market is projected to reach a value of USD 6.0 Billion by 2034.

The market growth is driven by rising disposable incomes and urbanization, increased consumer preference for high-protein diets, supportive government policies, and thriving foodservice and supermarket expansion that streamline access to diverse meat offerings.

The key trend of the Philippines meat market includes booming demand for processed and ready-to-eat products due to urban lifestyles, a shift toward sustainable and ethically sourced meats, and rapid expansion of online meat retail with enhanced cold-chain infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)