Philippines Molybdenum Market Size, Share, Trends and Forecast by Product Type, Sales Channel, End Use, and Region, 2025-2033

Philippines Molybdenum Market Overview:

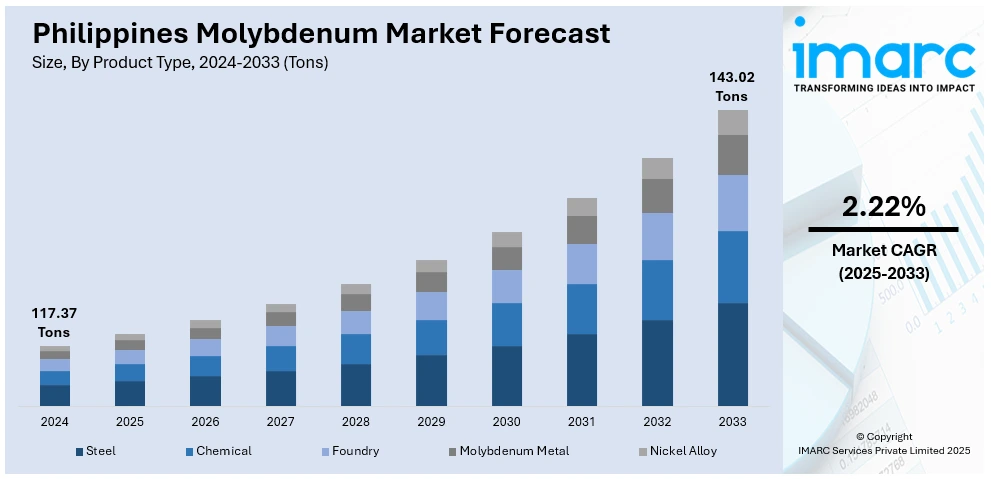

The Philippines molybdenum market size reached 117.37 Tons in 2024. Looking forward, IMARC Group expects the market to reach 143.02 Tons by 2033, exhibiting a growth rate (CAGR) of 2.22% during 2025-2033. Rapid industrialization, infrastructure development, and growing demand from oil and gas, automotive, aerospace, and electronics sectors drive growth. Molybdenum's role as a high-strength alloying agent in steel and specialty materials further supports demand. These dynamics enhance the Philippines molybdenum market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 117.37 Tons |

| Market Forecast in 2033 | 143.02 Tons |

| Market Growth Rate 2025-2033 | 2.22% |

Philippines Molybdenum Market Trends:

Increasing Industrial Demand Across Key Sectors

The Philippines molybdenum market is witnessing growing demand driven by its applications in a wide range of industries. Key sectors such as construction, automotive, aerospace, and energy are increasingly adopting molybdenum due to its excellent properties, including high strength, corrosion resistance, and temperature stability. The lack of sufficient local production capacity has led to a reliance on imports, indicating an opportunity for domestic players to expand capabilities. Between August 2022 and June 2024, the Philippines' molybdenum imports increased by 38.8%, while exports decreased by 82.5%, indicating a growing reliance on imported molybdenum to meet domestic industrial demand. The element’s integration into alloy manufacturing processes has become essential for producing high-performance materials required in heavy machinery and infrastructure development. As the country’s industrial activities accelerate, this sustained use of molybdenum in core sectors reflects ongoing Philippines molybdenum market growth.

To get more information on this market, Request Sample

Expanding Use in Advanced Manufacturing Applications

Molybdenum is gaining traction in advanced manufacturing industries due to its compatibility with cutting-edge technologies. Its powdered form is widely used in the production of high-strength components for electronics, semiconductors, and metal-based additive manufacturing. The Philippines' semiconductor and electronics sector was the largest export contributor at $42.6 Billion in 2024, highlighting the country's role in advanced manufacturing applications. Molybdenum's special qualities encourage innovation in precision engineering and next-generation devices as the Philippines continues to expand its high-tech manufacturing capabilities. The material’s increasing application in specialized processes—such as surface coatings, heat-resistant components, and electronic substrates—has positioned it as a critical resource for manufacturers. This trend toward more technologically advanced use points to a bright future for the Philippines' molybdenum market.

Philippines Molybdenum Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region and country levels for 2025-2033. Our report has categorized the market based on product type, sales channel, and end use.

Product Type Insights:

- Steel

- Chemical

- Foundry

- Molybdenum Metal

- Nickel Alloy

The report has provided a detailed breakup and analysis of the market based on the product type. This includes steel, chemical, foundry, molybdenum metal, and nickel alloy.

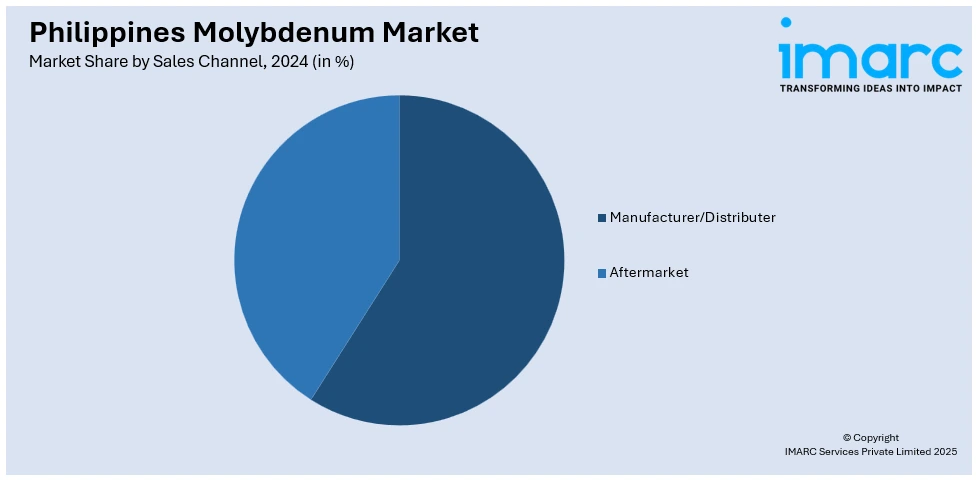

Sales Channel Insights:

- Manufacturer/Distributer

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes manufacturer/distributer and aftermarket.

End Use Insights:

- Oil and Gas

- Automotive

- Heavy Machinery

- Energy

- Aerospace and Defense

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes oil and gas, automotive, heavy machinery, energy, aerospace and defense, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major country markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Molybdenum Market News:

- In January 2025, FCF Minerals Corporation, the operator of the Runruno gold-molybdenum project in Nueva Vizcaya, announced its expansion into Abra province, drawn by the area's abundant mineral resources. Through the acquisition of Yamang Mineral Corporation, FCF secured key exploration tenements in the region. The company aims to advance sustainable mining practices, support economic development, and uplift local communities in Abra. With a strong track record in responsible mining, FCF has made substantial investments in social and environmental initiatives. This strategic move reflects the firm’s commitment to enhancing critical minerals production while replicating its successful Runruno model in a new, resource-rich location.

Philippines Molybdenum Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Steel, Chemical, Foundry, Molybdenum Metal, Nickel Alloy |

| Sales Channels Covered | Manufacturer/Distributer, Aftermarket |

| End Uses Covered | Oil and Gas, Automotive, Heavy Machinery, Energy, Aerospace and Defense, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines molybdenum market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines molybdenum market on the basis of product type?

- What is the breakup of the Philippines molybdenum market on the basis of sales channel?

- What is the breakup of the Philippines molybdenum market on the basis of end use?

- What is the breakup of the Philippines molybdenum market on the basis of region?

- What are the various stages in the value chain of the Philippines molybdenum market?

- What are the key driving factors and challenges in the Philippines molybdenum market?

- What is the structure of the Philippines molybdenum market and who are the key players?

- What is the degree of competition in the Philippines molybdenum market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines molybdenum market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines molybdenum market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines molybdenum industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)