Philippines Oil and Gas Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Philippines Oil and Gas Market Overview:

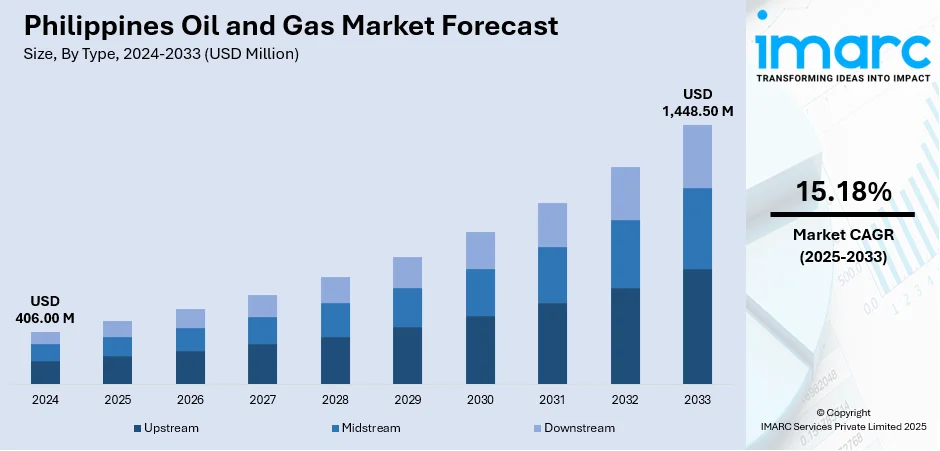

The Philippines oil and gas market size reached USD 406.00 Million in 2024. The market is projected to reach USD 1,448.50 Million by 2033, exhibiting a growth rate (CAGR) of 15.18% during 2025-2033. Rising domestic energy demand, government support for upstream exploration, foreign investment in offshore reserves, modernization of refining facilities, and LNG import projects, alongside infrastructure expansion to secure energy supply and reduce dependence on imports, are some of the factors contributing to the Philippines oil and gas market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 406.00 Million |

| Market Forecast in 2033 | USD 1,448.50 Million |

| Market Growth Rate 2025-2033 | 15.18% |

Philippines Oil and Gas Market Trends:

Rising LNG Imports and Energy Diversification

The Philippines is leaning more on liquefied natural gas (LNG) imports to address the gradual depletion of its Malampaya gas field, which has long supplied a major share of the country’s natural gas needs. With domestic output declining, the government and private sector are accelerating efforts to build LNG receiving terminals, pipelines, and storage facilities. Several international players have shown interest, including companies from Japan, South Korea, and Australia, signaling strong foreign investment in this area. This pivot to LNG aligns with the Philippines’ broader energy transition, aiming to balance affordability, supply security, and sustainability. Policymakers also see LNG as a flexible “bridge fuel” that can complement the growth of renewables in the energy mix, providing baseload power while the country ramps up solar, wind, and geothermal capacity. The increased reliance on imports, however, leaves the Philippines exposed to global price swings and competition from larger Asian buyers, making energy pricing volatility a recurring concern for local industries and households. These factors are intensifying the Philippines oil and gas market growth.

To get more information on this market, Request Sample

Upstream Exploration and Regulatory Shifts

Even with the growing emphasis on imported LNG, the Philippines is revisiting its upstream oil and gas exploration program to reduce dependency on external supply. The Department of Energy has been promoting exploration in offshore basins, including the West Philippine Sea, which is believed to hold significant untapped reserves. New policies are being introduced to attract investors, with the government offering more flexible service contracts, simplified approval processes, and clearer rules on profit-sharing. These reforms aim to restore investor confidence, which has previously been dampened by geopolitical disputes and bureaucratic hurdles. Companies from China, Europe, and Southeast Asia have expressed cautious interest, although investment decisions remain influenced by global crude prices and the outlook for long-term demand. The exploration drive also carries strategic importance, as it reinforces national energy security and reduces vulnerability to supply shocks. Whether these initiatives succeed depends on how effectively the government manages foreign partnerships, settles maritime issues, and balances environmental concerns with economic priorities.

Philippines Oil and Gas Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Upstream

- Midstream

- Downstream

The report has provided a detailed breakup and analysis of the market based on the type. This includes upstream, midstream, and downstream.

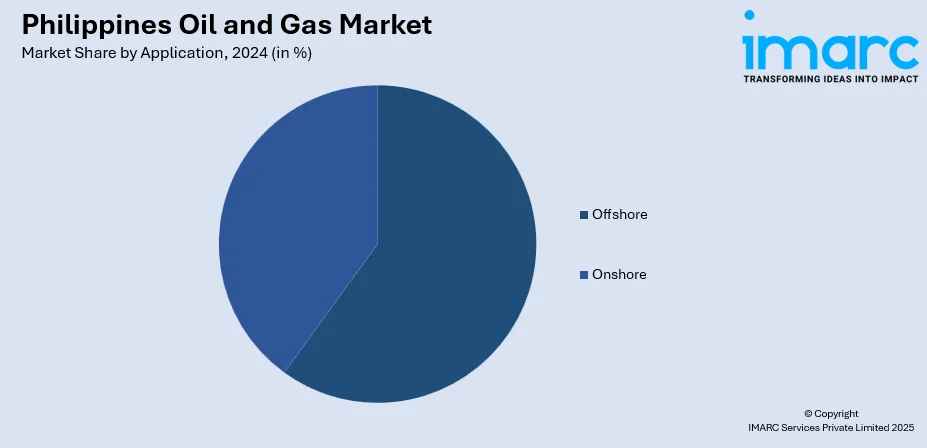

Application Insights:

- Offshore

- Onshore

The report has provided a detailed breakup and analysis of the market based on the application. This includes offshore and onshore.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Oil and Gas Market News:

- In August 2025, the Department of Energy (DOE), through its Oil Industry Management Bureau, announced a One-Stop-Shop in Palawan from 11 to 15 August to streamline licensing for liquefied petroleum gas (LPG) retailers, dealers, and gasoline station owners. Applicants with complete documents can secure a License to Operate (LTO) and Certificate of Compliance (COC) on the same day. The initiative reduces travel costs and processing delays, supporting small and medium operators in the provinces.

Philippines Oil and Gas Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Upstream, Midstream, Downstream |

| Applications Covered | Offshore, Onshore |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines oil and gas market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines oil and gas market on the basis of type?

- What is the breakup of the Philippines oil and gas market on the basis of application?

- What is the breakup of the Philippines oil and gas market on the basis of region?

- What are the various stages in the value chain of the Philippines oil and gas market?

- What are the key driving factors and challenges in the Philippines oil and gas market?

- What is the structure of the Philippines oil and gas market and who are the key players?

- What is the degree of competition in the Philippines oil and gas market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines oil and gas market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines oil and gas market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines oil and gas industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)