Philippines Oleochemicals Market Size, Share, Trends and Forecast by Type, Form, Application, Feedstock, and Region, 2026-2034

Philippines Oleochemicals Market Overview:

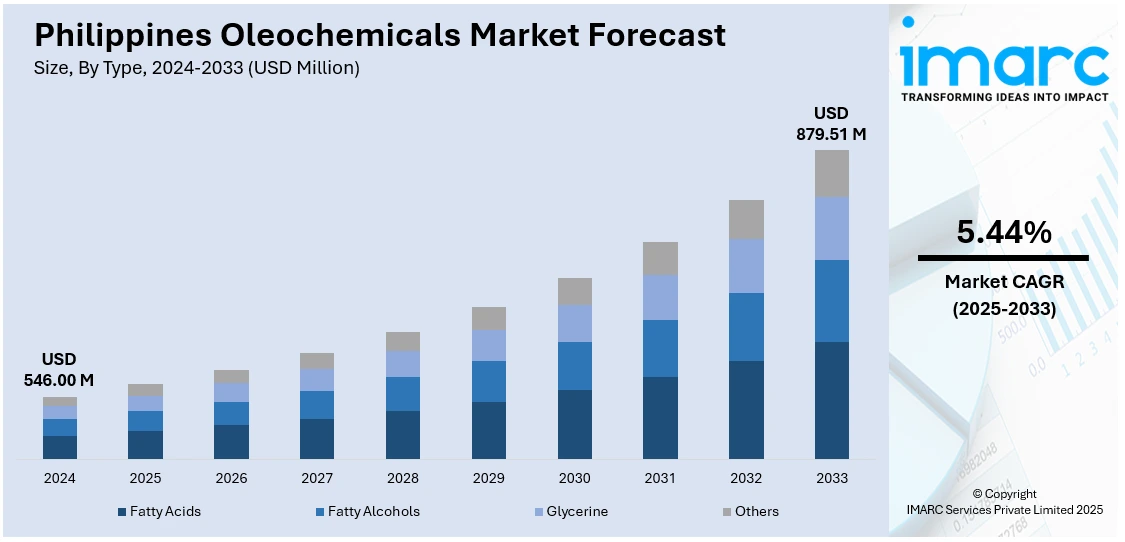

The Philippines oleochemicals market size reached USD 546.00 Million in 2025. The market is projected to reach USD 879.51 Million by 2034, exhibiting a growth rate (CAGR) of 5.44% during 2026-2034. The market is driven by increasing demand for sustainable and biodegradable alternatives for personal care, household, and industrial products. As demand increases for sustainable alternatives in eco-friendly applications and with government policies that enable and even promote green chemistry, increasing consumption is seen. The country also has enough coconut oil that the raw materials are abundant in supply making it more price efficient, and supply security has greatly impacted the market. Apart from that, the expanding oleochemicals applications in food additives, pharmaceuticals, and biodiesel have enhanced the Philippines oleochemicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 546.00 Million |

| Market Forecast in 2034 | USD 879.51 Million |

| Market Growth Rate 2026-2034 | 5.44% |

Philippines Oleochemicals Market Trends:

Abundant Coconut Oil Supply

The Philippines, the world’s largest exporter of coconut products, produced around 1.2 million tonnes of coconut oil in 2023, representing 83% of its total oils and fats output, with 90% of production exported. Coconut oil is the main feedstock that the country has for oleochemicals like fatty acids, glycerine, surfactants, that provides a consistent, low-cost supply that enhances local competitiveness. it is also diversified enough for uses in food, pharmaceutical, personal care, and industrial products. Moreover, the growing global demand for natural, biodegradable ingredients fits well within the sustainability trend. There are also many programs that promote modernization of coconut farming and value-added programs to improve resilience in the supply chain. The strong agriculture capacity will enable local growth and position the Philippines to be an important center for oleochemicals in the Asia-Pacific region, attracting international partnerships and investment while strengthening the nation's position as a leader in the sustainable supply of raw materials.

To get more information on this market, Request Sample

Rising Demand for Sustainable and Biodegradable Products

Growing environmental awareness and stricter sustainability standards are driving demand for oleochemicals in the Philippines. Consumers and industries increasingly prefer eco-friendly ingredients in personal care, cleaning, and industrial products, making oleochemicals attractive alternatives to petrochemical-based substances. Their biodegradable nature and low toxicity help reduce environmental impact, aligning with global green chemistry movements. Local and international brands are reformulating products to include plant-based surfactants, fatty alcohols, and glycerine, further fueling Philippines oleochemicals market growth. Government initiatives encouraging sustainable practices, such as regulations on hazardous chemicals, also create a favorable policy environment. Additionally, multinational corporations are sourcing more raw materials and derivatives from the Philippines to meet their sustainability commitments. This shift not only enhances domestic demand but also strengthens the country’s role in global supply chains for natural, renewable oleochemicals.

Expanding Applications Across Industries

The Philippines oleochemicals market is expanding in line with Asia-Pacific’s dominance, as the region accounted for 41.9% of global oleochemicals volume in 2024. Locally, demand is driven by diverse applications across food, pharmaceuticals, personal care, biofuels, and industrial uses. In food processing, oleochemicals function as emulsifiers, stabilizers, and additives, while in pharmaceuticals, glycerine and fatty acids play key roles in formulations and medical products. The personal care and cosmetics sector heavily relies on coconut-based derivatives for soaps, shampoos, lotions, and skincare, supported by strong consumer preference for natural products. Meanwhile, the biodiesel sector generates opportunities through rising blending mandates of fatty acid methyl esters (FAME), advancing renewable energy goals. Industrial applications, including lubricants, coatings, and detergents, further strengthen the market base. This wide applicability and alignment with Philippines oleochemicals market trends ensure steady, innovation-driven growth in the Philippines oleochemicals industry.

Philippines Oleochemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, form, application, and feedstock.

Type Insights:

- Fatty Acids

- Fatty Alcohols

- Glycerine

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes fatty acids, fatty alcohols, glycerine, and others.

Form Insights:

- Liquid

- Solid

- Flakes

- Pellets

- Beads

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and solid (flakes, pellets, beads, and others).

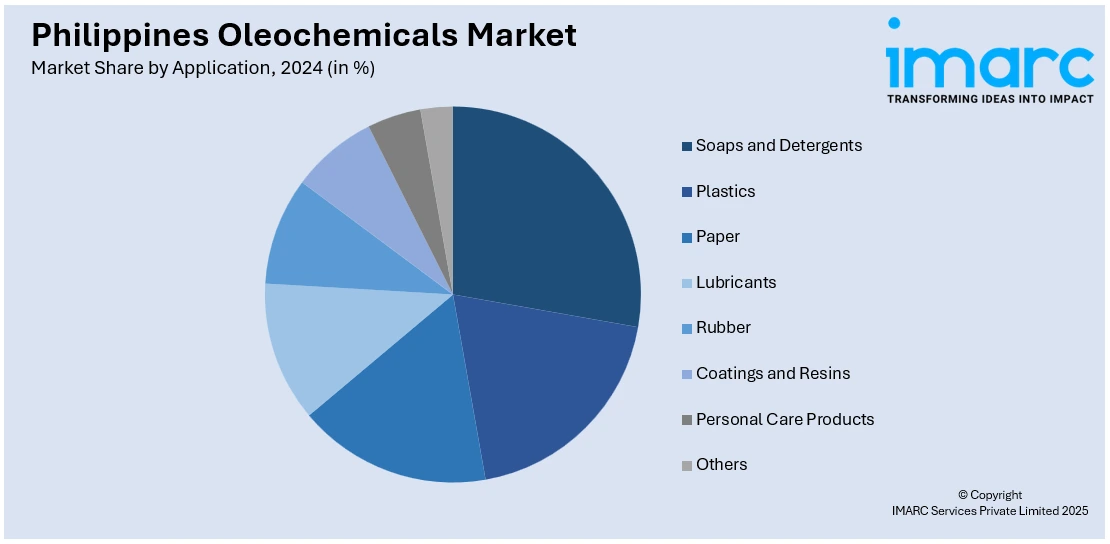

Application Insights:

- Soaps and Detergents

- Plastics

- Paper

- Lubricants

- Rubber

- Coatings and Resins

- Personal Care Products

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes soaps and detergents, plastics, paper, lubricants, rubber, coatings and resins, personal care products, and others.

Feedstock Insights:

- Palm

- Soy

- Rapeseed

- Sunflower

- Tallow

- Palm Kernel

- Coconut

- Others

A detailed breakup and analysis of the market based on the feedstock have also been provided in the report. This includes palm, soy, rapeseed, sunflower, tallow, palm kernel, coconut, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Oleochemicals Market News:

- In June 2025, Indonesian palm oil giant Musim Mas Group will acquire a surfactants facility in Bauan, Batangas, Philippines, from Stepan Company’s subsidiary. The deal, through Masurf, will expand Musim Mas’ surfactant portfolio for personal care, home care, and industrial uses, with a focus on fabric softeners. The group, sourcing raw materials from Indonesia and Malaysia, operates across 13 countries, with R&D in Singapore and global marketing via ICOF.

Philippines Oleochemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fatty Acids, Fatty Alcohols, Glycerine, Others |

| Forms Covered |

|

| Applications Covered | Soaps and Detergents, Plastics, Paper, Lubricants, Rubber, Coatings and Resins, Personal Care Products, Others |

| Feedstocks Covered | Palm, Soy, Rapeseed, Sunflower, Tallow, Palm Kernel, Coconut, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines oleochemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines oleochemicals market on the basis of type?

- What is the breakup of the Philippines oleochemicals market on the basis of form?

- What is the breakup of the Philippines oleochemicals market on the basis of application?

- What is the breakup of the Philippines oleochemicals market on the basis of feedstock?

- What is the breakup of the Philippines oleochemicals market on the basis of region?

- What are the various stages in the value chain of the Philippines oleochemicals market?

- What are the key driving factors and challenges in the Philippines oleochemicals market?

- What is the structure of the Philippines oleochemicals market and who are the key players?

- What is the degree of competition in the Philippines oleochemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines oleochemicals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines oleochemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines oleochemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)