Philippines Online Car Buying Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion Type, Category, and Region, 2026-2034

Philippines Online Car Buying Market Summary:

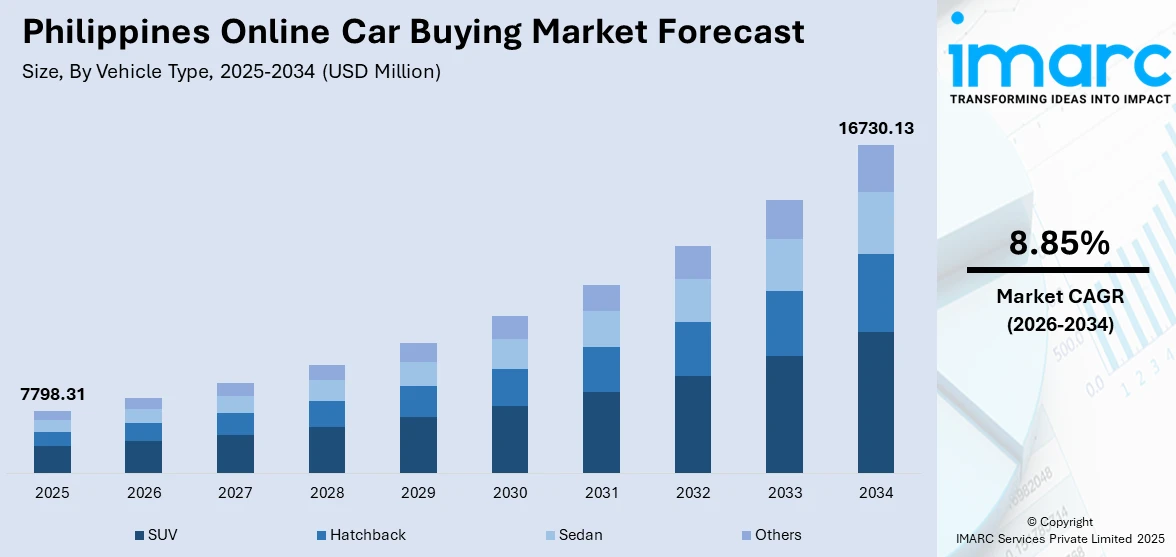

The Philippines online car buying market size was valued at USD 7,798.31 Million in 2025 and is projected to reach USD 16,730.13 Million by 2034, growing at a compound annual growth rate of 8.85% from 2026-2034.

The Philippines online car buying market is experiencing substantial expansion, driven by rapid digital transformation and evolving consumer preferences towards convenient purchasing channels. Rising internet penetration, expanding smartphone usage, and increasing acceptance of digital transactions are reshaping automotive retail across the archipelago. Online platforms are becoming the preferred choice for vehicle research, comparison, and purchase initiation among Filipino consumers.

Key Takeaways and Insights:

- By Vehicle Type: SUV dominates the market with a share of 40% in 2025, owing to strong consumer preference for versatile, family-oriented vehicles that offer elevated seating positions and cargo flexibility. The growing middle-class population seeking practical mobility solutions continues to drive compact and mid-sized SUV demand through digital channels.

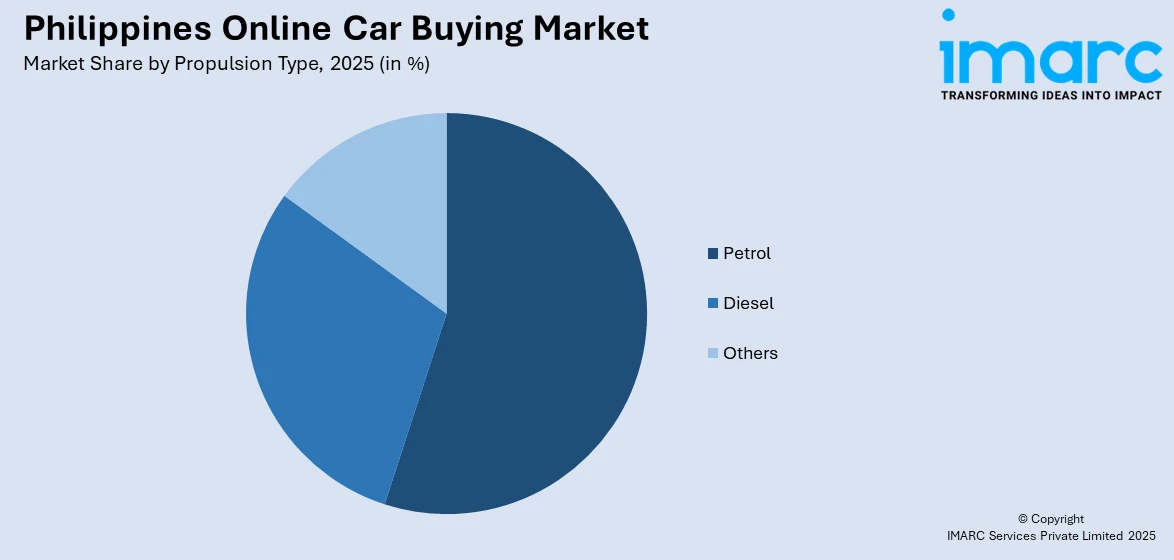

- By Propulsion Type: Petrol leads the market with a share of 63% in 2025, driven by established refueling infrastructure availability nationwide and consumer familiarity with conventional powertrains. Lower upfront acquisition costs compared to alternative propulsion technologies make gasoline vehicles accessible choices for online car buyers across income segments.

- By Category: Pre-owned vehicle exhibits a clear dominance with a 54% share in 2025, reflecting economic pragmatism among Filipino buyers seeking affordable mobility solutions. Digital platforms offering vehicle history reports, certified inspections, and transparent pricing are enhancing consumer confidence in purchasing second-hand vehicles online.

- By Region: Luzon comprises the largest region with 60% share in 2025, anchored by Metro Manila's economic concentration, advanced digital infrastructure, and high dealership density. Strong purchasing power among urban professionals combined with superior internet connectivity drives online automotive transaction volumes in this region.

- Key Players: Key players are transforming the Philippines online car buying landscape by integrating digital financing tools, expanding dealer networks, and enhancing platform features. Their investments in artificial intelligence (AI)-powered recommendation engines, seamless payment systems, and comprehensive vehicle verification services are accelerating consumer adoption of digital automotive retail channels.

To get more information on this market Request Sample

The Philippines online car buying market is witnessing remarkable growth, underpinned by rapid digital adoption and expanding internet connectivity across the archipelago. The convergence of automotive retail with digital technologies is creating seamless purchasing experiences that enable consumers to browse extensive vehicle inventories, compare prices across multiple dealers, and initiate financing applications from their devices. Major automakers are embracing digital retailing through dedicated platforms offering online configuration, quotation, and reservation functionalities. At the beginning of 2025, the Philippines reported approximately 97.5 Million internet users, representing 83.8% of its population, significantly expanding the addressable market for online automotive platforms. This high connectivity allows more Filipinos to browse car models, compare deals, and complete transactions digitally rather than solely visiting physical dealerships. The integration of bank financing tools directly into car-buying platforms is streamlining purchase journeys.

Philippines Online Car Buying Market Trends:

AI-Powered Platform Enhancement and Personalization

In the Philippines, online car buying platforms are increasingly integrating AI technologies to enhance user experience and streamline purchase decisions. These intelligent systems analyze browsing patterns and preferences to deliver personalized vehicle recommendations, improving match rates between buyers and suitable vehicles. AI-powered chatbots and virtual assistants provide real-time guidance, answering queries and assisting with financing or documentation processes. Predictive analytics help platforms forecast demand trends, enabling dynamic pricing and inventory management.

Automaker Digital Retailing Integration

Major automotive manufacturers are establishing direct digital channels to complement traditional dealership networks and capture online-first consumers. These branded platforms offer comprehensive features, including vehicle configuration tools, real-time inventory visibility, and reservation capabilities. They also integrate personalized financing and trade-in options, allowing buyers to complete most of the purchase process online. Virtual showrooms and 360-degree vehicle tours enhance the shopping experience, reducing dependence on physical visits. Furthermore, these platforms collect valuable customer data, enabling manufacturers to tailor marketing strategies and improve post-sale engagement.

Embedded Finance Solutions in Digital Platforms

Strategic partnerships between online automotive marketplaces and financial institutions across the Philippines are creating integrated purchasing experiences that combine vehicle selection with financing in unified digital journeys. These collaborations eliminate traditional friction points where buyers navigated between separate platforms for vehicle selection and loan applications. Buyers can access pre-approved loan options instantly, speeding up the purchase process. Additionally, seamless integration with insurance providers allows customers to complete coverage arrangements alongside financing, creating a truly end-to-end digital car buying experience.

Market Outlook 2026-2034:

The Philippines online car buying market is poised for sustained expansion, as digital infrastructure improvements and shifting consumer behaviors accelerate adoption of online automotive retail channels. Continued investments in platform technologies, expanded financing accessibility, and growing dealer participation in digital ecosystems are creating favorable conditions for market development. The market generated a revenue of USD 7,798.31 Million in 2025 and is projected to reach a revenue of USD 16,730.13 Million by 2034, growing at a compound annual growth rate of 8.85% from 2026-2034. Government initiatives promoting digital commerce and electronic payments are creating supportive regulatory environments. The expansion of certified pre-owned programs and enhanced vehicle verification services are building consumer confidence in online transactions.

Philippines Online Car Buying Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Vehicle Type |

SUV |

40% |

|

Propulsion Type |

Petrol |

63% |

|

Category |

Pre-Owned Vehicle |

54% |

|

Region |

Luzon |

60% |

Vehicle Type Insights:

- Hatchback

- Sedan

- SUV

- Others

SUV dominates with a market share of 40% of the total Philippines online car buying market in 2025.

SUV has emerged as the preferred vehicle type among Filipino online car buyers, driven by versatility requirements spanning urban commuting and occasional provincial travel. The elevated seating position, enhanced cargo capacity, and perceived safety advantages resonate strongly with family-oriented consumers. In 2024, the Toyota Raize compact SUV achieved sales of 18,024 units, ranking sixth overall in the Philippine market and demonstrating the strong consumer appetite for affordable, digitally accessible SUV models that combine practicality with modern styling.

The proliferation of compact and subcompact SUV offerings has expanded addressable demographics by providing entry points at accessible price ranges. Online platforms facilitate comparison shopping across multiple SUV variants, enabling consumers to evaluate specifications, features, and pricing from competing manufacturers efficiently. The integration of virtual showroom experiences and detailed specification comparisons on digital platforms supports informed purchase decisions, while financing calculators help buyers understand monthly payment implications across different SUV models and trim levels.

Propulsion Type Insights:

Access the comprehensive market breakdown Request Sample

- Petrol

- Diesel

- Others

Petrol leads with a share of 63% of the total Philippines online car buying market in 2025.

Petrol maintains commanding market presence, due to established refueling infrastructure availability and consumer familiarity with conventional powertrain technologies. The nationwide network of petrol stations eliminates range anxiety concerns that affect alternative fuel adoption, while lower acquisition costs compared to hybrid or electric alternatives appeal to price-conscious Filipino buyers. Additionally, widespread availability of spare parts and service centers ensures convenient maintenance, reinforcing consumer confidence in petrol vehicles. Strong resale values for petrol-powered cars further incentivize buyers, sustaining their dominant position in the market.

Online car buying platforms predominantly feature petrol vehicle listings, reflecting inventory compositions of partnered dealerships and consumer demand patterns. The availability of comprehensive fuel efficiency specifications on digital platforms enables buyers to compare operating costs across petrol variants, supporting informed selections. Digital marketplaces provide detailed performance data, maintenance requirements, and ownership cost projections that help petrol vehicle buyers understand total cost of ownership, while easy comparison tools facilitate evaluation against diesel and emerging alternative propulsion options.

Category Insights:

- Pre-Owned Vehicle

- New Vehicle

Pre-owned vehicle exhibits a clear dominance with a 54% share of the total Philippines online car buying market in 2025.

Pre-owned vehicle dominates online transactions, as economic pragmatism drives Filipino consumers towards affordable mobility solutions that maximize value retention. The pre-owned car market serves as the primary entry point for first-time vehicle owners, particularly among young professionals and expanding middle-class households. Rising fuel prices and higher new car costs further encourage buyers to consider reliable used vehicles. Flexible financing options for pre-owned cars make ownership accessible without significant upfront investment.

Digital platforms have transformed pre-owned vehicle transactions by introducing transparency mechanisms, including vehicle history reports, condition assessments, and standardized inspection protocols. Certified pre-owned programs operated by manufacturer-authorized dealers provide warranty coverage and quality assurances that mitigate traditional used car purchase anxieties. Online marketplaces aggregate listings from multiple sources, including individual sellers, multi-brand dealers, and bank-repossessed vehicle auctions, creating comprehensive selection visibility that supports competitive pricing and informed buyer decisions.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon represents the leading region with a 60% share of the total Philippines online car buying market in 2025.

Luzon dominates the Philippines online car buying landscape anchored by Metro Manila's economic concentration, advanced digital infrastructure, and superior dealership density. The capital region's high internet penetration rates, strong purchasing power among urban professionals, and established payment ecosystems create optimal conditions for digital automotive commerce. The presence of corporate fleets and ride-hailing services in Luzon also drives bulk and repeat purchases, strengthening the region’s market dominance. In September 2024, Xpress broadened its offerings to Central Luzon by starting its 4-wheel ride-hailing services in Pampanga. The initiative sought to provide a more intelligent and inclusive transportation choice for travelers in Region III, especially in Clark and Angeles City.

Metro Manila, Quezon City, and outlying provinces, such as Cavite, Bulacan, and Laguna, are major automotive centers and commercial hubs. Online car platforms experience most of their traffic and sales in this area. The presence of authorized dealerships, multi-brand showrooms, and service networks ensures that the vehicles are available across all segments. The high concentration of premium models is evident in this region, with the capital acting as the center for both new and certified pre-owned luxury vehicles. Digital platforms facilitate nationwide delivery services, expanding access to Luzon-based inventory for interested consumers.

Market Dynamics:

Growth Drivers:

Why is the Philippines Online Car Buying Market Growing?

Expanding Digital Connectivity and Internet Penetration

The increasing accessibility of the internet within the Philippines is undergoing a paradigm shift in the way consumers behave, leading to mass adoption of digital automotive retail touch points. The rise of smartphone adoption, improvements in mobile networks, and the development of data offers are bridging the gap to connect the mass market to online automotive retail. The rising number of internet users within the Philippines has accelerated consumers' adoption to research car models and make online inquiries for purchase through digital channels. Supportive government initiatives under the Digital Philippines Program are opening doors for online payments. The number of installed telecommunications towers increased significantly to 35,043 in 2023, expanding rural network coverage and improving service quality in urban areas. This connectivity expansion is transforming car buying from a traditionally physical experience into an increasingly digital journey where consumers conduct extensive online research before visiting showrooms, if visiting at all.

Strong Automotive Market Performance and Vehicle Demand

The Philippine automotive industry's robust performance is creating favorable conditions for online car buying platform expansion by generating substantial vehicle inventories and active buyer pools. Sustained economic growth, rising disposable incomes, and expanding middle-class demographics are driving personal vehicle ownership aspirations across diverse consumer segments. The Chamber of Automotive Manufacturers of the Philippines, Inc. (CAMPI) and Truck Manufacturers Association (TMA) jointly reported 467,252 new car sales in 2024, representing an 8.7% rise from 429,807 units in 2023. This record-breaking performance demonstrates sustained momentum that supports online platform growth and dealer digital adoption. The strong sales performance reflects fundamental demand drivers, including urbanization pressures, inadequate public transportation infrastructure, and lifestyle aspirations that position vehicle ownership as a priority expenditure. Industry projections targeting sales growth in subsequent years indicate confidence in continued market expansion that will further strengthen online automotive retail ecosystems.

Enhanced Auto Financing Accessibility Through Digital Channels

The integration of financing solutions directly into online car buying platforms is removing traditional barriers to vehicle purchase completion and enabling seamless end-to-end digital transactions. In the Philippines, strategic partnerships between automotive marketplaces and banking institutions are embedding loan application capabilities within vehicle browsing experiences, eliminating navigation between disparate systems. Banks have shortened loan processing time, while applications through digital platforms continue to grow year on year. This convergence of vehicle selection and financing creates compelling value propositions that accelerate purchase decisions. Financial institutions are competing to establish partnerships with leading platforms, driving innovations in instant credit decisions, flexible repayment structures, and competitive interest rates that enhance affordability for diverse buyer segments. Additionally, integrated financing solutions provide real-time eligibility checks and personalized loan offers, further streamlining the buying process and boosting consumer confidence in completing online car purchases.

Market Restraints:

What Challenges is the Philippines Online Car Buying Market Facing?

Digital Fraud Concerns and Cybersecurity Risks

The Philippines faces significant cybersecurity challenges that impact consumer confidence in conducting high-value transactions through digital channels. The prevalence of online fraud schemes, including phishing attacks, identity theft, and payment manipulation, creates hesitancy among potential buyers considering online car purchases. Fraudulent listings, fake seller profiles, and scam operations undermine platform credibility and require ongoing investments in verification systems and consumer education to maintain trust in digital automotive marketplaces.

Limited Vehicle History Transparency in Unorganized Segments

The persistent challenge of limited vehicle history transparency continues to undermine consumer confidence in the Philippines online car buying market, particularly in the dominant unorganized segment where documentation practices remain inconsistent. Incomplete maintenance records, unclear ownership histories, and potential undisclosed accident damage create purchase anxieties that inhibit transaction completion. The absence of comprehensive vehicle registration databases accessible to buyers complicates verification processes and sustains preference for physical inspections over remote transactions.

Financial Inclusion Barriers and Payment Infrastructure Gaps

Financial inclusion remains a challenge as small portion of the Philippine population is banked, limiting access to formal financing options and digital payment capabilities required for online car transactions. Underbanked populations face difficulties completing digital purchases that require credit assessments, bank transfers, or card payments. Regional disparities in banking infrastructure and digital payment ecosystem development create uneven market access, concentrating online car buying activity in financially developed urban centers while excluding potential buyers in underserved areas.

Competitive Landscape:

The Philippines online car buying market features a dynamic competitive landscape, characterized by diverse platform models, including dedicated automotive marketplaces, classified listing aggregators, and manufacturer-branded digital channels. Leading platforms differentiate through dealer network breadth, financing partnerships, user experience features, and value-added services, including vehicle verification and inspection programs. Market participants are investing in technology enhancements, including AI-powered recommendation engines, instant loan approval systems, and mobile-optimized interfaces, to capture growing digital-native consumer segments. Strategic partnerships between automotive platforms and financial institutions are reshaping competitive dynamics by creating integrated purchase journeys that combine vehicle selection with seamless financing access. The evolving market rewards platforms demonstrating comprehensive inventory coverage, transparent pricing mechanisms, and robust transaction security measures that build consumer confidence in digital automotive commerce.

Philippines Online Car Buying Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchback, Sedan, SUV, Others |

| Propulsion Types Covered | Petrol, Diesel, Others |

| Categories Covered | Pre-Owned Vehicle, New Vehicle |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines online car buying market size was valued at USD 7,798.31 Million in 2025.

The Philippines online car buying market is expected to grow at a compound annual growth rate of 8.85% from 2026-2034 to reach USD 16,730.13 Million by 2034.

SUV dominated the market with a share of 40%, driven by strong consumer preference for versatile, family-oriented vehicles offering elevated seating positions and cargo flexibility that appeal to Filipino buyers.

Key factors driving the Philippines online car buying market include expanding digital connectivity with increasing internet penetration, strong automotive market performance with record vehicle sales, and enhanced auto financing accessibility through integrated digital platform partnerships.

Major challenges include digital fraud concerns and cybersecurity risks affecting consumer confidence, limited vehicle history transparency in unorganized market segments, financial inclusion barriers with restricted banking access, and payment infrastructure gaps in underserved regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)