Philippines Online Gambling Market Size, Share, Trends and Forecast by Game Type, Device, and Region, 2026-2034

Philippines Online Gambling Market Summary:

The Philippines online gambling market size was valued at USD 1,991.13 Million in 2025 and is projected to reach USD 3,589.79 Million by 2034, growing at a compound annual growth rate of 6.77% from 2026-2034.

The Philippines online gambling market is experiencing robust expansion driven by widespread digital infrastructure development, increasing smartphone adoption, and favorable regulatory reforms implemented by PAGCOR. The sector benefits from a culturally receptive population with strong gambling traditions and rising disposable incomes among the growing middle class. Strategic government initiatives to formalize the gaming industry have attracted substantial domestic and international investments, positioning the Philippines as a leading online gambling hub in Southeast Asia.

Key Takeaways and Insights:

-

By Game Type: Sports betting dominates the market with a share of 51.55% in 2025, driven by strong basketball culture and accessible mobile betting platforms.

-

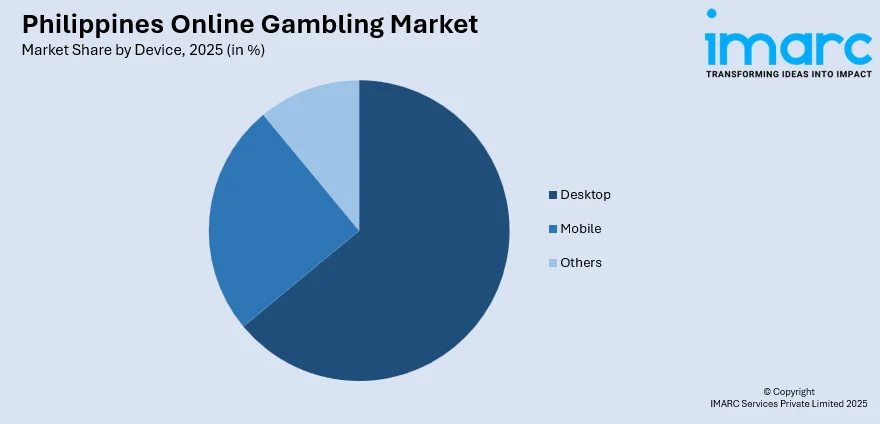

By Device: Desktop leads the market with a share of 64.04% in 2025, attributed to enhanced gaming experiences and higher transaction security preferences.

-

By Region: Luzon represents the largest segment with a market share of 52% in 2025, owing to Metro Manila's concentration of digital infrastructure and higher income demographics.

-

Key Players: The Philippines online gambling market exhibits a moderately concentrated competitive structure, with domestic operators and integrated resort operators competing alongside technology providers and licensed e-gaming platforms regulated by PAGCOR.

To get more information on this market Request Sample

The Philippines online gambling market has emerged as one of the most dynamic and rapidly evolving gaming sectors in Asia-Pacific. The market landscape is characterized by a diverse ecosystem encompassing sports betting, online casino games, e-bingo platforms, and specialty gaming offerings. DigiPlus Interactive, the company behind BingoPlus and ArenaPlus platforms, reached 40 million registered users by the end of 2024, doubling from 20 million users in the previous year. This substantial user growth reflects the broader market momentum driven by increasing digital literacy, expanding e-wallet adoption through platforms like GCash and Maya, and government efforts to transition gambling activities from unregulated channels into the licensed domestic market. The regulatory environment has undergone significant transformation following the ban on Philippine Offshore Gaming Operators, redirecting focus toward domestic-facing online operations. This strategic pivot has created opportunities for licensed operators while enhancing consumer protection measures and responsible gaming frameworks. The integration of advanced technologies including artificial intelligence for fraud detection, real-time betting capabilities, and mobile-first platform designs continues to shape market evolution and competitive differentiation among industry participants.

Philippines Online Gambling Market Trends:

Rapid Growth of E-Gaming and Digital Platforms

The Philippine online gambling sector is witnessing unprecedented growth in electronic gaming operations, fundamentally transforming the industry's revenue composition. The legal gambling ecosystem has grown as a result of the regulation changes, which have attracted previously unregistered operators to join the regulated market. With an all-time high of PHP 112 Billion in income for 2024, the Philippine Amusement and Gaming Corporation (PAGCOR) has reached a remarkable financial milestone. Compared to PHP 79 Billion in 2023, this amount represents a noteworthy 41% rise, mostly because to the exceptional performance of the electronic games (e-games) industry.

Integration of Advanced Technology and Enhanced User Experiences

Philippine gambling operators are increasingly adopting sophisticated technological solutions to enhance platform security and user engagement. The expansion of 5G network coverage across Metro Manila, Cebu City, Davao, and Iloilo has significantly elevated connection speeds, enabling seamless real-time betting experiences. Operators are implementing AI-driven identity verification systems and fraud prevention tools, with industry participants identifying AI-generated deepfakes as a critical emerging risk requiring advanced countermeasures. Live dealer games and interactive streaming features continue gaining popularity among Filipino players seeking authentic casino experiences.

Strengthened Regulatory Framework and Compliance Standards

The Philippine gaming regulatory environment has undergone substantial reform, establishing more rigorous compliance requirements and oversight mechanisms. PAGCOR has extended anti-money laundering standards beyond licensed operators to encompass affiliates, KYC processors, payment partners, and marketing agents. The Philippines' removal from the Financial Action Task Force grey list in February 2025 reflects improved AML/CFT framework implementation, enhancing the industry's international credibility and attracting legitimate investment while deterring illicit operations from the regulated market.

Market Outlook 2026-2034:

The Philippines online gambling market is positioned for sustained expansion throughout the forecast period, supported by continued digital infrastructure investments, regulatory stabilization, and evolving consumer preferences toward online entertainment. PAGCOR projects substantial gross gaming revenue growth driven by the expanding e-gaming sector and new integrated resort developments. The transition from offshore to domestic-focused operations, combined with favorable licensing reforms and increased smartphone penetration, creates a conducive environment for market participants seeking long-term growth opportunities. The market generated a revenue of USD 1,991.13 Million in 2025 and is projected to reach a revenue of USD 3,589.79 Million by 2034, growing at a compound annual growth rate of 6.77% from 2026-2034.

Philippines Online Gambling Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Game Type |

Sports Betting |

51.55% |

|

Device |

Desktop |

64.04% |

|

Region |

Luzon |

52% |

Game Type Insights:

- Sports Betting

- Football

- Horse Racing

- E-Sports

- Others

- Casino

- Live Casino

- Baccarat

- Blackjack

- Poker

- Slots

- Others

- Others

The sports betting dominates with a market share of 51.55% of the total Philippines online gambling market in 2025.

Sports betting has established a commanding position in the Philippine online gambling landscape, driven by the nation's deep-rooted passion for basketball and the widespread popularity of the Philippine Basketball Association and National Basketball Association. The segment benefits from accessible mobile betting platforms that enable real-time wagering on local and international sporting events. ArenaPlus, launched by DigiPlus in February 2023, has emerged as a leading 24/7 online sports betting platform covering various leagues worldwide. The integration of e-sports betting has further expanded the segment's appeal among younger demographics.

The sports betting ecosystem is characterized by diverse wagering options including fixed odds, live in-play betting, and proposition bets across multiple sports categories including football, boxing, and horse racing. Licensed bookmakers operate over several locations throughout the Philippines, offering legal sports betting services regulated by PAGCOR. The segment's growth trajectory is supported by increasing smartphone penetration and the cultural acceptance of sports wagering as a form of entertainment, with operators continually enhancing platform features to improve user engagement and retention.

Device Insights:

Access the comprehensive market breakdown Request Sample

- Desktop

- Mobile

- Others

The desktop leads with a share of 64.04% of the total Philippines online gambling market in 2025.

Desktop devices maintain market leadership in the Philippines online gambling sector, primarily attributed to superior display capabilities, enhanced security features, and stable internet connectivity preferred for high-value transactions. The segment dominates among serious gamblers who prioritize comprehensive gaming interfaces and multi-table functionality for casino games such as poker and baccarat. Market analysis indicates that desktop users demonstrate higher average transaction values and longer session durations compared to mobile counterparts, making this segment particularly valuable for operators targeting premium customer segments.

Desktop platforms facilitate more sophisticated gaming experiences through advanced graphics rendering, live dealer streaming capabilities, and secure payment processing infrastructure. The larger screen displays enable comprehensive multi-table functionality preferred by serious casino players engaging in poker, baccarat, and blackjack sessions. Desktop users benefit from enhanced navigation interfaces, superior video quality during live streaming sessions, and more robust cybersecurity features protecting high-value transactions. These platforms also support seamless integration with banking systems and e-wallet services for efficient fund management.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The Luzon exhibits a clear dominance with a 52% share of the total Philippines online gambling market in 2025.

Luzon, the most populous island group in the Philippines, commands the largest share of the online gambling market due to its concentration of digital infrastructure, higher disposable incomes, and advanced urbanization. Metro Manila, the Philippine National Capital Region located within Luzon, serves as the primary hub for gambling activities with over 20 land-based casinos in the metropolitan area alone. The region's Entertainment City development has positioned Manila alongside global gaming destinations, attracting both domestic players and international tourists seeking integrated resort experiences.

Manila, Quezon City, and Clark serve as critical hubs for the Philippine online gambling market, supported by robust telecommunications networks. The high concentration of financial services and e-wallet providers like GCash in Luzon facilitates efficient, seamless transaction processing. This sophisticated digital payment infrastructure, paired with superior connectivity, reinforces Luzon’s dominance within the national gambling ecosystem. Consequently, the region continues to lead market growth, offering a stable, technologically advanced environment for digital operators and consumers alike.

Market Dynamics:

Growth Drivers:

Why is the Philippines Online Gambling Market Growing?

Increasing Internet and Smartphone Penetration Enabling Digital Access

The Philippines has experienced substantial growth in digital connectivity, creating favorable conditions for online gambling market expansion. At the beginning of 2025, the Philippines had 97.5 million internet users, with an online penetration rate of 83.8%. Smartphone adoption is positioning the Philippines among Southeast Asia's fastest adoption rates, driven by affordable mobile data plans and expanding telecommunications infrastructure. The leading e-wallet platform, is demonstrating the rapid digitalization of financial transactions essential for online gambling, enabling seamless deposits and withdrawals that enhance user convenience and platform accessibility.

Favorable Regulatory Environment and Government-Supported Industry Formalization

PAGCOR's strategic regulatory reforms have created a more attractive operating environment for legitimate gambling operators. The reduction of licensing fees for e-games operators and for integrated resorts offering online gaming, has enhanced operator profitability and encouraged market formalization. As per the industry reports, by June 2024, more than 44 companies received permission to offer iGaming services, including major integrated resort operators such as Bloomberry and Travellers International, indicating robust regulatory approval processes. These policy adjustments have encouraged previously unregistered operators to enter the regulated market, expanding the legal gaming ecosystem while strengthening consumer protections and responsible gaming frameworks.

Rising Disposable Income and Cultural Affinity for Gambling Activities

The Philippines' expanding middle class and increasing disposable incomes have strengthened consumer capacity for leisure spending including online gambling. An estimated 32 million Filipinos engaged in online gambling from January to May 2025, representing almost 200% surge from 8.2 million participants in 2024. The cultural acceptance of gambling, rooted in traditional activities such as cockfighting and community card games since the Spanish colonial period, has facilitated adoption of modern online gambling platforms as digital entertainment alternatives. This deep-seated affinity for gaming activities continues driving engagement across demographics and income segments.

Market Restraints:

What Challenges the Philippines Online Gambling Market is Facing?

Competition from Illegal and Unregulated Gambling Platforms

The Philippine online gambling market faces significant competition from unlicensed operators capturing substantial market share outside regulatory oversight. A considerable portion of online gambling activity remains unregulated, operating without consumer protections or tax contributions. Authorities have taken down numerous gambling-related websites, yet enforcement challenges persist as offshore platforms continue targeting Filipino players through international servers.

Escalating Cybersecurity Threats and Fraud Risks

The digital nature of online gambling exposes platforms and users to evolving cybersecurity threats requiring continuous security investments. Cybercrime incidents have increased significantly, with gambling-related platforms being attractive targets for fraudsters. AI-generated deepfakes represent an emerging risk, with industry participants identifying synthetic identity fraud as a growing concern requiring advanced verification technologies.

Problem Gambling Concerns and Potential Regulatory Restrictions

Rising awareness of gambling addiction among Filipino populations has intensified calls for stricter regulations or potential prohibition of online gambling activities. Multiple bills seeking to ban or heavily regulate online gambling have been filed in the Philippine Senate and House of Representatives, creating regulatory uncertainty. Church groups and civic organizations have advocated for criminalization of online gambling, potentially threatening market stability if restrictive legislation advances.

Competitive Landscape:

The Philippines online gambling market exhibits a moderately concentrated competitive structure characterized by a mix of domestic digital entertainment companies, integrated resort operators, and licensed e-gaming service providers. Market leadership is primarily held by operators with PAGCOR licenses who have invested substantially in platform technology, user acquisition, and regulatory compliance. Competition is intensifying as integrated resort operators expand their digital offerings to complement land-based casino operations. The market structure favors established players with proven track records, substantial capitalization requirements, and sophisticated responsible gaming frameworks.

Recent Developments:

-

November 2025: DigiPlus Interactive signed a deal worth HK$1.6 Billion to acquire International Entertainment Corporation, the owner of New Coast Hotel Manila. The acquisition positions DigiPlus to establish its own integrated casino operation, combining online gaming platforms with physical entertainment facilities.

-

March 2025: DigiPlus Interactive contributed PHP 33.7 Billion in taxes and regulatory fees for 2024, establishing the company as one of the largest taxpayers in the Philippine digital entertainment sector. The contribution reflects the substantial revenue generation of platforms including BingoPlus, ArenaPlus, and GameZone.

Philippines Online gambling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Game Types Covered |

|

| Devices Covered | Desktop, Mobile, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines online gambling market size was valued at USD 1,991.13 Million in 2025.

The Philippines online gambling market is expected to grow at a compound annual growth rate of 6.77% from 2026-2034 to reach USD 3,589.79 Million by 2034.

Sports betting dominated the market with a 51.55% share in 2025, driven by the nation's strong basketball culture, accessible mobile betting platforms, and widespread popularity of local and international sporting events among Filipino bettors.

Key factors driving the Philippines online gambling market include increasing internet and smartphone penetration, favorable regulatory reforms by PAGCOR, rising disposable incomes among the expanding middle class, and cultural acceptance of gambling as entertainment.

Major challenges include competition from illegal gambling platforms capturing significant market share, escalating cybersecurity threats and fraud risks, problem gambling concerns driving potential regulatory restrictions, and uncertainty surrounding proposed legislation to ban online gambling.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)