Philippines Online Grocery Market Size, Share, Trends and Forecast by Product Type, Business Model, Platform, Purchase Type, and Region, 2026-2034

Philippines Online Grocery Market Summary:

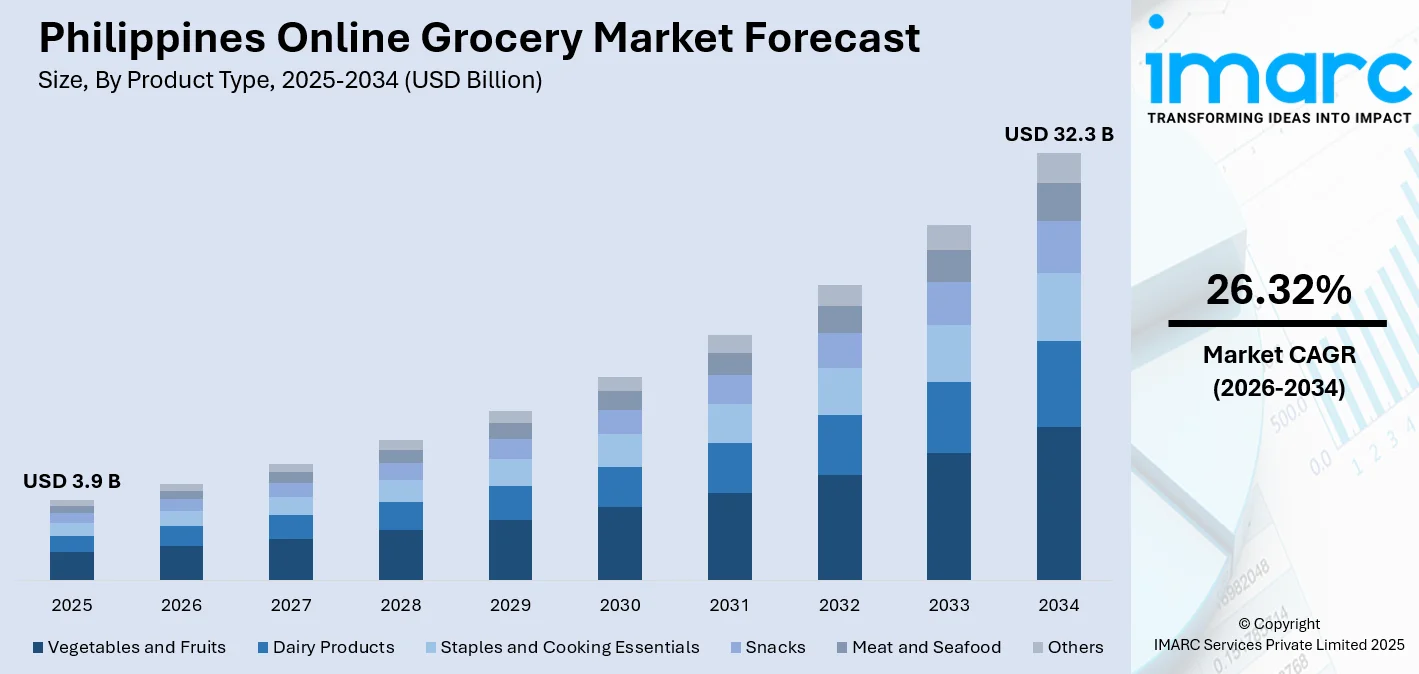

The Philippines online grocery market size was valued at USD 3.9 Billion in 2025 and is projected to reach USD 32.3 Billion by 2034, growing at a compound annual growth rate of 26.32% from 2026-2034.

Digital transformation continues reshaping how Filipino consumers purchase daily essentials, with mobile applications and digital wallets driving unprecedented adoption across urban and provincial areas. The convergence of improved internet infrastructure, smartphone proliferation, and evolving consumer preferences toward convenience-driven shopping experiences has fundamentally altered the grocery retail landscape throughout the archipelago.

Key Takeaways and Insights:

- By Product Type: Staples and cooking essentials dominates the market with a share of 29% in 2025, driven by recurring household purchasing patterns, bulk ordering preferences, and the essential nature of rice, cooking oil, and pantry staples in Filipino cuisine.

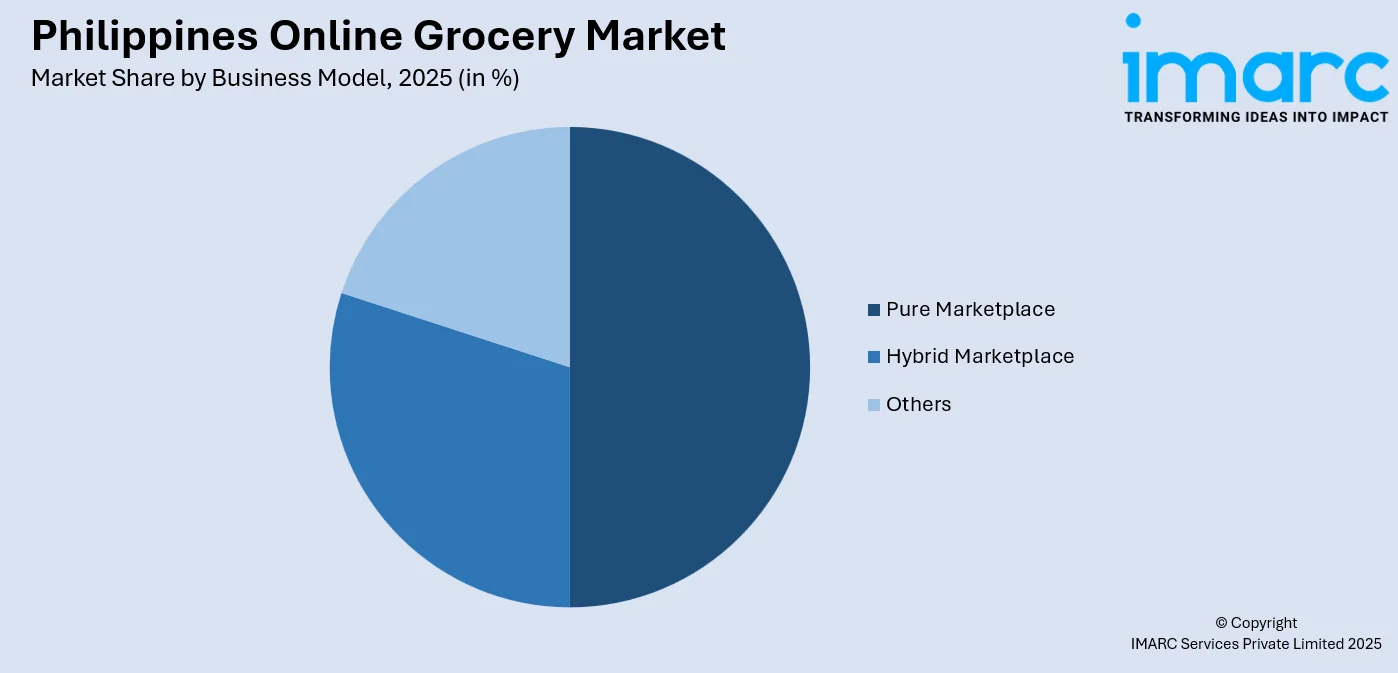

- By Business Model: Pure marketplace leads the market with a share of 50% in 2025, fueled by asset-light operational models that enable rapid geographic expansion without inventory ownership while offering consumers diverse merchant options and competitive pricing structures.

- By Platform: App-based represents the largest segment with a market share of 57% in 2025, driven by smartphone-focused consumer habits, enhanced user experiences through personalized interfaces, and smooth integration with digital payment platforms and push notifications.

- By Purchase Type: One-time dominates the market with a share of 78% in 2025, indicating consumer preferences for flexible buying patterns, promotional sensitivity, and the behavioral tendency to shop across multiple platforms based on specific deals rather than committing to subscription models.

- By Region: Luzon leads the market with a share of 57% in 2025, anchored by Metro Manila's high population density, advanced digital infrastructure, substantial middle-class consumer base, and concentration of logistics networks enabling rapid delivery fulfillment.

- Key Players: The Philippines online grocery market exhibits moderate competitive intensity, with established digital platforms competing alongside traditional retailers expanding their omnichannel presence. Some of key players operating in the market include, Ever Supermarket, foodpanda, GERALD.ph, Grab, Lazada Group, Metro Retail, MetroMart, Shop Suki, Supervalue, Inc., Valuemart, and WalterMart Delivery.

To get more information on this market Request Sample

The Philippines online grocery sector is shifting from pandemic-driven adoption to normalized, digital-first shopping. Urban consumers, especially dual-income households in Metro Manila, prioritize convenience and time savings over traditional wet markets. According to reports, Grab has been expanding its GrabMart operations across Metro Manila, partnering with supermarkets such as Ultramega and convenience stores like Lawson and Shell Select to broaden its product offerings and delivery footprint, helping boost on-demand grocery purchases in everyday life. Despite geographic challenges, innovations such as dark stores, micro-warehouses, and motorcycle-based last-mile delivery have expanded reach beyond major cities. Maturing digital payments via GCash and Maya have reduced transaction friction. With millennials and Gen Z embracing mobile commerce, online grocery is becoming mainstream, reshaping household purchasing and intensifying competition around delivery speed, quality assurance, and loyalty integration.

Philippines Online Grocery Market Trends:

Mobile-First Shopping Experience Optimization

Platform operators prioritize smartphone-native interfaces accommodating Filipino shopping behaviors through visual-heavy browsing, vernacular language support, and intuitive navigation for varying digital literacy levels. In August 2025, Robinsons Supermarket officially expanded its online grocery ordering options by enabling customers to order via platforms like Foodpanda, GrabMart, and MetroMart through its digital channels, reinforcing how integrated mobile interfaces are becoming central to major supermarket chains’ customer experience strategies. One-click reordering, personalized recommendations, and voice search capabilities enhance user convenience. Platforms address connectivity challenges with offline cart functionality and compressed image loading. Push notifications balance promotions with delivery updates, maintaining engagement without fatigue. Desktop interfaces decline in relevance as smartphones dominate internet access nationwide.

Quick Commerce and Ultra-Fast Delivery Proliferation

Platforms compete intensely on fulfillment speed, with dark store networks across Metro Manila and secondary cities enabling minute-range deliveries rather than hours. Social commerce startup SariSuki’s rapid grocery‑delivery arm Supah vowed to deliver groceries within 15 minutes across key Metro Manila districts through a network of strategically located dark stores and first‑party riders, putting hyper‑fast fulfillment at the center of its value proposition. Micro-fulfillment centers use data analytics for high-velocity inventory stocking while minimizing spoilage. Motorcycle-based fleets navigate congested traffic efficiently. Real-time tracking builds consumer confidence. Speed transitions from convenience feature to competitive necessity, requiring substantial infrastructure investments yet generating defensible advantages through superior customer experiences.

Integrated Financial Services and Digital Payment Ecosystem

Platforms integrate deeply with digital financial infrastructure, embedding GCash, Maya, and e-wallets that eliminate checkout friction through instant confirmations. In May 2025, Philippine fintech BillEase partnered with Maya Business to embed its Buy‑Now‑Pay‑Later (BNPL) service into Maya’s QR Ph‑enabled payment gateway and point‑of‑sale terminals, allowing shoppers to split purchases into instalments at checkout without a credit card, a move that strengthens mobile checkout flexibility across digital and physical retail channels. Buy-now-pay-later options address affordability concerns for larger purchases. Loyalty programs create switching costs through ecosystem-wide point redemption. Some platforms explore micro-lending for sari-sari store inventory ordering. QR code payments eliminate cash-on-delivery complications. Grocery platforms transform into financial management tools, accelerating cashless adoption among unbanked consumers.

Market Outlook 2026-2034:

The Philippines online grocery market demonstrates exceptional expansion potential as structural drivers cement digital channels into mainstream shopping behavior. Infrastructure investments in fiber-optic connectivity and cellular networks expand addressable markets into provincial areas. Government digitalization initiatives and e-commerce frameworks encourage platform investments. The young, digitally-native population accelerates adoption across product categories. Competition drives innovation in delivery models, payment options, and customer experiences. Traditional retailers' omnichannel transformations validate the channel while expanding consumer choice. The market generated a revenue of USD 3.9 Billion in 2025 and is projected to reach a revenue of USD 32.3 Billion by 2034, growing at a compound annual growth rate of 26.32% from 2026-2034.

Philippines Online Grocery Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Staples and Cooking Essentials | 29% |

| Business Model | Pure Marketplace | 50% |

| Platform | App-Based | 57% |

| Purchase Type | One-Time | 78% |

| Region | Luzon | 57% |

Product Type Insights:

- Vegetables and Fruits

- Dairy Products

- Staples and Cooking Essentials

- Snacks

- Meat and Seafood

- Others

The staples and cooking essentials dominates with a market share of 29% of the total Philippines online grocery market in 2025.

Staples and cooking essentials represents the cornerstone of Filipino dietary patterns, with households purchasing substantial quantities regularly, making it an anchor category for online grocery platforms. Philippines‑based supermarket WalterMart partnered with logistics provider 2GO to operationalize its e‑commerce grocery delivery service across Metro Manila, ensuring same‑day delivery of daily essentials and pantry staples directly to consumers’ homes, highlighting how core grocery categories like cooking oils, condiments, and rice are moving online as part of mainstream shopping behavior. Cooking oils, soy sauce, vinegar, and other pantry staples demonstrate high repurchase frequency that drives platform stickiness and repeat transactions. These products possess extended shelf lives that minimize spoilage concerns for both merchants and consumers, reducing operational complexity.

The segment benefits from predictable demand patterns that enable efficient inventory management and supply chain planning. Many platforms leverage staples as loss leaders to attract customers while generating margins through complementary product sales. Digital channels provide price transparency that empowers consumers to compare offerings across merchants instantly, intensifying competition yet building trust through consistent pricing. The essentiality of these products ensures sustained demand regardless of economic fluctuations, providing revenue stability. As platforms expand into subscription models, staples emerge as ideal categories for recurring delivery programs that enhance customer lifetime value while ensuring inventory turnover.

Business Model Insights:

To get detailed segment analysis of this market Request Sample

- Pure Marketplace

- Hybrid Marketplace

- Others

The pure marketplace leads with a share of 50% of the total Philippines online grocery market in 2025.

Pure marketplace architectures enable rapid geographic expansion without capital-intensive inventory investments, allowing platforms to scale across the archipelago's diverse urban and provincial markets efficiently. This asset-light approach transfers inventory risk to merchant partners while the platform focuses resources on technology development, customer acquisition, and logistics coordination. Multiple merchant participation creates competitive dynamics that benefit consumers through pricing pressure and product variety. Platform operators generate revenue through commission structures rather than product margins, aligning incentives toward transaction volume maximization.

The model proves particularly effective in the Philippines where numerous small-scale retailers and suppliers seek digital sales channels without developing proprietary e-commerce capabilities. Platforms provide merchant partners with access to digital payment infrastructure, delivery logistics, and marketing reach that would otherwise require prohibitive investments. Low barriers to merchant onboarding accelerate marketplace inventory depth across categories. The approach accommodates regional product variations and local preferences through decentralized merchant networks. Pure marketplaces demonstrate superior scalability characteristics compared to inventory-owning models, enabling faster response to demand shifts while maintaining operational flexibility across diverse market conditions and consumer segments.

Platform Insights:

- Web-Based

- App-Based

The app-based dominates with a market share of 57% of the total Philippines online grocery market in 2025.

Smartphone penetration exceeding desktop computer ownership throughout the Philippines establishes mobile applications as the primary digital commerce interface for the majority population. The Philippines smartphone market size reached USD 563.5 Million in 2025, highlighting the widespread availability of devices that support mobile-first commerce and underpin app-driven grocery adoption. App-based platforms deliver superior user experiences through interfaces optimized for touchscreen navigation, simplified checkout flows, and persistent login states that reduce friction. Push notification capabilities enable real-time order updates, promotional alerts, and re-engagement messaging that drives retention. Native applications leverage device features including location services for delivery address accuracy, camera integration for QR code scanning, and biometric authentication for secure transactions.

Mobile-first design philosophies recognize Filipino consumer behaviors including visual-heavy product browsing, frequent price comparison, and preference for localized content. Apps accommodate intermittent connectivity challenges through offline functionality and optimized data consumption. Integration with mobile wallets like GCash and Maya creates seamless payment experiences aligned with the nation's digital financial infrastructure trajectory. The intimate nature of smartphone usage generates richer behavioral data that platforms leverage for personalization and targeted marketing. As internet access increasingly occurs through mobile devices rather than fixed broadband, app-based platforms position themselves as the natural commerce interface for digitally-native younger demographics driving market growth.

Purchase Type Insights:

- One-Time

- Subscription

The one-time leads with a share of 78% of the total Philippines online grocery market in 2025.

Filipino consumer shopping patterns demonstrate strong promotional sensitivity and price consciousness that favor flexible purchasing over subscription commitments. One-time transactions enable consumers to capitalize on flash sales, seasonal discounts, and platform-specific promotions by shifting purchases across competing services. Many households exhibit variable grocery needs influenced by payday cycles, special occasions, and changing family circumstances that resist predictable subscription patterns. Cultural preferences for fresh ingredients and frequent market visits translate digitally into sporadic online orders rather than scheduled deliveries.

The transaction model eliminates commitment anxieties and cancellation friction that some consumers perceive as barriers to subscription adoption. Platforms employ one-time purchases as customer acquisition mechanisms, offering aggressive promotional pricing to attract trial while building familiarity and trust. The approach accommodates impulse purchases and immediate need fulfillment that subscriptions cannot address. Lower-income segments particularly favor payment flexibility over locked-in recurring expenses, even when subscriptions offer marginal per-unit savings. As the market matures, platforms experiment with hybrid approaches including flexible subscriptions with pause capabilities, yet one-time transactions continue dominating through superior alignment with established Filipino shopping behaviors and economic realities across diverse consumer segments.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon exhibits a clear dominance with a 57% share of the total Philippines online grocery market in 2025.

The capital region hosts the nation's highest smartphone penetration rates, digital payment adoption, and internet connectivity speeds that facilitate seamless online grocery experiences. Affluent and middle-class segments prevalent in Luzon demonstrate willingness to pay delivery premiums for convenience, supporting viable platform unit economics. Established retail infrastructure including supermarkets and convenience stores transitioning into omnichannel operations concentrates in Luzon's urban centers.

The region benefits from superior road networks and transportation infrastructure compared to other island groups, reducing last-mile delivery challenges and enabling quick commerce fulfillment windows. Corporate headquarters, technology companies, and business process outsourcing centers employing young professionals create demographic concentrations aligned with online grocery adoption profiles. Educational institutions and universities foster digital literacy and technology familiarity. Luzon's advanced logistics ecosystems including courier networks, cold chain facilities, and warehousing options support the operational requirements of online grocery fulfillment. As platforms establish viable business models in Luzon's high-density markets, they subsequently expand into Visayas and Mindanao, yet the capital region maintains dominance through sustained population concentration and digital infrastructure advantages.

Market Dynamics:

Growth Drivers:

Why is the Philippines Online Grocery Market Growing?

Pervasive Smartphone Adoption and Mobile Internet Penetration

The Philippines ranks among Southeast Asia's highest smartphone penetration markets, with mobile devices serving as primary internet access points across urban and provincial areas. Affordable smartphone availability through installment plans places devices within reach of middle and lower-income segments. Telecommunications providers continuously invest in network infrastructure upgrades, expanding coverage and bandwidth capabilities. This connectivity transformation eliminates historical barriers to online transactions, enabling real-time browsing, price comparison, and seamless checkout. Younger demographics demonstrate pronounced comfort with mobile interfaces, translating digital fluency into grocery purchasing behaviors. Platform optimization for mobile-first engagement creates self-reinforcing adoption cycles.

Digital Payment Infrastructure Maturation and E-Wallet Proliferation

Digital wallets including GCash, Maya, and platform-specific solutions eliminate cash-on-delivery dependencies that historically complicated online grocery transactions. In October 2025, e‑wallet usage in the Philippines has surged at the grassroots level, with a 2025 report finding that about half of surveyed sari‑sari store owners saw a 75% increase in e‑wallet transactions between January and August, and 85% used GCash while 15% used Maya for business operations, underscoring how digital wallets are rapidly becoming everyday payment tools beyond urban commerce. Instant payment confirmation provides transaction certainty while reducing delivery complications and fraud risks. Integration between platforms and payment providers creates frictionless checkout requiring minimal user input beyond biometric authentication. Payment infrastructure enables promotional mechanics including instant rebates, loyalty accumulation, and coordinated discounts. E-wallets expand financial inclusion by providing banking-adjacent services to unbanked segments, transforming payment from friction into competitive advantage.

Urbanization and Time Scarcity Among Dual-Income Households

Metro Manila's notorious traffic congestion transforms grocery shopping into significant time investments that justify delivery service premiums. Dual-income households prioritize convenience over marginal cost savings, recognizing opportunity costs of commuting, navigating crowds, and checkout lines. Traffic conditions in Metro Manila have been shown to slow travel speeds significantly, with ride‑hailing data indicating that peak‑hour travel times can increase by about 20%–25% due to congestion, reinforcing why urban residents increasingly turn to online delivery services for groceries and essentials. Work-from-home arrangements create daytime delivery windows previously unavailable. Young professionals demonstrate pronounced digital commerce comfort, transferring online behaviors from fashion and electronics into groceries. Extended working hours and lengthy commutes compress domestic task availability, elevating delivery from luxury to practical necessity. The value proposition encompasses time savings, stress reduction, and lifestyle enhancement. Accelerating urbanization toward metropolitan employment intensifies convenience imperatives.

Market Restraints:

What Challenges the Philippines Online Grocery Market is Facing?

Archipelagic Geography and Last-Mile Delivery Complexity

The Philippines geographic fragmentation across thousands of islands creates inherent logistics challenges complicating nationwide expansion beyond urban centers. water crossings introduce transportation delays and cost premiums undermining delivery speed advantages. provincial areas lack population densities justifying infrastructure investments, limiting addressable markets. road quality varies dramatically outside metropolitan regions, particularly during monsoons when flooding disrupts routes. remote barangays remain economically difficult to serve given low order volumes. temperature-controlled supply chains for perishables prove challenging across extended distances, confining growth predominantly to luzon's urban corridors.

Traditional Market Preferences and Fresh Produce Quality Concerns

Filipino shopping culture maintains strong attachment to wet markets and palengkes where consumers personally select fresh produce, seafood, and meat through direct vendor interactions that online platforms cannot replicate. tactile product inspection represents deeply ingrained behavior, particularly among older demographics resistant to delegating quality assessment. concerns regarding freshness persist as adoption barriers despite platform assurances. cultural preferences for supporting neighborhood vendors and maintaining personal relationships create switching costs favoring traditional channels. skepticism regarding online representations versus delivered realities generates trust deficits requiring consistent execution to overcome.

Infrastructure Limitations and Payment Fragmentation

Internet connectivity remains unreliable in provincial areas despite improving penetration, creating technical barriers to seamless shopping experiences. electricity supply inconsistencies disrupt consumer access and cold chain requirements for perishables. many filipinos lack formal banking relationships or credit cards, though e-wallet growth mitigates this constraint. digital literacy varies substantially across age cohorts and socioeconomic segments, with older consumers and lower-income groups demonstrating limited comfort navigating online interfaces. fraud concerns create hesitancy about sharing payment information despite improving security protocols. address standardization challenges in informal settlements complicate delivery logistics in densely populated areas.

Competitive Landscape:

The Philippines online grocery market demonstrates moderate concentration with established platforms competing across differentiated strategic positions. Pure-play digital platforms leverage technology-first approaches emphasizing delivery speed and user experience, while traditional retailers pursue omnichannel strategies integrating physical stores with digital ordering. International e-commerce giants extend established logistics networks from adjacent categories into groceries, bringing substantial capital and operational expertise. Regional players differentiate through localized assortments, vernacular support, and community partnerships that multinationals struggle replicating. Competition centers on delivery speed, freshness assurance, pricing transparency, and payment flexibility. Market structure remains fluid as participants explore partnership models including last-mile collaborations and cross-platform loyalty integrations. Entry barriers remain manageable through asset-light marketplaces, yet operational efficiency requires sustained investments favoring capitalized players.

Some of the key players include:

- Ever Supermarket

- foodpanda

- GERALD.ph

- Grab

- Lazada Group

- Metro Retail

- MetroMart

- Shop Suki

- Supervalue, Inc.

- Valuemart

- WalterMart Delivery

Recent Developments:

- In February 2025, foodpanda Philippines is boosting its grocery delivery arm, pandamart, by focusing on value, convenience, and innovative features to meet rising consumer demand for quick and efficient online shopping. The platform aims to enhance customer experience and support continued growth in the country’s online grocery and delivery market.

Philippines Online Grocery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vegetables and Fruits, Dairy Products, Staples and Cooking Essentials, Snacks, Meat and Seafood, Others |

| Business Models Covered | Pure Marketplace, Hybrid Marketplace, Others |

| Platforms Covered | Web-Based, App-Based |

| Purchase Types Covered | One-Time, Subscription |

| Regions Covered | Luzon, Visayas, Mindanao |

| Companies Covered | Ever Supermarket, foodpanda, GERALD.ph, Grab, Lazada Group, Metro Retail, MetroMart, Shop Suki, Supervalue, Inc., Valuemart, WalterMart Delivery, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines online grocery market size was valued at USD 3.9 Billion in 2025.

The Philippines online grocery market is expected to grow at a compound annual growth rate of 26.32% from 2026-2034 to reach USD 32.3 Billion by 2034.

Staples and cooking essentials dominated the Philippines online grocery market with a share of 29%, driven by high repurchase frequency, essential household consumption patterns, and predictable demand that enables efficient inventory management across platform operations.

Key factors driving the Philippines online grocery market include pervasive smartphone adoption enabling mobile-first commerce experiences, digital payment infrastructure maturation through e-wallet proliferation eliminating transaction friction, urbanization creating time-scarce dual-income households prioritizing convenience, improved internet connectivity expanding addressable markets beyond metropolitan centers, and evolving consumer preferences toward digital channels cemented through pandemic-period behavioral shifts.

Major challenges include archipelagic geography complicating nationwide logistics expansion beyond urban centers, traditional market preferences and fresh produce quality concerns limiting adoption among older demographics, infrastructure limitations affecting connectivity reliability in provincial areas, payment fragmentation despite e-wallet growth, digital literacy gaps across age cohorts, delivery cost economics in low-density areas, and competitive intensity compressing margins while requiring sustained infrastructure investments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)