Philippines Pallet Market Size, Share, Trends and Forecast by Type, Application, Structural Design, and Region, 2025-2033

Philippines Pallet Market Overview:

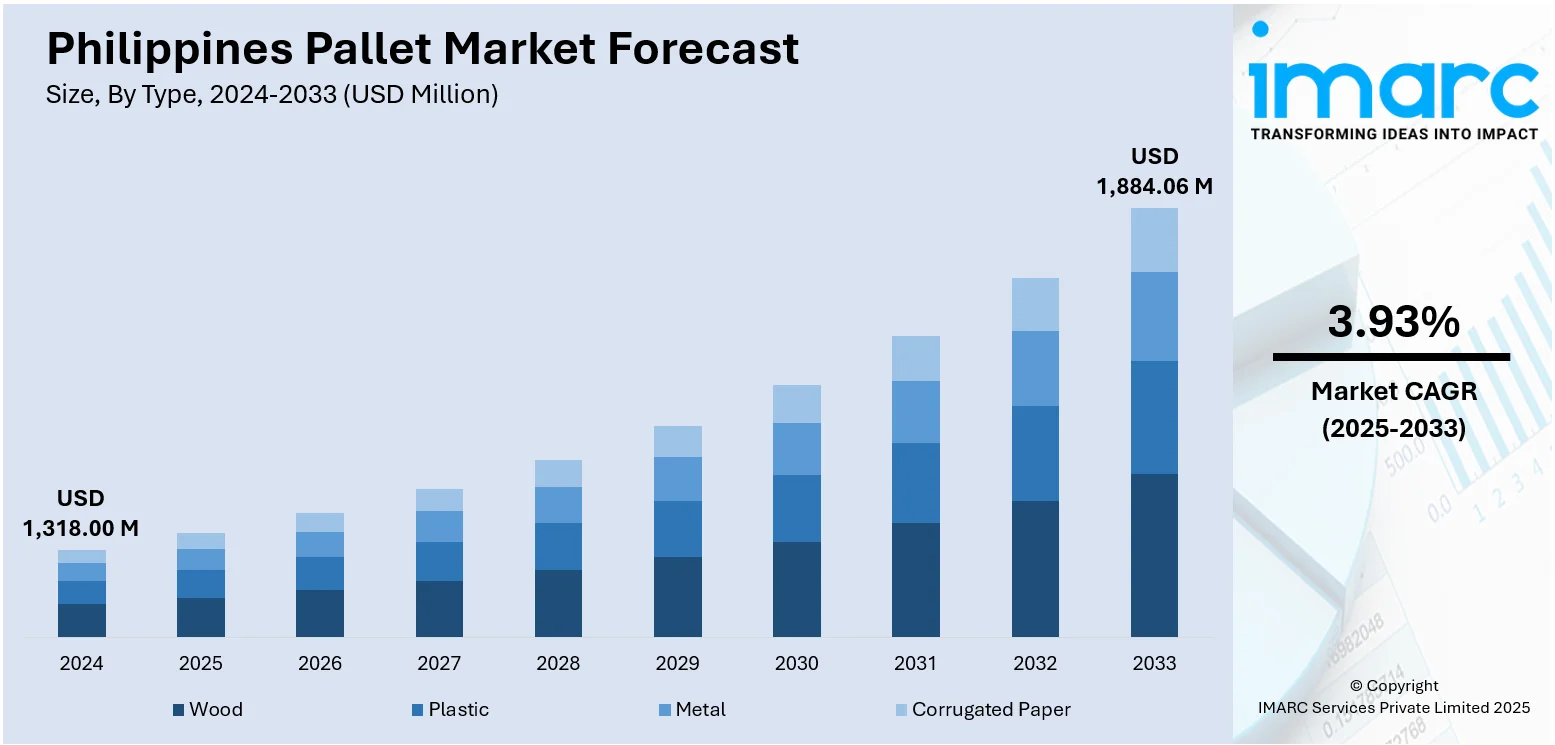

The Philippines pallet market size reached USD 1,318.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,884.06 Million by 2033, exhibiting a growth rate (CAGR) of 3.93% during 2025-2033. The market is driven by the robust expansion of export-oriented manufacturing and agriculture. Further impetus comes from the need for enhanced supply chain efficiency and cost reduction across the complex logistics network, favoring durable, reusable pallet solutions. The concurrent growth of modern retail, third-party logistics providers, and pallet pooling services is accelerating adoption, further augmenting the Philippines pallet market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,318.00 Million |

| Market Forecast in 2033 | USD 1,884.06 Million |

| Market Growth Rate 2025-2033 | 3.93% |

Philippines Pallet Market Trends:

Accelerating Shift Towards Plastic and Alternative Material Pallets

The market is experiencing a pronounced shift away from traditional wood towards plastic and other alternative materials. This transition is primarily driven by stringent hygiene and safety regulations, especially within the fast-growing pharmaceutical, food and beverage, and export-oriented manufacturing sectors. The Philippine food and beverage sector is forecasted to grow 5% in 2025 as per the USDA, with sustained domestic demand, fueled by rising incomes and softening inflation. U.S. exports remain the leader, with the Philippines being a key market for wheat, dairy, poultry, and processed fruits. Despite the pressures of inflation, local producers experienced growth in 2024, relying on U.S. ingredients to maintain quality and consistency. Plastic pallets offer significant advantages as they are easier to clean and sanitize, resistant to pests and moisture, more durable for repeated use, and often lighter than their wooden counterparts, contributing to lower freight costs. Exporters particularly favor them due to compliance with International Standards for Phytosanitary Measures (ISPM 15), eliminating the need for costly heat treatment or fumigation required for wood. Furthermore, advancements in manufacturing and increased local production capacity are gradually making plastic pallets more cost-competitive over their lifecycle, overcoming the initial higher purchase price barrier. While wood remains dominant overall due to lower upfront costs and established supply chains, the demand trajectory for plastic is robust and expanding rapidly, particularly among large, modern logistics operators and multinational corporations prioritizing supply chain efficiency and compliance.

To get more information on this market, Request Sample

Growing Adoption of Pallet Pooling and Rental Services

The accelerating need for cost optimization, flexibility, and reduced asset management burdens, pallet pooling, and rental services are positively influencing the Philippines pallet market growth. Companies, especially those with fluctuating demand patterns or seasonal peaks such as FMCG, agriculture exporters, are increasingly recognizing the financial and operational benefits of renting pallets instead of owning them. The pooling model eliminates large upfront capital expenditure, reduces costs associated with pallet retrieval, repair, storage, and replacement, and transfers the burden of pallet loss and damage management to the pooling provider. This is particularly valuable in a fragmented logistics landscape with complex reverse logistics challenges. The expansion of major international pallet pooling companies (such as CHEP and Loscam) within Indonesia, alongside the emergence of local players, is providing greater access to these services nationwide. The model also supports sustainability goals by maximizing pallet utilization and lifespan through centralized repair networks. As supply chains become more complex and businesses focus on core competencies, the convenience and economic efficiency of pallet pooling are compelling more Indonesian businesses to transition from outright ownership to rental solutions.

Philippines Pallet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and structural design.

Type Insights:

- Wood

- Plastic

- Metal

- Corrugated Paper

The report has provided a detailed breakup and analysis of the market based on the type. This includes wood, plastic, metal, and corrugated paper.

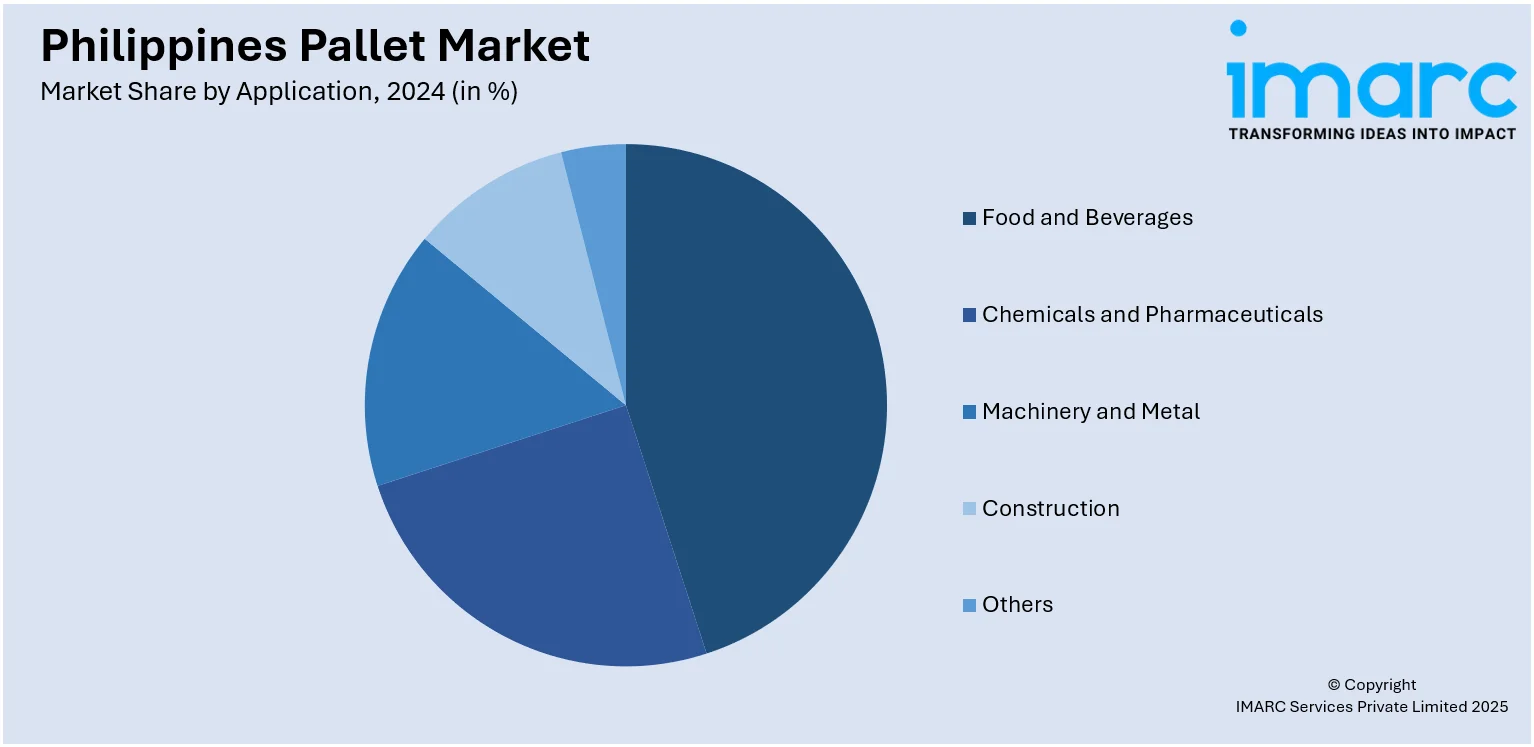

Application Insights:

- Food and Beverages

- Chemicals and Pharmaceuticals

- Machinery and Metal

- Construction

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes food and beverages, chemicals and pharmaceuticals, machinery and metal, construction, and others.

Structural Design Insights:

- Block

- Stringer

- Others

The report has provided a detailed breakup and analysis of the market based on the structural design. This includes block, stringer, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Pallet Market News:

- November 04, 2024: Maersk opened its largest distribution hub in the Philippines, the 10-hectare Maersk Optimus Distribution Center in Calamba, Laguna, with a capacity of 76,000 pallets. The facility is intended to enhance logistics efficiency in Southern Luzon and is equipped with advanced technologies to save energy and water. By serving key industries such as food and beverage, the center strengthens the country's logistics system and competitiveness.

Philippines Pallet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wood, Plastic, Metal, Corrugated Paper |

| Applications Covered | Food and Beverages, Chemicals and Pharmaceuticals, Machinery and Metal, Construction, Others |

| Structural Designs Covered | Block, Stringer, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines pallet market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines pallet market on the basis of type?

- What is the breakup of the Philippines pallet market on the basis of application?

- What is the breakup of the Philippines pallet market on the basis of structural design?

- What is the breakup of the Philippines pallet market on the basis of region?

- What are the various stages in the value chain of the Philippines pallet market?

- What are the key driving factors and challenges in the Philippines pallet market?

- What is the structure of the Philippines pallet market and who are the key players?

- What is the degree of competition in the Philippines pallet market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines pallet market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines pallet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines pallet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)