Philippines Paper Bags Market Size, Share, Trends and Forecast by Product Type, Material Type, Thickness, Distribution Channel, End-Use Industry, and Region, 2026-2034

Philippines Paper Bags Market Summary:

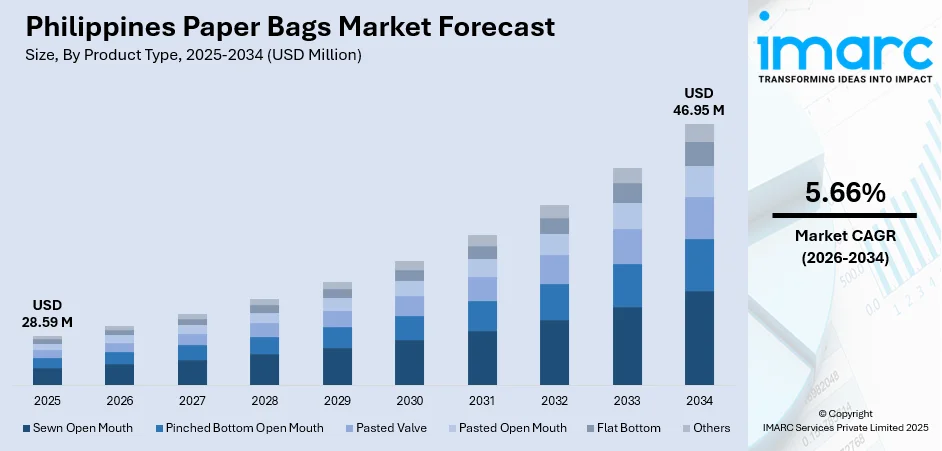

The Philippines paper bags market size was valued at USD 28.59 Million in 2025 and is projected to reach USD 46.95 Million by 2034, growing at a compound annual growth rate of 5.66% from 2026-2034.

The Philippines paper bags market is experiencing robust expansion driven by increasing environmental concerns, stringent government bans on single-use plastics, and rising adoption among retailers and foodservice providers. The growing preference among consumers for eco-friendly packaging solutions and sustainable business practices is further accelerating market growth. Additionally, the expanding food and beverage sector combined with heightened awareness of plastic pollution is strengthening demand dynamics across the Philippines paper bags market share.

Key Takeaways and Insights:

-

By Product Type: Flat bottom dominates the market with a share of 35.02% in 2025, attributed to its superior structural stability, enhanced load-bearing capacity, and widespread preference among retailers and quick-service restaurants for carrying food items and merchandise.

-

By Material Type: Brown kraft holds the largest share of 80.04% in 2025, underpinned by its cost-effectiveness, natural aesthetic appeal, biodegradable properties, and strong consumer preference for eco-friendly packaging alternatives across retail and foodservice applications.

-

By Thickness: 2 ply leads the market with a share of 40.07% in 2025, reflecting the optimal balance between durability and cost-efficiency that meets requirements for medium-weight applications in grocery, retail, and food delivery segments.

-

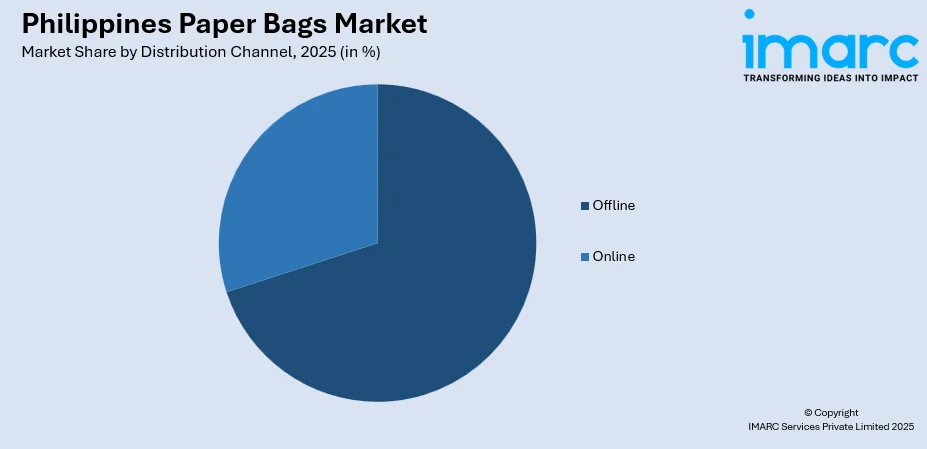

By Distribution Channel: Offline dominate with 70.05% market share in 2025, as businesses prioritize bulk procurement through established distributor networks, direct manufacturer relationships, and traditional wholesale channels for consistent supply.

-

By End-Use Industry: Food and beverages accounts for the leading share of 40.08% in 2025, driven by the rapid expansion of quick-service restaurants, food delivery platforms, and increasing consumer preference for sustainable takeaway packaging solutions.

-

By Region: Luzon leads the market with a share of 56% in 2025, propelled by the concentration of commercial activities in Metro Manila, robust retail infrastructure, and substantial presence of food service establishments across the National Capital Region.

-

Key Players: The Philippines paper bags market demonstrates a competitive landscape characterized by domestic manufacturers and regional suppliers serving diverse end-use requirements. Market participants differentiate through product quality, customization capabilities, pricing strategies, and distribution network reach.

To get more information on this market Request Sample

The Philippines paper bags market is undergoing significant transformation propelled by regulatory initiatives against single-use plastics and evolving consumer environmental consciousness. For example, in April 2025, Quezon City officially banned single‑use plastics, including plastic bags and packaging, within city government buildings under Executive Order No. 3, Series of 2025, supporting the transition to sustainable alternatives such as paper bags. Retailers and foodservice operators increasingly adopt paper-based packaging solutions to align with sustainability commitments and comply with local government ordinances. The expanding middle class coupled with changing consumption patterns is enabling broader adoption of eco-friendly packaging alternatives. Infrastructure development in secondary cities is further extending market reach beyond traditional metropolitan centers. Government initiatives focused on ecological solid waste management demonstrate policy support toward promoting biodegradable packaging materials across the country.

Philippines Paper Bags Market Trends:

Accelerating Shift from Plastic to Paper Packaging

The Philippines is experiencing a rapid shift from plastic to paper packaging, driven by stronger environmental awareness and local government plastic bans. In July 2025, Watsons Philippines shifted 81% of stores to paper bags, reflecting the SM Group’s sustainability efforts and growing retail adoption of eco-friendly packaging. Rising consumer demand for sustainable options is creating growth opportunities for paper bag manufacturers. Retailers and quick-service restaurants are increasingly adopting paper alternatives to strengthen brand image and demonstrate environmental responsibility, positioning paper bags as the preferred packaging solution across diverse commercial applications.

Rising Demand from Quick-Service Restaurants and Food Delivery

The rapid expansion of quick-service restaurants and food delivery platforms is driving strong demand for paper bags in Philippine cities. These services require durable, grease-resistant packaging that preserves food quality during transit. Paper bags meet operational needs through breathability and heat retention while offering biodegradability. In 2025, Treasure Island Packaging Corp., maker of iPak, partnered to expand recyclable, sustainable food-grade packaging, meeting rising foodservice and delivery demand and aligning with greener local packaging trends. Additionally, restaurants increasingly use custom-printed paper bags to boost brand visibility and signal commitment to sustainable, responsible packaging practices.

Growth in Customized and Branded Paper Bag Solutions

Demand for customized and branded paper bags is rising rapidly across Philippine retail and foodservice sectors, as businesses increasingly use them as functional marketing tools. At events like ProPak Philippines 2025, local packaging manufacturers and retailers showcased advanced customizable and sustainable packaging solutions, highlighting how tailored designs and print options are becoming central to brand differentiation and customer engagement in the industry. Manufacturers are expanding customization options such as advanced printing, handle types, and specialized coatings.

Market Outlook 2026-2034:

The Philippines paper bags market is expected to register steady growth over the forecast period, supported by stricter regulations on single-use plastics, rapid expansion of the foodservice industry, and rising consumer awareness regarding environmental sustainability. The market outlook remains favorable, with increasing adoption of paper bags across retail packaging, food delivery and takeaway services, and various industrial applications, as businesses seek eco-friendly alternatives that align with regulatory compliance and sustainability goals. The market generated a revenue of USD 28.59 Million in 2025 and is projected to reach a revenue of USD 46.95 Million by 2034, growing at a compound annual growth rate of 5.66% from 2026-2034.

Philippines Paper Bags Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Flat Bottom |

35.02% |

|

Material Type |

Brown Kraft |

80.04% |

|

Thickness |

2 Ply |

40.07% |

|

Distribution Channel |

Offline |

70.05% |

|

End-Use Industry |

Food and Beverages |

40.08% |

|

Region |

Luzon |

56% |

Product Type Insights:

- Sewn Open Mouth

- Pinched Bottom Open Mouth

- Pasted Valve

- Pasted Open Mouth

- Flat Bottom

- Others

The flat bottom dominates with a market share of 35.02% of the total Philippines paper bags market in 2025.

Flat bottom paper bags represent the preferred choice across Philippine retail and foodservice sectors owing to their superior structural stability and enhanced load-bearing capacity.. Quick-service restaurants and retail establishments favor flat bottom configurations for their professional appearance and practical functionality in carrying various food items and merchandise. In 2025, DOST‑ITDI showcased local green packaging technologies at ProPak Philippines, highlighting sustainable solutions by Filipino innovators to help MSMEs and larger companies adopt eco-friendly packaging across industries.

The segment's dominance is reinforced by growing adoption among bakeries, cafes, and specialty food retailers who require presentable packaging solutions that enhance customer experience. Manufacturers offer flat bottom bags in various sizes and weight capacities to accommodate diverse application requirements from light pastries to heavier grocery items. The versatility and aesthetic appeal of flat bottom designs continue driving preference among businesses seeking both functional and visually attractive packaging options

Material Type Insights:

- Brown Kraft

- White Kraft

The brown kraft leads with a share of 80.04% of the total Philippines paper bags market in 2025.

Brown kraft paper bags continue commanding the Philippine market owing to their cost-effectiveness, natural rustic aesthetic, and strong environmental credentials. In 2025, Stacks Packaging PH highlighted Filipino food brands and cafés adopting kraft paper packaging to meet sustainability goals and reduce single-use plastics, emphasizing its growing role as an eco-friendly alternative in foodservice and retail. Consumers associate brown kraft packaging with eco-friendliness and authenticity, making it particularly appealing for organic products, artisanal goods, and environmentally conscious brands.

The market demand for brown kraft paper bags in the Philippines is increasingly driven by their versatility and compatibility with custom branding. Businesses are leveraging printing and embossing options to create distinctive packaging that reinforces brand identity while maintaining eco-friendly credentials. The bags’ robust construction supports a wide range of product weights, from groceries to boutique merchandise, enabling retailers to combine functional durability with sustainable marketing, thereby enhancing customer perception and loyalty.

Thickness Insights:

- 1 Ply

- 2 Ply

- 3 Ply

- > 3 Ply

The 2 Ply dominates with a market share of 40.07% of the total Philippines paper bags market in 2025.

The 2 ply thickness segment represents the ideal balance between durability and cost-efficiency, effectively meeting requirements across a wide range of commercial applications. This configuration delivers sufficient strength for medium-weight products such as groceries, takeaway food items, and general retail merchandise, while keeping pricing competitive. Businesses favor 2 ply bags for their dependable performance in everyday usage scenarios, offering a practical solution that combines reliability, affordability, and versatility without incurring excessive material or production costs.

Additionally, the 2 ply segment benefits from growing adoption among organized retail chains and foodservice operators seeking standardized, eco-friendly packaging solutions. Its compatibility with automated bag-making processes and ease of printing for branding purposes further enhance its appeal. As sustainability regulations tighten and bulk procurement increases, demand for 2 ply paper bags is expected to remain strong, supported by consistent performance, scalability, and favorable unit economics across high-volume commercial use cases.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

The offline leads with a share of 70.05% of the total Philippines paper bags market in 2025.

Traditional offline distribution channels continue to hold a dominant position in the Philippines paper bags market, reflecting strong consumer and business confidence in established procurement practices. Companies prioritize bulk sourcing through trusted distributors, direct manufacturer connections, and wholesale partners, which ensure consistent supply, competitive pricing, and reliability. In-person interactions further allow buyers to discuss product customization, verify quality standards, and arrange flexible payment terms, making offline channels the preferred choice for many commercial and retail buyers.

Offline distribution remains the preferred route for paper bag procurement in the Philippines, driven by established buyer trust and familiarity with conventional purchasing methods. Businesses leverage distributors, wholesalers, and direct manufacturer networks to secure steady supply, volume discounts, and cost efficiencies. Face-to-face engagement enables detailed discussions on product specifications, quality checks, and negotiated pricing, while long-term relationships support flexible credit and timely delivery. These advantages reinforce the sustained dominance of offline channels among commercial and retail clients.

End-Use Industry Insights:

- Food and Beverages

- Pharmaceutical

- Retail

- Construction

- Chemicals

- Others

The food and beverages dominates with a market share of 40.08% of the total Philippines paper bags market in 2025.

Food and beverage applications represent the primary driver of paper bag demand in the Philippines driven by rapid expansion of quick-service restaurants, cafes, bakeries, and food delivery services. Paper bags offer food-safe properties, grease resistance options, and breathability characteristics essential for maintaining product quality during transport and storage. In June 2025, the Philippine government launched the National Plastic Action Partnership (NPAP), a multi‑stakeholder platform led by the Department of Environment and Natural Resources to tackle plastic pollution, promote a circular economy, and reduce reliance on single‑use plastics across sectors.

Additionally, growing environmental awareness among Filipino consumers is encouraging restaurants and retailers to adopt paper bags as a sustainable alternative to single-use plastics. Government regulations limiting plastic usage in commercial establishments further support this shift, prompting widespread integration of eco-friendly packaging solutions. Customization options, such as branded prints and varied sizes, also enhance the appeal of paper bags for marketing and promotional purposes, boosting demand across both urban and regional food service outlets.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The Luzon exhibits a clear dominance with a 56% share of the total Philippines paper bags market in 2025.

Luzon accounts for the highest regional demand for paper bags, driven by Metro Manila’s dense commercial ecosystem and surrounding provinces such as Cavite, Laguna, Batangas, Rizal, and Bulacan. The region’s robust retail, foodservice, and industrial sectors require reliable packaging solutions to support daily operations. Growing urbanization and a rising number of small- and medium-sized enterprises further amplify the need for paper bags, making Luzon a critical hub for packaging manufacturers and distributors.

The island’s leadership in paper bag consumption is reinforced by well-established distribution networks and close proximity to manufacturing facilities. Efficient logistics channels facilitate timely deliveries to urban and suburban markets, reducing lead times and operational costs for businesses. Additionally, Luzon’s strategic location enables suppliers to serve high-demand areas quickly, while regional wholesalers and distributors provide scalable solutions for bulk procurement, ensuring continuous availability of paper bags across diverse commercial and retail applications.

Market Dynamics:

Growth Drivers:

Why is the Philippines Paper Bags Market Growing?

Government Regulations Against Single-Use Plastics

The Philippine government's stringent stance against single-use plastics through national legislation and local government unit ordinances is creating substantial demand for paper bag alternatives. Regulatory initiatives including plastic bag bans, mandatory fees, and restrictions on single-use packaging. In January 2025, the Department of Environment and Natural Resources (DENR) launched the National Plastic Action Partnership (NPAP) Philippines, a multi-stakeholder platform to tackle plastic pollution and accelerate the shift to a circular economy, strengthening policy support for alternatives such as paper-based packaging. Increasing numbers of cities and municipalities are implementing localized plastic reduction programs that directly stimulate paper bag market growth across affected commercial establishments.

Rising Environmental Awareness Among Consumers

Filipino consumers are demonstrating heightened environmental consciousness and increasing preference for brands demonstrating sustainable business practices. The growing awareness of plastic pollution impacts on marine ecosystems and public health is driving demand shifts toward eco-friendly packaging alternatives. According to reports, over 80 % of Filipino consumers say they prefer eco‑friendly products and brands that are perceived as environmentally responsible, reflecting broad support across socioeconomic groups for sustainability‑aligned purchasing decisions. Consumers actively seek retailers and food establishments offering paper-based packaging options, creating competitive advantages for businesses adopting sustainable solutions. Social media amplification of environmental messages and youth activism are accelerating awareness levels and influencing purchasing behaviors across consumer demographics.

Expansion of Food Service and Delivery Sectors

The rapid expansion of quick-service restaurants, cafes, bakeries, and food delivery platforms is generating substantial demand for paper bags across Philippine urban centers. The proliferation of food delivery applications requires reliable packaging solutions capable of maintaining product quality during transit while meeting sustainability expectations. Quick-service restaurant chains are standardizing paper bag usage across their operations to demonstrate corporate environmental responsibility. The growing café culture and artisanal food retail segment further drives demand for presentable, branded paper packaging solutions that enhance customer experience.

Market Restraints:

What Challenges the Philippines Paper Bags Market is Facing?

Competition from Plastic Packaging

Despite regulatory pressure, the plastic packaging industry remains a formidable competitor offering lower costs and versatile performance characteristics. Many small businesses continue preferring plastic due to competitive pricing and water-resistance properties that paper alternatives may lack. Price-sensitive commercial buyers particularly in informal retail sectors prioritize cost considerations over environmental attributes.

Raw Material Price Volatility

Dependence on imported pulp and paper materials creates vulnerability to global commodity price fluctuations and supply chain disruptions affecting manufacturing costs. Currency exchange rate variations influence import expenses and downstream product pricing competitiveness. Raw material availability constraints during global supply tightness periods impact production planning and inventory management for paper bag manufacturers.

Limited Moisture and Grease Resistance

Lower moisture and grease resistance compared to plastic restricts paper bag usage in several food and beverage segments. Improving barrier performance requires specialized coatings, increasing manufacturing costs and potentially undermining recyclability. Limited strength in wet conditions further constrains adoption in applications that require dependable, fully waterproof packaging solutions across commercial distribution and handling environments.

Competitive Landscape:

The Philippines paper bags market features a diverse competitive environment with domestic manufacturers and regional suppliers serving varied end-use requirements. Local companies leverage established distribution networks and customer relationships while competing on pricing, customization capabilities, and delivery reliability. The market structure encourages continuous innovation as players compete across product quality, design capabilities, and service dimensions. Strategic investments in production capacity and printing technologies are strengthening competitive positions. Competition intensifies with manufacturers enhancing customization offerings, expanding geographic reach, and developing specialized products for different industry applications to capture growing consumer demand.

Recent Developments:

-

In March 2025, Ajinomoto Philippines relaunched paper packaging for key products to curb plastic waste and advance sustainability initiatives. This move reinforces the adoption of eco-friendly materials in the local food industry, aligning with growing environmental awareness and regulatory support for alternatives to single-use plastics.

Philippines Paper Bags Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sewn Open Mouth, Pinched Bottom Open Mouth, Pasted Valve, Pasted Open Mouth, Flat Bottom, Others |

| Material Types Covered | Brown Kraft, White Kraft |

| Thickness Covered | 1 Ply, 2 Ply, 3 Ply, > 3 Ply |

| Distribution Channels Covered | Online, Offline |

| End-Use Industries Covered | Food and Beverages, Pharmaceutical, Retail, Construction, Chemicals, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines paper bags market size was valued at USD 28.59 Million in 2025.

The Philippines paper bags market is expected to grow at a compound annual growth rate of 5.66% from 2026-2034 to reach USD 46.95 Million by 2034.

Flat bottom dominates the Philippines paper bags market with a 35.02% share, driven by its superior structural stability, enhanced load-bearing capacity, and widespread preference among retailers and foodservice establishments.

Key factors driving the Philippines paper bags market include government regulations against single-use plastics, rising environmental awareness among consumers, expansion of food service and delivery sectors, and increasing corporate sustainability commitments

Major challenges include competition from lower-cost plastic packaging alternatives, raw material price volatility affecting production costs, limited moisture and grease resistance compared to plastic options, and infrastructure requirements for scaling local manufacturing capacity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)