Philippines Paper Packaging Market Size, Share, Trends and Forecast by Product Type, Grade, Packaging Level, End-Use Industry, and Region, 2025-2033

Philippines Paper Packaging Market Overview:

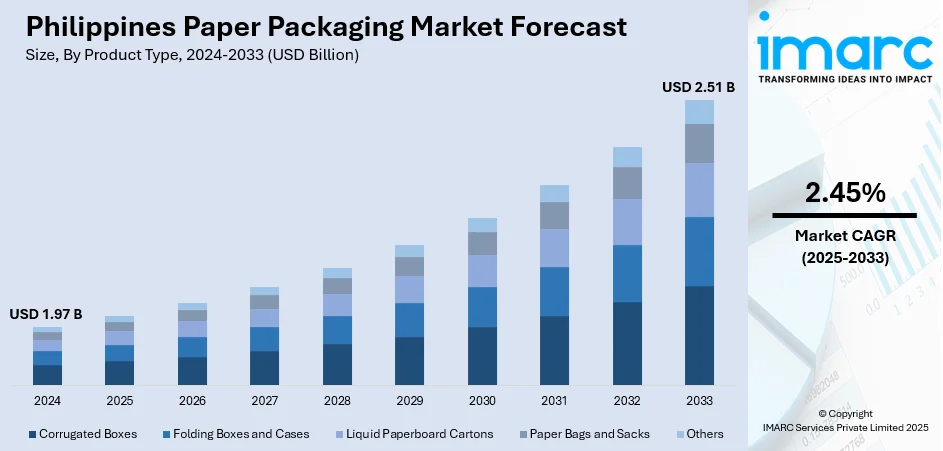

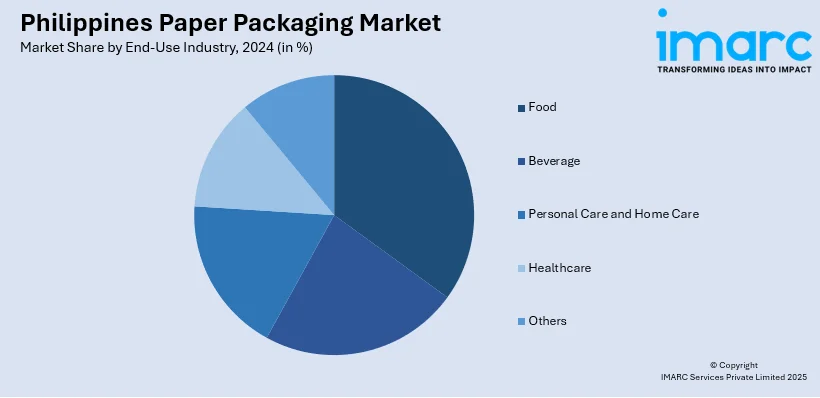

The Philippines paper packaging market size reached USD 1.97 Billion in 2024. The market is projected to reach USD 2.51 Billion by 2033, exhibiting a growth rate (CAGR) of 2.45% during 2025-2033. Rising sustainability demands, with businesses and consumers shifting away from single-use plastics toward recyclable and biodegradable options that align with eco-friendly values and regulatory requirements are influencing the market demand. Additionally, expanding food, beverage, personal care, and pharmaceutical sectors require safe, attractive, and functional packaging, making paper an ideal choice for balancing performance, aesthetics, and environmental responsibility thus strengthening the Philippines paper packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.97 Billion |

| Market Forecast in 2033 | USD 2.51 Billion |

| Market Growth Rate 2025-2033 | 2.45% |

Philippines Paper Packaging Market Trends:

Sustainability & Regulatory Pressure

The push for sustainability is one of the strongest forces driving Philippines paper packaging market growth. Consumers are increasingly aware of the environmental impact of plastic, making paper-based alternatives more attractive. At the same time, businesses are adopting eco-friendly packaging to enhance their brand image and meet evolving market expectations. Regulations aimed at reducing plastic waste are accelerating this shift, encouraging companies to explore recyclable and biodegradable options. Paper packaging also provides versatility, allowing manufacturers to balance function with environmentally responsible practices. From food products to retail goods, brands are redesigning their packaging strategies to meet these demands. In this context, paper packaging is no longer just an option—it has become a key part of corporate sustainability plans and a competitive advantage for businesses seeking to attract conscious consumers and comply with tightening environmental guidelines.

To get more information on this market, Request Sample

Boom in E‑Commerce & Online Retail

The Philippine Statistics Authority reports that in 2023, e‑commerce accounted for 14% of the country’s digital economy and employed 87.3% of the 9.68 million people working in the sector, underscoring its massive impact on trade and consumer behavior. This surge has transformed shopping habits, creating a strong demand for practical and reliable packaging. Paper packaging has become a preferred option for online sellers because it is lightweight, protective, and customizable for branding while appealing to eco‑conscious buyers seeking reduced plastic use. The expansion of direct‑to‑consumer ventures and small online retailers has boosted the need for affordable, flexible solutions like mailers, pouches, and corrugated boxes. These paper options not only protect goods during transit but also enhance the unboxing experience—a growing competitive differentiator. As delivery volumes rise, paper packaging delivers the ideal balance of cost, sustainability, and functionality for the Philippine e‑commerce market.

Growth in Food, Beverage & Other End‑User Industries

The expansion of industries such as food and beverage, personal care, pharmaceuticals, and consumer goods is another major Philippines paper packaging market trend boosting the market growth. As lifestyles become more urbanized and convenience-oriented, there is a greater need for safe, attractive, and sustainable packaging that protects product quality. For food and drinks, paper packaging offers excellent shelf appeal while complying with hygiene and safety requirements. In personal care and household products, paper solutions help brands deliver a premium, sustainable brand image that resonates with buyers. Even industrial sectors, such as agriculture and construction, increasingly rely on durable paper bags and sacks for bulk products, aligning with both performance needs and sustainability practices. This broad application across sectors ensures paper packaging remains versatile and indispensable, supporting businesses as they adapt to evolving consumer preferences and industry demands.

Philippines Paper Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, grade, packaging level and end-use industry.

Product Type Insights:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others.

Grade Insights:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes solid bleached, coated recycled, uncoated recycled, and others.

Packaging Level Insights:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

A detailed breakup and analysis of the market based on the packaging level have also been provided in the report. This includes primary packaging, secondary packaging, and tertiary packaging.

End-Use Industry Insights:

- Food

- Beverage

- Personal Care and Home Care

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes food, beverage, personal care and home care, healthcare, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Paper Packaging Market News:

- In May 2024, Mondi introduced TrayWrap a sustainable secondary packaging solution designed to replace plastic shrink wrap for bundling food and beverage products. Made from 100% renewable, uncoated kraft paper from Mondi’s Advantage StretchWrap range, it ensures recyclability within existing paper streams. Used by a Swedish coffee brand, TrayWrap secures products with minimal adhesive dots, featuring pre‑punched folds for stability, stackability, visibility, and easy unpacking—offering an eco‑friendly alternative to traditional plastic wraps.

Philippines Paper Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End-Use Industries Covered | Food, Beverage, Personal Care and Home Care, Healthcare, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines paper packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines paper packaging market on the basis of product type?

- What is the breakup of the Philippines paper packaging market on the basis of grade?

- What is the breakup of the Philippines paper packaging market on the basis of packaging level?

- What is the breakup of the Philippines paper packaging market on the basis of end-use industry?

- What is the breakup of the Philippines paper packaging market on the basis of region?

- What are the various stages in the value chain of the Philippines paper packaging market?

- What are the key driving factors and challenges in the Philippines paper packaging market?

- What is the structure of the Philippines paper packaging market and who are the key players?

- What is the degree of competition in the Philippines paper packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines paper packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines paper packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines paper packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)