Philippines Party Supplies Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2026-2034

Philippines Party Supplies Market Summary:

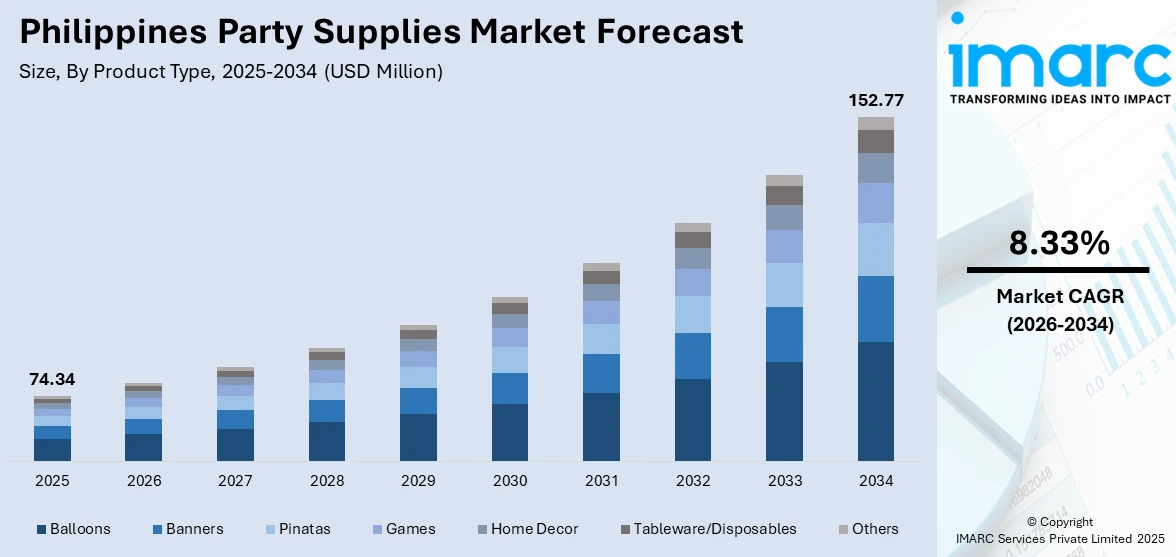

The Philippines party supplies market size was valued at USD 74.34 Million in 2025 and is projected to reach USD 152.77 Million by 2034, growing at a compound annual growth rate of 8.33% from 2026-2034.

The Philippines party supplies market is experiencing robust expansion driven by the country's vibrant celebration culture encompassing fiestas, birthdays, and family gatherings. Growing consumer preference for personalized and themed events, coupled with increasing social media influence on decorative trends, is propelling demand. The expansion of modern retail formats, rising disposable incomes, and growing urbanization continue to reshape purchasing patterns across the Philippines party supplies market share.

Key Takeaways and Insights:

- By Product Type: Balloons dominate the market with a share of 27% in 2025. These intricate balloon arrangements are growing in popularity for themed events because of social media-inspired décor trends, their aesthetic appeal, and their adaptability in creating festive moods.

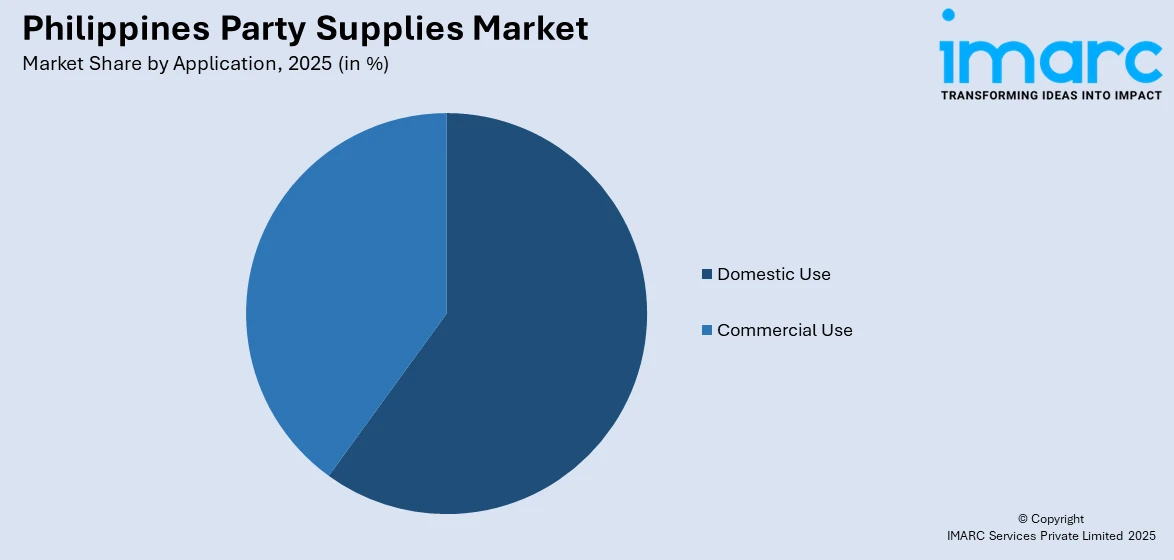

- By Application: Domestic use leads the market with a share of 60% in 2025. This dominance is driven by the Filipino tradition of home-based celebrations, growing preference for DIY party planning, and cost-conscious consumers organizing intimate family gatherings and milestone celebrations.

- By Distribution Channel: Supermarkets and hypermarkets represent the biggest segment with a market share of 35% in 2025, reflecting the prevalence of large retail chains in both urban and suburban locations, consumer preferences for convenient one-stop shopping, and competitive pricing.

- By Region: Luzon is the largest region with 49% share in 2025, driven by the concentration of population in Metro Manila, higher purchasing power, advanced retail infrastructure, and the presence of major commercial centers throughout the region.

- Key Players: Key players drive the Philippines party supplies market by expanding product portfolios, enhancing distribution networks, and introducing innovative themed collections. Their investments in e-commerce capabilities, sustainability initiatives, and strategic partnerships with retailers boost accessibility, accelerate adoption, and ensure consistent product availability across diverse consumer segments.

To get more information on this market Request Sample

As businesses, families, and event planners embrace creative celebration solutions that transform ordinary occasions into memorable ones, the market for party supplies in the Philippines is expanding. Immediate interest in popular styles and themed setups is being driven by growing consumer awareness of international party trends, especially through social media platforms where Filipino households spend a lot of time interacting with decoration instructions and celebration ideas. Innovative goods that resonate with cultural festivals, such as traditional fiestas, birthdays, anniversaries, and religious milestones that are essential components of Filipino social life, are being introduced by creative local designers. The nation's youthful, tech-savvy populace, which appreciates shareable, eye-catching party aesthetics, further boosts the industry. Suppliers are expanding sustainable party supply choices, such as biodegradable balloons and eco-friendly dinnerware, in response to environmental advocacy groups' requests to communities to stop using disposable plastic decor during festivities. This emphasis on sustainability is in line with consumer demands for eco-friendly goods that reduce environmental effect without sacrificing the quality of celebrations. Demand for customization, digital impact, and environmental awareness are all coming together to change the dynamics of the Philippine party supply market and its growth trajectory.

Philippines Party Supplies Market Trends:

Social Media-Driven Decoration Trends

Party supply choices are being drastically altered by social media platforms as customers look for eye-catching and viral celebration setups. Trending balloon arches, themed backdrops, and coordinated color schemes are in high demand right now thanks to viral décor instructions and influencer-led content. Themed party searches have significantly increased on Pinterest in recent years, which is indicative of the growing impact of digital inspiration on consumer choices. The desire for high-quality, customisable party decorations that enable unique, photo-worthy parties is being driven by event planners and do-it-yourself enthusiasts who actively copy web material.

Rise of Sustainable and Eco-Friendly Party Supplies

Party supplier choices are becoming more and more influenced by environmental consciousness as customers and event planners give preference to sustainable options. As people become more conscious of plastic pollution, products like recyclable decorations, biodegradable balloons, and compostable tableware are becoming more popular. Suppliers are being encouraged to create eco-friendly product lines by local government programs that support the reduction of single-use plastics. This shift toward sustainability is a reflection of broader customer attitudes, especially among younger populations who favor firms that use ethical production and packaging techniques and take the environment into account while organizing celebrations.

Personalization and DIY Culture Expansion

Customizable party supplies are in high demand around the Philippines due to the rising popularity of bespoke events. Instead of buying generic off-the-shelf items, consumers are increasingly looking for distinctive designs catered to particular themes, color schemes, and event specifications. Custom banners, personalized balloons, and décor kits are becoming more and more popular for milestone celebrations. By enabling consumers to see their customized setups before to purchase, digital platforms that provide configuration and preview tools have boosted engagement, promoting event-specific branding and innovative celebration strategies.

Market Outlook 2026-2034:

The Philippines party supplies market is positioned for sustained growth as celebration culture remains deeply embedded in Filipino society and consumer spending patterns continue evolving toward premium, themed, and personalized products. Expanding modern retail presence, coupled with robust e-commerce development, is enhancing product accessibility across urban and provincial markets. The market generated a revenue of USD 74.34 Million in 2025 and is projected to reach a revenue of USD 152.77 Million by 2034, growing at a compound annual growth rate of 8.33% from 2026-2034. Rising disposable incomes, increasing urbanization, and the proliferation of social media-driven celebration trends are expected to sustain market momentum. The growing emphasis on sustainability and eco-friendly alternatives presents significant opportunities for market differentiation. As Filipinos continue prioritizing celebratory experiences, demand for innovative, high-quality party supplies will remain strong throughout the forecast period.

Philippines Party Supplies Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Balloons |

27% |

|

Application |

Domestic Use |

60% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

35% |

|

Region |

Luzon |

49% |

Product Type Insights:

- Balloons

- Banners

- Pinatas

- Games

- Home Decor

- Tableware/Disposables

- Others

Balloons dominate with a market share of 27% of the total Philippines party supplies market in 2025.

Because of their visual adaptability, affordability, and capacity to produce striking decorative displays for a variety of celebration kinds, balloons continue to hold the top spot in the product category. The market gains from changing consumer tastes for ornate balloon arrangements that enhance party aesthetics, such as arches, garlands, and themed configurations. Budget-conscious shoppers continue to favor latex balloons, while those looking for long-lasting, striking decorations are drawn to premium foil choices. Flexibility for various venue needs and celebration themes is offered by the availability of helium-filled floating balloons and air-filled display choices.

Manufacturers continue to innovate the balloon market by introducing designs for a variety of themes and events, such as business gatherings, weddings, christenings, and birthdays. Social media's increasing influence has sparked innovative balloon configurations, with influencers and event planners exhibiting intricate settings that stimulate customer demand for high-end, personalized solutions. Number balloons, letter balloons, and foil character balloons with popular cartoon and film themes are among the trendy designs that Filipino consumers are rapidly embracing, turning everyday festivities into Instagram-worthy occasions. This aesthetic appeal encourages customers to make further purchases as they try to replicate creative decorating ideas, which improves segment performance even more.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial Use

- Domestic Use

Domestic use leads with a share of 60% of the total Philippines party supplies market in 2025.

Domestic use maintains clear dominance as Filipino families prioritize home-based celebrations that emphasize intimate gatherings with relatives and close friends. The cultural tradition of hosting celebrations at residences rather than commercial venues drives consistent demand for party supplies suited to household settings and backyard spaces. Cost-conscious consumers benefit from organizing celebrations at home while maintaining quality through carefully selected decorations and themed elements that reflect personal tastes. The growing DIY culture, fueled by online tutorials and social media inspiration, empowers households to create professional-looking party setups without relying on expensive event planning services, enabling creative expression while managing budgets effectively.

The domestic segment benefits from the Philippines' strong family-oriented society where milestone celebrations including birthdays, christenings, graduations, and anniversaries represent significant occasions warranting thoughtful decoration investments. Extended family participation in celebrations further amplifies supply requirements as hosts prepare for larger guest counts. E-commerce platforms have further enhanced accessibility, allowing domestic consumers to browse extensive product catalogs, compare prices across multiple vendors, and receive convenient doorstep deliveries that simplify party preparation for time-constrained households across urban and provincial areas.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialized Stores

- Online Stores

- Others

Supermarkets and hypermarkets exhibit a clear dominance with 35% share of the total Philippines party supplies market in 2025.

Supermarkets and hypermarkets serve as anchor channels for party supply purchases as consumers value one-stop shopping convenience and competitive pricing that simplifies celebration preparation. Major retail chains maintain dedicated party supply sections offering diverse product assortments ranging from basic decorations to complete themed celebration kits tailored to various occasions and budget requirements. These retailers strategically position party supplies near complementary categories including confectionery, beverages, and baked goods, encouraging incremental purchases during routine grocery trips and maximizing basket sizes. Bundled promotions, loyalty programs, and frequent discount events encourage repeat purchases among price-sensitive Filipino consumers seeking value without compromising celebration quality.

Seasonal displays during peak celebration periods including Christmas, graduation season, and summer birthdays further stimulate impulse buying and drive category visibility. The channel benefits from extensive geographic coverage across urban and suburban areas, ensuring product accessibility for diverse consumer segments regardless of location. The dense outlet networks of leading retailers provide widespread physical presence that establishes supermarkets as primary destinations for both planned purchases and last-minute party supply needs throughout the Philippines. This accessibility advantage reinforces channel dominance as consumers prioritize convenience alongside affordability when preparing for celebrations.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon represents the leading segment with 49% share of the total Philippines party supplies market in 2025.

Luzon commands the largest regional share driven by Metro Manila's concentration of population, commercial activity, and purchasing power that collectively generate substantial demand for celebration-related products. The region benefits from advanced retail infrastructure, widespread mall presence, and sophisticated digital connectivity supporting both physical and online party supply purchases across diverse consumer segments. Higher disposable incomes among urban consumers enable premium product selections and elaborate themed celebrations while extensive logistics networks facilitate efficient distribution across the island group. The presence of numerous shopping centers, specialty party stores, and established e-commerce fulfillment hubs ensures product availability and timely delivery for time-sensitive celebration preparations.

Provincial areas within Luzon including Central Luzon and Calabarzon are experiencing retail modernization that expands party supply accessibility beyond traditional Metro Manila boundaries. The Luzon Economic Corridor development is reducing travel times between important hubs, improving inventory lead times for party supplies dependent on imported materials and enabling faster replenishment cycles for retailers. Major retail expansion continues as SM Prime allocated PHP 100 Billion for capital expenditure in 2025, including new malls supporting enhanced product accessibility.

Market Dynamics:

Growth Drivers:

Why is the Philippines Party Supplies Market Growing?

Strong Cultural Celebration Traditions

The Philippines maintains one of the strongest celebration cultures globally, with fiestas, birthdays, anniversaries, and religious occasions forming integral parts of social life throughout the year. Filipino families traditionally invest significantly in commemorating milestones and gatherings, creating sustained baseline demand for decorative supplies regardless of economic conditions. Each city and barrio celebrates at least one local fiesta annually, typically honoring patron saints, ensuring continuous celebration activity across the archipelago. This deeply embedded cultural emphasis on communal celebration and hospitality drives consistent consumption patterns as families seek quality decorations to honor traditions and create memorable experiences for guests and loved ones. The cultural expectation of elaborate celebration presentations motivates households to allocate budgets toward party supplies that reflect their commitment to honoring important occasions appropriately.

Rising Disposable Incomes and Urbanization

Growing household purchasing power across the Philippines is enabling increased spending on celebration-related products and services. The country is approaching upper-middle-income status, with gross national income per capita reaching USD 4,470 in 2024, just below the World Bank's upper-middle-income threshold. This income growth translates directly into expanded consumer budgets for discretionary categories including party supplies. Simultaneously, rapid urbanization is concentrating populations in metropolitan areas where modern retail formats, themed party concepts, and social media-influenced celebration trends flourish. Urban consumers demonstrate heightened interest in premium, branded, and imported party supplies that distinguish their celebrations from standard offerings. The expanding middle class increasingly allocates household budgets toward experiential spending categories, including elaborate celebrations that require quality decorative supplies.

E-Commerce Expansion and Digital Retail Integration

The rapid growth of digital commerce is transforming party supply accessibility and purchasing convenience across the Philippines. Mobile commerce adoption is particularly strong, with mobile devices accounting for the majority of online transactions as smartphone penetration continues expanding. Digital payment systems and wallet services have simplified purchasing processes, encouraging impulse buying and enabling consumers in provincial areas to access product varieties previously available only in metropolitan retail centers. Social commerce integration allows consumers to discover trending party themes through live streaming and influencer content before seamlessly completing purchases. This digital retail ecosystem expansion ensures party supplies reach broader consumer segments while enabling sellers to showcase innovative products efficiently.

Market Restraints:

What Challenges the Philippines Party Supplies Market is Facing?

Environmental Regulations and Plastic Reduction Initiatives

Growing environmental consciousness and regulatory pressure regarding single-use plastics pose challenges for traditional party supply products. Local government units are implementing ordinances restricting disposable plastic items, affecting demand for conventional tableware, decorations, and packaging materials. The Extended Producer Responsibility Act mandates plastic waste recovery targets, requiring manufacturers to invest in collection and recycling infrastructure. These regulatory developments necessitate product reformulation and sustainable alternative development, potentially increasing production costs and constraining margins for manufacturers unprepared for the transition toward eco-friendly materials.

Supply Chain Vulnerabilities and Logistics Costs

The archipelagic geography of the Philippines creates inherent distribution challenges affecting party supply availability and pricing across island regions. Inter-island shipping requirements increase logistics expenses and delivery timeframes, particularly for time-sensitive celebration occasions. Traffic congestion in Metro Manila inflates freight costs significantly compared to efficient cities, while port capacity limitations can delay imported product arrivals. Natural disaster exposure periodically disrupts supply chains, creating stock shortages during peak celebration seasons. These logistical constraints affect pricing consistency and product assortment breadth across provincial markets.

Competition from Unorganized Sector and Price Sensitivity

The presence of numerous small-scale vendors and informal market participants creates intense price competition affecting margins for organized retailers. Traditional wet markets and neighborhood stores offer basic party supplies at lower price points, appealing to budget-conscious consumers prioritizing affordability over brand recognition or premium quality. Filipino households demonstrate significant price sensitivity, often comparing options across multiple channels before purchasing. This competitive dynamic limits pricing power for manufacturers and retailers while necessitating continuous promotional activities that compress profitability across the value chain.

Competitive Landscape:

The Philippines party supplies market features a moderately fragmented competitive landscape comprising international manufacturers, regional distributors, and local specialized retailers serving diverse consumer segments. Competition intensifies through product innovation, pricing strategies, and distribution network expansion as participants vie for market share across traditional and digital channels. Major retail chains leverage their extensive store networks and established supplier relationships to offer comprehensive party supply assortments at competitive prices. Specialized party stores differentiate through customization services, themed collections, and event consultation offerings that command premium positioning. E-commerce platforms enable smaller vendors to reach nationwide audiences while established brands strengthen omnichannel capabilities. Strategic partnerships between manufacturers and retailers facilitate exclusive product launches and promotional collaborations that enhance brand visibility and consumer engagement.

Philippines Party Supplies Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Balloons, Banners, Pinatas, Games, Home Decor, Tableware/Disposables, Others |

| Distribution Channels Covered | Commercial Use, Domestic Use |

| Applications Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialized Stores, Online Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines party supplies market size was valued at USD 74.34 Million in 2025.

The Philippines party supplies market is expected to grow at a compound annual growth rate of 8.33% from 2026-2034 to reach USD 152.77 Million by 2034.

Balloons dominated the market with a share of 27%, driven by visual versatility, affordability, and the growing popularity of elaborate balloon arrangements inspired by social media decoration trends.

Key factors driving the Philippines party supplies market include strong cultural celebration traditions, rising disposable incomes, expanding e-commerce accessibility, social media influence on decoration trends, and growing preference for personalized themed celebrations.

Major challenges include environmental regulations affecting plastic products, supply chain vulnerabilities across the archipelago, rising logistics costs, competition from unorganized sector vendors, and price sensitivity among budget-conscious consumers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)