Philippines Passenger Vehicles Lubricants Market Size, Share, Trends and Forecast by Product Type and Region, 2026-2034

Philippines Passenger Vehicles Lubricants Market Summary:

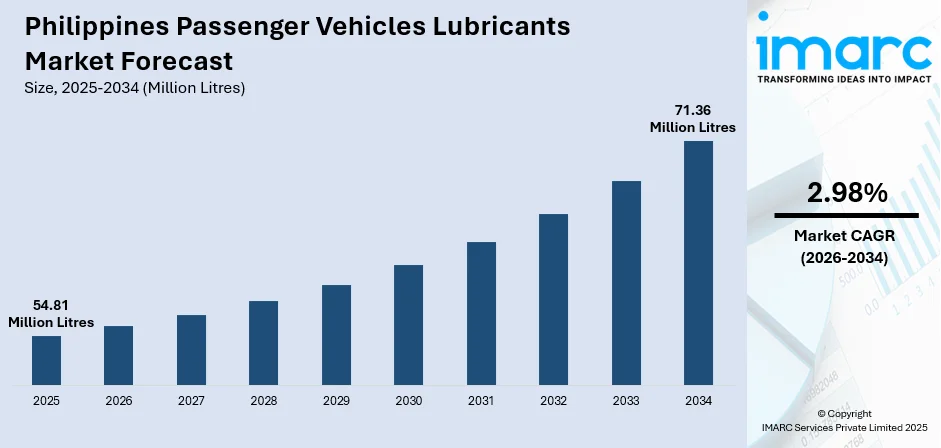

The Philippines passenger vehicles lubricants market size reached 54.81 Million Litres in 2025 and is projected to reach 71.36 Million Litres by 2034, growing at a compound annual growth rate of 2.98% from 2026-2034.

The market is driven by rising vehicle ownership, growing emphasis on regular maintenance, and increasing consumer awareness of the importance of proper engine care. Expanding service networks, wider product availability, and stronger alignment between consumer needs and maintenance practices continue to support steady demand across key regions. The development of organized retail channels and evolving mobility patterns further enhance product uptake, reinforcing long-term market momentum and contributing to the continuing expansion of Philippines passenger vehicles lubricants share.

Key Takeaways and Insights:

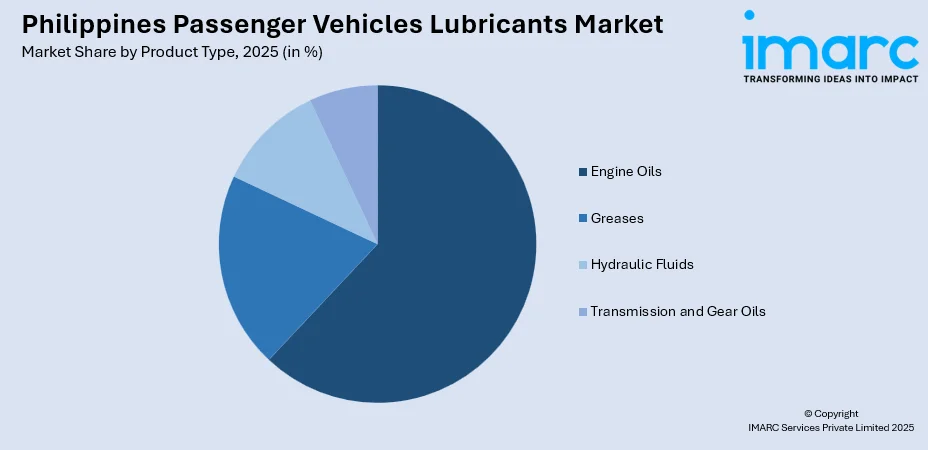

- By Product Type: Engine oils dominate the market with a share of 62% in 2025, driven by the concentration of passenger vehicles requiring regular oil changes, higher maintenance frequency among Filipino vehicle owners, and widespread availability through service stations and automotive shops.

- Key Players: The Philippines passenger vehicles lubricants market reflects balanced competition, where global petroleum brands operate alongside regional suppliers offering diverse formulations. Competitors differentiate through performance, reliability, and value-driven products, creating a dynamic environment across multiple consumer segments and evolving vehicle maintenance preferences.

To get more information on this market, Request Sample

The Philippines passenger vehicles lubricants market is experiencing robust growth driven by several interconnected factors. Increasing disposable incomes among Filipino consumers have enabled higher vehicle ownership rates, directly expanding the addressable market for automotive lubricants. The growing awareness regarding proper vehicle maintenance and engine care has prompted more frequent oil changes and preference for premium lubricant formulations. In April 2024, General Petroleum launched its automotive lubricants in the Philippines, including engine oils, transmission and hydraulic fluids, and specialty lubricants, promoting them through the GP Gymkhana motorsports event. Additionally, government initiatives promoting local automotive manufacturing and assembly have stimulated the domestic vehicle market, creating sustained demand for associated maintenance products. Furthermore, the expansion of organized retail channels and authorized service centers has improved product accessibility across major metropolitan areas and provincial regions, facilitating market penetration of both premium and value-segment lubricant offerings.

Philippines Passenger Vehicles Lubricants Market Trends:

Transition Toward Synthetic and Semi-Synthetic Lubricant Formulations

The Philippine market is witnessing a pronounced shift from conventional mineral-based lubricants toward synthetic and semi-synthetic alternatives due to their superior thermal stability and extended drain intervals. Vehicle owners increasingly recognize the long-term cost benefits of premium formulations that offer enhanced engine protection and improved fuel economy. In May 2023, Motul Philippines, with distributor Infiniteserv International, launched the 8100 Power fully-synthetic engine oil, targeting performance-focused daily drivers seeking enhanced engine protection and reliability. Further, this transition aligns with manufacturer recommendations for modern engine designs that require advanced lubrication properties. The growing availability of synthetic options through mainstream retail channels further accelerates consumer adoption across various vehicle segments.

Digital Transformation in Lubricant Distribution and Consumer Engagement

E-commerce platforms and digital marketplaces are revolutionizing lubricant distribution in the Philippines, enabling consumers to compare products, access technical specifications, and receive doorstep delivery. Lubricant manufacturers are leveraging social media and digital marketing strategies to enhance brand awareness and educate consumers about proper maintenance schedules. In February 2025, Repsol acquired a 40% stake in Unioil Lubricants Inc., strengthening its Philippine operations and enabling targeted marketing and digital distribution to reach new customer segments. Additionally, mobile applications providing vehicle service reminders and product recommendations are gaining traction among tech-savvy vehicle owners. This digital ecosystem creates new touchpoints for consumer engagement while improving market transparency and competitive dynamics.

Integration of Environmentally Conscious Product Formulations

Environmental sustainability considerations are increasingly influencing lubricant product development and consumer preferences in the Philippine market. Manufacturers are introducing eco-friendly formulations with reduced environmental impact, biodegradable additives, and improved recyclability characteristics. Consumer awareness regarding the environmental implications of lubricant disposal is driving demand for products that minimize ecological footprint. As per sources, in July 2023, Shell Lubricants Philippines launched the ‘Shell Lube Recycle’ program, enabling customers to return used lubricant containers for recycling into eco‑bricks, supporting circular solutions and government recycling initiatives. Moreover, this trend aligns with broader regional sustainability initiatives and positions environmentally conscious brands favorably among increasingly aware Filipino consumers seeking responsible automotive care solutions.

Market Outlook 2026-2034:

The Philippines passenger vehicles lubricants market is expected to advance steadily, supported by expanding vehicle usage, rising awareness of proper maintenance, and a growing shift toward higher-quality formulations. Increasing consumer preference for reliable engine protection and enhanced vehicle performance is strengthening demand across service centers and retail channels. Improvements in road connectivity, broader access to organized maintenance services, and the adoption of digital purchase platforms further reinforce market momentum. As motorists prioritize efficiency and long-term engine health, premium lubricant categories are well-positioned for sustained revenue growth. The market generated a revenue of 54.81 Million Litres in 2025 and is projected to reach a revenue of 71.36 Million Litres by 2034, growing at a compound annual growth rate of 2.98% from 2026-2034.

Philippines Passenger Vehicles Lubricants Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Engine Oils | 62% |

Product Type Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Engine Oils

- Greases

- Hydraulic Fluids

- Transmission and Gear Oils

The engine oils dominate with a market share of 62% of the total Philippines passenger vehicles lubricants market in 2025.

Engine oils dominate the Philippines passenger vehicles lubricants market due to their essential role in ensuring smooth engine operation, maintaining thermal stability, and preventing wear during daily driving. Their widespread use across both new and older vehicles reinforces consistent demand, particularly as motorists prioritize reliability and long-term engine protection. Regular servicing habits and increasing awareness of proper vehicle care further strengthen their position.

The segment also benefits from broad availability across formal workshops, authorized service centers, fuel stations, and retail outlets, allowing motorists convenient access during routine maintenance. In February 2025, Aramco signed an agreement to acquire a 25% stake in Unioil Petroleum Philippines, planning to extend its brand, retail offerings, and Valvoline lubricants. Further, with varying formulations tailored to different vehicle types and driving conditions, engine oils offer flexibility appealing to a wide consumer base. As vehicle ownership grows and maintenance culture improves, high-quality engine oils continue to maintain firm dominance.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon remains the leading region, supported by Metro Manila’s dense vehicle presence, well-established service networks, and strong consumer purchasing power. The area’s extensive commercial activity and widespread access to maintenance facilities reinforce consistent lubricant demand and encourage adoption of higher-quality products across diverse passenger vehicle segments.

Visayas is experiencing rising demand as vehicle ownership expands across Cebu and nearby provinces. Strengthening distribution links and growing economic activity enhance access to maintenance products. Increasing consumer awareness, improving service infrastructure, and steady growth in transportation needs support broader lubricant usage, positioning the region for continued expansion within the passenger vehicles segment.

Mindanao shows substantial potential with growing transportation requirements driven by agriculture, commerce, and regional development efforts. Infrastructure improvements and expanding service networks are gradually enhancing product accessibility. Rising vehicle registrations, emerging urban centers, and consistent demand from key industries support stable lubricant consumption, contributing to the region’s strengthening role in the national passenger vehicles lubricants market.

Market Dynamics:

Growth Drivers:

Why is the Philippines Passenger Vehicles Lubricants Market Growing?

Rising Vehicle Ownership and Expanding Automotive Parc

The Philippines passenger vehicles lubricants market is experiencing substantial growth driven by increasing vehicle ownership rates across metropolitan and provincial areas. As per sources, in January 2025, Philippine car sales grew 8.7% in 2024, reaching 467,252 units, with passenger cars representing 120,770 units, reflecting rising vehicle ownership nationwide. Furthermore, rising disposable incomes among Filipino consumers have enabled greater affordability of personal transportation, directly expanding the addressable market for automotive lubricants. The growing middle-class population increasingly views vehicle ownership as essential for daily commuting, family transportation, and economic activities. Urbanization trends continue to support demand for personal mobility solutions, with first-time vehicle buyers entering the market at accelerating rates. The expansion of vehicle financing options and installment programs has further democratized access to automotive ownership, creating sustained demand for associated maintenance products including lubricants.

Growing Consumer Awareness Regarding Engine Maintenance

Enhanced consumer education regarding proper vehicle maintenance practices is significantly contributing to lubricant market expansion. Vehicle owners increasingly recognize the correlation between regular oil changes, engine longevity, and overall vehicle performance optimization. Manufacturer recommendations for specific lubricant grades and change intervals are gaining greater consumer adherence, supporting consistent replacement cycles. In July 2024, Shell Pilipinas upgraded over 500 Shell Helix Oilchange+ stations nationwide, offering faster, convenient oil change services with trained mechanics and premium lubricants to enhance vehicle maintenance. Further, the proliferation of automotive content through digital platforms and social media has elevated consumer knowledge regarding lubricant specifications and quality differentiators. Service center advisories and manufacturer communications continue to reinforce maintenance best practices, encouraging more frequent lubricant replacements and premiumization toward higher-performance formulations that offer superior engine protection.

Expansion of Organized Retail and Service Network Infrastructure

The development of organized retail channels and authorized service networks is facilitating broader market accessibility and consumer convenience. Branded service centers operated by major lubricant manufacturers and automotive dealers are expanding their footprint across urban centers and secondary cities. This infrastructure development improves product availability while ensuring proper installation and disposal practices. In July 2024, ExxonMobil appointed Juliana Holdings, Inc. as its official distributor of Mobil-branded lubricants in the Philippines, supplying products for passenger vehicles and motorcycles, including Mobil 1, Mobil Super, Mobil Super Moto, and Mobil Delvac, enhancing market presence and distribution reach nationwide. Moreover, the integration of lubricant services within comprehensive vehicle maintenance offerings creates bundled value propositions that encourage regular servicing schedules. Additionally, the growth of automotive parts retailers and convenience store distribution channels enhances consumer access to lubricant products, supporting impulse purchases and maintenance compliance across diverse vehicle owner segments.

Market Restraints:

What Challenges the Philippines Passenger Vehicles Lubricants Market is Facing?

Prevalence of Counterfeit and Substandard Products

The Philippine lubricants market faces challenges from counterfeit products that undermine consumer confidence and brand integrity. Substandard formulations sold through informal channels pose risks to engine performance and longevity while affecting premium brand market share. Consumer difficulty in distinguishing authentic products from counterfeits creates hesitation regarding premium purchases and channel selection.

Price Sensitivity Among Value-Conscious Consumer Segments

Significant portions of the Philippine consumer base remain highly price-sensitive, limiting premiumization potential for advanced lubricant formulations. Budget constraints influence purchasing decisions toward lower-cost alternatives despite awareness of performance differentiators. Economic uncertainties and inflationary pressures further reinforce value-seeking behaviors that constrain premium segment expansion.

Informal Service Sector and Inconsistent Maintenance Practices

A substantial portion of vehicle maintenance occurs through informal service providers who may utilize substandard products or inconsistent servicing practices. This fragmented service landscape limits quality control and proper lubricant application standards. Consumer reliance on informal channels reduces engagement with recommended maintenance schedules and premium product adoption.

Competitive Landscape:

The Philippines passenger vehicles lubricants market exhibits a moderately consolidated competitive structure characterized by the presence of established multinational petroleum corporations alongside regional distributors and emerging local players. Market participants compete across multiple dimensions including product performance specifications, brand reputation, distribution network coverage, pricing strategies, and after-sales service capabilities. Leading players leverage extensive distribution networks encompassing authorized service centers, retail outlets, and e-commerce platforms to maximize market reach. Competitive differentiation increasingly emphasizes technical product attributes including synthetic formulation advances, extended drain intervals, and manufacturer certifications. Strategic partnerships with automotive manufacturers for original equipment recommendations and first-fill arrangements provide competitive advantages. The market demonstrates ongoing consolidation trends as larger players pursue distribution partnerships and brand portfolio expansions to strengthen market positioning.

Recent Developments:

- In April 2024, ENI made its Philippine market debut at the Inside Racing Bike Fest and Trade Show, introducing its I-Sint, I-Sint Tech, and I-Sint Professional lubricant lines. The products aim to improve engine protection, enhance fuel efficiency, and offer environmentally friendly performance, catering to the growing demand for premium passenger vehicle lubricants.

- In April 2024, FUCHS, the Germany-based independent lubricant manufacturer, officially introduced its TITAN line in the Philippines. The range includes high-performance engine oils, gear oils, hydraulic fluids, brake fluids, and fuel additives, offering enhanced engine protection, improved fuel efficiency, and sustainable solutions for automotive and consumer sectors.

Philippines Passenger Vehicles Lubricants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Litres |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Engine Oils, Greases, Hydraulic Fluids, Transmission and Gear Oil |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines passenger vehicles lubricants market size reached 54.81 Million Litres in 2025.

The Philippines passenger vehicles lubricants market is expected to grow at a compound annual growth rate of 2.98% from 2026-2034 to reach 71.36 Million Litres by 2034.

Engine oils dominated the market, supported by frequent maintenance needs and broad passenger vehicle usage. Their essential role in engine protection and performance makes them the most consistently demanded product category across consumer segments.

Key factors driving the Philippines passenger vehicles lubricants market include rising vehicle ownership rates, growing consumer awareness regarding engine maintenance, expansion of synthetic lubricant adoption, development of organized retail and service networks, and increasing demand for fuel-efficient formulations.

Major challenges include prevalence of counterfeit products in informal distribution channels, price sensitivity among value-conscious consumers, inconsistent maintenance practices in fragmented service sectors, limited premiumization penetration in provincial areas, and competition from extended drain interval products reducing replacement frequency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)