Philippines Patient Engagement Solutions Market Size, Share, Trends and Forecast by Therapeutic Area, Application, Component, Delivery Type, End User, and Region, 2025-2033

Philippines Patient Engagement Solutions Market Overview:

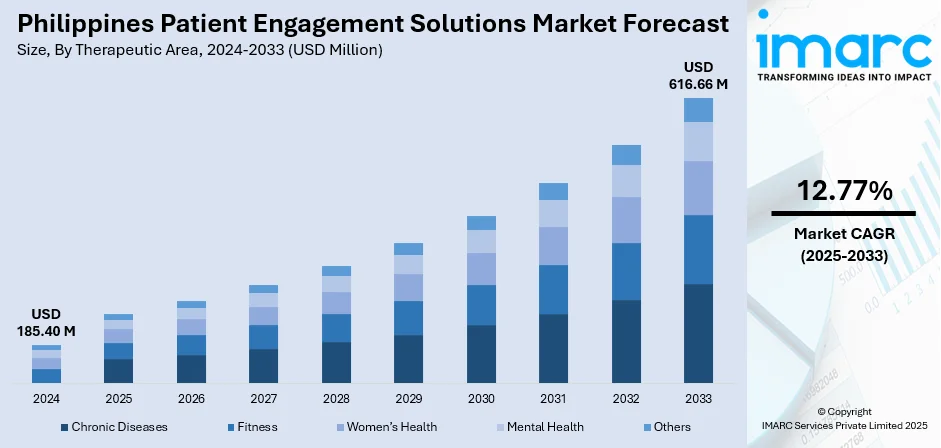

The Philippines patient engagement solutions market size reached USD 185.40 Million in 2024. The market is projected to reach USD 616.66 Million by 2033, exhibiting a growth rate (CAGR) of 12.77% during 2025-2033. The market is driven by increasing digital healthcare adoption, rising smartphone and internet penetration, and government initiatives promoting eHealth and telemedicine. Growing prevalence of chronic diseases and the need for continuous patient monitoring encourage hospitals to adopt digital platforms for improved care coordination. Additionally, heightened health awareness after the COVID-19 pandemic has accelerated demand for remote consultations and mobile health apps. The push toward personalized care, cost reduction, and improved patient outcomes further supporting the Philippines patient engagement solutions market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 185.40 Million |

| Market Forecast in 2033 | USD 616.66 Million |

| Market Growth Rate 2025-2033 | 12.77% |

Philippines Patient Engagement Solutions Market Trends:

Rising Digital Healthcare Adoption and Technological Advancements

The rapid digital transformation in the Philippines healthcare sector is a major driver in the Philippines patient engagement solutions market trends. With smartphone ownership reaching 77% in 2023, alongside rising internet penetration, digital health tools such as mobile applications, patient portals, and telemedicine platforms are becoming more accessible to the population. Hospitals and clinics are increasingly implementing cloud-based platforms and AI-based systems to streamline processes, enhance patient engagement, and provide more personalized care. The move facilitates enhanced patient education, remote tracking of chronic conditions, and minimizing operational inefficiencies. In addition, the convergence of technologies such as electronic health records (EHRs), wearable technology, and mobile health applications empowers patients to assume greater control of their healthcare experience. As Philippine healthcare organizations continue to place emphasis on digitalization to improve service delivery, efficiency, and patient satisfaction, patient engagement solution demand is forecasted to increase substantially.

To get more information on this market, Request Sample

Government Support, eHealth Policies, and Post-Pandemic Health Awareness

Philippine government policies, such as the National eHealth Strategy and investments in telemedicine, are driving the growth of patient engagement solutions. The policies prompt healthcare institutions to adopt digital platforms for enhancing care coordination, preventive healthcare, and increasing access in rural and underserved communities. The COVID-19 pandemic also brought into focus the role of remote healthcare, which prompted both patients and providers to turn to digital channels for consultations, follow-ups, and health education. As awareness of health grows, patients are more willing to employ apps and portals for tracking vital signs, scheduling appointments, and getting customized health information. Incentives from the government and partnerships with private health technology players are rendering digital health solutions cheaper and scalable. This policy-led momentum, coupled with public demand for convenient, safe, and personalized healthcare experiences, strongly accelerates Philippines patient engagement solutions market growth.

Growing Prevalence of Chronic Diseases and Aging Population

The Philippines is witnessing a steady rise in lifestyle-related chronic diseases such as diabetes, hypertension, cardiovascular illnesses, and cancer. This growing health burden is compounded by an aging population, with individuals aged 60+ accounting for 8.8% of the population in 2023, projected to rise to 10.5% by 2030 and 15.4% by 2050. These trends make strong demands for ongoing patient monitoring and forward-looking disease control. Patient engagement solutions play a central part by facilitating prompt communication between patients and care providers, providing self-management capabilities, and scheduling reminders for drug compliance and follow-up appointments. Older adults and patients with chronic diseases especially gain from remote monitoring and electronic platforms that provide continuity of care with reduced visits to the hospital. By gathering current patient data, these solutions improve clinical decision-making, facilitate preventive intervention, and decrease healthcare system burden and enhance quality of life.

Philippines Patient Engagement Solutions Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on therapeutic area, application, component, delivery type, and end user.

Therapeutic Area Insights:

- Chronic Diseases

-

- Obesity

- Diabetes

- Cardiovascular

- Others

-

- Fitness

- Women’s Health

- Mental Health

- Others

The report has provided a detailed breakup and analysis of the market based on the therapeutic area. This includes chronic diseases (obesity, diabetes, cardiovascular, and others), fitness, women’s health, mental health, and others.

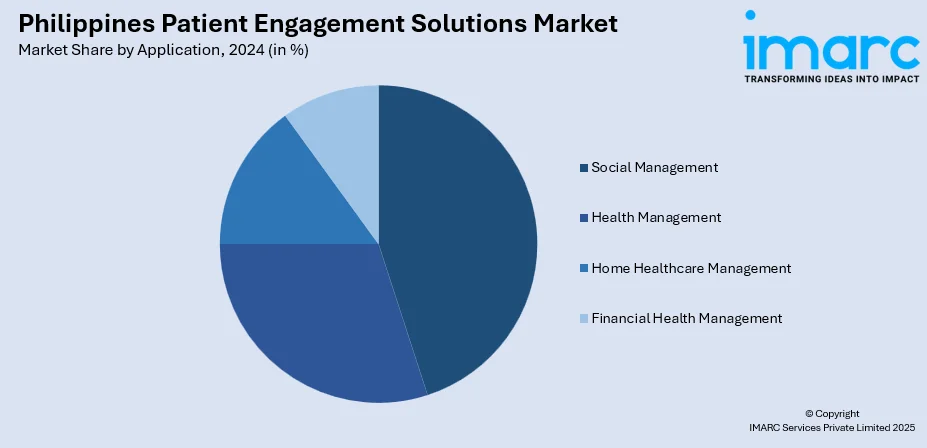

Application Insights:

- Social Management

- Health Management

- Home Healthcare Management

- Financial Health Management

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes social management, health management, home healthcare management, and financial health management.

Component Insights:

- Software

- Services

- Hardware

The report has provided a detailed breakup and analysis of the market based on the component. This includes software, services, and hardware.

Delivery Type Insights:

- Web-based/Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the delivery type have also been provided in the report. This includes web-based/cloud-based and on-premises.

End User Insights:

- Payers

- Providers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes payers, providers, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Patient Engagement Solutions Market News:

- In July 2025, Makati City became the Philippines’ first city to fully digitalize healthcare, investing $61 million in an integrated 24/7 system. The platform unifies telehealth, EMRs, diagnostics, and virtual appointments across facilities, with support from KonsultaMD for round-the-clock access. Features include AI-powered cancer screening, online queuing, and medicine delivery. This milestone reflects national efforts to accelerate healthcare digitalization, though challenges like limited internet and electricity access in rural areas persist.

- In May 2025, Carenet Health, a global leader in tech-enabled healthcare services, opened its first dedicated facility in Makati City, Philippines. Located at Ayala’s Circuit Corporate Center, the 39,000-square-foot center features over 500 seats, modern conference rooms, a client lounge, and wellness-focused amenities like nap rooms and game rooms. The facility aims to boost employee engagement, deliver world-class client service, and strengthen Carenet’s global commitment to advancing healthcare engagement.

Philippines Patient Engagement Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapeutic Areas Covered |

|

| Applications Covered | Social Management, Health Management, Home Healthcare Management, Financial Health Management |

| Components Covered | Software, Services, Hardware |

| Delivery Types Covered | Web-based/Cloud-based, On-premises |

| End Users Covered | Payers, Providers, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines patient engagement solutions market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines patient engagement solutions market on the basis of therapeutic area?

- What is the breakup of the Philippines patient engagement solutions market on the basis of application?

- What is the breakup of the Philippines patient engagement solutions market on the basis of component?

- What is the breakup of the Philippines patient engagement solutions market on the basis of delivery type?

- What is the breakup of the Philippines patient engagement solutions market on the basis of end user?

- What is the breakup of the Philippines patient engagement solutions market on the basis of region?

- What are the various stages in the value chain of the Philippines patient engagement solutions market?

- What are the key driving factors and challenges in the Philippines patient engagement solutions market?

- What is the structure of the Philippines patient engagement solutions market and who are the key players?

- What is the degree of competition in the Philippines patient engagement solutions market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines patient engagement solutions market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines patient engagement solutions market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines patient engagement solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)