Philippines Pectin Market Size, Share, Trends and Forecast by Raw Material, End Use, and Region, 2025-2033

Philippines Pectin Market Overview:

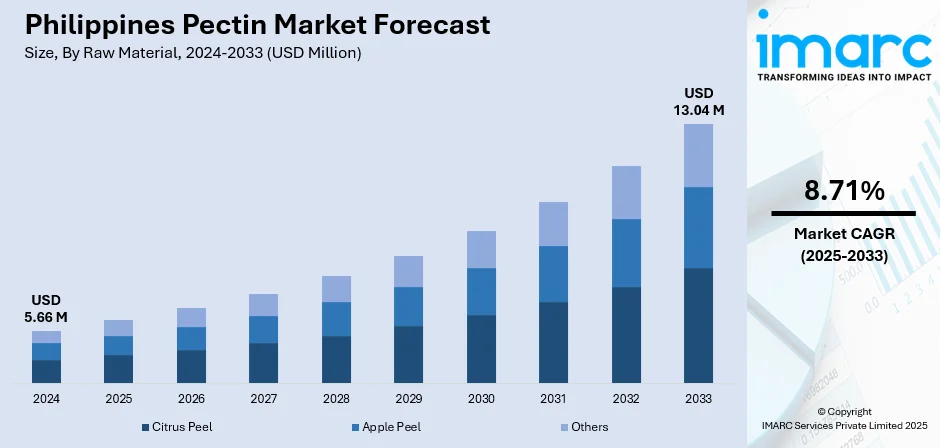

The Philippines pectin market size reached USD 5.66 Million in 2024. The market is projected to reach USD 13.04 Million by 2033, exhibiting a growth rate (CAGR) of 8.71% during 2025-2033. The market is driven by rising demand for natural, plant-based ingredients in food and beverages (F&B), especially in jams, jellies, confectionery, and dairy products. Growing health-consciousness fuels preference for clean-label and low-fat formulations, where pectin serves as a stabilizer and gelling agent. Expanding processed food and beverage industries, supported by urbanization and changing consumer lifestyles, further boost usage. Additionally, the country’s robust fruit production, particularly mangoes and citrus, ensures raw material availability, enhancing local manufacturing potential and reducing import dependency thus aiding the Philippines pectin market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.66 Million |

| Market Forecast in 2033 | USD 13.04 Million |

| Market Growth Rate 2025-2033 | 8.71% |

Philippines Pectin Market Trends:

Rising Demand for Clean-Label and Natural Ingredients

Consumers in the Philippines are increasingly seeking healthier and more natural alternatives in their F&B. Pectin, derived from fruits such as citrus and apples, is valued as a plant-based, non-genetically modified organisms (GMO), and chemical-free additive, making it highly suitable for clean-label formulations. This aligns with the global health-conscious movement, where consumers prefer minimally processed products with recognizable ingredients. In the Philippines, this trend is particularly evident in jams, jellies, dairy beverages, and fruit-based products, where pectin serves as a gelling, stabilizing, and thickening agent. The growing middle class, exposure to global health trends, and awareness of diet-related diseases further amplify Philippines pectin market growth. With increasing emphasis on transparency and natural sourcing, pectin stands out as an essential additive, driving adoption across multiple food categories and reinforcing its role in supporting the shift toward sustainable and healthy consumption.

To get more information on this market, Request Sample

Abundant Fruit Production Supporting Local Supply Potential

The Philippines is one of Asia’s top producers of tropical fruits such as mangoes, bananas, pineapples, and citrus—many of which are potential sources of pectin or complement pectin-based applications. According to FMC Philippines, annual mango production reaches about 1 million metric tons, with 95% consumed locally and 5% exported, generating around USD 35 million in revenues. This strong agricultural base creates opportunities for local pectin production, reducing dependence on imports and offering cost advantages for domestic manufacturers. Mangoes and calamansi, central to Philippine food culture, are widely processed into juices, jams, and preserves that rely on pectin for stability and consistency. Strengthening local supply chains can increase value addition, minimize post-harvest losses, and support sustainability. Backed by government initiatives in agricultural innovation and food processing, the Philippines’ fruit industry can reinforce long-term growth in the pectin market.

Growth of the Processed Food and Beverage Industry

Another significant Philippines pectin market trend is the rising demand for processed F&B sector, fueled by rapid urbanization, higher disposable incomes, and evolving consumer preferences. Busy lifestyles have increased demand for ready-to-eat meals, packaged snacks, fruit-based beverages, and dairy alternatives—all of which rely on pectin for texture, stability, and shelf-life extension. The expansion of supermarkets, convenience stores, and online grocery platforms has further boosted accessibility and variety of processed foods, driving the need for functional ingredients like pectin. Local food manufacturers also prioritize pectin because it improves product quality without artificial additives, aligning with consumer expectations for both convenience and health. As global F&Bbrands expand their presence in the Philippines, demand for standardized, high-quality stabilizers will rise. This strong growth trajectory of the processed food sector makes pectin increasingly vital for meeting both functional and consumer-driven product requirements.

Philippines Pectin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on raw material and end use.

Raw Material Insights:

- Citrus Peel

- Apple Peel

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes citrus peel, apple peel, and others.

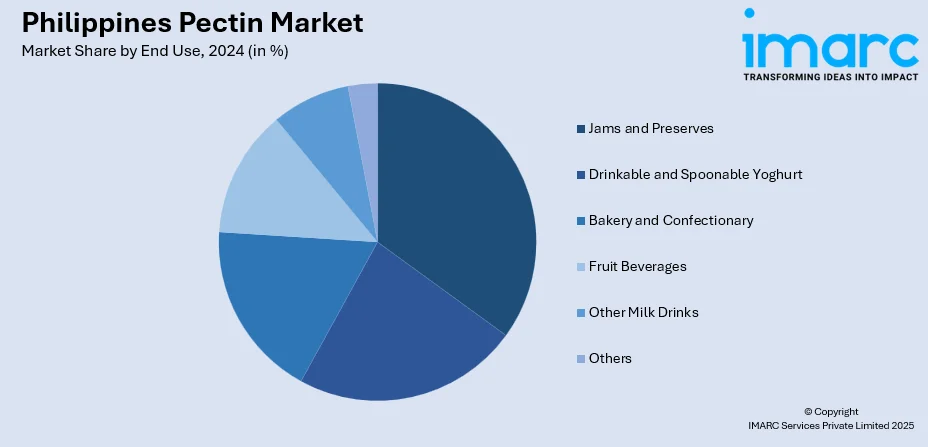

End Use Insights:

- Jams and Preserves

- Drinkable and Spoonable Yoghurt

- Bakery and Confectionary

- Fruit Beverages

- Other Milk Drinks

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes jams and preserves, drinkable and spoonable yoghurt, bakery and confectionary, fruit beverages, other milk drinks and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Pectin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Citrus Peel, Apple Peel, Others |

| End Uses Covered | Jams and Preserves, Drinkable and Spoonable Yoghurt, Bakery and Confectionary, Fruit Beverages, Other Milk Drinks, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines pectin market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines pectin market on the basis of raw material?

- What is the breakup of the Philippines pectin market on the basis of end use?

- What is the breakup of the Philippines pectin market on the basis of region?

- What are the various stages in the value chain of the Philippines pectin market?

- What are the key driving factors and challenges in the Philippines pectin market?

- What is the structure of the Philippines pectin market and who are the key players?

- What is the degree of competition in the Philippines pectin market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines Pectin market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines Pectin market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines Pectin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)