Philippines Personal Protective Equipment Market Size, Share, Trends and Forecast by Equipment Type, End Use Industry, and Region, 2025-2033

Philippines Personal Protective Equipment Market Overview:

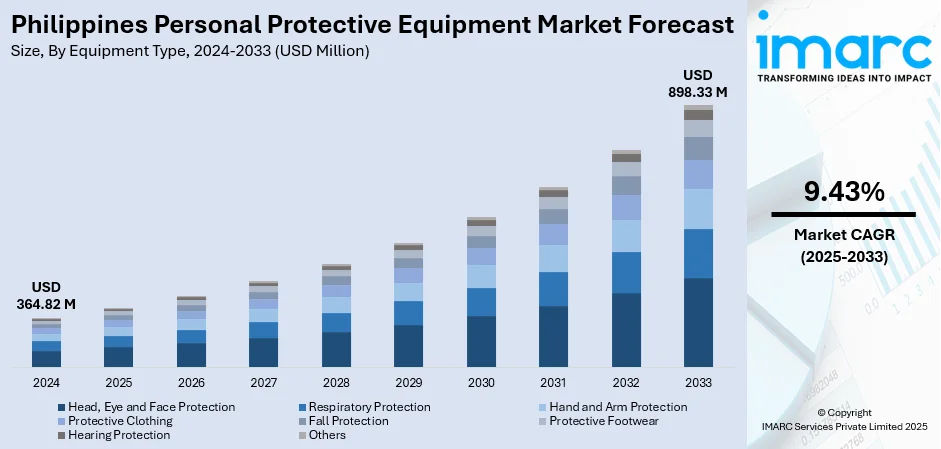

The Philippines personal protective equipment market size reached USD 364.82 Million in 2024. The market is projected to reach USD 898.33 Million by 2033, exhibiting a growth rate (CAGR) of 9.43% during 2025-2033. The market is driven by heightened awareness of workplace safety, stricter government regulations, and enforcement of occupational health standards across industries. The healthcare sector’s growing demand, particularly after the COVID-19 pandemic, has further accelerated usage. Rapid industrialization, especially in construction and manufacturing, also fuels the need for PPE. Moreover, rising investments in infrastructure, coupled with increasing employer responsibility for worker protection, strengthen demand. Technological advancements and availability of cost-effective local products also support Philippines personal protective equipment share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 364.82 Million |

| Market Forecast in 2033 | USD 898.33 Million |

| Market Growth Rate 2025-2033 | 9.43% |

Philippines Personal Protective Equipment Market Trends:

Stricter Government Regulations and Safety Compliance

The government of the Philippines has been enhancing workplace safety regulations and occupational health legislation, which is a key driver in the Philippines personal protective equipment market trends. Institutions like the Department of Labor and Employment (DOLE) impose strict implementation under occupational safety and health standards, thus compelling the use of PPE in risky industries such as construction, mining, and manufacturing. Inadequacy usually leads to fines, compelling employers to make appropriate protective equipment a priority for their employees. Also, international standards promoted by multinational corporations doing business in the nation compel local businesses to adhere to similar safety protocols. The growing emphasis on employee rights and safety under domestic labor codes further compels ongoing investment in PPE. With industries growing, compulsory safety initiatives and regulation inspections confirm demand to be consistent, resulting in a long-term and stable driver for the PPE market in both public and private sectors.

To get more information on this market, Request Sample

Rising Industrialization and Infrastructure Development

The Philippines' expanding industrial base and fast-paced infrastructure growth are driving the demand for PPE in various industries. With continuous government-initiated projects such as "Build, Build, Build" and private sector investments in city development, demand for protection equipment such as helmets, gloves, safety shoes, and high-visibility shirts has surged in construction. Likewise, manufacturing, mining, and energy industries are growing, demanding rigorous safety measures and specialized personal protective equipment for safeguarding employees from workplace hazards. Industrialization also brings new technologies and machines, enhancing the risk of accidents and the need for protective gear. Expansion of export industries, particularly in electronics and automobiles, further supports the Philippines PPE market growth. With the Philippines taking its place as an up-and-coming industrial center in Southeast Asia, its large-scale development of heavy industries and infrastructure thrusts consumption of PPE as a driving market force that is both important and on-going.

Post-Pandemic Healthcare Demand and Public Awareness

The COVID-19 pandemic transformed the Philippines PPE industry by spurring demand for protective gear in medical and other sectors. Hospitals, clinics, and frontline workers called for massive orders of masks, gloves, gowns, and face shields, putting PPE in the limelight at the national level. Even after post-pandemic highs, heightened emphasis on infection prevention and occupational health sustains steady demand. The institutions, enterprises, and consumer are more conscious of preparation for future health emergencies in order to utilize PPE for the long run in medical and non-medical settings. Retail, hospitality, and educational sectors have also included PPE as a protective feature. Such a cultural change for protection of health ensures consistent consumption, particularly in urban areas. Along with government initiatives to increase healthcare infrastructure, post-pandemic legacy remains an influential force for the PPE market in the Philippines.

Philippines Personal Protective Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on equipment type and end use industry.

Equipment Type Insights:

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Protective Footwear

- Hearing Protection

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes head, eye and face protection, respiratory protection, hand and arm protection, protective clothing, fall protection, protective footwear, hearing protection, and others.

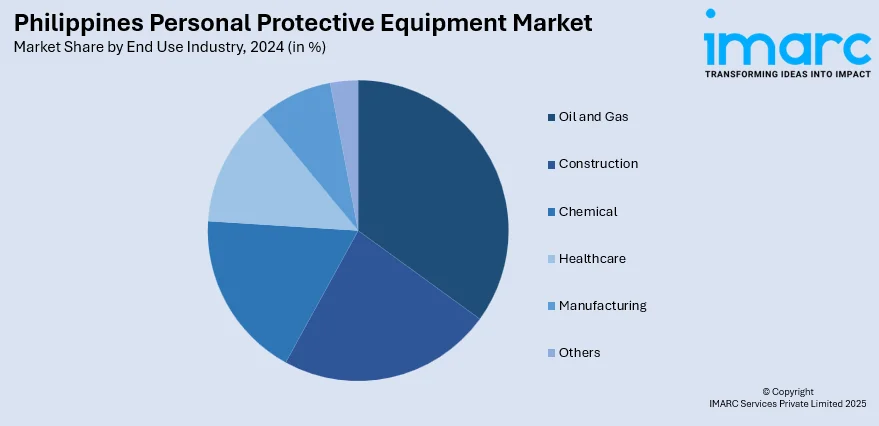

End Use Industry Insights:

- Oil and Gas

- Construction

- Chemical

- Healthcare

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes oil and gas, construction, chemical, healthcare, manufacturing, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Personal Protective Equipment Market News:

- In August 2025, India’s SMPP Limited and the Philippines’ Asia Defence and Firepower Corporation (ADFC) signed an MoU to establish a joint defense production venture in the Philippines, concluded during President Marcos Jr.’s state visit to India. The partnership, part of Manila’s Self-Reliant Defence Posture program, will produce ballistic systems, armor, and ammunition. Strengthening the new Strategic Partnership, this move boosts India’s Act East policy while enhancing the Philippines’ defense independence against Chinese influence in Southeast Asia.

Philippines Personal Protective Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Head, Eye and Face Protection, Respiratory Protection, Hand and Arm Protection, Protective Clothing, Fall Protection, Protective Footwear, Hearing Protection, Others |

| End Use Industries Covered | Oil and Gas, Construction, Chemical, Healthcare, Manufacturing, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines personal protective equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines personal protective equipment market on the basis of equipment type?

- What is the breakup of the Philippines personal protective equipment market on the basis of end use industry?

- What is the breakup of the Philippines personal protective equipment market on the basis of region?

- What are the various stages in the value chain of the Philippines personal protective equipment market?

- What are the key driving factors and challenges in the Philippines personal protective equipment market?

- What is the structure of the Philippines personal protective equipment market and who are the key players?

- What is the degree of competition in the Philippines personal protective equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines personal protective equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines personal protective equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines personal protective equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)