Philippines Pet Supplement Market Size, Share, Trends and Forecast by Type, Pet Type, Form, Application, Distribution Channel, and Region, 2025-2033

Philippines Pet Supplement Market Overview:

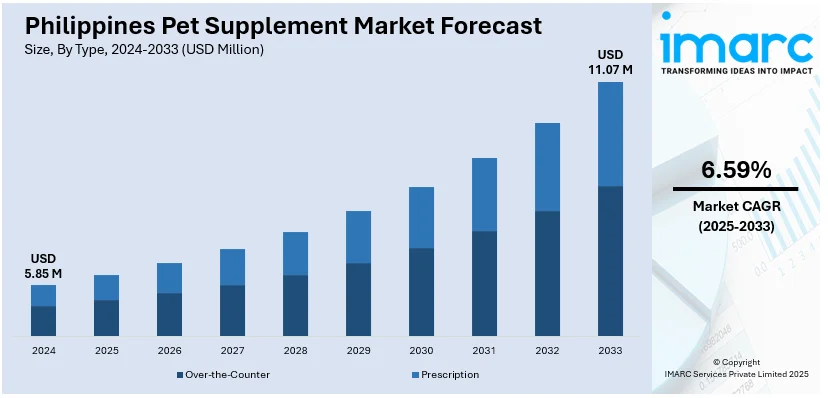

The Philippines pet supplement market size reached USD 5.85 Million in 2024. Looking forward, the market is expected to reach USD 11.07 Million by 2033, exhibiting a growth rate (CAGR) of 6.59% during 2025-2033. The market is fueled by increasing pet ownership, increasing awareness about pet health and the humanization of pets in urban homes. With more Filipinos considering pets as family, interest in products promoting joint health, digestion, immunity, and coat care remains on the rise. Pet care professionals and veterinarians also assist in informing owners of preventive care and nutritional requirements, driving supplement uptake further. The expansion of pet specialty stores and e-commerce renders a high variety of local and international goods more accessible, fueling the Philippines pet supplement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.85 Million |

| Market Forecast in 2033 | USD 11.07 Million |

| Market Growth Rate 2025-2033 | 6.59% |

Philippines Pet Supplement Market Trends:

Growing Humanization of Pets Fueling Premiumization

Growing humanization of pets is one of the most powerful trends molding the Philippines pet supplement market. The demand for high-end pet care items like nutritional supplements is rising as more Filipino dog and cat owners embrace the idea that their animals are members of their family. This trend is most strongly felt in urban centers like Metro Manila, where pet health is indicative of lifestyle and standards of care. Pet owners are increasingly willing to spend money on supplements that offer improved mobility, enhanced immunity, and healthy skin and coats for their animals. Therefore, premium-quality, vet-approved supplements are gaining popularity in physical and digital stores. Premiumization also encompasses items that use natural ingredients, no artificial ingredients, and are targeted to specific life stages or breed-related requirements. Demand for such products is building market value and motivating international brands to enter and grow in the Philippines.

To get more information on this market, Request Sample

Increasing Role of E-Commerce and Pet Specialty Retailers

The retail landscape in the Philippines pet supplement market is transforming very quickly, with e-commerce channels and pet specialty retailers dominating consumer access and purchase behavior. Online stores have become an easy option for busy urban residents who enjoy having pet supplies delivered to their doorsteps. They tend to carry a wider range of supplements, such as imported and specialty brands that might not be easily found in conventional stores. Social media, especially Facebook and Instagram, have also been a prominent means of advertising for small pet supplement companies and veterinary clinics to reach consumers directly. Moreover, the growth of brick-and-mortar pet specialty stores located in shopping malls and commercial areas has helped promote product visibility and facilitated locations for face-to-face consultations with pet care experts. These shopping trends popularize supplements and facilitate consumer education, which is crucial for driving market expansion in a nation where pet nutrition consciousness is still emerging.

Trend toward Functional and Natural Ingredient-Based Supplements

Another trend contributing to the Philippines pet supplement market growth is the demand for functional and natural ingredient-based products. Philippine health-conscious pet owners are becoming increasingly discerning on the quality and make of supplements they give to their pets. Supplements that are high in probiotics, omega-3 fatty acids, turmeric, glucosamine, and other natural substances are increasing in demand because of their perceived health advantages and lower potential for side effects. These are in line with general trends on human wellness where consumers prefer clean labels and plant-based foods. Philippine pet supplement companies are reacting by reformulating existing products and introducing new lines that highlight organic, locally produced, or veterinarian-endorsed ingredients. This is especially visible in niche niches, e.g., for older pets, pets with joint problems, or pet food sensitivities. With growing veterinary support and consumer recognition, natural and functional pet supplements are poised to further influence product development and buying behavior throughout the market.

Philippines Pet Supplement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, pet type, form, application, and distribution channel.

Type Insights:

- Over-the-Counter (OTC)

- Prescription

The report has provided a detailed breakup and analysis of the market based on the type. This includes over-the-counter (OTC) and prescription.

Pet Type Insights:

- Dogs

- Cats

- Others

The report has provided a detailed breakup and analysis of the market based on the pet type. This includes dogs, cats, and others.

Form Insights:

- Pills/Tablets

- Chewables

- Powders

- Others

The report has provided a detailed breakup and analysis of the market based on the form. This includes pills/tablets, chewables, powders, and others.

Application Insights:

- Skin and Coat

- Hip and Joint

- Digestive Health

- Immune Support

- Weight Management

- Oral/Dental Health

- Heart Health

- Cognitive Function

- Calming/Anxiety and Stress Relief

- Muscle and Performance

- Eye Health

- Kidney and Liver Support

- Multivitamins

- Allergy Relief

The report has provided a detailed breakup and analysis of the market based on the application. This includes skin and coat, hip and joint, digestive health, immune support, weight management, oral/dental health, heart health, cognitive function, calming/anxiety and stress relief, muscle and performance, eye health, kidney and liver support, multivitamins, and allergy relief.

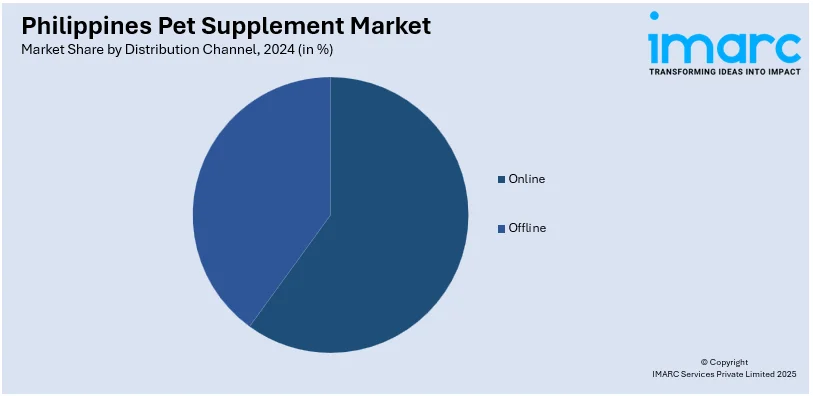

Distribution Channel Insights:

- Online

- Offline

- Hypermarkets and Supermarkets

- Pet Specialty Stores

- Pharmacy and Drug Stores

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes online and offline (hypermarkets and supermarkets, pet specialty stores, pharmacy and drug stores, convenience stores, and others).

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which includes Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Pet Supplement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Over-the-Counter (OTC), Prescription |

| Pet Types Covered | Dogs, Cats, Others |

| Forms Covered | Pills/Tablets, Chewables, Powders, Others |

| Applications Covered | Skin and Coat, Hip and Joint, Digestive Health, Immune Support, Weight Management, Oral/Dental Health, Heart Health, Cognitive Function, Calming/Anxiety and Stress Relief, Muscle and Performance, Eye Health, Kidney and Liver Support, Multivitamins, Allergy Relief |

| Distribution Channels Covered |

|

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines pet supplement market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines pet supplement market on the basis of type?

- What is the breakup of the Philippines pet supplement market on the basis of pet type?

- What is the breakup of the Philippines pet supplement market on the basis of form?

- What is the breakup of the Philippines pet supplement market on the basis of application?

- What is the breakup of the Philippines pet supplement market on the basis of distribution channel?

- What is the breakup of the Philippines pet supplement market on the basis of region?

- What are the various stages in the value chain of the Philippines pet supplement market?

- What are the key driving factors and challenges in the Philippines pet supplement market?

- What is the structure of the Philippines pet supplement market and who are the key players?

- What is the degree of competition in the Philippines pet supplement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines pet supplement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines pet supplement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines pet supplement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)